Accelerate AP Processing With Our Intelligent Invoice Matching Software

Eliminate manual errors, ensure faster approvals, and achieve seamless financial operations with an advanced invoice matching solution.

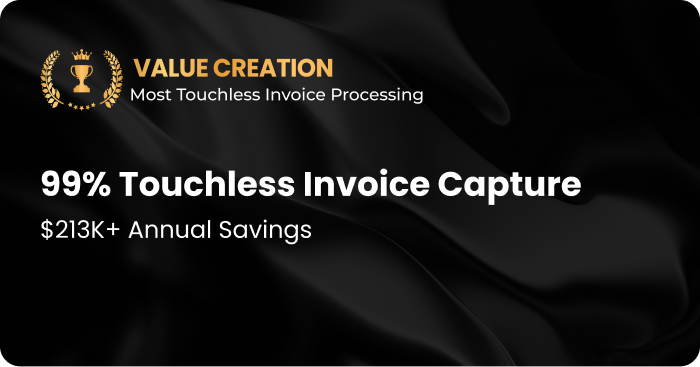

- Reduce manual effort with touchless invoice-matching software.

- Ensure accuracy with automated two-way and three-way matching.

- Gain complete control over invoice validation and exception handling.

Trusted by 1100+ Global Businesses

See how AI can build 95% accurate cash forecast

Just complete the form below