Demystifying Bank and ERP data for Treasury Automation

Learn how Bank and ERP Data could help decision makers to achieve treasury automation.

Executive Summary

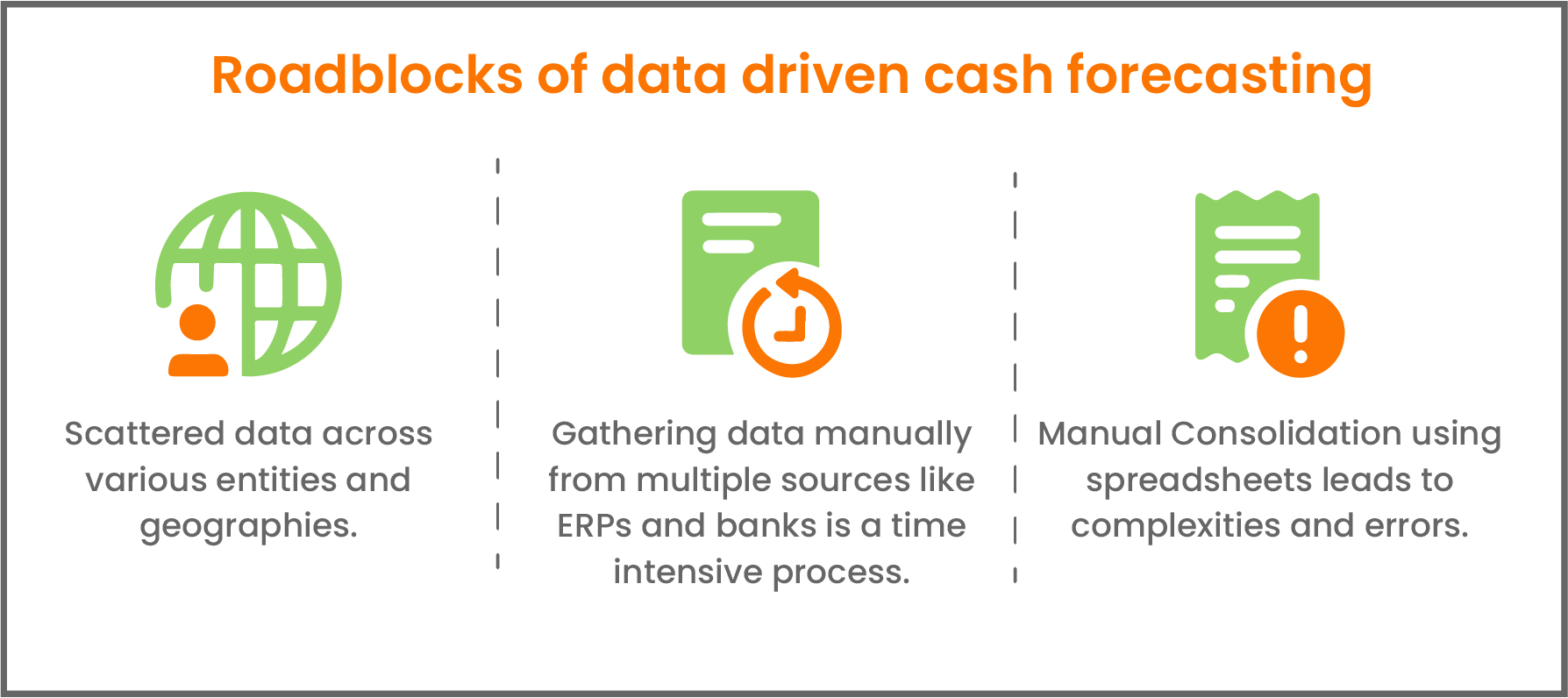

With a renewed focus on centralization of business activities to improve real-time reporting, huge volumes of data get generated which are highly unstructured and varied. Organizations have to face acute data reconciliation and consistency problems while forecasting cash.

During cash forecasting ‘actuals’ data need to be fetched from multiple sources such as ERPs and banks on a timely basis. It becomes increasingly difficult for organizations to deal with varied data sources, especially when their businesses are spread across various landscapes.

Moreover, many organizations still rely on manual processes for data gathering which is error-prone and further impedes the identification of relevant data. Thus it becomes imperative to identify the most relevant data sources and extract structured and relevant data sets.

AI-enabled solutions can automate the data gathering process by easily integrating data from multiple sources and generating data sets that provide a strong foundation of a robust forecasting model.

Data is quickly becoming an essential strategic arsenal in the finance landscape. This ebook focuses on optimizing unstructured data to figure out relevant data sets to improve the quality and timeliness of the data and achieve granular visibility.

Significance of Data in Cash Forecasting

In a recent survey conducted by IDC, 59% of 400 participating treasurers stated that real-time data for cash forecasting is increasingly becoming a priority.

As per GIGO, the accuracy achieved by a cash forecasting model depends on the credibility of the data available. Treasury needs to have clarity regarding the data inputs and what purpose they serve while analyzing data sources for cash forecasting.

Challenges in Data Gathering

A robust data gathering process is an essential component to ensure reliability. However, the data gathering process in most organizations is still limited due to the use of manual and obsolete tools like spreadsheets and SFTP.

Manual – The manual method primarily involves the use of spreadsheets to individually collect information and then integrate them. The process is extremely time-consuming with treasurers usually on average, spending more than two hours every day collating data from various sources such as spreadsheets, departments, entities to feed into the cash forecasting models. Further, the process is error-prone, and maintaining data integrity becomes a serious challenge when dealing with huge amounts of data.

SFTP (Secure File Transfer Protocol) – SFTP is a secure method to send files directly from a server to a client. SFTP has gained popularity over the years due to its simplicity to collect data from banks and ERPs. However, there are major drawbacks:.

- Integration of individual files collected from Banks and ERP remains challenging.

- Real time access of data becomes difficult with SFTP.

- The requirement of SFTP compatible software further hinders data aggregation.

Such practices are generating data that are inadequate and lacking in relevancy. This makes cash forecasting difficult resulting in inaccurate forecasts. Thus organizations are forced to rely on historical data to generate baseline forecasting. This inhibits them from capturing industry volatility making them vulnerable to market risks.

Catalyst for Accurate Cash Forecasting: Bank and ERP Data

To get the most out of the cash forecasting process, it is important to constantly compare the forecasted values against the actuals by performing variance analysis thus improving the accuracy of the forecasts.

Bank data :

Bank data can be utilized in variance analysis to ensure that the forecasts are accurate. Organizations performing variance analysis continuously can identify areas where the forecast is not very precise. This will enable the treasurers to take necessary actions to find the source of errors and correct them. A new quality analysis can be performed during the following session, ultimately ensuring a rise in the overall efficacy of the forecasting process.

However, there are several limitations in integrating bank data:

1. Multi-bank dealings:

- Most banks provide their data through varied electronic formats such as MT940s, BAI2. Aggregation of this data becomes a challenge for organizations dealing with multiple banks.

2. Limited visibility :

- Lack of access to a global view of data such as balances, pending transactions, and open invoices makes the data aggregation difficult leading to inaccurate cash forecasts.

- This makes it impossible to create a comprehensive cash forecast leaving organizations with limited visibility and a lack of proper analysis.

3. Inadequate tools :

- Most banks provide online access for statements and activity for up to one year.

- This results in organizations investing a lot of time and money to gather their historical records.

- The lack of adequate tools and technology to dive into their historical bank data compels them to roll forward prior balances and integrate outstanding payments.

4. Manual data gathering:

- Processing the varied formats of the files sent by the bank such as BAI2s, MT940s, manually is extremely difficult and time-consuming.

- After processing the bank data, it needs to be compiled into a master spreadsheet which can lead to errors.

ERP Data :

Raw data like sales orders, purchase orders, general ledger account balances, and outstanding invoices need to be organized in a structured way so that data extractions can take place easily.

Organizations face multiple challenges while integrating ERP data :

- Data Gathering : The operations are frequently repetitive, laborious, and time-consuming.

- Data Consolidation : Organizations with multiple ERP systems have scattered data that are difficult to integrate into one place. Also modeling and forecasting are very difficult to implement when line items are not consolidated.

Bank and ERP data together form the “actuals” component of data required for the forecasting process. Thus the data gathering needs to be extensive enough to capture even the smallest of variations and at the same time maintain desired levels of accuracy.

Automation: Turning Data into an Asset

Modern automation software uses Application Programming Interfaces (APIs), which are crucial data gathering tools. It aids in creating a data integration process that is seamless and standardized.

APIs work by creating an interface between otherwise incompatible software and data sources. This interface enables smooth data transfer. This enables organizations to easily collect real-time data from multiple entities with different technology environments, like Banks and ERPs, and integrate them.

Further, during integration, APIs bring about the desired level of standardization to deal with data inconsistency issues that occur while collating data from multiple sources. This results in the creation of integrated datasets that are structured and relevant.

Along with the capability of harnessing ‘actuals’ data, automation can easily fetch data like past forecast reports, financial statements and FP&A reports.

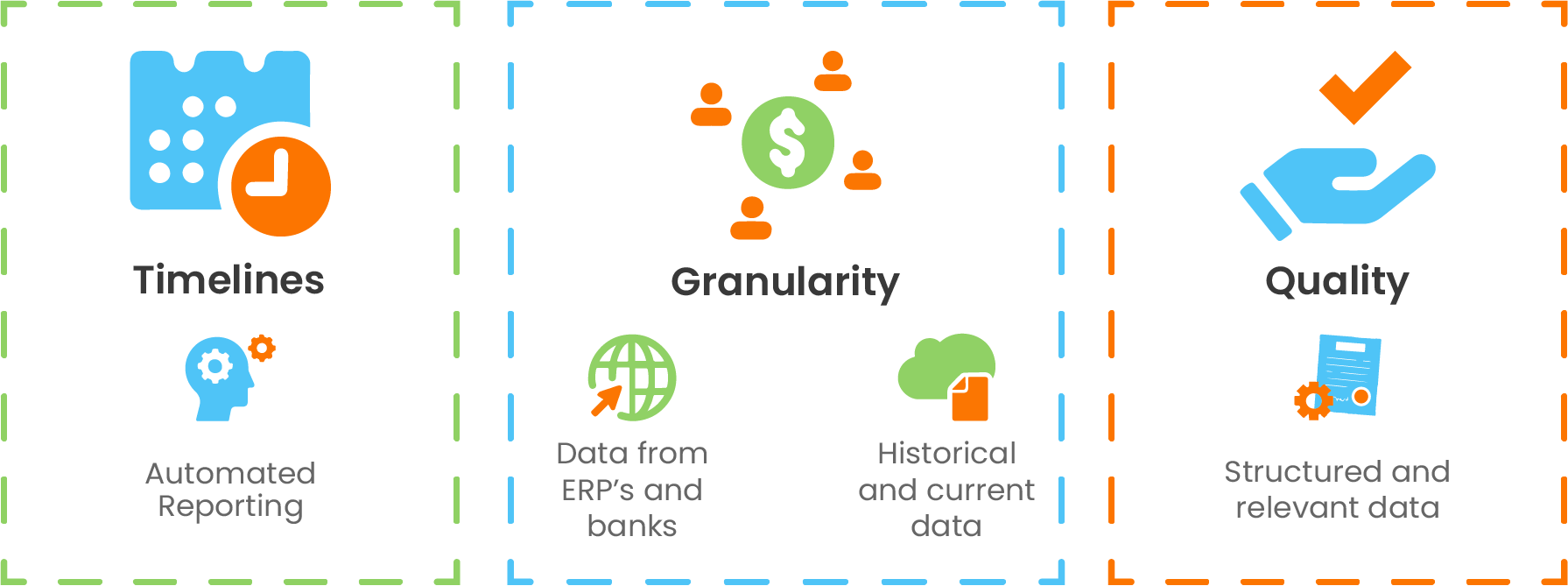

Proper integration of data ensures non-redundancy, standardization, and better cash visibility. The reliability of data collected can be ensured by the three key factors :

- Timeliness

- Granularity

- Quality

Turning data into an asset

Automated solutions can track cash movements, support seamless integration, and have the ability to drill down to the root cause of variance in forecast vs. actuals.

Timeliness : Real-time and on-demand reporting capability enable organizations to track transactions and balances at much shorter intervals. This ensures better capture of small variations in cash position which in turn makes the subsequent forecast model generated more robust.

Granularity : With help of automation, transaction-level data gathering from multiple sources like banks and ERPs become easy. This along with seamless integration of historic and current data of the organization facilitates an in-depth view of variations of cash positions for transactions. This granular view helps in building a more accurate forecast model.

Quality : AI-based treasury automation tools easily remove redundancy from data and generate structured data. The ability to segregate data based on their relevance further ensures the data available to build the forecast model is pertinent and of the highest quality.

Automating the entire data-gathering process based on these three principles can solve multiple data-related problems. This not only secures optimal utilization of Bank and ERP data but also brings about the integration of past and current financial data. Thus, paving the foundation of a resilient yet flexible forecasting model.

Conclusion: Automation, the Way Ahead

Automation helps treasuries in fully utilizing the potential of bank and ERP data to build insightful forecasts.

Forecasting cash has traditionally been more art than science, ML and AI are driving the future of treasury digitization, automation, and data integration. It can assist finance teams to streamline their daily operations and increase their ability to help the organization optimize cash flow in the future.

The ability to automatically analyze more transactions over a longer time with the help of ML and AI can help improve accuracy and reduce variance. Forecasting technology that is up to date can quantify variance and pinpoint where a forecast goes wrong.

As a result, treasurers and other financial decision-makers are increasingly emphasizing automation and AI tools. They can benefit immensely as these equip them not only with the ability to monitor KPIs like DSO, DPO, and client payment performance, but also to enhance these metrics and have a positive impact on financial operations.

Finally, this enables organizations with better insights and information to deal with capital market volatilities, providing them the ability to measure various business risks more accurately and make more informed financial decisions.