Roadmap towards successfully integrated treasury solutions

Discover how successful integrated treasury solutions can help companies that are utilizing technology to embrace automated treasury software solutions and benefit from it.

Importance of treasury software systems integration

Treasury is often focused on transactional activities related to cash, short-term debt, investments, etc. However, Treasury should also align with the company’s growth and support the needs of the growing business. Understanding the priorities of CFOs or treasurers for the company should be the starting point before considering treasury solutions. It is necessary to assess the time that is spent truly adding value to the company. If the company is forecasting cash, managing cash, or reporting (weekly, quarterly, monthly) manually, then chances are high that the company needs technology implementation or a cash forecasting tool.

What is meant by integrated treasury solutions?

Integrated treasury solutions are a holistic approach towards financing the balance sheet with the deployment of budgets across the domestic, global money, and forex demands. This approach enables the business to optimize its asset-liability management. Centralization of treasury facilitates a view of an organization’s global operations’ cash flows and risk scenarios, thereby backing treasurers to make decisions based on the overall performance and not limit the same to a regional treasury performance.

Corporate treasury software integration challenges

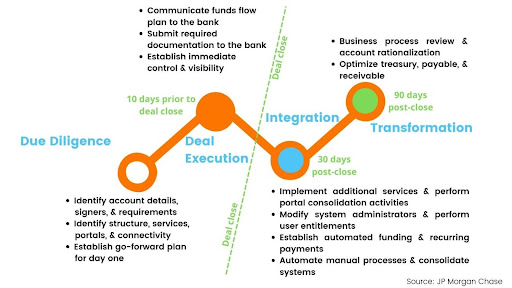

An effective integration depends on having a detailed execution plan that is structured to support the goals of the acquisition. A successful integration project meets productivity expectations within the desired timeline and price point.

But, unfortunately in some cases integration projects fail and companies end up paying for a system from which they get declining value or no value at all.

Benefits of corporate treasury software treasury integration

The several benefits associated with the implementation of a robust treasury management solution are:

- Reduced costs: With a centralized system that has all information about the company’s finances, one can directly see any costs associated with any transactions and reduce those costs with proactive borrowing, reallocation of resources to high-value tasks instead of manual activities.

- Improved efficiency: Providing one place to do everything creates efficiency which can be done by a centralized treasury system.

- Improved visibility: As data is dispersed across multiple organizations such as TMSs, ERPs, bank portals, and sales order systems and non-standard processes, such as currency changes, visibility is hampered. Treasury management can estimate when existing sources of credit will be insufficient to cover cash deficits with proper data flow visibility.

- Strategic growth: By automating the entire treasury management process, companies are left with more free time. And business operators can focus on areas that are more important to them and do more to encourage strategic long-term growth and development.

Strategic integration of corporate treasury software

Technology is a central component of any strategic treasury integration. A strategic vision should be coming from the CFO or treasurer and should highlight the treasury focus areas or areas that need to be scaled.

Technology helps in improving data flow and communication. Determining the proper quantities of cash or cash equivalents to ensure that organizations can pay their financial obligations is one of the more critical roles of treasury management. With treasury technology in place, a company can gain better visibility into its cash and make more informed financial decisions.

Steps of treasury solution integration

The integration and transformation processes present treasurers with an opportunity to set up their treasury tech-stack for long-term success.

How to successfully implement an effective corporate treasury software?

Every potential client has its own set of criteria, expectations, and constraints to implementing a treasury management system or any other type of software. Considering this, they are all taking the same strategic moves toward implementing a new system.

Following are the ways to ensure a successful treasury technology implementation:

- Understand the strategic vision of the company’s treasury and assess the key pain points and challenges.

- Identify the stakeholders, those who are part of the business, departments, and teams as well as the customers.

- Determine the right requirements.

- Create a general timeline.

Implementation process

The implementation process varies from vendor to vendor. The majority of TMS vendors use a five-step phase installation process or methodology, which includes:

- Phase-1: Preparation

The teams on both sides prepare to onboard the project by signing the agreement during this step. Documents must be put together with all the information for a better understanding of the consultants in order to have a very effective preparation period. - Phase-2: Design

In this phase, the main goal is to get the buy-in with the implementation process. These are the things that should be considered in the design phase:- Create a design document or a blueprint document and lay down the requirements.

- Prepare a small implementation test system.

- Get to the point where the customer signs off and proceeds to the next phase.

- Phase-3: Configuration

The system goes through a lot of development at this phase. There are many workstreams involving third-party software owners that must also be managed here. The end goal is to create, integrate, and configure the system using the design document as a guide. - Phase-4: Testing

The customer and the team test the system in a standard testing environment where all of the master data and the system, as well as the integrations, have been properly configured. The purpose is to ensure that the system provides the intended results. - Phase-5: Cut-over and go-live

During this phase, the consultant or vendor migrates the data needed for the production environment and prepares it for deployment.

Benefits of implementing treasury solutions

- Adjusting targets, reward systems, and metrics to reflect changes in procedures and approaches to production.

- Creating budgetary plans and supplements to cover any extra cross-functional estimates that may arise from the integration processes.

- Automating and upgrading communication structures across functional groups and processes within the organization to achieve efficiency through effective flow and sharing of information.

- Standardizing of business processes and data versions to incorporate the interests of both internal and external stakeholders.

Steps to maximize value from effective treasury solutions

Best practices for getting continued value from the implemented system

Tips to get continued value from the implemented treasury technology:

- Keep up with all the upgrades of the implemented technology.

- Make sure that all the phases of the buying process are finished.

- Attend the annual conferences or meetings conducted by the vendors.

- Provide feedback to the vendors.

- Maintain the system regularly for better performance.

How to keep up with all the upgrades of the implemented technology?

Most products today are offered as SaaS products so the upgrades come to the users automatically. But not all the items within an upgrade are automatically forced upon the users and they have the ability to choose whether to implement that part of the functionality. So it’s really important to:

- Have at least one person in the company who keeps up the release note and shares it with everybody else when there is any new relevant functionality that’s going to benefit the environment of the organization.

- Read the release notes.

- Attend the training if there are webinars, conferences, etc.

- Keep up with each and every release note.

Post-deal synergies

The corporate treasury team concentrates on stabilizing and optimizing the new company’s infrastructure, such as bank account rationalization and bank fee analysis, as well as debt management. There is likely to be an overflow of bank accounts following integration, and a well-executed study can result in cost savings. Treasury should establish working capital requirements for the firm in order to meet predicted figures and free up excess working capital. It’s considerably more critical in highly leveraged transactions because the cost of borrowing for this liberated working capital is substantially higher. Whenever possible, efforts should be made to seek opportunities to increase the Accounts Payable (A/P) Cycle. Collaboration with various finance leads and overall project management teams allows them to keep on top of company-wide cost-cutting goals and synergy savings. Maintaining awareness of the company’s financial position also aids in the production of accurate projections in preparation for covenant management.

To reach desired levels of post-deal synergies and cost-effectiveness, companies should focus on:

- Understanding of the intended expenses, as well as a plan for getting there.

- Maintaining the governance model established during integration in order to propel activities forward.

- Evaluating groups to find areas that are working efficiently and areas that need to be improved.

- Designing working capital management techniques with a specific amount of working capital in mind in order to unlock value.

- Overseeing debt covenant compliance reporting to financiers.

- Improving capability to foresee future compliance/actions to ensure that preset terms are met.

Summary

Ways to maximize value from treasury solution implementation:

- Review the regional KPIs and objectives annually that are there from the beginning of the project, to get better results.

- Evaluate continuously to ensure if the technology is adding value to the employees and whether it is meeting the mission of the whole project. If not, then change it accordingly.

- Keep up with all the upgrades of the implemented technology.

- Maintain the system regularly for better performance.

- Make sure that all the phases of the buying process are finished.

- Attend the annual conferences or meetings conducted by the vendors.

- Provide feedback to the vendors.