Research & Requirement Gathering

How To Convince Your C-Suite Series

Research & Requirement Gathering

2.1† STAKEHOLDER IDENTIFICATION

Identify all the important stakeholders who are going to be impacted by the digital disruption project and start involving them right from the initial stages of the project. This would allow the respective teams to be prepared for the incoming change, share their perspective on the pros and cons of the change and also provide their share of invaluable contributions to help make the project a grand success. The various parties who need to be involved for a Cash Allocation Automation project include:

- IT Teams

- Sales Teams

- Treasury Team

- Customer Service Team

- Human Resources Team

- Credit Management Teams

- Collections Teams

- Invoicing/Billing Team

- Dispute/Claims Resolution Team

More teams can be added or removed based on company polices & preferences. Once the teams are identified, a board of project members involving representatives from each team should be formed and should meet regularly to discuss updates, issues and arrive at a plan of action.

2.2 HIGH LEVEL REQUIREMENT IDENTIFICATION

This is the phase where all the teams mutually agree, discuss and arrive upon a set of high-level objectives or outcomes which the intended project is expected to achieve. For instance, the sample objectives of a Cash Allocation Automation project could be as below:

- Reallocation of resources for high-value tasks

- Cost reduction of silos-based solutions

- Search for a solution adhering to the existing compliances, policies

- Transparency, visibility through proactive reporting mechanism

2.3 PREPARING A REQUEST FOR PROPOSAL

A Request for Proposal (RFP) is a comprehensive list for the vendors to help them understand the precise requirements of the buyer. An incomplete/vague RFP could fuel misconceptions within the vendors. It helps to solicit bids from vendors, acquire all the information which could help you extract the most optimal solution at the lowest price, & ensure a fair & transparent vendor selection process.

2.4 ANATOMY OF AN RFP

Any RFP should cover the below essential sections so that the vendors would be clear about the company they are going to work with, the exact details of the project they would be undertaking & also provide with pricing details which are neither underpriced nor inflated.

a) Company Overview

A company should introduce themselves to the vendor before proceeding to discuss more important items. This section should explain company history, its business model & industry, financial data such as annual revenue, employee strength, geographical presence, types of customers it deals with as well the values it stands for.

b) Project Objectives

The company should provide the vendor with a brief project overview for which the company is inviting bids. This should include details about the process in discussion, the intention to consider the process, current challenges, details about the various stakeholders. For example, you could describe A/R landscape in short before proceeding to explain the

- Cash Allocation team size

- Types of payments & remittances to be processed

- ERPs into which cash is to be posted

c) Detailed Scope of Work

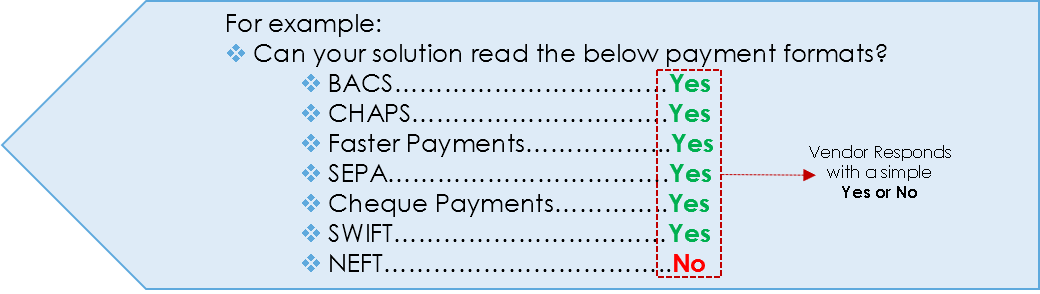

This is the most critical chapter as it gives the vendor a detailed understanding of the company?s expectations and helps them assess their internal capabilities to match those expectations. An insufficiently defined scope of work might result in the vendors quoting inaccurate prices or promising impractical timelines. For a sample Cash Allocation Automation RFP, please refer to the below sample scope of work. SAMPLE FOR DETAILED SCOPE OF WORK CASH ALLOCATION AUTOMATION For Credit and Finance Managers working on RFPs, below is a list of factors which should be considered for Cash Allocation Automation Project RFP. The scope of work helps companies identify & asses capabilities & deficiencies of different vendors with respect to various functionalities, which they would not have revealed by themselves until the elater stages of evaluation. Vendors participating in the bidding process are required to reply with a simple YES or NO against the requirement.  The key requirements that should be considered in the project scope are as follows: c.1 Payment Capture Confirm with a Yes/No if your solution can:

The key requirements that should be considered in the project scope are as follows: c.1 Payment Capture Confirm with a Yes/No if your solution can:

- Enter cash into ERP in the following formats

- BAI, ANSI, EDIFACT

- Process excel spreadsheets for credit card payments

- Capture payment information from the following payment formats?

- BACS, CHAPS, FP, SEPA, Cheques, SWIFT, ACH, Wire

- Provide standard interfaces for following payment types

- BACS, CHAPS, SEPA, Faster Payments, SWIFT & Wire payments

- Generate service charge/interest invoices generated at the time of late payment/end of a particular period

c.2 Remittance Capture Confirm with a Yes/No if your solution can:

- Capture remittance from the following sources:

- Paper, emails, customer web portals, EDI, BAI2, MT940

- Capture remittance data from email content & attachments in

- PDF, Excel, TXT, BAI, EDI820, MT940, MT942, HTML formats

- Handle remittances across multiple customers & business units

- Process remittance with a one-time setup instead of regular configurations/calibration/programming

c.3 Invoice Capture and Matching Confirm with a Yes/No if your solution can:

- Handle multiple transactions against same line item in same application

- Perform customer search by: customer name, customer number, invoice number, address, phone number

- Match remittance with invoices when customers quote just their name/customer number in bank statement information

- Have a central location for all invoices across ERP instances

- Match credit & debit using following parameters

- Amount, claim data, invoice number, customer PO number

- Process payment with less than complete invoice number, gross/net euros

- in data

- Generate customer-specific mapping for payment application

- (reference number)

- Roll-up payment lines which contain same reference number & close the invoice

- Apply payments across all ERP instances depending on the remittance

- Transfer open items to another customer or business unit

- Link payments to remittances aggregated from emails, websites & customer portals

c.4 Exception Handling Confirm with a Yes/No if your solution can:

- Process any exception using the data across ERPs before the payment is pushed down to logical systems

- Reach out to customers via email with the link to invoices with no remittance/reference

- Adapt to changes in customer payment behavior/changes in electronic bank statement information

- Auto-create a charge back to relevant customer account for payments that cannot be fully matched by amount

c.5 Capturing Customer Claims Confirm with a Yes/No if your solution can:

- Mark partial payments as open/unapplied on account

- Handle following disputes/remittance:

- short payments, trade discounts, damages, bank wire charges/deduction

- Identify & convert customer reason code into company?s internal reason code

- Roll-up claims by following parameters

- reference number, reason codes, credit/debit terms

- Utilise ERP deduction reason code tables

- Capture & assign reason codes for logistics deductions such as tax, freight by comparing remittance vs invoice amounts

- Capture reason codes for cash discounts such as earned, unearned, discounts earned but not taken, discount beyond grace period

- Create disputes & capture information as standard text, related reason code

- Set discount %, discount days, grace days, simultaneous multiple batch processing at the user business unit level

c.6 Cash Posting Against Open A/R Confirm with a Yes/No if your solution can:

- Allocate cash automatically & update the status real-time in ERPs

- Generate output files in the following formats:

- BAI2, EDI823, CSV

- Process payments across multiple ERPs simultaneously

- Clear line items using remittances received after payment posting

- Handle complex, multiple payer & parent-child business scenarios

- Integrate directly with incumbent accounting system such as QuickBooks

- Post cash without modification to the existing electronic bank statement delivery schedules & formats

c.7 IT Infrastructure requirements Confirm with a Yes/No if your solution can:

- Integrate with the following ERPs: SAP, Oracle, NetSuite simultaneously

- Be compatible in the following languages:

- English, Francais, Espanol, Polish, Deutsch

- Provides workflows which are business-configurable

c.8 Miscellaneous Confirm with a Yes/No if your solution can:

- Provide security by user & business unit

- Provide a daily reconciliation report that indicates a logical system split of payments across ERPs listed

- Generate predefined status reports on cash allocation process such as on automation rate, unapplied cash

- Customize existing report settings/parameters such as report layouts, filters

- Provide tools to extract all data for further processing or reporting & other tools such as BO, Excel, BI, BW

d) Vendor Related Information

The vendor should provide information about their background, previous experience & achievements as well important details of the solution such as solution architecture, integration capabilities, key features, digital brochures, web links, videos, demo links, etc.

e) Pricing Requirements

The company should ask for the cost structure of the solution offered by the vendor. This should include basic package cost, subscription costs, additional enhancement costs.

f) Performance Measurement Standards

The company should clearly define the standards to measure the vendor?s performance such as timeline, security, cost reduction.

g) List Of Deliverables

The company should ask for an implementation plan from the vendor along with other requirements such as ongoing support, blueprint, timelines, methodology.

h) Submission Guidelines

The company should call out the standardised format/ template for each section, as well the timeline to submit. This is to prevent various versions of entries which would make compiling an comparison a nightmare for you.

i) Standards & Classifications

The company should ask the vendor to provide information & validation if the work or product meets the international standards, for example, ISO standards, ERP certifications, GDPR compliances, PCI-DSS compliance.

j) Terms & Conditions

The company should ask the vendor for their IT policies, security measures, legal policies, & their business terms and conditions. This could include password policy, system upgrade policy, data retention policy, privacy policy & confidentiality, project dates, Non-disclosure agreements.