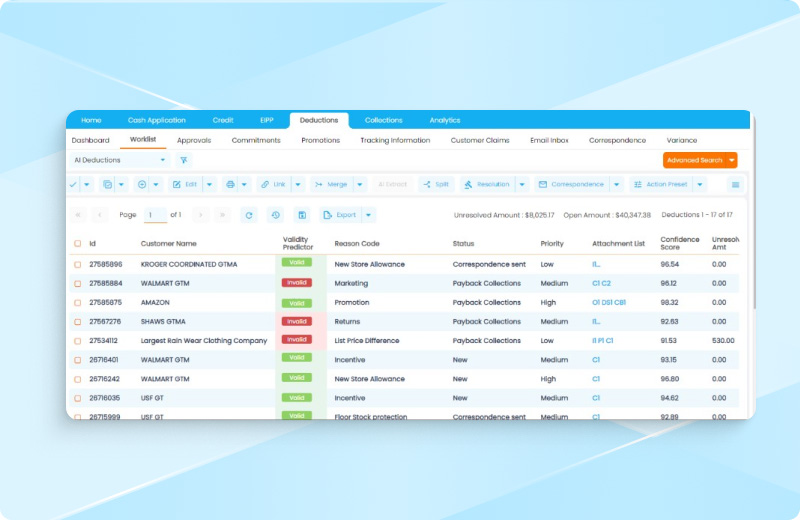

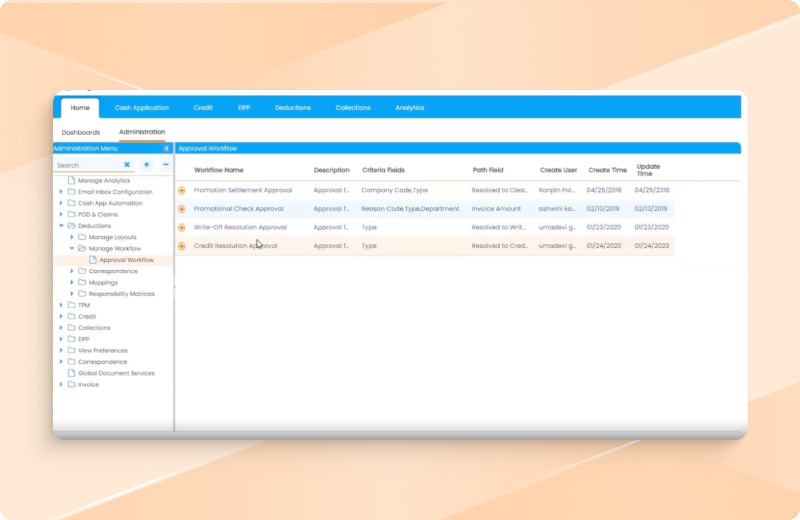

Maximize Cash Flow with Collaborative Accounts Receivable Software

Reclaim your time and enhance cash flow

HighRadius empowers you to transform invoices into cash faster, reduce Days Sales Outstanding, and boost productivity by 30%.

Trusted By 1000+ Finance Teams Globally

See how AI can get you paid in less time

Just complete the form below