Treasury Systems Implementation Fatigue

Read this ebook to learn the steps to prevent the implementation fatigue caused while implementing new treasury solutions.

Need for adopting treasury technology

Treasury is the backbone of any business due to its contribution in managing liquidity and funding requirements, which is crucial for long-term sustenance. To complement these roles, there is a need to improve accountability, visibility, and transparency of operations. And that can only be achieved with the use of emerging technologies.

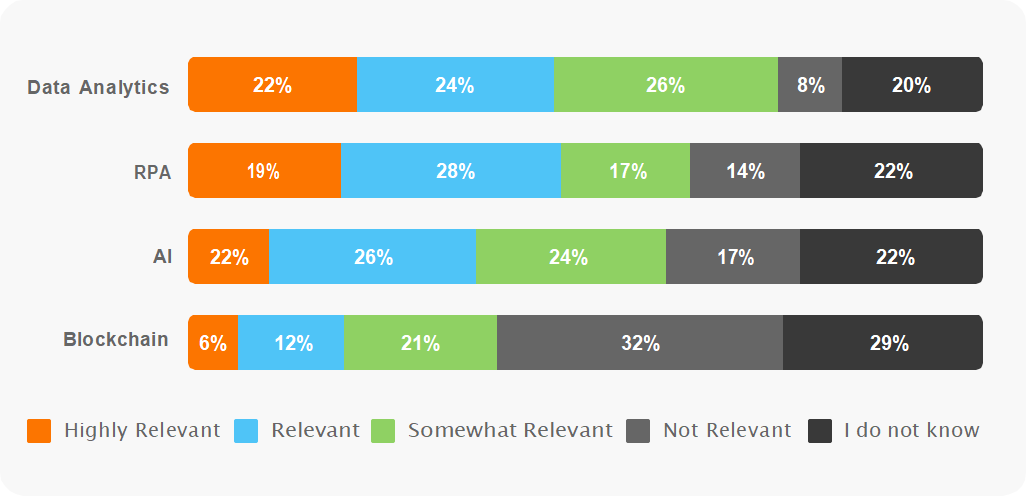

How relevant do you believe the following technologies are for Treasury in the next 2-3 years?

Source: PWC | 2019 Global Treasury Benchmarking Survey

The above survey states that technologies such as Artificial Intelligence and AI will be quite relevant in recent times.

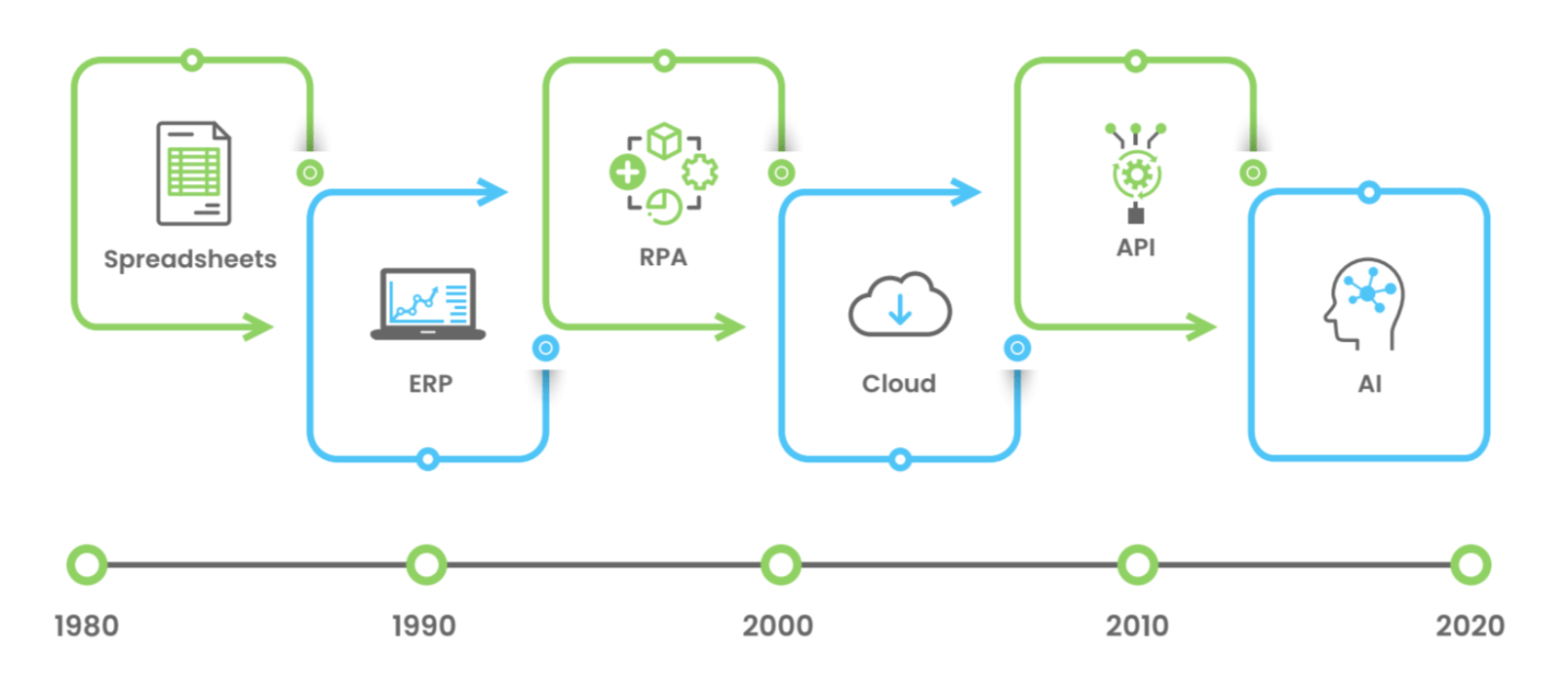

The following diagram shows the evolution of treasury systems over the past few decades:

The 2021 Citi Treasury Diagnostics survey found that 74 percent of treasurers are not yet in a position to fully embrace the digital treasury management systems (TMS). The same survey also showed that 54 percent of treasury professionals were using application programming interfaces (APIs) to assist with their treasury functions.

Although treasurers are expressing willingness to adopt treasury technologies, there is a certain degree of resistance associated with the prior grunt work required during implementation. During tech implementation, treasury project teams sometimes have to encounter several challenges for a long duration that lead to implementation fatigue.

What is ‘implementation fatigue’?

Treasury system implementation projects can take months or even years to complete and somewhere in that timeframe the implementation team might tend to reach their peak stress level as timelines are pushed out and costs rise. This leads to implementation fatigue. As a result, the team focuses on the bare minimum to get the project over the line.

Timing and resourcing are frequently the most challenging issues. Too many companies cut corners on the time it takes to plan and implement projects. Even the best-planned and best-resourced projects experience bumps in the road and a degree of implementation fatigue. Hence, it is advisable to be prepared for it and plan everything accordingly.

Complications faced when implementing a treasury system

For the treasury departments, implementing Artificial Intelligence in treasury management is a project that, when done well, yields tremendous benefits. The key areas for a successful implementation are to:

- Prepare thoroughly ahead of time

- Stay focused on the priorities and the end goal

- Stick to the project plan that has been agreed upon by all parties involved

The three biggest issues that the treasury faces are:

- Accurate cash management

Managing cash is most vital to the treasury, but in light of recent events, it has become challenging. The first area where most people struggle is ensuring timely visibility into cash balances across local, regional, and global entities and this is due to decentralized systems and spreadsheet-driven processes.

- Scalability and flexibility

Spreadsheets and legacy systems lack scalability and flexibility, which prevents modifications to the system during M&As. Technology enables in establishing standardized processes that can simply be replicated by other organizations.

- Liquidity risk management

Treasury needs a framework to track operational risks associated with treasury activities and make extensive use of KPIs that are explicit, measurable, achievable, relevant and time-phased. But, delayed reporting due to obsolete systems leads to poor risk management.

How to overcome the implementation challenges

Understanding the priorities

The priority of treasury is to ensure the business has the money it needs to manage its day-to-day business obligations, while also helping develop its long-term financial strategy and policies.

Before engaging with vendors, a treasury department should review everything it performs daily to see where it can improve. The purpose of this assessment is to identify where technology can drive improvements.

Five steps to a more effective global treasury

- Centralize the treasury function globally

- Strengthen governance

- Enhance treasury-management systems

- Increase the accuracy of cash flow forecasting

- Manage working capital in developing markets

Implementing emerging treasury technologies

Technologies that are transforming treasury are:

- Robotic Process Automation (RPA): RPAs are robots that are programmed to run a certain set of tasks without any help from humans. These are useful when it comes to freeing up a lot of time previously used in repetitive tasks like data gathering and consolidating and focusing more on higher-value duties like cash forecasting, which remain the top priorities of treasuries.

- Application Program Interface: APIs are software interfaces that streamline how applications interact with each other. APIs are able to provide real-time data on payments and transactions.

- Cloud: Moving to a cloud server allows all data to be accessed by employees remotely over the internet. This facilitates data accessibility from a variety of locations and regional treasuries to collaborate better. This also enables any computing software to be upgraded or improved without the requirement to upgrade the entire IT infrastructure.

- Artificial intelligence: Artificial intelligence utilizes self-learning algorithms to identify patterns and guide treasuries with suggestions. It can track anomalies in transactions and prevent them. It can mitigate risks by identifying and tracking fraudulent activities and help to manage liquidity to optimize usage of cash and prevent avoidable debts.

AI-enabled treasury solutions are now being implemented into treasury processes for the following reasons:

- Process automation and standardization

- Optimized working capital and liquidity management

- Straight-through processing environment

- Enhanced reporting and strategic planning

Understanding and following stages of implementation

-

Understand the current-state processes

The first step is to have a clear understanding of all current processes of the treasury function. Typical processes include those surrounding cash forecasting, liquidity management, treasury payment execution, and risk management hedging. Other processes to consider include banking structure, risk management compliance, financial reporting, and bank account and cash reconciliation.

During the time of implementation, the project team should collect all the information, such as:

- The tool or application currently used to perform the task

- The amount of time required to execute each task in each of these processes

- Gaps or deficiencies between desired processes and the current capabilities of systems

The analysis should extend to all branches of the company and participation in the process redesign initiative should not be limited to members of the treasury function, but should include each internal group that provides input to a specific treasury process.

-

Implementation roadmap

The implementation of a new treasury system requires a number of steps to create a well-defined roadmap that measures progress and ensures the organization maintains focus.

They need to think of a preplanned roadmap for the successful deployment of AI, and the roadmap should take into account- its priority, impact on the organizations, and the level of effort required to complete it.

If the company has not taken any precautionary measures in advance, then it is difficult to prepare a realistic timeline and resource requirements. In such situations, it is necessary to reach out to the internal technical teams to provide accurate input at the right time.

Additionally, all stakeholders in the project including functions outside treasury should be engaged in planning the project roadmap. The project will need the support of these groups throughout its lifecycle to obtain the input.

-

Implementation plan

An implementation plan is a project management tool that simplifies the execution of a project by breaking it down into smaller parts, outlining the timetable, and identifying the resources required. The strategy may be created in collaboration with the chosen vendor, as they are the most knowledgeable about their product.

How to create an implementation plan

- After signing the contract, the vendor starts the project onboarding process.

- The vendor begins the designing process after gathering the information according to the client’s requirements

- After this designing process, project management and coordination takes place

- Firms utilize the testing phase to identify all of the system flaws, fix those issues and verify if the product fits the needs of their clients.

How to maximize value from the implementation

Best practices for implementing new treasury solutions

Treasurers can significantly improve the timeliness, consistency, and completeness of cash-flow forecasting information by using application program interfaces (APIs) to access both bank and internal systems, especially when combined with robotic process automation (RPA) and artificial intelligence (AI). According to a Euromoney survey, 57% of corporate treasurers expect to use APIs to help their cash forecasting and cash concentration operations across various banking partners. Here are some outcomes of increasing efficiency:

- Make a list of the resources needed to implement the new technologies. These resources include, but are not limited to, budget allocation, stakeholder trading, and IT support.

- After gathering all the requirements, divide the task among the team members.

- Analyze the metrics and allocate work before transferring the project to production.

- Check whether the project is heading in the right direction and provide continuous feedback to the chosen vendor.

Schedule a demo to learn more on how to ensure a win-win for both clients and vendors while implementing treasury solutions for your company.