Four Leaks to Plug for Collection Prioritization

This e-book uncovers the leaks in account prioritization, which can inflate past-due A/R by 150% and the means to seal the leaks through industry best practices and smart segmenting factors to increase team productivity and ensure faster collections

Four Leaks to Plug for Collection Prioritization

As discussed in the previous chapter, account prioritization is inefficient in the presence of lagging factors like aging data and invoice value and needs more insight. But what if the collectors could track the payment history of an account and decide the priority for that account based on whether it is a fast-paying customer or one with consistent delinquencies? This kind of strategy in segmenting the accounts provides better judgement about the priority associated with the account. Moreover, since the collections process isn?t insulated from other credit-to-cash processes, some of these leading factors in account prioritization can be derived from other A/R processes. The accounts can also be classified as: At Risk Accounts: This is the case where there is a high probability of customer not paying and the invoice falling into a larger aging bucket with time. De-prioritized Accounts: This is the scenario where the account can be pushed back on the priority list and the collectors can spend time on more strategic accounts. Low Hanging Fruit: This refers to the scenario where collecting might be easy or the customer has an incentive make payments.

Leveraging Credit History

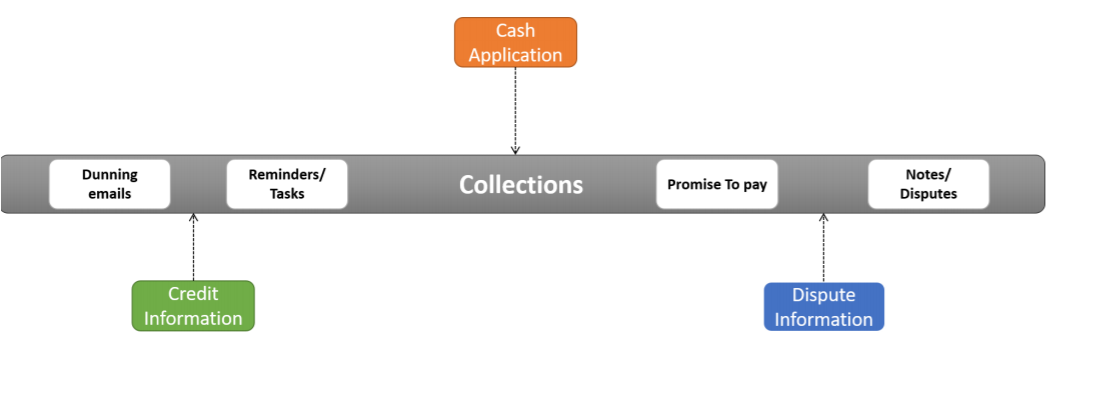

The collections team can leverage credit history of the customers to identify their financial position and notice any downward trends in the financial health of the account. If a customer has a history of late payments and has a high credit risk, the financial health of that account might be unstable making it an ?At Risk? account. In this scenario, the collector should flag the customer as a high-risk customer, entice them to make early payments to get discounts and offer different modes of payment so that they don?t end up falling in larger past-due buckets and are not written off in the end! Moreover, the collections team can obtain the credit limit utilization from the credit management team. If a customer with a growing business and low credit risk is approaching a credit hold, the collections team can motivate the customer for clearing their invoices to prevent their next order from getting blocked. The collections team can leverage credit limit utilization of all customers to find these ?Low Hanging Fruits? and eliminate them from their collections worklist.

Insights from Deductions and Claims

The collections team can leverage inputs from the deductions management and claims processing to pinpoint the customers with open disputes or unresolved deductions which need to be reviewed by the deduction analysts. These accounts can be ?De-prioritized? since they cannot be worked upon by collectors unless the disputes or claims are resolved. However, if it is found that a deduction or dispute is invalid, the account becomes an ?At Risk? account where the collections team must prioritize this account and follow-up with the customer. The reason behind is that the disputed invoices have already been open while the deductions team worked on them, and any further delay in closing them would only put them in a larger aging bucket and increase the past-due A/R.

Inputs from Cash Application

The collectors often hear from the customers that they have already made payments against the invoice in question. This scenario occurs when the cash is applied in batches and the real-time updated information is unavailable to the collectors or when the cash has been applied incorrectly. The collectors should ?De-prioritize? such accounts and check with the cash application team before following up with these customers.

Best Practices in Internal Collections Process

Some best practices can be incorporated into the collections process to de-clutter the collections worklist and improve account prioritization. The collections team should have a means of collecting Promise-to-Pays against invoices from the customers. The collectors can add the promised payment date for such accounts in the calendar and set reminders for themselves while classifying the account as ?De-prioritized? from the worklist. However, if a customer has broken a promise-to-pay that is failed to make payment by the promised payment date, it should be treated as an ?At Risk? account where the customer should be called on the same day and the account should be escalated internally. If a customer has an open dunning notice they should be ?De-prioritized? from the collections worklist while the collector should add a follow-up date in the calendar as a reminder for himself. If a customer has been sent multiple notices and reminders and has been contacted through calls and the payment is still pending, it should be treated as an ?At Risk? account since the customer is showing reluctance to pay. The collector should further call the customer, offer incentives like discounts and recommend other modes of payment to the customer. The collectors can leverage the customers? correspondence log to check if the customer has asked for an invoice. This shows the willingness to pay and is a ?Low Hanging Fruit?. The collectors should immediately follow-up with the customer to fasten the payment and collections process. If a customer has asked to follow-up on a later agreed date then it should be ?De-prioritized? from the worklist and the collector should not follow up with the customer before the agreed date. The collectors can gain insights from the customer?s account history and identify if it is a large, fast-paying customer. In this case, the collectors should treat them as ?Low Hanging Fruit? and should send personalized reminders but less frequently. If it is a small to medium account where the customer usually pays without being called and need reminders via mail, they can be termed as ?Low Hanging Fruit?. The collectors should mark these accounts, group them and send bulk generic emails periodically.