Automation Techniques

This e-book presents information on deduction automation that†every A/R leader should know before starting their automation journey.

Automation Techniques

Automation of manual, repetitive and low-value tasks is a very successful method to speed up deduction resolution. In the resolution process discussed earlier, each step of the process contains many repetitive tasks that could be automated to free-up resources to then focus on high-value and complex activities instead. Automation also brings down the cost of processing deductions drastically. The sections below cover the automation of low-value tasks in detail.

1. Backup Aggregation

Many medium and large customers upload their claim documents to a web-portal and provide the suppliers/manufacturers with the login. Other customers use formats, such as emails, EDI, and paper documents to share the details of the claims. Backup aggregation involves downloading and maintaining documents such as claims and PODs from these various sources before starting the deductions research.† Collecting backup for thousands of deductions cases every day becomes a time-consuming and tedious task.† Moreover, extracting the associated deductions documentation is only the beginning of the overall deductions research workflow. Fortunately, backup aggregation is a routine task with fairly consistent steps for most of the incoming debit memos. Modern technology provides options that allow analysts to shift their attention from these mundane tasks to more valuable tasks. Best-in-class backup automation solutions identify the source, read and understand the source message, extract the data and standardize it.

2. Critical Properties for Backup Automation

Efficiency

The purpose of implementing backup automation technology is to free-up as much resource time as possible by automating manual tasks. It is important to measure and benchmark the percentage of the manual work being eliminated in this fashion. For example, if someone is required to manually identify sources before the automation technology is able to download it, it is not efficient enough. Additionally, businesses are looking to rapidly implement solutions and realize the benefits faster. Only a few vendors are able to provide a plug-and-play solution for backup aggregation in deductions management.

Versatility

Versatility is the degree to which the technology is source-agnostic. In selecting a solution, be sure to find one that supports extraction from all types of sources such as websites, email, images, and EDI. Check for accuracy in standardizing the document backups to simplify research for deduction analysts. Also, be sure the solution provides pre-integrated download facilities to all the major retailers? claim websites in the customer portfolio. A solution with end-to-end process automation could automate as much as 95%, if not more, of the A/R tasks to resolve trade deductions. Additionally, about 20% of the time spent by deductions teams could be freed-up using automation technology.

3. Documentation Collection and Sorting

Downloading backup documentation in a source-agnostic, efficient and accurate way is only a part of the whole solution. Linking these documents to the original deduction case and sorting, indexing and categorizing the documents must also be addressed. At times the volume is so immense that companies with a large inflow of deductions need to employ additional teams to handle the document management overflow. Every deduction document needs to be sorted and indexed so that the analyst is able to easily locate the piece when required. This is done based on various parameters, for example, the type of deduction (trade or non-trade), the responsible department (operations, sales, or warehouse), customers by buying volume (large and small), customers by-products, and so on. This quickly becomes very complex when all deduction categories are added together for thousands of customers. The next step in the process is the linking/matching of each document to a particular deduction. Again, this is a manual process that involves identifying attributes on debit memos, including claim ID, debit memo number and dates, searching the open deduction in the ERP or other applications, and tying the document to a particular deduction when a match is found. Current technology reduces this humongous scale of work to three easy steps as follows:

Identification

The type of document and the details within, such as customer ID, amount and type of deduction, purchase order, and invoice number, need to be identified to link it to the appropriate deduction case. However, most existing software solutions are unable to accurately extract the information due to legacy technology issues. Consider the claim document image shown in Figure 7: Sample Claim Document.

Figure 7: Sample Claim Document

The information elements that a deduction analyst would require are the claim #, the claim date, PO #, claim amount and so on. Optical Character Recognition (OCR) is widely used to read the image document and extract the data details. A typical OCR engine divides the document into capture rectangles, aligning each data piece on the image into a box. The OCR reads the data pixel by pixel from each box and converts it into human-readable text. However, a number of difficulties arise with OCR, including:

- Not every claim document is formatted in the same way

- Not every claim document has same information

- Other formatting differences occur ? font type, color, size, printing clarity, etc.

Hence, the accuracy of OCR is low and dedicated resources may be required to check for errors and exceptions for the documents being processed. The use of Artificial Intelligence (AI) and Robotic Process Automation (RPA) are the keys to solving the problems not resolved by OCR. AI is a machine learning-enabled system that processes even the most complex and non-tabular, mixed structured data from a multitude of formats. AI is able to capture the content, extract the information, make sense of the data and correct for quality issues. If the concept of AI is applied to the A/R challenge, some unique solutions could be visualized. For example, by repeated reading of claim documents, the AI engine begins to understand the typical invoice number locations, how many digits, in general, are present in the claim number and which data type is preceded by a ?$? symbol to represent dollars, and so on. The more documents the AI engine processes, the greater its accuracy becomes. RPA modularizes the automation steps and provides end-to-end process automation by emulating real-world business steps. The solution operates as several ?process automation units? performing in tandem to enhance the task output for the business users. RPA orchestrates across all the automation steps for the various types of deductions and related processes and steps.

Linking

Once the information is successfully extracted from the document, the claim needs to be linked to the actual deduction or dispute case. The open A/R details are acquired by the linking software to match it to the data extracted from the claim and POD documents. A robust linking engine would extract the required details from open A/R and align it to the matching claim document.

Research-Ready Deductions

Displaying the completely matched deduction case with the documents and details is the final step in preparing the deduction case for research and analysis. Deductions analysts are able to review each deduction item upon login to the solution with all the details and documents readily available.

4. Trade Promotions Matching

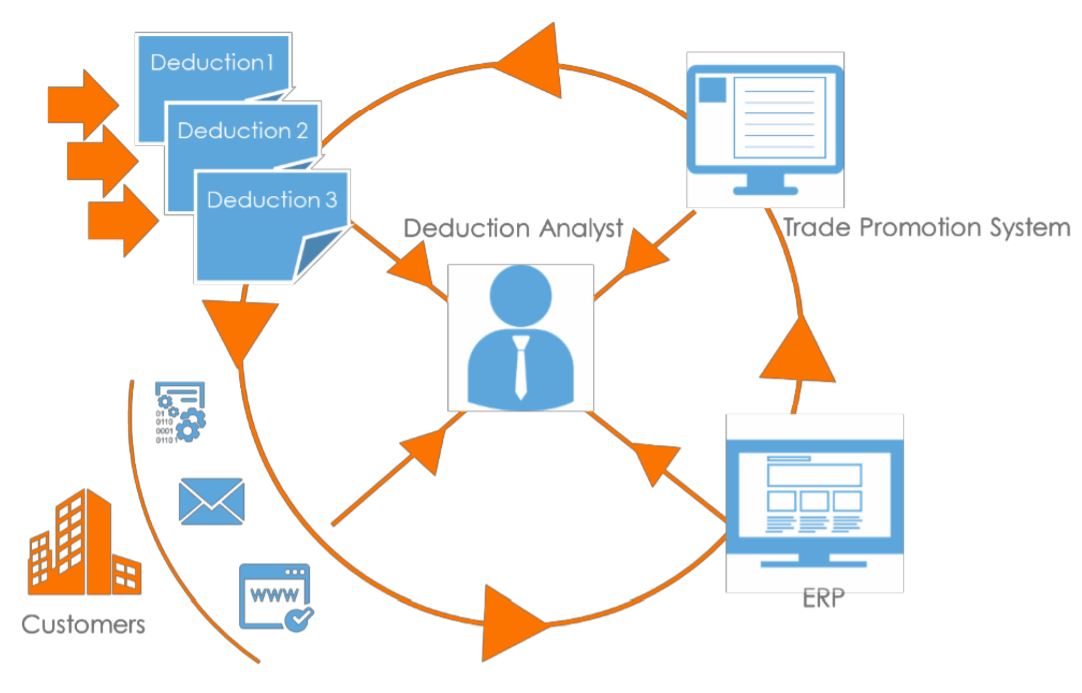

Customers often negotiate rewards, discounts, rebates, and other promotions, then use short payments to recoup the reward benefits. However, this creates extra work for the deductions team as every trade deduction needs to be validated against the promotion to which it applies. Deductions analysts have to find, match and analyze the trade deduction to validate the short payment. Automation plays a critical role in helping the deductions analyst clear the trade promotion deductions rapidly, and also frees additional time for the analysts to review the more complex deduction items and resolve them. See Figure 8: Deductions Analyst Tasks – Researching Trade †for a typical trade promotion deduction to be researched by an analyst.

Figure 8: Deductions Analyst Tasks – Researching Trade Deductions

The deduction analyst is at the center of the resolution activity. The analyst has to gather information from† various sources, such as:

- The incoming claims and deductions

- The ERP which contains the details on the deduction

- The customer systems from where the claim document is to be downloaded

- The trade promotion management system which contains the details of the promotion against which the customer has taken a deduction

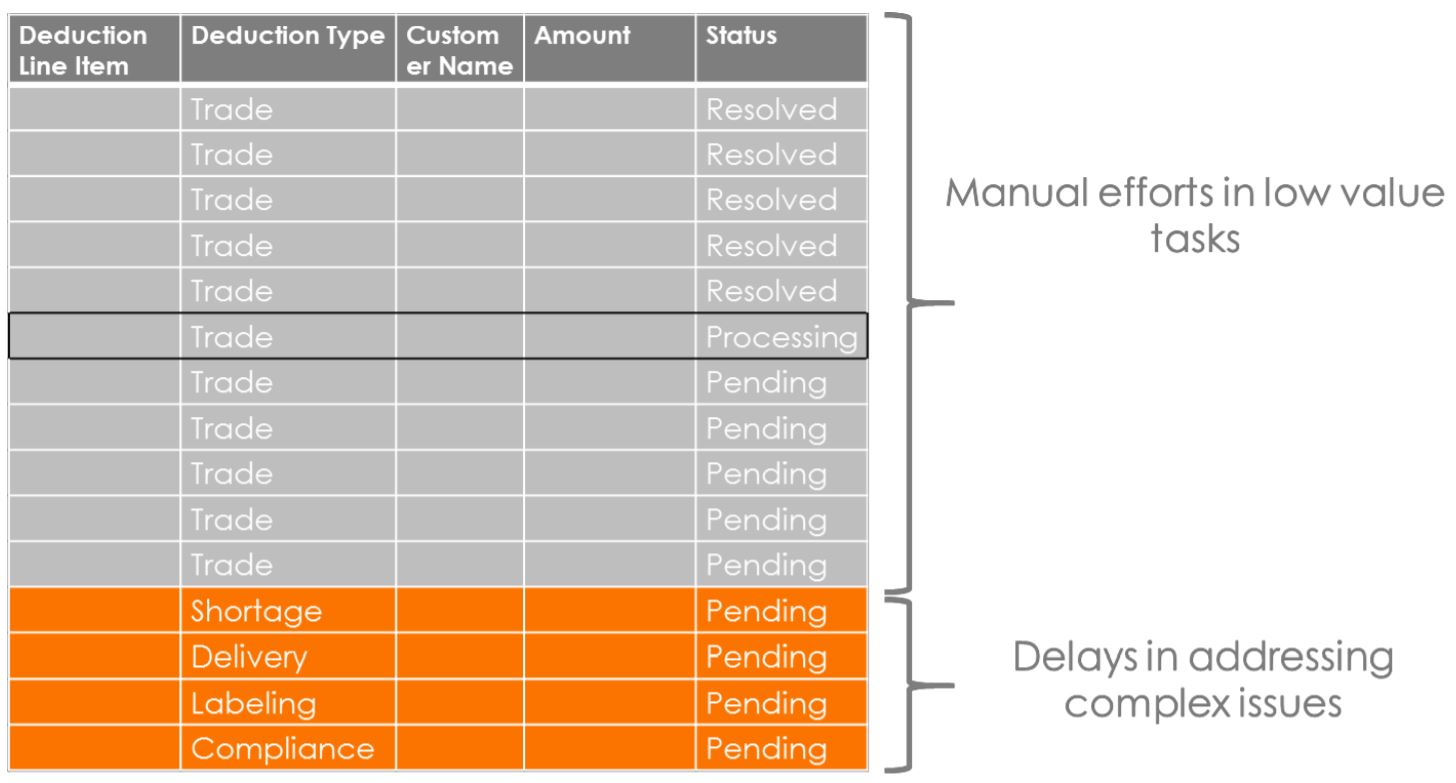

The time taken to collect the relevant details and the monotony of doing the same activity over-and-over for† every trade deduction drastically reduces the efficiency of analysts. As a result, trade deductions, which are† easy to process, take more time while the more complex and time-demanding deductions related to† shortages, compliance and others are not allocated enough time for quality analysis (Error! Reference source† not found.). Furthermore, due to the aging limits on a deduction, the critical items are written-off leading to† an unwanted revenue loss.

Figure 9: Tasks delayed due to manual processes

Technology helps match the claim details to the trade promotion details automatically and provides suggestions to enable deduction analysts to make quick decisions and close the deduction. The time savings are immediately available to analysts to investigate critical deductions and reduce write-off.

5. Research and Workflows

The most critical parts in the lifecycle of handling deductions are the research, root-cause analysis and decision-making on the open deduction cases. These activities require expert investigation because of the variability and complexity in the nature of deductions. A/R teams perform deductions research in 66% of companies, while sales teams approve deductions in 55% of companies. Various other departments may also be involved in linking deductions within the organization. Keeping track and following up on hundreds of deductions simultaneously across departments is not only expensive but also time-consuming. Ultimately, much of the dollar amount associated with deductions is written off because of the rising cost of investigations. This creates a strong case for conducting a deductions workflow with the following attributes:

- Coordination and Collaboration: Employ easy assignment, access and approval methods to help teams organize their activities, prioritize the cases and communicate the resolutions rapidly.

- Visibility and Accountability: Utilize comprehensive tracking and reporting mechanisms to remove bottlenecks in the approval and investigation chain and thereby improve accountability and efficiency.

- Speed: Streamline deductions processing using workflows to reduce DDO, improve deductions resolution time, and boost the coverage and recovery for more deductions.

- Automation: Integrate robotics to perform the manual, clerical tasks freeing up resources to investigate more deductions and reduce write-offs.

6. Correspondence

Traditionally, correspondence templates have been a nightmare for the A/R department. To a large extent, this arises from dependency on IT to incorporate any changes in the letters and template. Correspondence letters need flexibility around the email format, attachment options, and content. Correspondence solutions should provide the following benefits to the credit and A/R teams:

High Accuracy

Irregular or inaccurate notifications impact customer relationships and deduction recovery rates significantly. Every correspondence template requires specific types of documents or information attached or copied with the emails. For bulk mail, a system?s ability to accurately create and send letters is essential for analysts to remain productive.

Ease of Setup

The ease with which correspondence is set up and executed has an impact on the level of automation achieved in the dunning process. Best-in-class solutions should be able to execute the correspondence effort in a few clicks, allowing business users to manage them on their own and eliminate the need for IT involvement.

Improved Tracking

Being able to systematically track history and fine-tune correspondence strategies is a powerful functionality for credit and A/R teams. Correspondence history and tracking provide many benefits, including:

- A quick summary of interactions with customers

- Details on customers who are not responsive to email communication

- Details on the correspondence that work the best

- Optimized time-gap between correspondences

This intelligence and other benefits that could be realized with an automated correspondence solution improve the correspondence strategy and help adopt best practices for customer communication.