4 Leaks to Plug for Collection Prioritization and Improve Productivity by 130%

This e-book uncovers the leaks in account prioritization, which can inflate past-due A/R by 150% and the means to seal the leaks through industry best practices and smart segmenting factors to increase team productivity and ensure faster collections

Collections at A Glance

The Evolution of Collections Process

Collections is one the most important processes in Accounts Receivables. For a business to have a leading growth graph, a business ‘needs’ to put efforts into Collections Management. It doesn’t matter how well a company’s marketing efforts are going or how many sales they make if they are unable to collect any of their open invoices. With the changing economic times, the collections process has evolved over the decades from 1st generation to the 3rd generation. The evolution focuses on how collections has grown from a fully manual and limited ‘dial for dollars’ approach to a reactive process with semi-automation.

1st generation collections teams leveraged custom programs written over mainframe or ERP databases to prepare aging reports on a daily or weekly basis. The team would then ‘dial for dollars’ via phone calls.

2nd generation in the early 2000s saw the emergence of Data Warehousing and Business Intelligence tools which added additional insights to regular aging reports. However, the analysis was still manual and the teams would still ‘dial for dollars’ but had a better context to filter ‘who’ and ‘what’ in calls.

3rd generation from 2010 onwards saw dedicated software products for Collections Management which became the defacto standard for collections and brought fundamental automation into the picture. Email adoption added value by shifting a good proportion of phone calls to emails. This enabled 30-40% collections automation and an average 10% DSO improvement.

The focus over the years in the collections process has been on improving the accessibility of data and enabling some amount of automation. With the onset of collections evolution, the other accounts receivables process in the credit-to-cash cycle have also matured over time. The readers would agree that the days when A/R processes were siloed are far behind us. The next section takes a closer look.

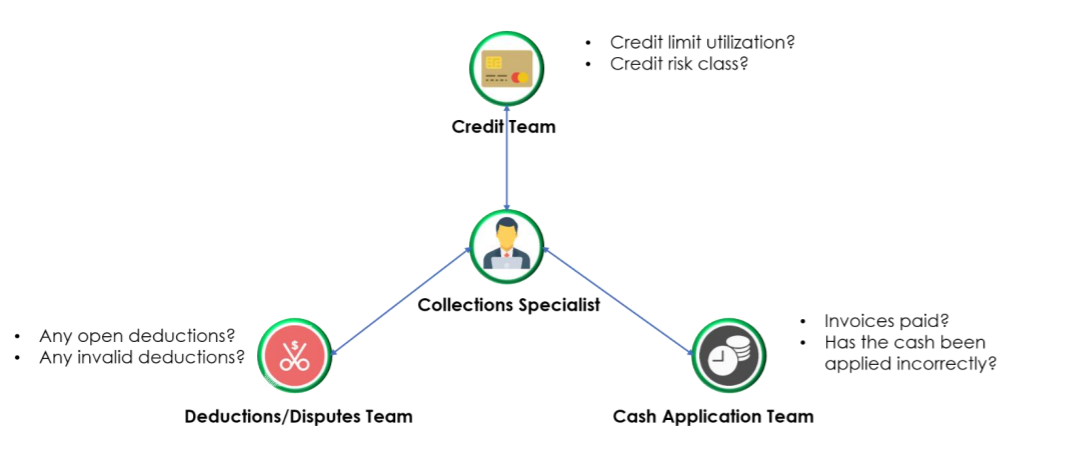

Connect between Collections and other Credit-to-Cash Processes

In the developing A/R scenario, it is no longer possible for collections process to remain isolated. The inter-department connect is of paramount importance when it comes to collections as the process needs data from other departments for not only slicing and segmenting the information for better worklists but also for efficient correspondence with the customers.

The collections team interacts with the credit management team to get information regarding credit risk class and credit limit utilization to formulate a fruitful correspondence strategy. The credit team in return also needs the support from collections teams to correspond with the customers for releasing blocked orders. The cash application team provides inputs for the invoices against which the payments have been made so that they can be removed from the worklist. Moreover, the collectors often identify pre-deductions, forward them to the deductions team and update the worklist accordingly. They also get inputs from the deductions team on the invoices with invalid deductions and need to kick start correspondence with them so they can decrease the overall past-due A/R.

Collections Today

The current scenario in Collections

As much as the collections process has evolved, the pitfalls in the process fail to disappear. The collectors still struggle across the roadblocks like too many delinquent accounts and a shortage of time to cover all accounts in the worklist. While the majority of their time is spent in sending email reminders, the use of Excel or spreadsheets as a main system of record further slows down the process. Amidst all the shortcomings in the collections process, DSO, past-due A/R and account coverage remain key concerns for the collections team.

The golden rule in collections states ‘The longer a debt is owed, the less likely it is to be repaid’ and rightly so as per the reports by Atradius that state that 52% of 90-days past-due invoice values are usually written-off. As per McKinsey’s report, more than 70% collection calls are wasted! These calls are made for accounts where the customer would have paid even in the absence of these calls. These facts and figures along with the identified process pitfalls pose an undeniable threat to the scalability and seamless working of the collections process. At a closer look, it can be identified that there is something wrong with the way the collections worklist prioritization works today, leading to wasted phone calls, increasing past-due A/R and insufficient account coverage. The next section explores the root causes of the problem.

The Leaks in Account Prioritization

The collections teams have traditionally used aging data and invoice value as the two pillars to slice and dice the invoice data extracted from the ERP. While this technique may seem reasonable and insightful enough from a top-level view, the industrial statistics disagree.

When aging data is used to prioritize a collections worklist, it may prioritize accounts in the worklist which have a claim or dispute associated with it. Now the collections process for these types of accounts cannot proceed or start unless the corresponding dispute has been resolved by the deductions team. However, the worklist prioritized based on aging would show up these accounts at the top for every collector.

If the collections team focuses on invoice value while prioritizing the day’s worklist, the small and medium accounts are left unaddressed and this may lead to increasing past-due A/R due to their accumulated invoice value. Moreover, there is a high probability that these customers would have paid if they had been sent a reminder or email about the same. What is more interesting is the fact that in a collections worklist 20% accounts on an average have high invoice value while 80% are small to medium accounts. The collectors who focus on only the large accounts often end up delaying numerous payments by small and medium customers.

The combination of aging data and invoice value also doesn’t support account prioritization in an optimized manner as they are lagging indicators of delinquency by an account. Moreover, using this tactic doesn’t identify or segregate the fast-paying customers, slow-paying customers or the regularly delinquent account.

Conclusion

In conclusion, the static method of prioritizing accounts based on just the aging data and invoice value does more harm than any benefit to the collections process and are the leaks in accounts prioritization. This leaves room for more dynamic and leading indicators of delinquency as factors while prioritizing accounts.The next chapter discusses the plugs to seal the leaks.

Four Leaks to Plug for Collection Prioritization

As discussed in the previous chapter, account prioritization is inefficient in the presence of lagging factors like aging data and invoice value and needs more insight. But what if the collectors could track the payment history of an account and decide the priority for that account based on whether it is a fast-paying customer or one with consistent delinquencies? This kind of strategy in segmenting the accounts provides better judgement about the priority associated with the account. Moreover, since the collections process isn’t insulated from other credit-to-cash processes, some of these leading factors in account prioritization can be derived from other A/R processes.

The accounts can also be classified as:

At Risk Accounts: This is the case where there is a high probability of customer not paying and the invoice falling into a larger aging bucket with time.

De-prioritized Accounts: This is the scenario where the account can be pushed back on the priority list and the collectors can spend time on more strategic accounts.

Low Hanging Fruit: This refers to the scenario where collecting might be easy or the customer has an incentive make payments.

Leveraging Credit History

The collections team can leverage credit history of the customers to identify their financial position and notice any downward trends in the financial health of the account. If a customer has a history of late payments and has a high credit risk, the financial health of that account might be unstable making it an ‘At Risk’ account. In this scenario, the collector should flag the customer as a high-risk customer, entice them to make early payments to get discounts and offer different modes of payment so that they don’t end up falling in larger past-due buckets and are not written off in the end!

Moreover, the collections team can obtain the credit limit utilization from the credit management team. If a customer with a growing business and low credit risk is approaching a credit hold, the collections team can motivate the customer for clearing their invoices to prevent their next order from getting blocked. The collections team can leverage credit limit utilization of all customers to find these ‘Low Hanging Fruits’ and eliminate them from their collections worklist.

Insights from Deductions and Claims

The collections team can leverage inputs from the deductions management and claims processing to pinpoint the customers with open disputes or unresolved deductions which need to be reviewed by the deduction analysts. These accounts can be ‘De-prioritized’ since they cannot be worked upon by collectors unless the disputes or claims are resolved.

However, if it is found that a deduction or dispute is invalid, the account becomes an ‘At Risk’ account where the collections team must prioritize this account and follow-up with the customer. The reason behind is that the disputed invoices have already been open while the deductions team worked on them, and any further delay in closing them would only put them in a larger aging bucket and increase the past-due A/R.

Inputs from Cash Application

The collectors often hear from the customers that they have already made payments against the invoice in question. This scenario occurs when the cash is applied in batches and the real-time updated information is unavailable to the collectors or when the cash has been applied incorrectly. The collectors should ‘De-prioritize’ such accounts and check with the cash application team before following up with these customers.

Best Practices in Internal Collections Process

Some best practices can be incorporated into the collections process to de-clutter the collections worklist and improve account prioritization.

The collections team should have a means of collecting Promise-to-Pays against invoices from the customers. The collectors can add the promised payment date for such accounts in the calendar and set reminders for themselves while classifying the account as ‘De-prioritized’ from the worklist. However, if a customer has broken a promise-to-pay that is failed to make payment by the promised payment date, it should be treated as an ‘At Risk’ account where the customer should be called on the same day and the account should be escalated internally.

If a customer has an open dunning notice they should be ‘De-prioritized’ from the collections worklist while the collector should add a follow-up date in the calendar as a reminder for himself. If a customer has been sent multiple notices and reminders and has been contacted through calls and the payment is still pending, it should be treated as an ‘At Risk’ account since the customer is showing reluctance to pay. The collector should further call the customer, offer incentives like discounts and recommend other modes of payment to the customer.

The collectors can leverage the customers’ correspondence log to check if the customer has asked for an invoice. This shows the willingness to pay and is a ‘Low Hanging Fruit’. The collectors should immediately follow-up with the customer to fasten the payment and collections process. If a customer has asked to follow-up on a later agreed date then it should be ‘De-prioritized’ from the worklist and the collector should not follow up with the customer before the agreed date.

The collectors can gain insights from the customer’s account history and identify if it is a large, fast-paying customer. In this case, the collectors should treat them as ‘Low Hanging Fruit’ and should send personalized reminders but less frequently. If it is a small to medium account where the customer usually pays without being called and need reminders via mail, they can be termed as ‘Low Hanging Fruit’. The collectors should mark these accounts, group them and send bulk generic emails periodically.

Conclusion

Summary

As discussed in the previous chapter the accounts in the collections worklist can be classified as Deprioritized, At Risk and Low Hanging Fruit. The actions that the collections team should take for each scenario were also suggested in the previous chapter. In conclusion, the fast-paying customers, the small to medium accounts, the customers with low credit risk who have exhausted more than 90% of their credit limit and the customers who have asked for and been sent invoices come under ‘Low Hanging Fruit’. The customers with open dunning notices, unresolved disputes, approaching promise-to-pay or follow update along with those who have a discrepancy in cash application come under ‘De-prioritized’ accounts. The customers with invalid deductions, multiple dunning notices, broken promise-to-pays or the accounts where customers are habitual late payers are ‘At Risk’ accounts.

Future of Collections

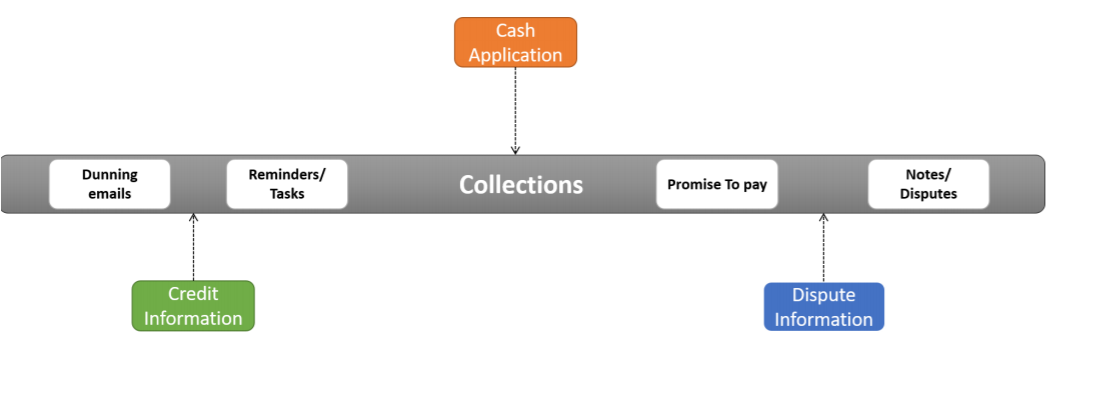

The first chapter discussed the evolution of collections process into a reactive, semi-automated process which relies heavily on a mismatch of tools like Emails, Excel Spreadsheets, Messenger, Calendar, ERP system, To-do lists, Sticky notes, Notepads, etc. However, are these tools really a necessity in the future of collections?

Technology is the future of the collections process where all the data, analysis, strategies, correspondence and information are only a click away. HighRadius Collections Cloud solution provides a complete set of tools to optimize and automate the collections management process. All the information you need like invoices, dispute information, PODs, claims, tracking info, etc. on each case is automatically presented in a collections work-space and ready for use with a single click

Key Features Include:

- Rules-based Collections Optimization automatically prioritizes and assigns collections activities to analysts based on predefined business rules.

- Integrated Collections Work-space tracks promises-to-pay and tasks and reminders for every account and collection effort.

- Predictive Risk Scoring Model identifies ‘at-risk’ customers who might be current on their account and integrates the risk level into prioritization.

- Dunning Correspondence Automation generates and sends out correspondence packages containing needed documentation based on predefined templates.

- Easy integration with ERP, Accounting, and other systems

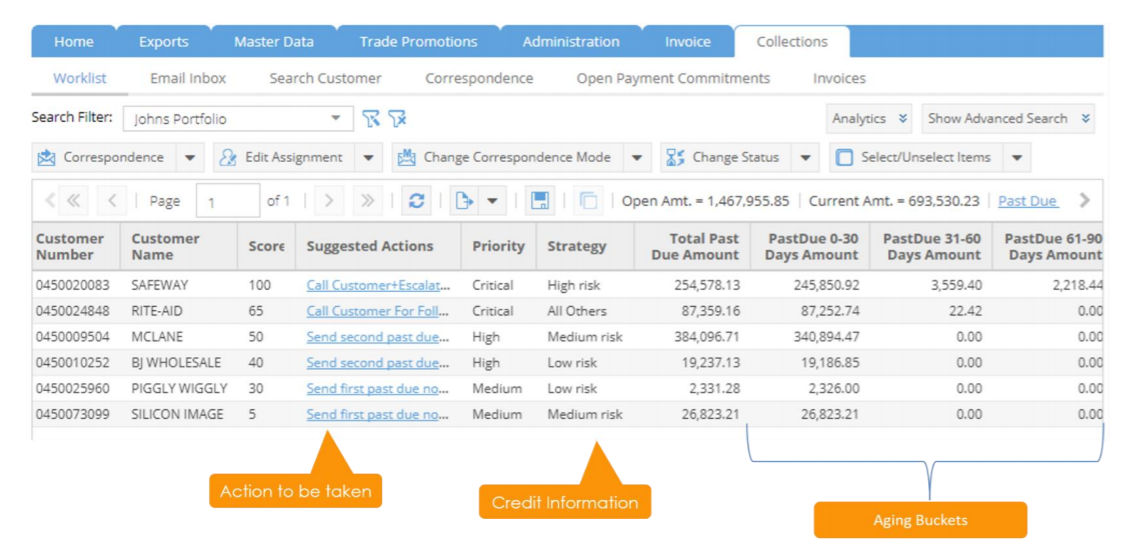

Collections Worklist

About HighRadius

HighRadius is a Fintech enterprise Software-as-a-Service (SaaS) company. The HighRadius™ Integrated Receivables platform optimizes cash flow through automation of receivables and payments processes across credit, collections, cash application, deductions, electronic billing and payment processing.

Powered by Rivana™ Artificial Intelligence Engine and Freda™ Virtual Assistant for Credit-to-Cash, HighRadius Integrated Receivables enables teams to leverage machine learning for accurate decision making and future outcomes. The radiusOne™ B2B payment network allows suppliers to digitally connect with buyers, closing the loop from supplier receivable processes to buyer payable processes.

HighRadius solutions have a proven track record of optimizing cash flow, reducing days sales outstanding(DSO) and bad debt, and increasing operational efficiency so that companies may achieve strong ROI in just a few months. To learn more, please visit https://www.highradius.com/.

HighRadius’ Integrated Receivables Platform

Integrated Receivables is a solution to optimize accounts receivable operations by integrating all receivable and payment modules to work as a unified business process. At the core of the Integrated Receivables platform are solutions for credit, collections, deductions, cash application, electronic billing and payment processing covering the entire gamut from credit-to-cash. The HighRadiusTM Integrated Receivables platform is a stand-out as it enables every credit and A/R operation to execute real-time from a unified platform with an end goal of lower DSO, reduced bad-debt, faster dispute resolution and improved efficiency, accuracy for cash application, billing and payment processing.

HighRadius™ Integrated Receivables leverages Rivana™ Artificial Intelligence for Accounts Receivable to convert receivables faster and more effectively using machine learning for accurate decision making across credit and receivable processes. The Integrated Receivables platform also enables suppliers to digitally connect with buyers via the radiusOne™ network, closing the loop from the supplier A/R process to the buyer A/P process.