What is SOX Compliance Software?

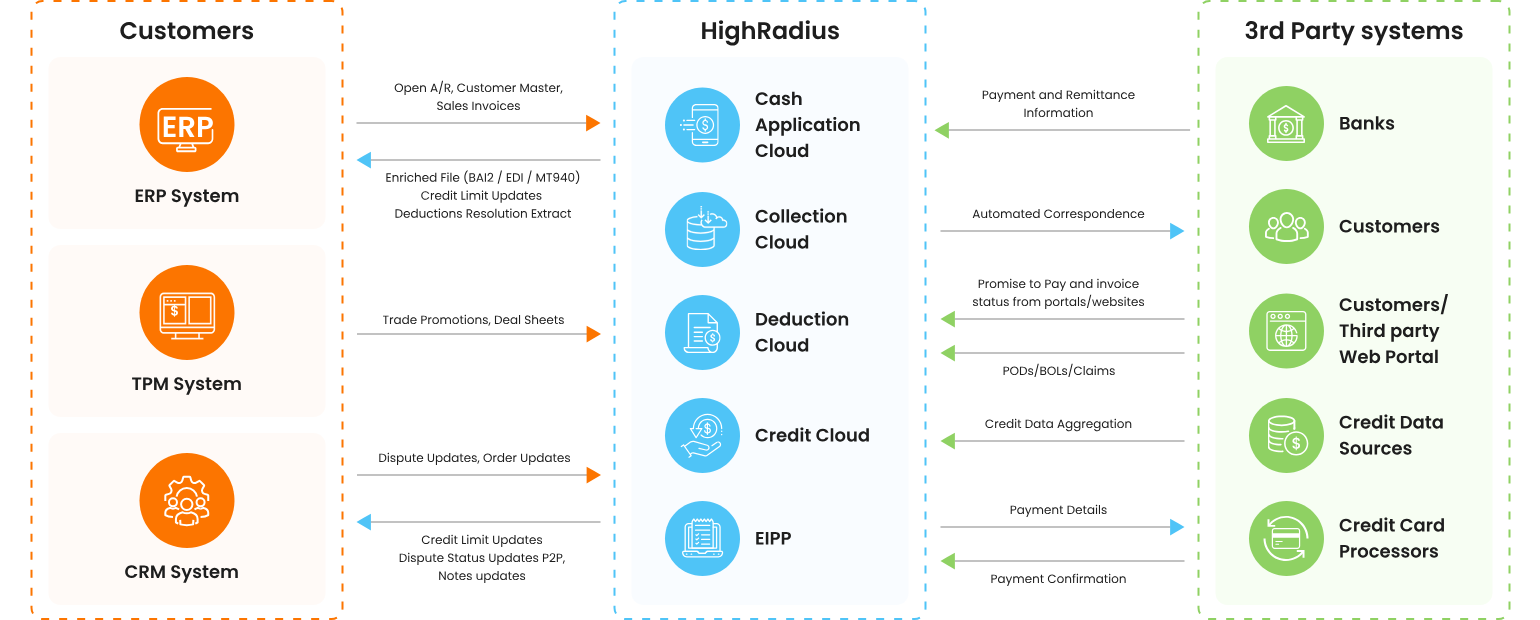

Automated SOX compliance software automates the processes and tasks businesses must perform in order to ensure compliance with the Sarbanes-Oxley (SOX) Act. Enacted to reduce fraud and protect external stakeholders from financial misinformation, the SOX Act mandates that publicly traded companies implement strong and effective internal controls for fraud and risk mitigation.

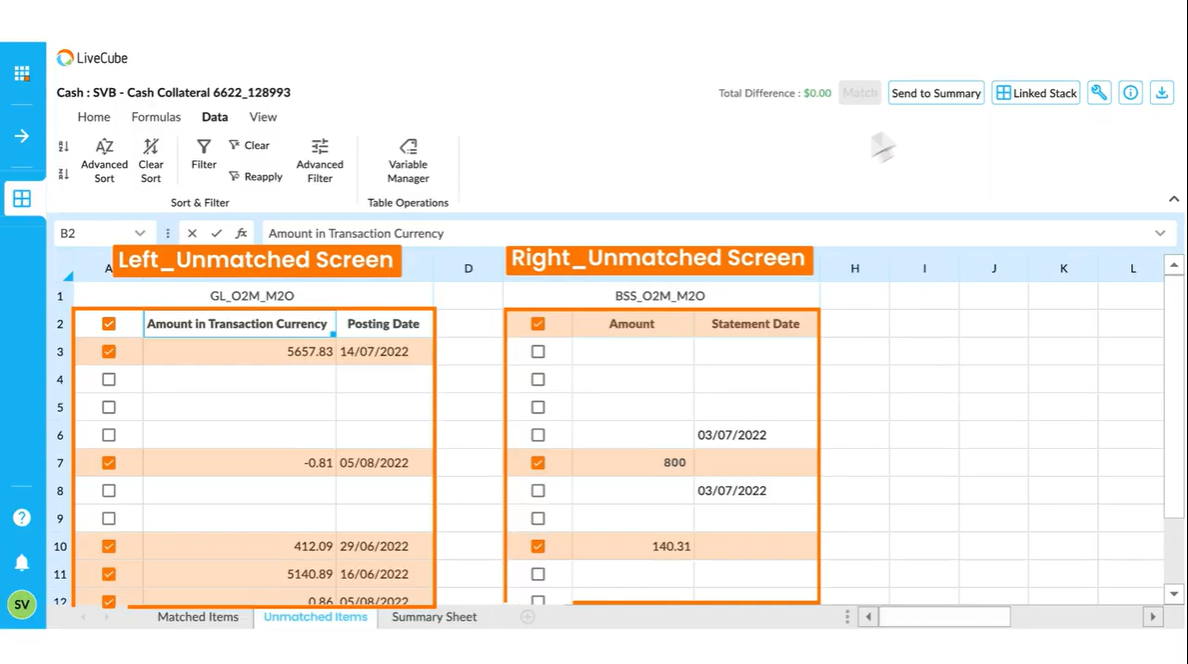

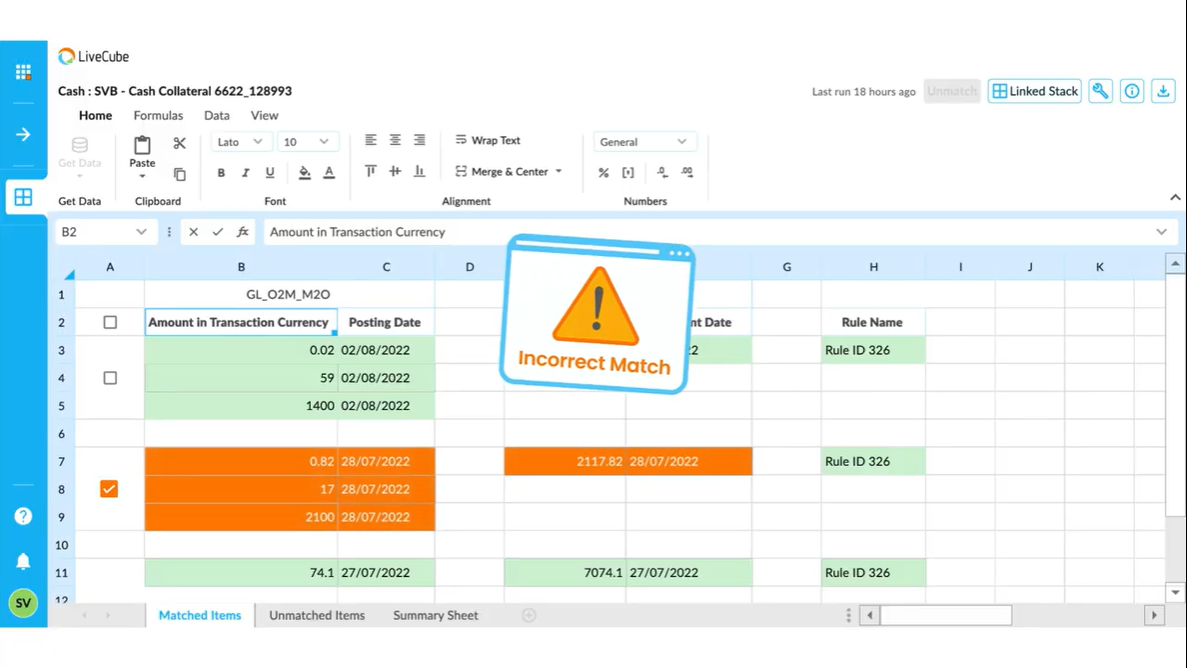

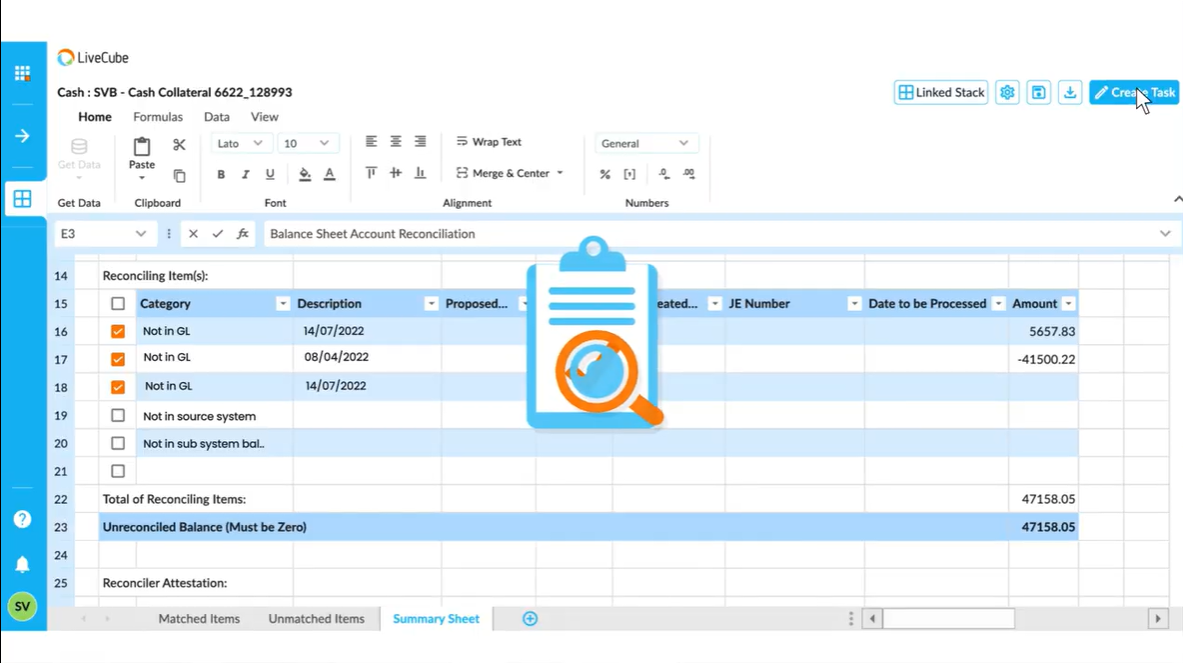

SOX compliance software simplifies adherence by automating key compliance tasks, ensuring businesses remain audit-ready at all times. The software streamlines essential SOX compliance tasks and processes that are continuous in nature, such as data extraction, SOX testing, and approval and review workflows. Further, automating the testing of internal controls enhances their effectiveness by ensuring they are regularly updated and aligned with evolving compliance requirements.