Balance Sheet Reconciliation Software for an Audit Ready Close

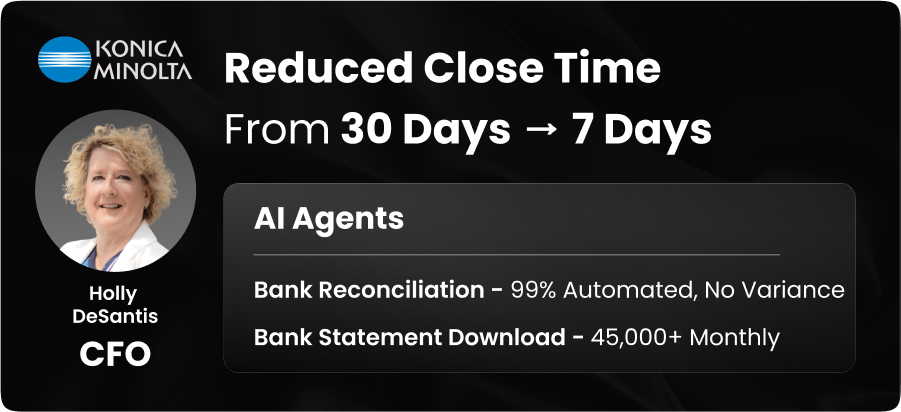

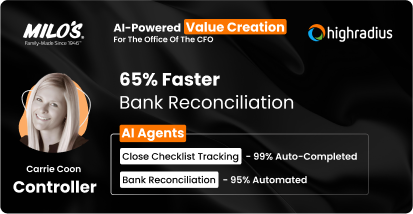

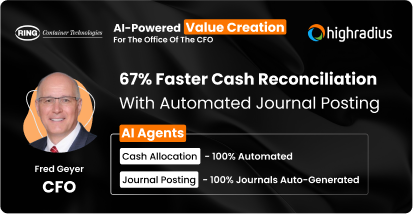

Experience 90% Automated Reconciliation with 21 AI Agents

- 95% Automated Journal Posting via AI-Driven ERP Integration

- 30% Faster Close with a Continuous Accounting Cycle

- 100% Account Substantiation for Audit-Ready Assets & Liabilities

- Eliminate Post-Close Adjustments with 99% Reconciliation Accuracy