Automated Invoice Management System for Enterprises

Smarter Invoice Management = Faster Payments

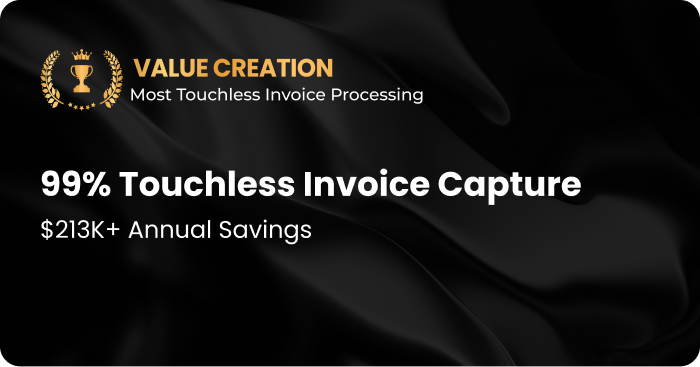

- Automate invoice capture and validation for error-free processing.

- Speed up approvals and payments with rule-based workflows.

- Leverage real-time insights for smarter decision making.

Trusted by 1100+ Global Businesses

See how AI can build 95% accurate cash forecast

Just complete the form below