Decreasing Revenue Leakage

An insightful summary on how to leverage credit and A/R data to lower operational costs

Decreasing Revenue Leakage

While businesses have long been in the know about the impact of accounts receivable in improving cash flows and profitability, decision makers often push the process onto the back burner, assuming that leaving well enough alone is perfectly fine.

In general, accounts receivable in organizations is a pretty reactive department. Processes kick in and actions are taken AFTER due dates are crossed and the clock starts ticking.

From extending credit to unqualified customers to failing to follow up with past-due accounts in a timely manner, reactive A/R practices suck time, money and productivity from a business.

They often produce a ripple effect that touches virtually every aspect of running a company.

A crucial part of optimise accounts receivable processes is to be persistent about starting the process early. A proactive culture helps identify problems early on and take corrective actions before things go out of hand, thereby leaving more scope for process improvements and less chances of problem recurrence.

1.Proactive Collections Management

i.Prediction of invoice payment date prior to the due date

ii.Data based customer segmentation and strategy definition

2.Data-driven dispute management

3.1. Proactive Collections Management

A typical B2B collections process is initiated only after the account turns delinquent. Once the payment becomes past due, a soft reminder is sent to the customer. It is then followed by multiple calls/email reminders depending on the aging of the invoice. It may or may not warrant a strict notice/legal reminder post which the customer relents to pay up (hopefully) but on their terms. Your A/R team has to unwillingly agree to their discounts and accept partial payments thinking that some money is better than no money.

Such reactive and largely ineffective approach to collecting past due payments will continue to be adopted unless businesses understand that collections is more than just applying fancy algorithms to the aging list of invoices to figure out which customers to contact today.

Such algorithms conjure up a list of some 300 accounts for dunning when the collector has time to reach out to not more than 50 today! In the face of such overwhelming ‘advice’, collectors have no option but to go back to the tried and tested ‘oldest-invoice-largest-account-first’ method, leaving a large chunk of the portfolio untouched.

On an average, your collections team is not able to cover more than 60-70% of accounts in any 30-day past-due cycle, with diminishing collectability of the rest with each passing day.

Statistical and data-based approaches to predict customers’ payment behavior have the potential to deliver unprecedented results for collections efforts.

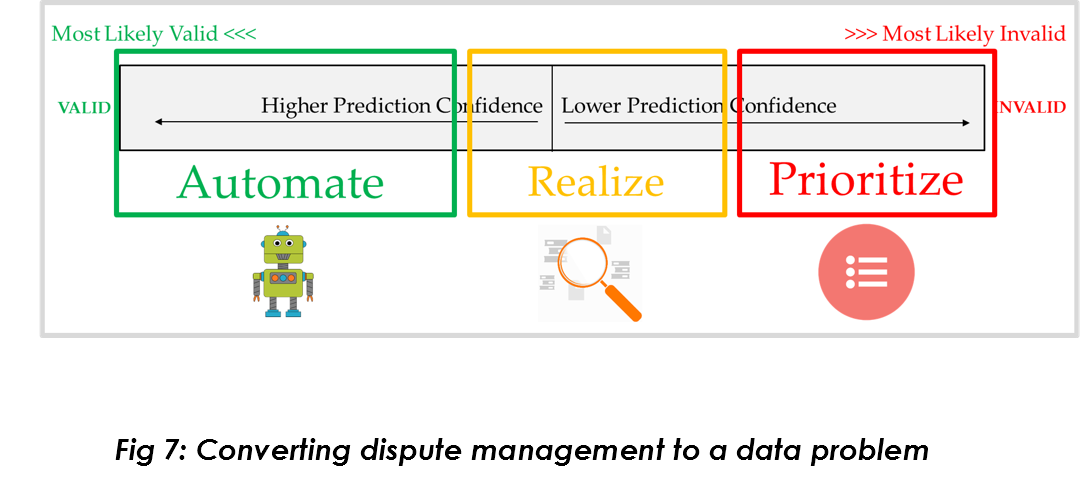

Machine learning, natural language processing, and big-data analytics form the foundation of predictive data models that accurately forecast invoice payment date and manage customer credit risk in real time. This enables dynamic, multi-dimensional customer segmentation, strategy definition and portfolio management (Fig. 6).

Organizations experience benefits such as improved DSO and increased collections efficiency through:

Prediction of invoice payment date prior to due date.

Allow collections teams to anticipate which of the open invoices will be paid late or the payment date of a particular invoice to scientifically and accurately gauge AR risk and adopt proactive collections strategies that preclude late payment

Data-based customer segmentation and strategy definition.

Combine collectors’ experience and expertise with advanced analytics to support multi-faceted customer segments and dunning strategies. It enables informed decision making, collector performance-based portfolio allocation and frees up time to focus on accounts that need urgent attention while automating the collection process for the others

3.2. Data Driven Dispute Management

Short payments, overpayments, and invoice disputes endanger customer relationships and engender customer churn. The repercussions go beyond the explicit costs incurred.

Time and resources spent on resolving deductions could otherwise be spent on more value-added activities. The deductions analyst has to reach out to sales brokers, customer service, invoicing department, marketing, and trade promotion personnel to research and resolve disputes.

All the communication occurs manually over phone/email/fax leaving little scope for even holistic monitoring of all dispute case status and deduction reasons, let alone root-cause analysis and proactive corrective actions to address existing receivable issues.

Think about this: 60% of deductions go in favor of the customer. That means you essentially research 100% of the deductions to identify 40% invalid deductions. The culprit – a reactive outlook towards the resolution process that kicks in after the real transaction has already occurred. It is only after a customer makes a short payment that the A/R team:

- Checks if the customer received right invoice

- Checks if sales team has separate deal document

- Cross verifies remittance of the customer

- Contacts customer

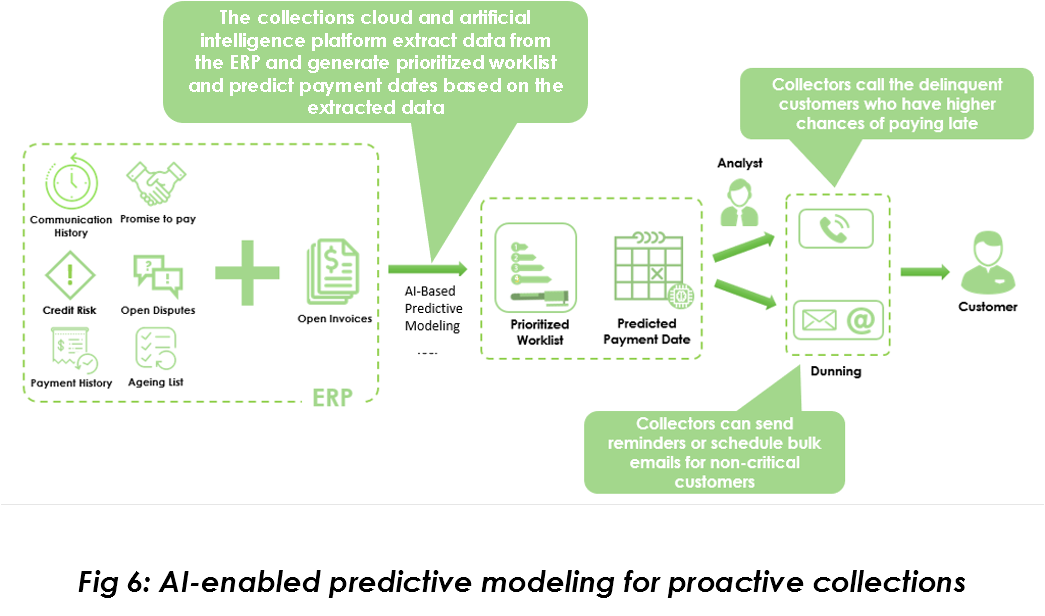

With the help of advanced analytics backed by artificial intelligence, it is possible to predict the validity of a deduction by analyzing several factors such as customer payment history, past deductions characteristics, root causes, resolution trends, and so on.

With these predictions, 60% of the deductions worklist is automatically resolved with recommendations to prioritize and resolve the remaining 40% (Fig. 7).

This translates into a 40% decrease in human touches, huge savings on valid disputes, high recovery rate, and reduced write-offs with more focus on collecting invalid deductions.