Warner Bros AR Metrics: A Blockbuster Script for Financial Growth!

How does Warner Bros. Discovery stay in shape financially as it continues to produce blockbuster content?

31%

Rise in AR

47%

CCC improvement

7 days

Increase in DSO

16%

Rise in DPO

As much as creative excellence plays a major role in this ever-changing media and entertainment industry, operational efficiency holds equal importance.

Industry giant Warner Bros. Discovery monitors its Order-to-Cash metrics to stay in shape financially and to set strategic direction.

The following analysis explores some of the key O2C metrics of Warner Bros. Discovery-in particular, Accounts Receivable, Cash Conversion Cycle, Days Sales Outstanding, Days Inventory Outstanding, and Days Payable Outstanding-from 2019 onwards and up to 2023.

Comparing these metrics against those of competitors Disney and Netflix, to name but a few will give a better idea of how well Warner Bros. Discovery positions itself within an increasingly competitive landscape.

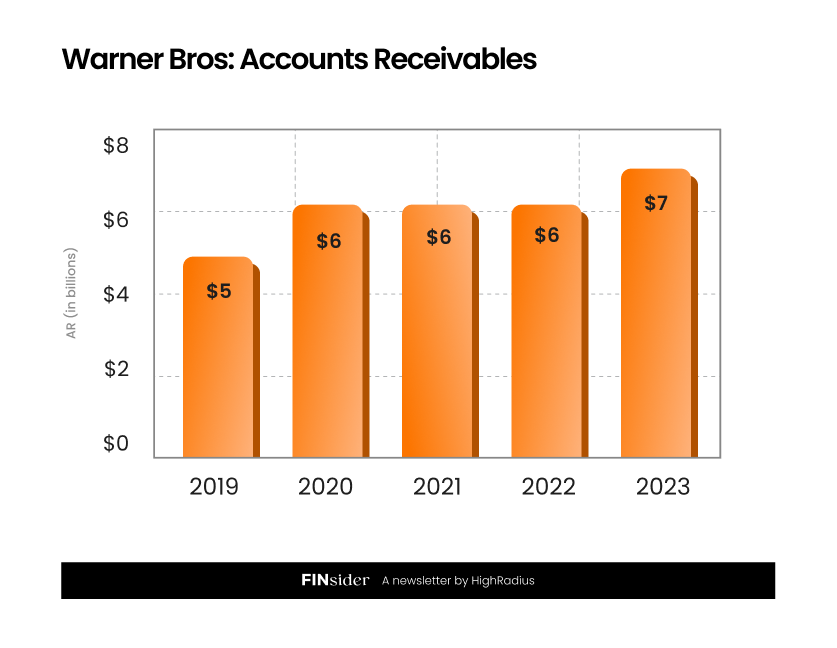

Warner Bros. AR Climbs by 31% in 2023

Accounts Receivable for Warner Bros. Discovery has been on an upward trajectory from 2019 at $5.2 billion to $6.8 billion in 2023. This reflects the new business horizon that the company is moving to in streaming services and the associated challenges brought by digital-age content distribution.

By comparison, Disney grew slower to about $8.1 billion in 2023, while Netflix maintained a much lower AR, at about $4.6 billion, since its subscription model was highly streamlined.

How has licensing and streaming impacted Warner Bros. AR?

Content Licensing Agreements:Warner Bros. AR growth happened due to multi-year content licensing agreements signed with international broadcasters, mainly. Such deals are paid in large amounts with longer payment terms, which increase the balance in accounts receivables.

Expansion of Streaming Services: The growth of streaming platforms like HBO Max has also contributed to Warner Bros. AR growth. As the service expands globally, delays in collecting subscription revenue, especially from international markets, increase AR.

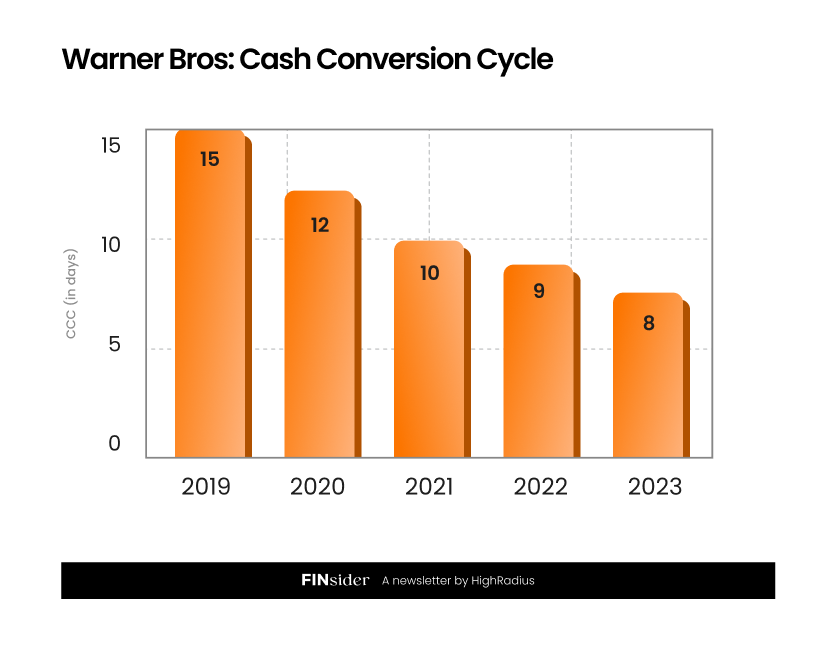

Warner Bros. CCC improved by 47% in 2023

The Cash Conversion Cycle (CCC) slightly improved for Warner Bros. Discovery from 15 days in 2019 to 8 days in 2023. The improved yet positive CCC reflects an intricate balance of receivables, inventory, and payables at Warner Bros. Discovery.

On the other hand, Disney with more diversified revenue streams had a CCC of 5 days in 2023, while Netflix remained negative at -3 days due to faster turnover from the production of content to subscription revenues.

We will now analyze Warner Bros DSO, DPO, and DIO to understand how exactly Warner Bros. CCC improved over the years.

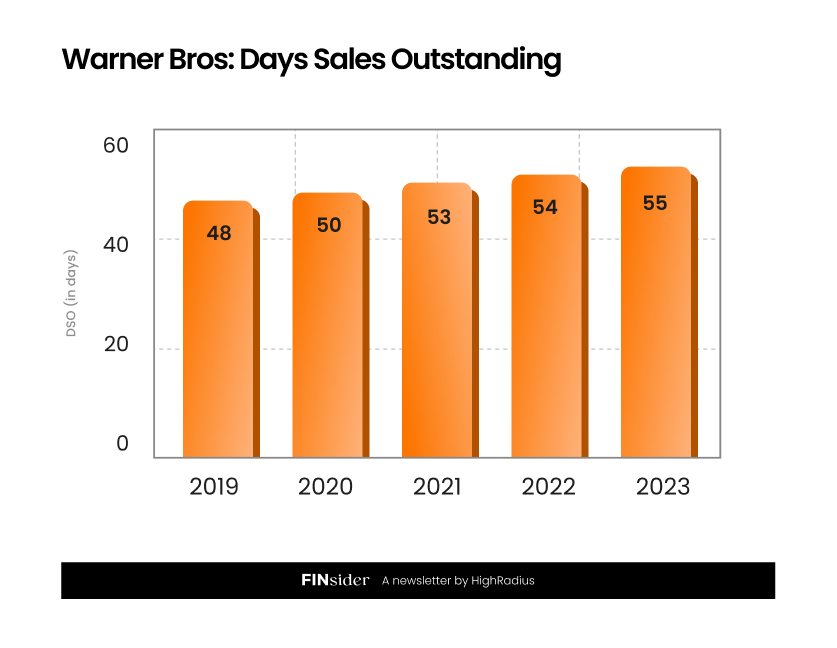

Warner Bros. DSO Reaches 55 Days in 2023

Warner Bros. DSO had increased from 48 days in FY 2019 to 55 days in FY 2023. This shows that the company mostly relies on long-term content deals and the fact that collections are usually delayed.

Disney's DSO, on the other hand, was at a stable 52 days, while for Netflix, the same was much lower at 35, thanks to their phenomenal subscriber momentum.

What factors are driving the increase in Warner Bros. DSO?

Multi-year licensing agreements: This indicates that the major part of the Warner Bros. DSO increase has resulted from multi-year licensing agreements, reached in particular with foreign broadcasters, under which payments are spread over more than a year.

Delayed Ad Revenue Collection: Warner Bros. Discovery faces delays in collecting advertising revenues, amidst changes in the industry to digital platforms and longer payment cycles.

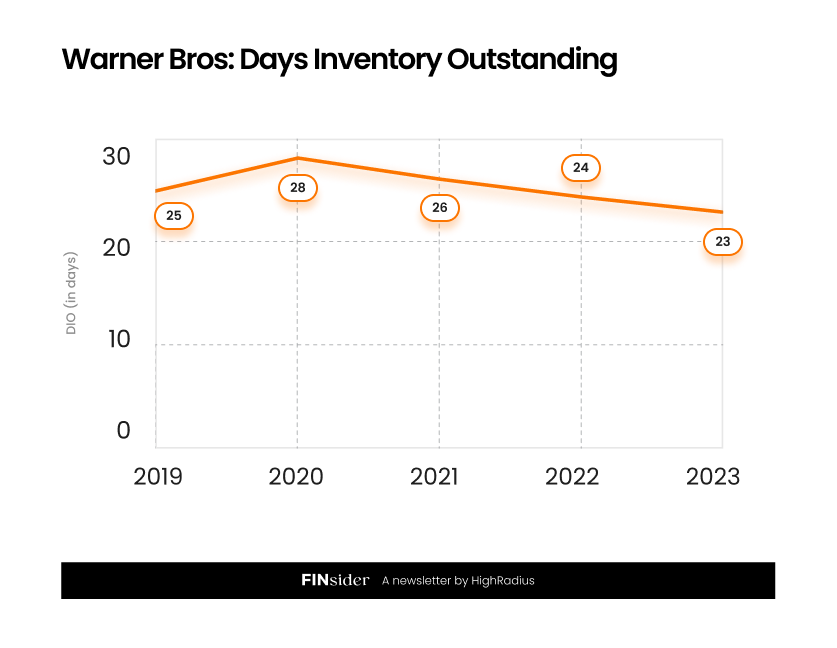

Warner Bros. DIO Decreases to 23 Days in 2023

Warner Bros. Discovery’s Days Inventory Outstanding (DIO) has remained fairly stable, with a slight decrease from 25 days in 2019 to 23 days in 2023. This stability is due to the company’s ability to manage its content catalog, including films, TV shows, and digital media, ensuring optimal turnover of these assets.

In comparison, Disney’s DIO hovered around 22 days, while Netflix’s DIO was lower at 15 days, reflecting its faster content turnover.

How do production schedules and distribution delays impact Warner Bros. DIO?

Content Production Schedules: The DIO is heavily influenced by Warner Bros. Discovery’s content production schedules. Major films and TV shows temporarily increase inventory, which is then converted to sales upon release.

Distribution Delays: Occasionally, delays in distribution, particularly in international markets, can extend the DIO, but these are generally short-term fluctuations.

Warner Bros. DPO Increases by 16% in 2023

Warner Bros. Discovery’s Days Payable Outstanding (DPO) increased from 58 days in 2019 to 67 days in 2023, reflecting its strong negotiating power with suppliers and partners.

Disney’s DPO was similar, at 65 days in 2023, while Netflix maintained a much shorter DPO of 40 days, reflecting quicker payments to content producers.

How do extended terms and deferred tech payments drive Warner Bros. DPO?

Negotiation with Production Companies: Warner Bros. Discovery’s ability to secure extended payment terms with production companies is a key driver of its increasing DPO.

Deferred Technology Payments: The company strategically defers payments related to technology and platform maintenance, which is crucial for managing cash flows in a capital-intensive industry.

From Blockbusters to Balance Sheets: Warner Bros. Discovery’s Financial Story

Warner Bros. O2C metrics from 2019 to 2023 highlight a company adept at balancing creative production with financial discipline. The rise in Warner Bros. AR and DSO underscores the complexities of managing multiple revenue streams and long-term deals, while the steady CCC and increasing DPO reflect Warner Bros.

Compared to its competitors, Warner Bros. Discovery demonstrates a strong position in managing its financial operations, ensuring that it remains competitive in a rapidly changing industry.

Sources:

- Warner Bros. Discovery Annual Reports (10-K filings), 2019-2023

- Disney and Netflix Annual Reports (10-K filings), 2019-2023

- Warner Bros. Discovery Earnings Calls and Investor Presentations

Want more insights? Subscribe to our finance newsletter for the latest in finance—from the best finance newsletters and compelling finance stories to treasury, R2R and AR insights.

Linkedin

Linkedin

Facebook

Facebook

Twitter

Twitter

Copy url

Copy url