$30B HubSpot Faces Liquidity Issues: Will Google Acquire?

With the mid-market CRM industry growing 224% YoY, HubSpot is in the spotlight not just for financial growth but also for a potential Google acquisition deal. What strategies lie hidden in HubSpot’s treasury metrics that are driving this success?

$72B

TAM projected for CRM industry in 2028

40%

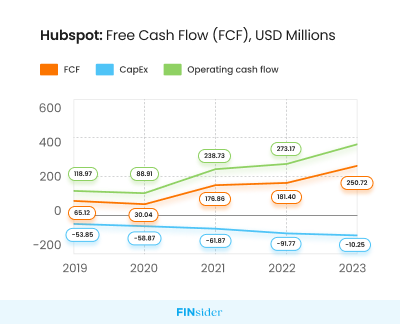

YoY growth in Free Cash Flow (FCF)

2x

the industry average Borrowed in 2024

In the year 2006, the world was a different place. George Bush was leading the United States, the Indianapolis Colts were celebrating their NFL victory, and in the middle of it all, two MIT graduates, Brian Halligan and Dharmesh Shah, set the foundation of a CRM platform, HubSpot, that would transform how organizations ‘operationalize’ their sales and marketing efforts.

Fast-forward to the year 2024, the Customer Relationship Management (CRM) industry has exploded into a bustling $52B industry. Among the giants that roam this landscape, Salesforce towers over the rest, claiming nearly 50% of the industry's market share.

Then there's HubSpot, holding a modest market share of 5.23%, it stands alongside Monday.com and Freshworks. There’s more; Google is reportedly moving forward with plans to acquire HubSpot, at a $30B valuation. This acquisition could possibly be Google's largest.

In this research article we’ll analyze HubSpot's Treasury metrics. What do they reveal about HubSpot’s financial journey? Let’s find out.

Methodology for Evaluating the Financial Performance

In order to ensure an accurate comparison, our study zeroed in on a specific subset of the CRM industry that exclusively caters to the mid-market segment and is composed of public companies—including well-established players such as Monday.com and Freshworks.

Our focus will primarily be on three key indicators for HubSpot:

- Earnings compared to the industry average.

- Borrowing compared to the industry average.

- Management of short and long-term liabilities.

A CRM software can help increase sales by up to 29%, as well as improve sales productivity by up to 34% and sales forecasting accuracy by 42%.

Let’s start our analysis by first taking a look at HubSpot’s business model in a brief.

HubSpot Sees Positive Results with “Freemium” Model

In 2024, HubSpot reported $2.1B in revenue.

Business model: The company operates on a freemium business model, primarily earning revenue through subscriptions to its CRM Platform. In 2022, subscription revenue represented 98% of HubSpot’s total income.

User adoption strategy: HubSpot is free for the first 14 days. During these 14 days, you can explore some features that HubSpot provides. If you find value in what you’ve just experienced, you become a paying customer. It is “product-led growth” at its finest.

After understanding HubSpot’s primary revenue model, understanding the trends in Free Cash Flow (FCF) is vital as it’s an indicator of a company’s financial health, showing leftover cash after expenses. This cash can be used for reinvestments, dividends, or debt reduction.

At $141M, HubSpot’s Average FCF is 2x the Industry

HubSpot at $141M, has a five-year average Free Cash Flow (FCF)2x the industry average—growing at a CAGR of 31%. Capital Expenditures (CapEx), growing at 13%, and Net Operating Cash Flow, growing at 24%, are also subjects of steady positive growth.

But, did you know? Year-on-year, the mid-market CRM industry’s FCF is growing at a whooping 224%.

HubSpot enjoys a steady flow of FCF. But how?

- Effective Revenue Generation: The “freemium model” has proven to be highly effective for HubSpot. This model has resulted in a steady increase in subscription revenue. In fact, in 2024, HubSpot saw its subscription revenue rise to $604M, which represents a 23% increase compared to 2023.

- Investments into Product Enhancements: HubSpot invests heavily into R&D. As a result, HubSpot has succeeded in creating a product-market fit that delivers great value to their customers.

- Capital-intensive Sales and Marketing: At HubSpot, sales and marketing form an essential part of their overall growth strategy. In 2022, 51% of its revenue was dedicated to these areas. By 2024, these investments have clearly paid off, with HubSpot boasting a customer base of 216k, which has grown year-on-year at a rate of 22%.

Also Read: How Apple Hedged 96% of its Forex Risk? Treasury Metrics Reveal! (link)

Now, let’s examine HubSpot’s debt trends.

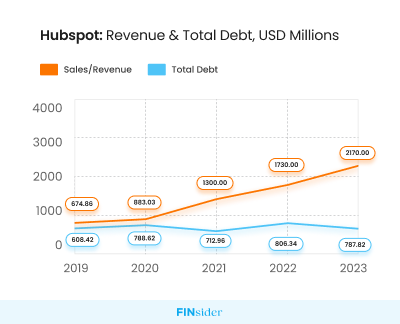

HubSpot Earned & Borrowed 2x the Industry Average

HubSpot is performing well with its sales/revenue growing at a 5-year CAGR of 34%, and in 2024, it was reported at $2.1B. The same year, the industry average was slightly over $1B.

On the other hand, HubSpot’s total debt (5-year average) was twice that of the industry average ($740.83 million vs $342.40 million). HubSpot’s total debt has been increasing at a 5-year CAGR of 5.3%, while its sales revenue has been growing at a CAGR of 26.31%. The fact that the sales growth rate is outstripping the growth rate of total debt is a positive indicator.

How HubSpot manages its Debt to fuel growth?

- Strategic Investment Strategy: In an effort to stimulate growth, HubSpot launched a $100M investment fund1 in 2021 to actively support early and growth-stage technology companies who share HubSpot’s mission.

- Effective Debt Management Practices: Despite carrying significant liabilities, HubSpot maintains net cash and a healthy balanced sheet. According to Simply Wall St.2 , the balance, along with strong revenue growth, indicates that the company has effective strategies in place for managing its debt.

- Support Growth Efforts: HubSpot needs to increase spending3 among its existing customers. Its current growth rate for average subscription revenue per customer is only 1% YoY, now standing at $11,365.

- Tap into Growth Potential: The CRM industry’s Total Addressable Market (TAM) was valued at $51B and is projected to expand to $77B4 by 2023. This represents a significant growth opportunity for companies like HubSpot that operate within this industry.

Salesforce, a leading CRM platform, was founded in 1999 by Marc Benioff during a sabbatical in India and Hawaii, where he cultivated an interest in yoga and Eastern religions.

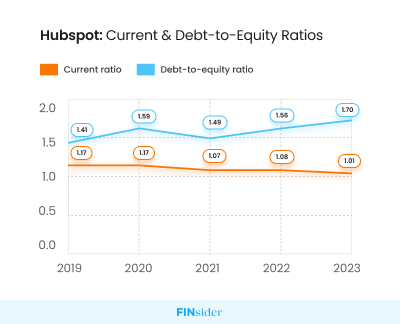

Now that we’ve examined HubSpot’s earnings and borrowing patterns, let’s understand how these financial indicators interact and what they mean for the company’s liquidity. Let’s delve into the details of HubSpot’s current and debt-to-equity ratios.

Current Ratio at “1.1”, HubSpot has a Liquidity Problem!

Over the course of the last five years, HubSpot has maintained an average current ratio of 1.10. This figure falls short when compared to the industry average, which stands at 2.36.

However, the Debt-to-Equity Ratio pictures a different image! HubSpot’s average ratio, over the same five-year period, is 1.55. This is marginally above the industry average of 1.41, thereby indicating a slightly higher reliance on debt financing, which we identified above.

HubSpot is struggling with its short-term liquidity!

A lower ratio, in terms of financial analysis, could suggest that HubSpot is experiencing less liquidity in comparison to its competitors. In this particular context, it means HubSpot’s current liabilities with respect to its current assets have remained relatively constant or growing at a similar rate.

A clear analysis of the data shows that HubSpot’s Current Liabilities are increasing at a CAGR of 17%. In contrast, its Current Assets are growing at a CAGR of 13%. This indicates that Liabilities will likely continue to increase faster than Assets, potentially reducing the ratio value below 1.

“The current ratio measures a company’s capacity to pay its short-term liabilities due in one year. A good current ratio is typically considered to be anywhere between 1.5 and 3.” — Business Insider

Why is HubSpot pursuing a more aggressive growth strategy?

HubSpot’s higher debt-to-equity ratio indicates that the company is leveraging debt to fund its operations more than its competitors. This also means that HubSpot has a more ambitious growth strategy and is not shying away from taking calculated risks to accelerate its expansion and gain a competitive edge in the market. Moreover, this approach could be indicative of HubSpot’s confidence in its ability to generate substantial revenue in the future.

Final Words: HubSpot’s Financial Journey Recap!

As the CRM industry continues to grow, HubSpot is strategically positioned to capitalize on these growth opportunities. A fundamental aspect of HubSpot’s financial strategy lies in its willingness to reinvest in key areas such as Research & Development (R&D), Sales, and Marketing.

This commitment to internal growth and innovation not only fuels its product and market expansion but also enhances customer satisfaction and retention, factors that are critical to long-term success in the competitive CRM industry.

The company’s robust Free Cash Flow (FCF), consistently increasing sales/revenue, and strategic utilization of debt financing underscore a forward-thinking growth strategy. Despite a higher Debt-to-Equity ratio and potential liquidity concerns, HubSpot’s proactive debt management practices can help to mitigate risk—acquisition by Google might be one of those strategies.

In light of these considerations, HubSpot’s future appears stable with sustained financial success and mid-market dominance.

Sources Links:

Linkedin

Linkedin Facebook

Facebook Twitter

Twitter Copy url

Copy url