How Do Robots Fare Against Retailer Portals

An actionable deep dive on how technology can automate dispute resolution and help your teams keep with dispute resolution windows

How Do Robots Fare Against Retailer Portals

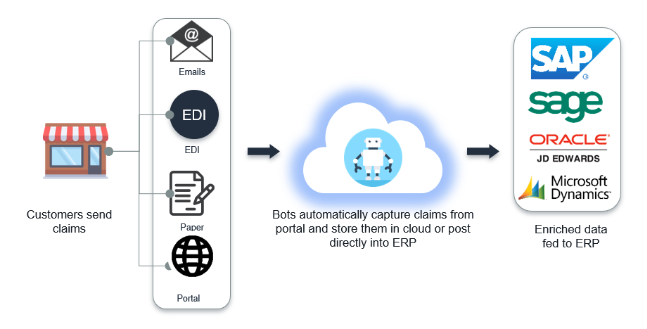

1.Claims and POD Aggregation

“As a result, all claim/dispute information are exported from retailer portals in one single batch eliminating the need for manual download”

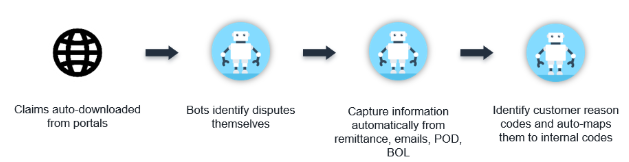

2.Auto-coding Deductions

“Time spent on dispute identification and coding is now saved and they are directly assigned to analysts who directly start working on them.”

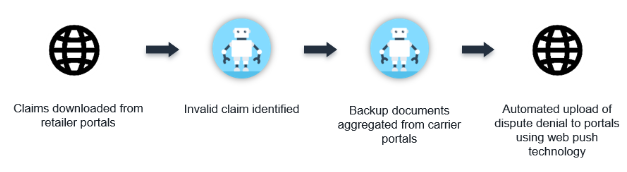

3.

“For invalid claims, denial package is uploaded to retailer portals with all the related deductions backup including, proof of delivery and bill of lading.”

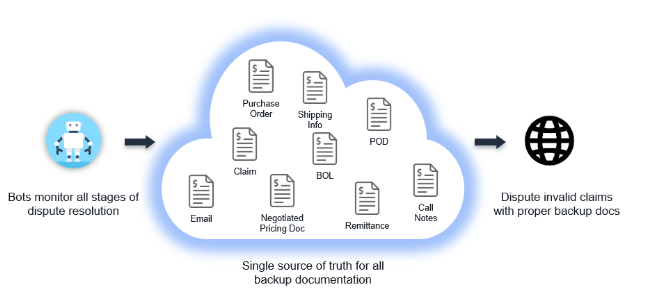

4.Dispute Correspondence

“Analysts don?t have to separately write emails, attach documents for each customer”

5.Audit Trail

“Disputing timely with proper backup documentation results in faster resolution”