Variance Analysis Software

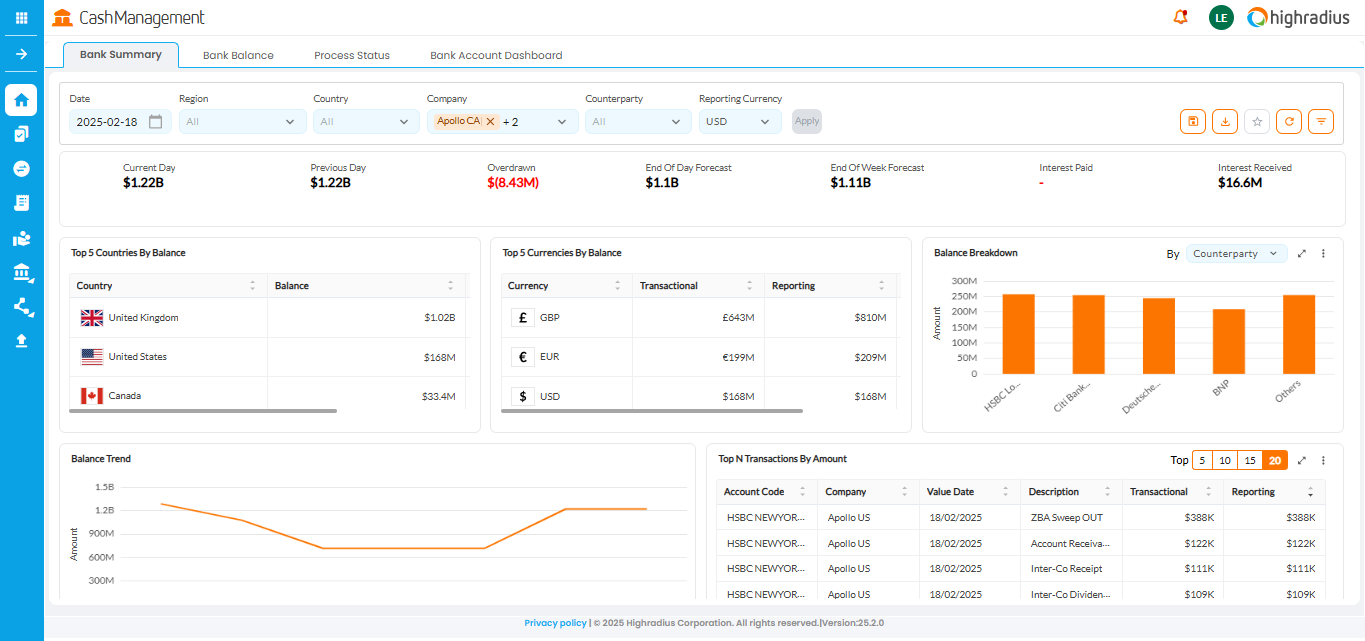

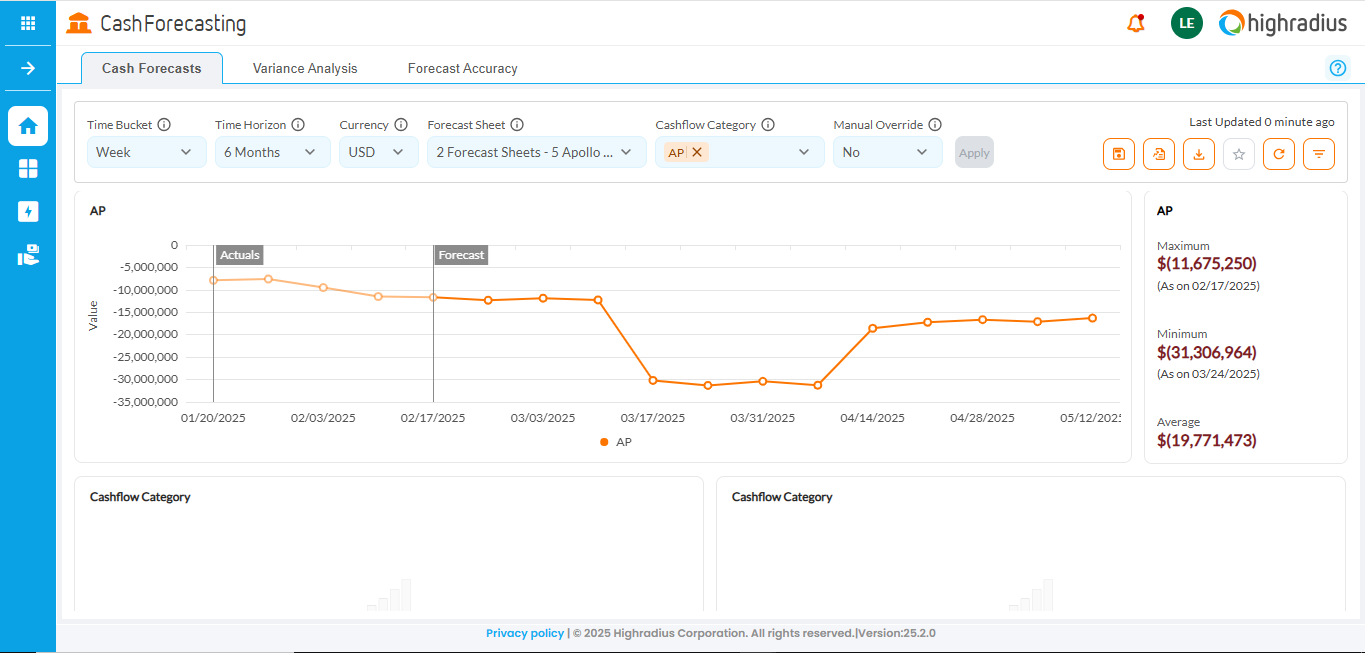

100% cash visibility powered by AI agents

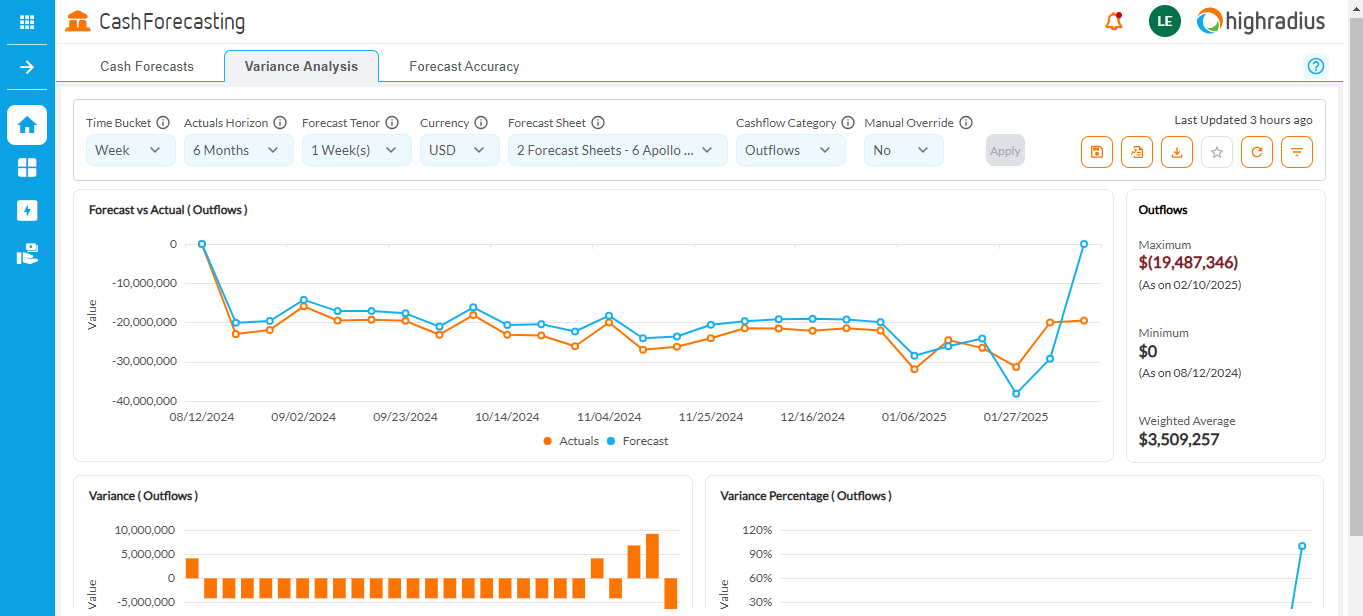

- Leverage AI-driven variance analysis to identify trends and track deviation

- Enhance cash flow forecasting efficiency and make data-driven decisions

- Make informed adjustments and streamline financial planning

Trusted by 1100+ Global Businesses

Enhance Forecash Accuracy by 95% with AI

Just complete the form below