SIGNS YOUR CURRENT CREDIT SCORING MODEL IS VINTAGE

An insightful summary of building the best-in-class credit scoring model capable of streamlining information, reducing bad-debt and predicting bankruptcy.

SIGNS YOUR CURRENT CREDIT SCORING MODEL IS VINTAGE

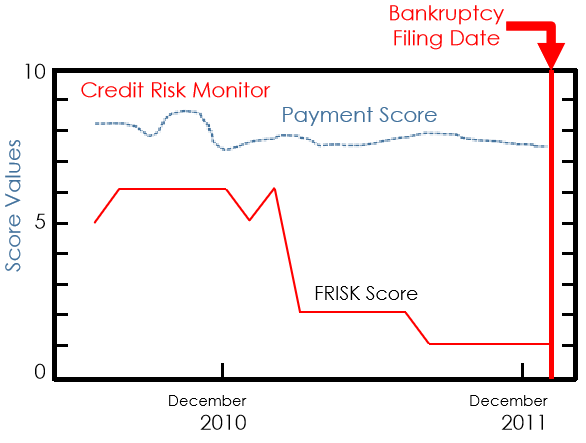

Have you heard about the ?cloaking effect??

The ?cloaking effect?: The credit scoring model is not able to predict bankruptcy, financial stress or delinquent behavior. For example, Eastman Kodak is a company whose payment behavior to its suppliers did not reflect its financial condition. But Kodak filed for bankruptcy on January 19, 2012. The company was able to maintain a Payment Score around 8, which indicates no evidence of severely delinquent payment behavior until it went bankrupt. This is known as the cloaking effect.  Along with this, high bad-debt, undetermined losses, loss of business opportunities, an increase in delinquent behavior/delayed payments, and a prolonged credit approval process are signs that your current credit scoring model has become outdated.

Along with this, high bad-debt, undetermined losses, loss of business opportunities, an increase in delinquent behavior/delayed payments, and a prolonged credit approval process are signs that your current credit scoring model has become outdated.