Best Revenue Recognition Software For Seamless Sales Reconciliation

Automated Revenue Recognition → Simplified Compliance, Total Control

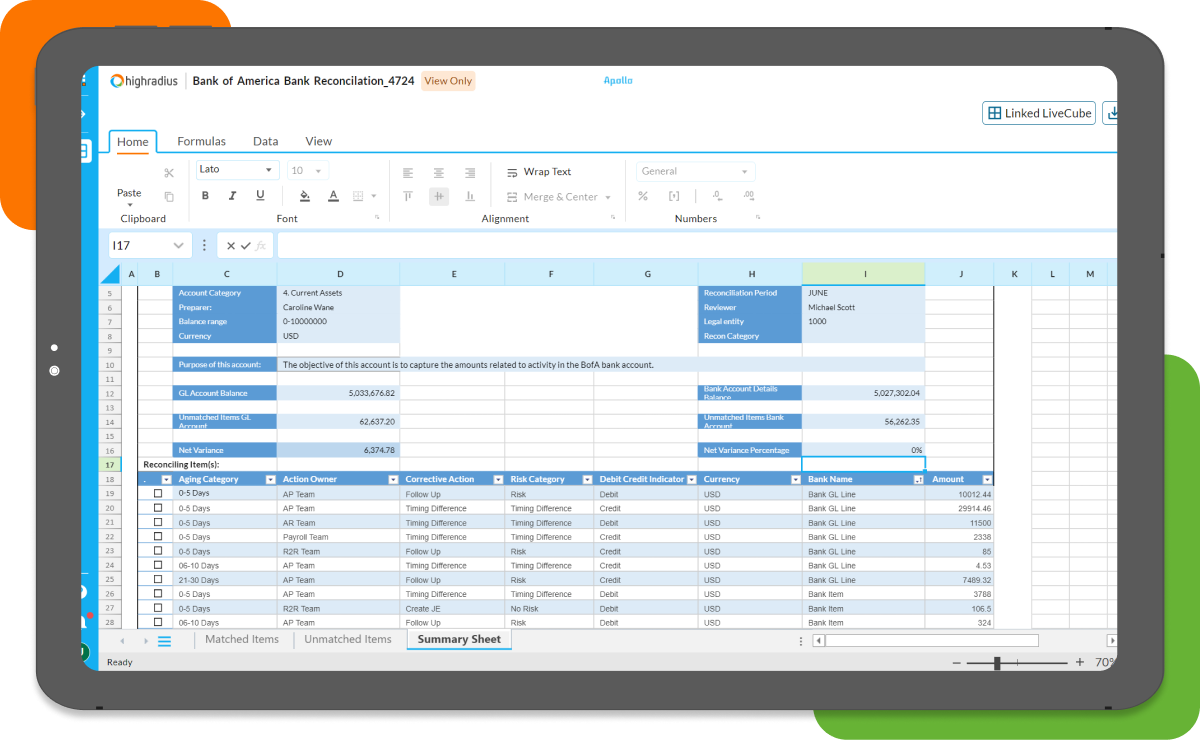

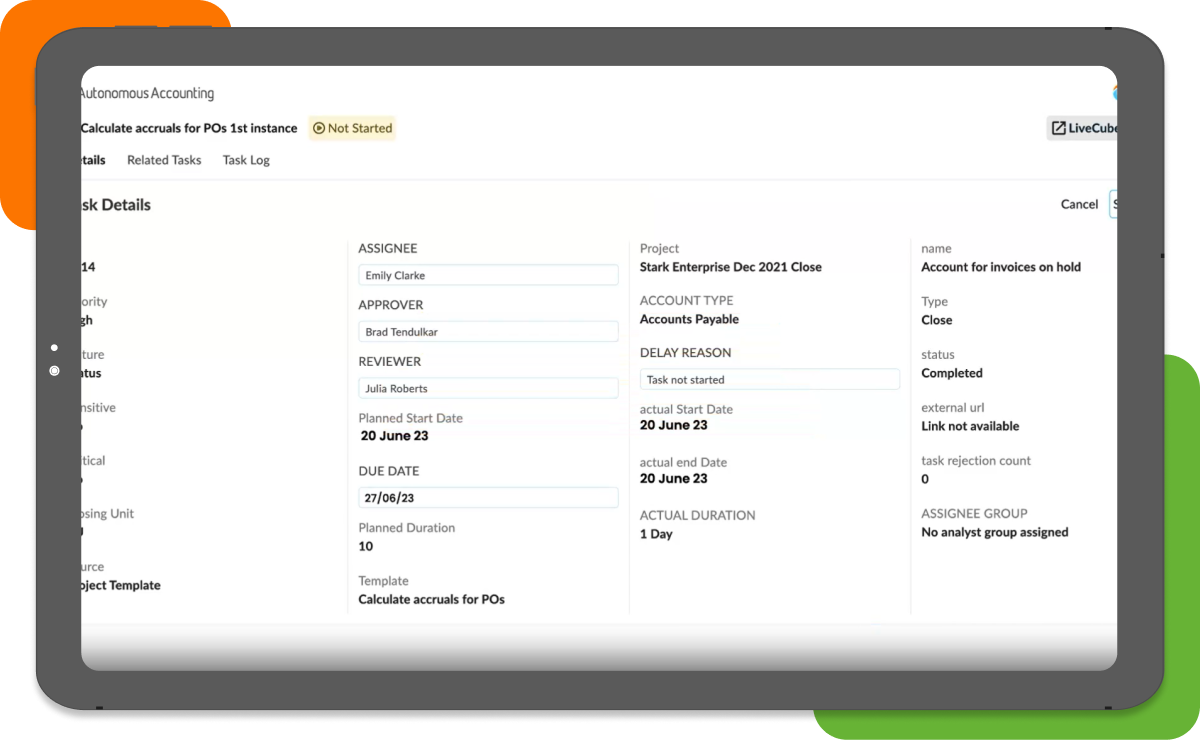

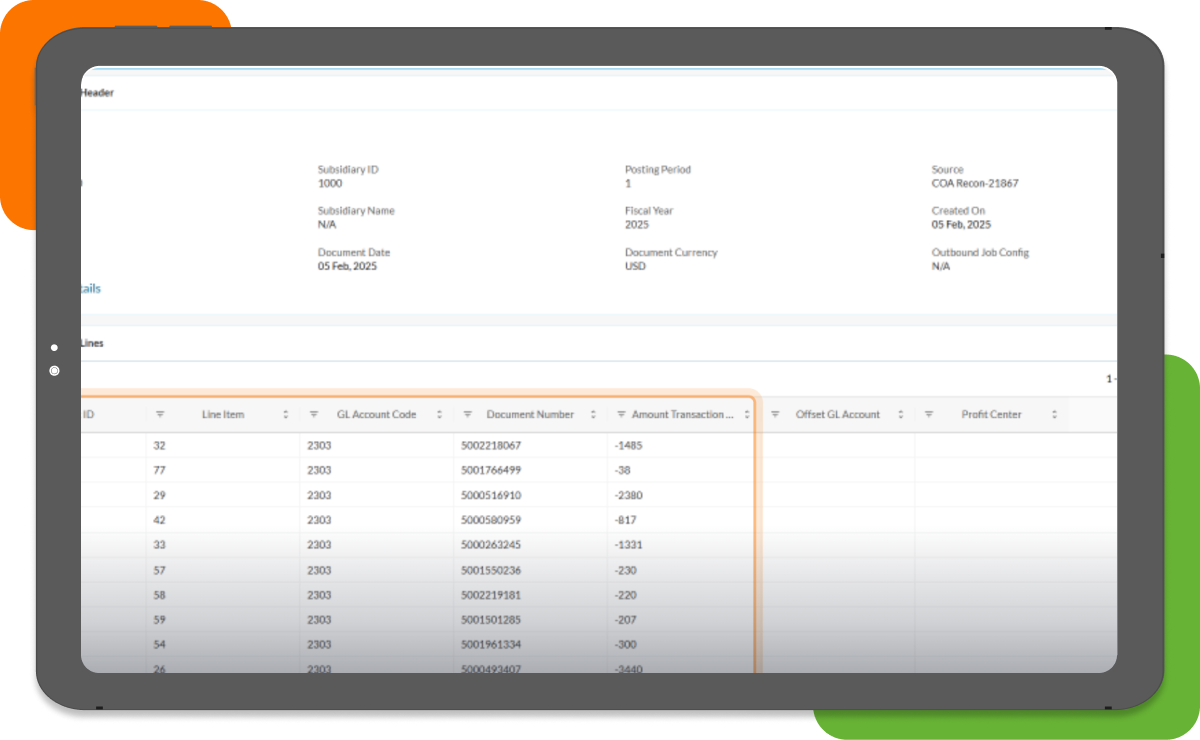

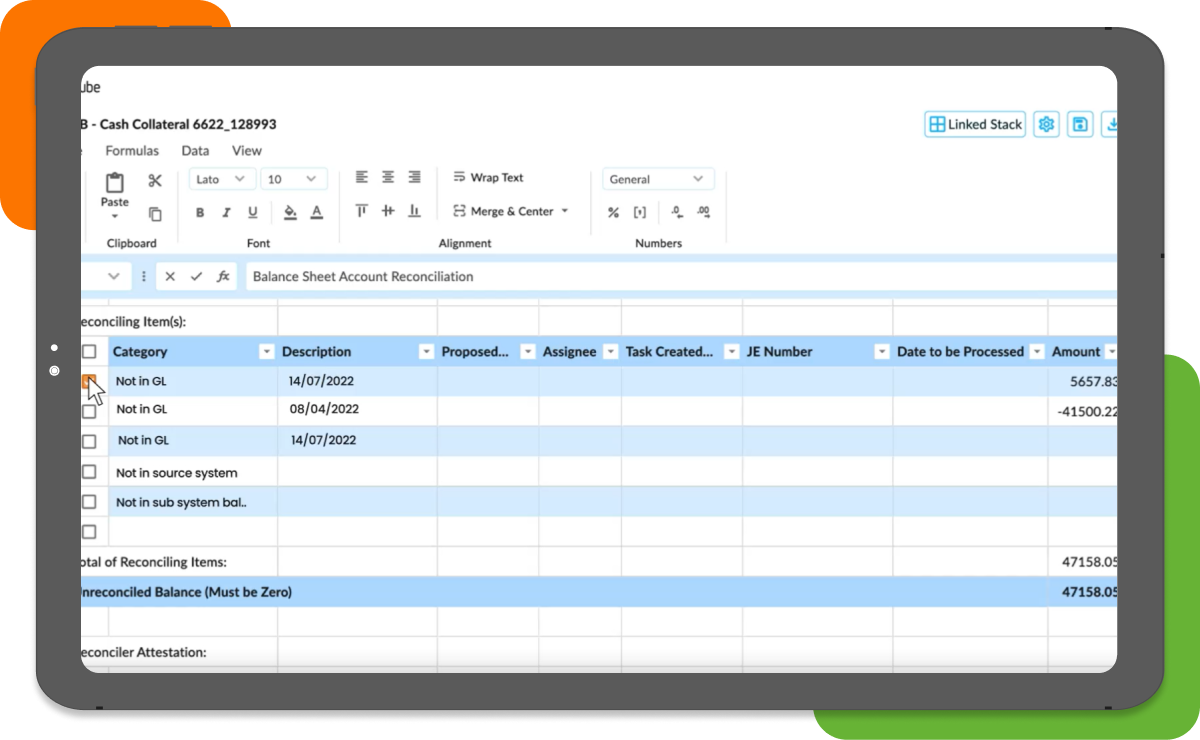

- 95% auto-matching complex, high-volume daily sales reconciliation

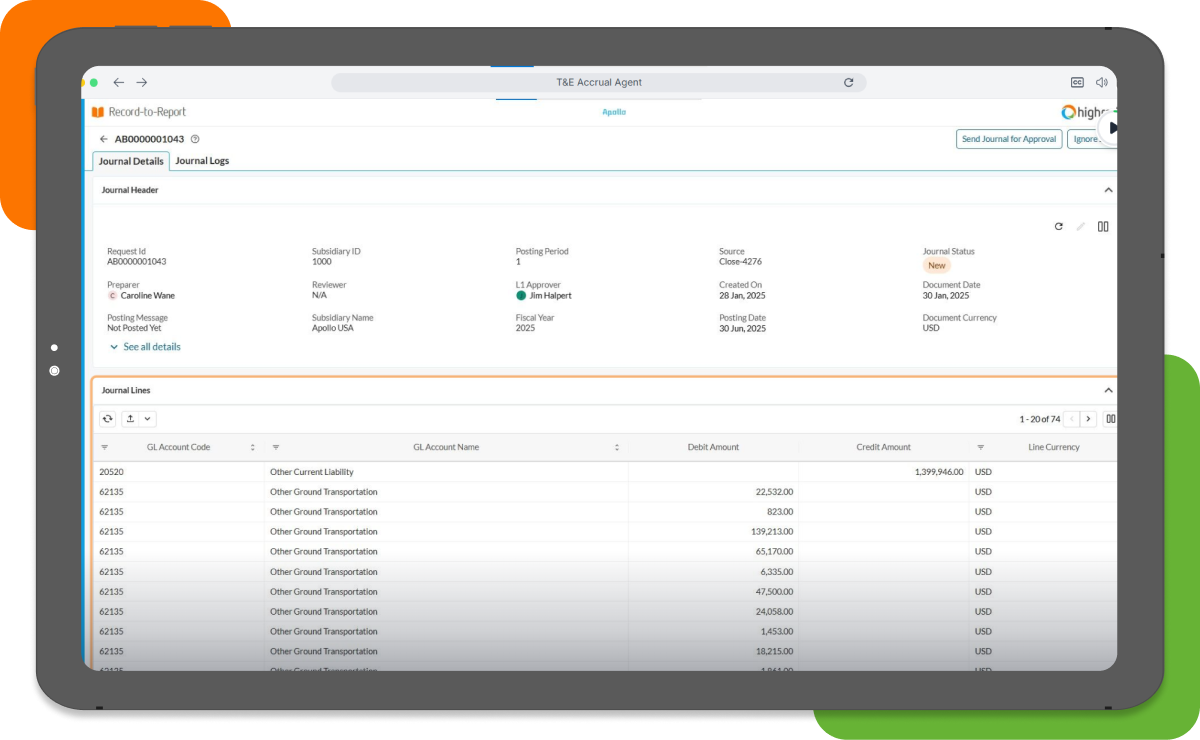

- 99% revenue recognition accuracy

- 70% improved revenue reconciliation productivity

- 30% reduction in days to reconcile revenue

Trusted by 1100+ Global Businesses

Realize 99% accurate revenue recognition

Just complete the form below