How to Choose the Right Provider for Automated Electronic Invoicing Software

Selecting the right automated electronic invoicing software provider is critical for improving your invoicing processes and achieving cost efficiency. Consider these key factors to ensure you make the right choice for your business needs:

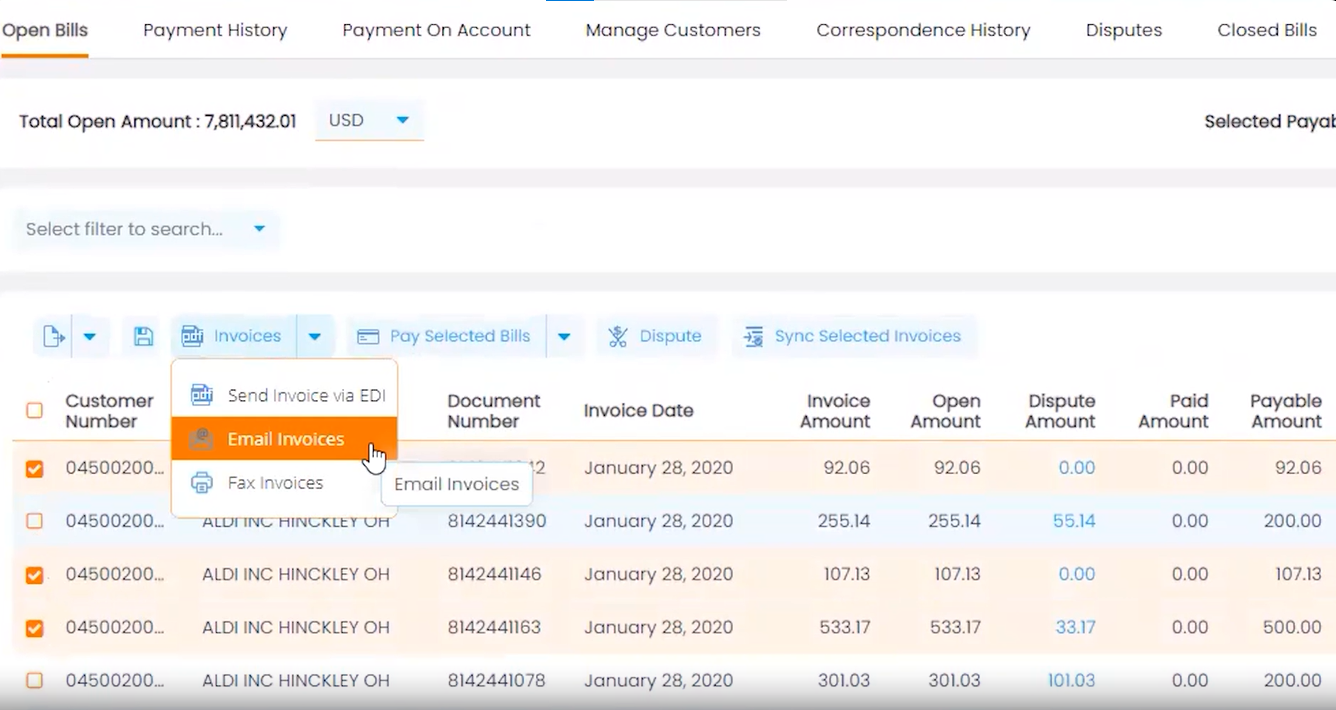

Evaluate Core Features and Functionality

Start by analyzing the software’s core capabilities. Look for features like invoice creation, delivery automation, real-time tracking, payment reconciliation, and compliance with tax regulations. Advanced options like AI-driven insights, customizable templates, and integration with existing ERP systems are also essential for scaling operations.

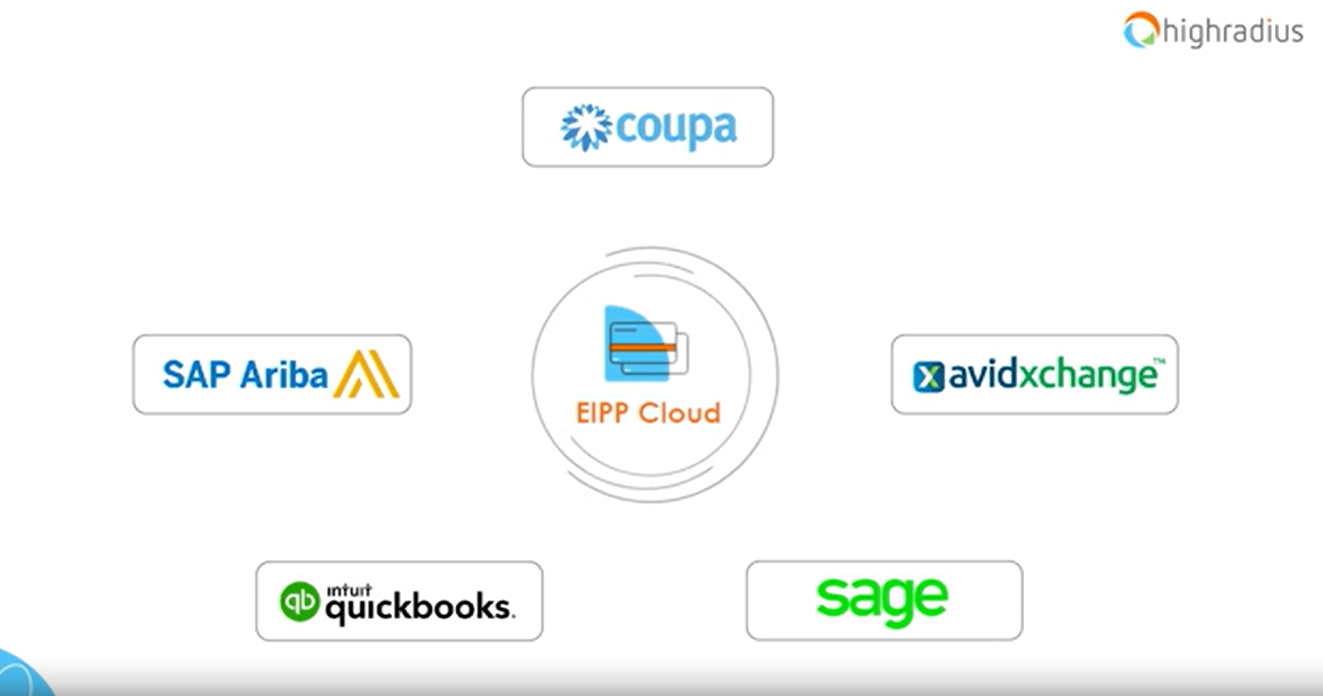

Integration and Scalability

Ensure the provider offers seamless integration with your current systems, such as ERP, CRM, or accounting software. Check whether the solution can handle increasing transaction volumes as your business grows, ensuring it supports your long-term scalability goals.

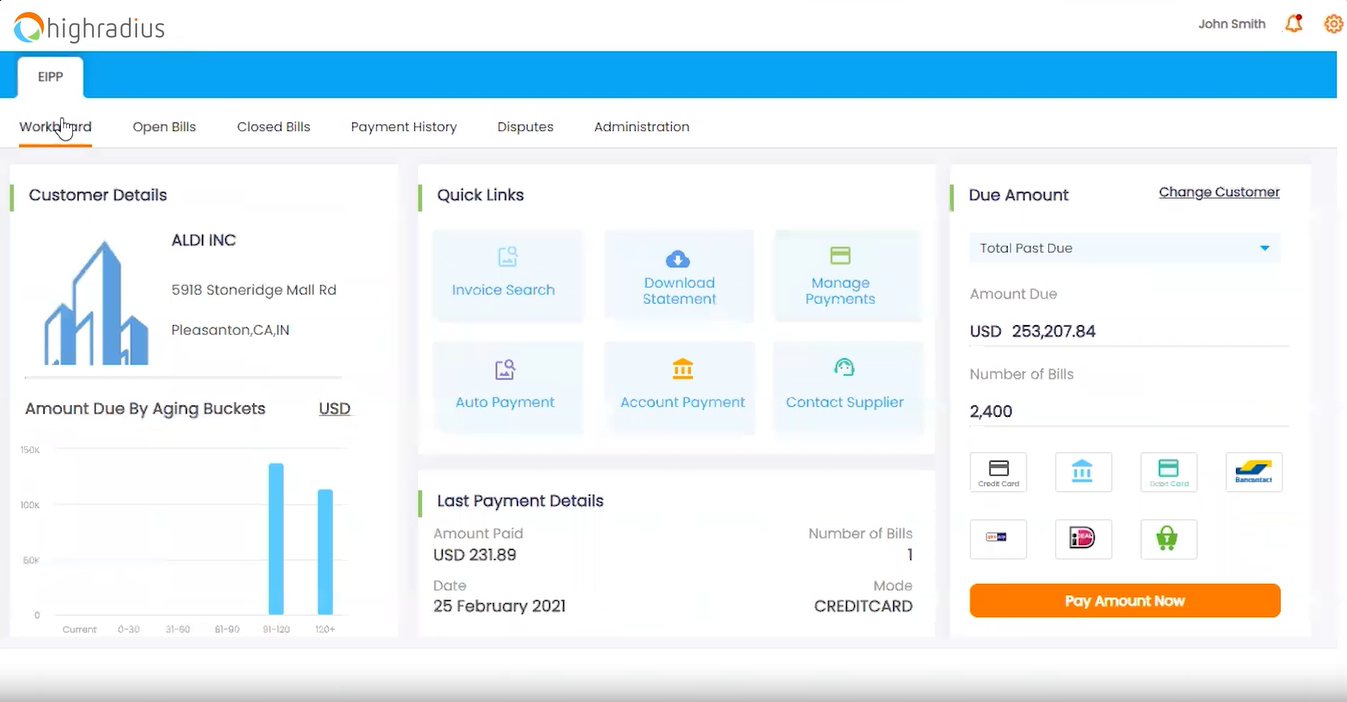

Ease of Use and Implementation

Choose software that is intuitive and easy to use, requiring minimal training for your team. Evaluate the provider’s implementation process to ensure it’s smooth and doesn’t disrupt your business operations. Providers offering guided onboarding and support should be prioritized.

Compliance and Security Standards

Verify that the software complies with regional and global tax and invoicing regulations, such as e-invoicing mandates or VAT requirements. Additionally, ensure the provider follows high-level data security standards like GDPR, SOC 2, and ISO certifications to protect sensitive customer and financial information.

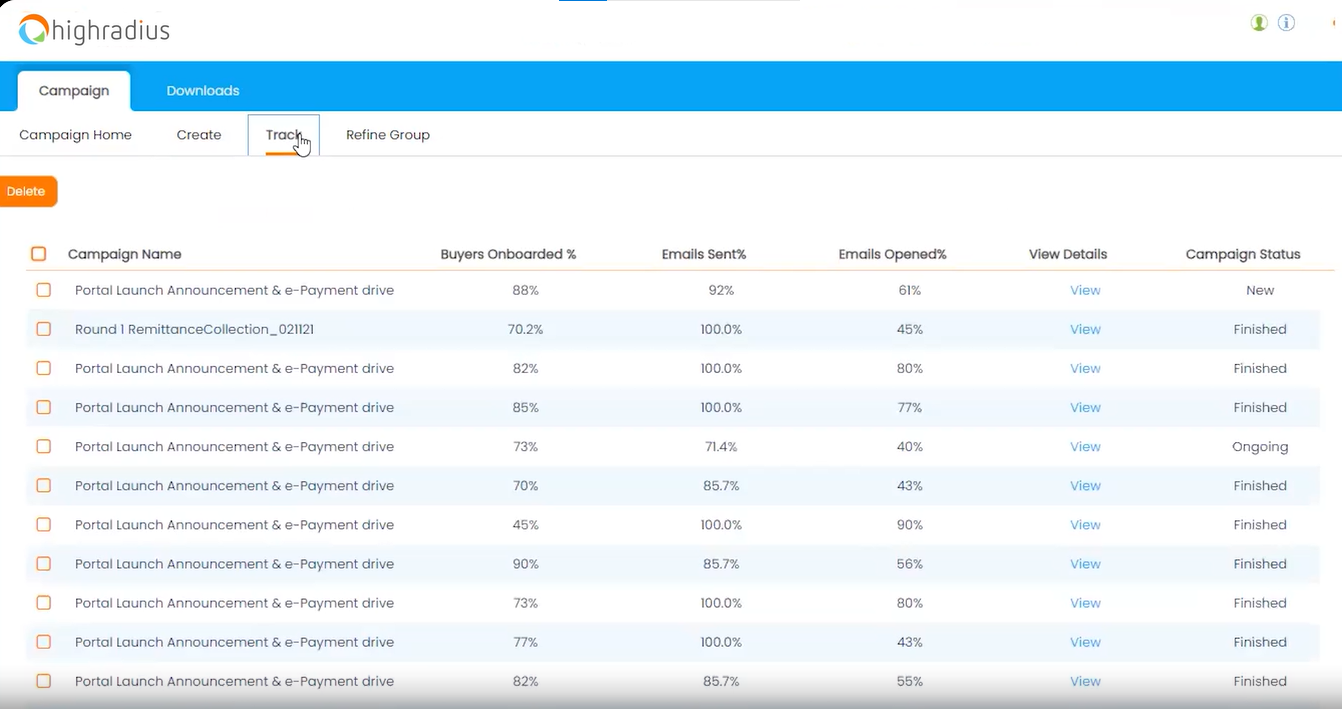

Customization and Flexibility

Select a provider that allows you to customize the software to match your unique business workflows. Flexible options for invoice templates, approval hierarchies, and reporting tools ensure the solution aligns with your operational needs.

Customer Support and Reliability

A reliable provider offers robust customer support, including live chat, phone, or email assistance. Check for round-the-clock availability and the quality of support offered. Reading customer reviews or asking for references can provide insight into their reliability.

Cost and ROI

Consider the software’s pricing model—whether it’s subscription-based or per-invoice—and analyze the total cost of ownership. Compare it to the value delivered in terms of time saved, error reduction, and process efficiency. Opt for a provider that delivers measurable ROI while staying within budget.

Reputation and Industry Expertise

Choose a provider with a proven track record in your industry. Experienced vendors understand your specific challenges and offer tailored solutions. Look for case studies, client testimonials, and third-party reviews to gauge their expertise.