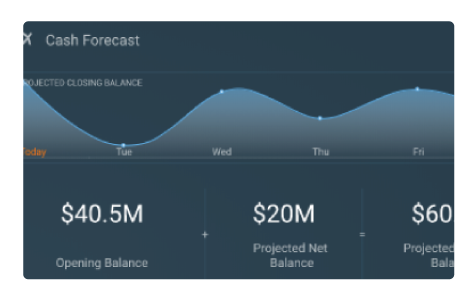

With HighRadius Rivana – decision making is now an integral part of receivables and treasury processes. Rivana combines the power of Machine Learning with rich A/R, A/P, payments, non-operational cash flow, FP&A and bank statement data, to help both receivables and treasury departments to significantly reduce the manual effort lost in transaction processing or statistical forecasting, freeing up their time for critical high-value work. Additionally, the AI platform enables rich, data-backed insights enabling analysts to take actions resulting in more favorable outcomes.

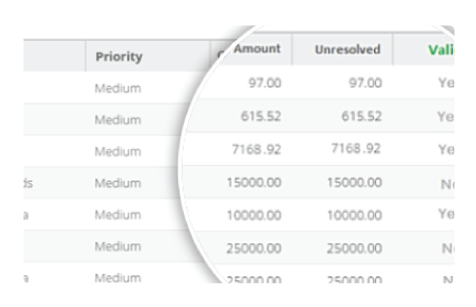

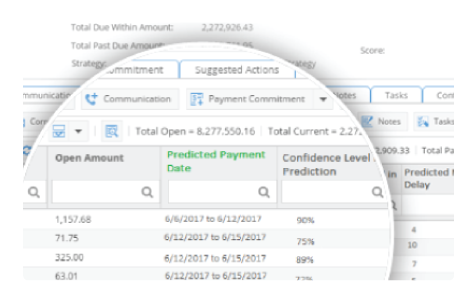

HighRadius Rivana Artificial Intelligence Platform is currently built on a dozen machine learning algorithms to continuously learn and provide insights on all possible A/R and treasury scenarios including use-cases such as predicting invoice payment dates, validation of deductions, predicting customer default or forecasting cash flows with pinpoint accuracy right upto individual invoice level and across all cash flow categories.

The current generally available platform relies on learning algorithms such as regression and classification done using Decision Trees and Random Forest methods.