CFO Survey Results: Priorities and Action Plans 2022

- A large majority of finance executives are optimistic about revenue growth in 2022, compared to 2021

- The role of CFO has expanded with new responsibilities involving modernization initiatives and talent management added to the profile

- 86% of finance leaders believe investing in accounts receivable automation provides competitive advantage

CFOs’ Priorities and Focus Areas

Cost optimization remains the top priority for CFOs despite all the other hats they don as modern CFO. 56.4% of finance leaders mention that cost optimization is a top priority for their business. Across the survey, on various questions such as parameters for choosing software and reasons for automating, lower costs figure as a prominent reason for the various decisions that CFOs take.

Next to cost optimization, data-driven decision making and reducing risk are the other top priorities for finance leaders. The growing volumes of data and the importance of using it for predicting future events make analytics a growing field of interest for CFOs. Predictive analytics, machine learning, and artificial intelligence are increasingly used by finance teams for risk management, fraud detection, budgeting, and reporting.

Managing risks becomes essential to mitigate revenue and asset loss. Due to the increased emphasis on financial risk management and prevention of cyberattacks and data breaches, finance executives need to keep a tight tab on operations, data management and handling, and predicting, identifying, and thwarting risks.

We also asked CFOs whether their focus on areas such as financial accounting, expenditure planning, and talent acquisition have decreased or increased in 2021 and 2022. Despite CFOs donning new hats, a majority of the finance leaders mention that their focus on core areas such as financial accounting (59%), cash and revenue forecasting (42%), budgeting (46%), compliance management (43%), and financing activities (45%) will increase in 2022.

27% of the CFOs felt that their focus on financial analysis will diminish in 2022 while 23% feel that their focus on strategic planning will be lower. CFOs’ focus on M&A activities in 2022 is also slightly higher than in 2021 (33% vs 30%), indicating a renewal in economic and market prospects.

Market Outlook

Among businesses with more than 100 million in revenue, the optimism is higher, with 92% of finance leaders expecting revenue growth of over 10%; 81% expect it to grow by over 20%.

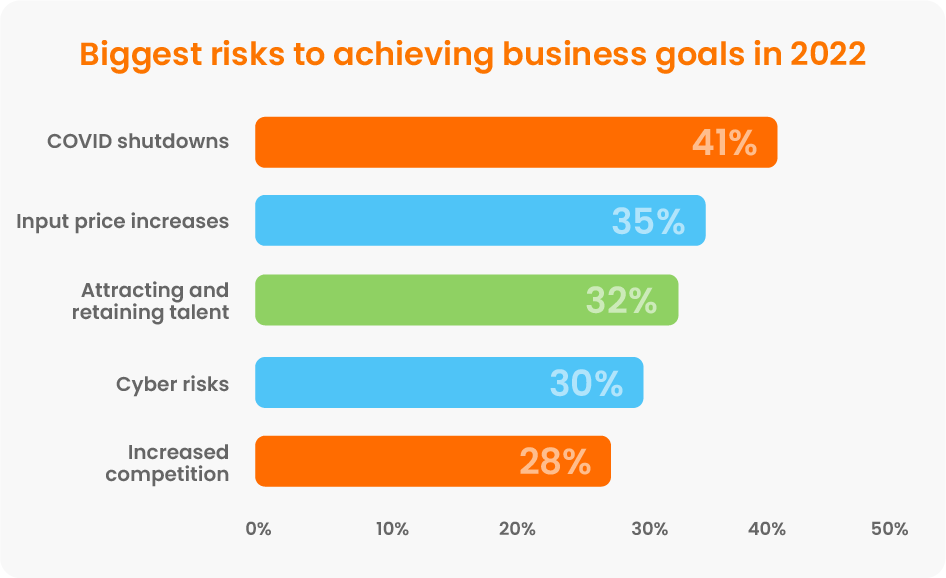

According to mid-market finance leaders, the biggest risk to achieving their 2022 goals remain COVID shutdowns. The COVID lockdowns in 2020 and 2021 had resulted in the closure of several businesses, a stall in cash inflows, and a freeze in hiring activities. Though governments and businesses are taking all measures to prevent another economic meltdown, the threat of COVID shutdowns remains. The unpredictability of the pandemic and the prolonged remote work environment is what probably makes it a high-risk concern.

Outdated technology stack is the biggest factor that is negatively impacting the efficiency of business operations, according to 41% of the respondents. Other factors affecting the efficiency of business operations include remote workforce (41%), length of time to onboard customers (37%), and verification of customer credit facilities (36%).

Other Challenges: Remote work and talent crunch

As employees worked remotely due to the pandemic, maintaining data security (39%) and monitoring productivity (32%) were the biggest challenges for CFOs. Information gaps, access to data, and communication were the other key challenges that businesses faced due to the remote work environment.

While 41% of finance leaders expect their team to work completely on-site in 2022, 53% will adopt a hybrid model (39%) or a fully remote mode of working (14%). This concession of allowing some flexibility in the mode of work could be to attract and retain talent, which is another key challenge that business leaders face.

Attracting and retaining talent is the third biggest risk that businesses feel can affect their 2022 goals. Sourcing talent is a top priority for more than a third (36%) of the finance leaders. Their focus on talent acquisition has increased in 2021 and 2022, according to 43% of the CFOs. Hiring more staff to close the skills gaps within AR/AP teams is on top of the minds of 70% of the CFOs.

Accounts Receivable: Challenges and Future Plans

With revenue growth expected to be over 10% for most businesses, CFOs need to prepare for processing and managing a higher number of invoices as well as customers.

Cash reconciliation errors (36%), credit management (34%), and lack of skilled resources (35%) are the top challenges that finance leaders face in managing accounts receivables, in addition to scaling for growth (44%) and maneuvering outdated technology or slow manual processes (42%).

Automation is the way to achieve scale. The biggest benefits CFOs expect from AR automation are improved working capital management (44%) and improved transparency into cash flow (43%). Other benefits expected from AR automation include reduced errors, increased AR capacity, and the ability to accept digital payments (35%).

86% of businesses say improving AR efficiency is a potential source of cost savings (53% say it is a very significant potential source of cost savings).

AR Automation Technology

56.5% of SMBs say they currently use accounting software for AR management. 42% also use spreadsheets to manage AR, often along with other tools.

But utilization of ERP solutions for AR management was much lower with only one out of four (26%) finance leaders saying their business uses ERP for AR management. Businesses with higher revenues (> $100 million) also use CRM tools (48%) compared to only 29% of smaller businesses (<$100 million revenue).

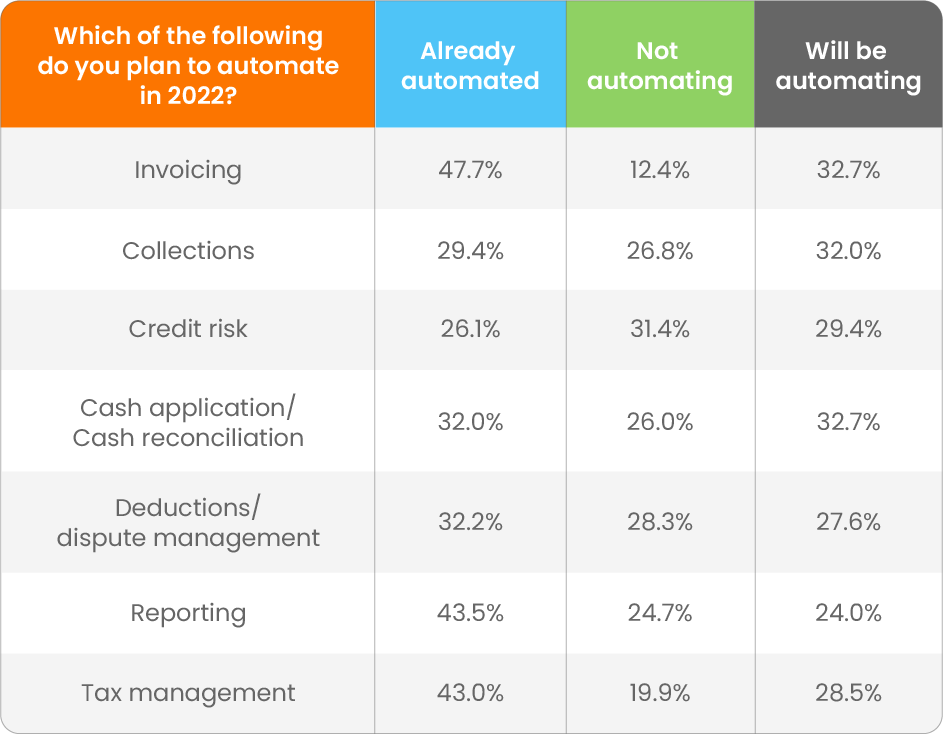

Within the AR function, as many as 47% of the businesses have automated their invoicing processes. 33% of firms are also looking to automate invoicing in 2022. An equal number also mention that they want to automate their cash application or reconciliation process.

Credit risk management and collections management also offer significant potential for automation with ~30% of businesses mentioning that they plan to automate these processes.

The below table looks at the percentage of businesses that have already automated the different AR and finance functions as well as their automation plans for 2022.

Digital payment options will significantly impact receivables operations in the next 2-3 years, according to 38% of the finance leaders that we surveyed. Data analytics (35%) is the other area that most CFOs feel will significantly impact their receivables operations.

Here’s a chart depicting what mid-market finance leaders believe will be the technologies that’ll most significantly impact accounts receivable operations in the next two to three years.

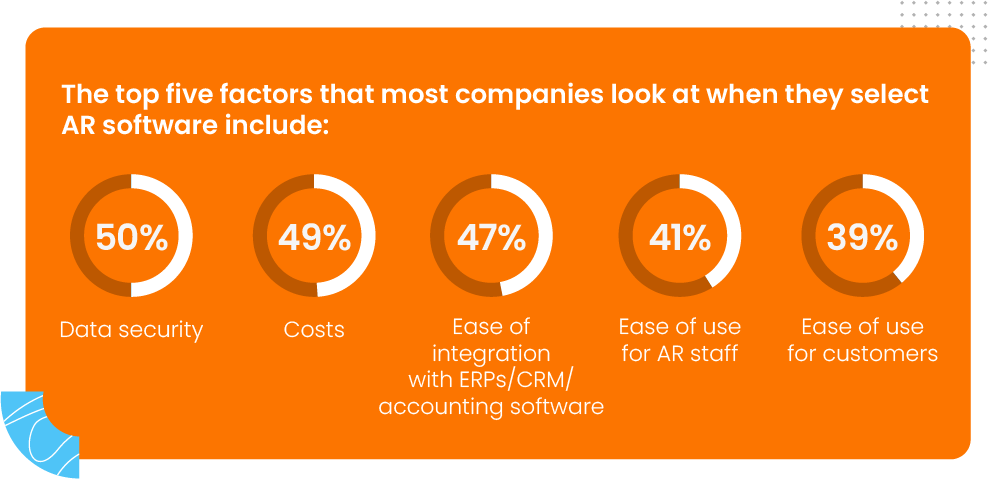

86% of the businesses believe that implementing AR automation technology is either very important (63%) or important (23%) to keep pace with competitors. Competitors providing superior customer service (41%) is one of the main implications of falling behind the curve in terms of adopting AR technology.

AR Outsourcing vs AR Automation

Outsourcing AR function to a third-party vendor is another route that businesses take to tackle AR management. 66% of the respondents said they’ll be outsourcing AR to an offshore low-cost staffing provider. 41% mention that they’ll be fully outsourcing their AR function while 25% say they’ll partially outsource.

When asked why they’d outsource their AR function, 41% say it helps them scale quickly. 40% of the respondents also mentioned that it is too costly to implement AR automation with their existing legacy systems. 36% said the nature of their business doesn’t lend itself to automating while 20% said outsourcing helps them lower costs.

CFOs’ Outlook on Technology

Investing in SaaS/automation/AI/other digital technology is a priority for two-thirds (65%) of the CFOs, with 36% of them saying it’s a top priority for them. Data-driven decision-making, most often enabled by AI algorithms and big data mining tools, is also a priority for 70% of our respondents. 58% of the CFOs say the lack of modernization of IT can be a big risk to being able to achieve their 2022 goals and 68% of them believe outdated technology stacks are negatively impacting their business efficiency.

The pandemic hit the cash flow of many small and mid-size businesses and they were forced to shut shop. Offering electronic payment options (34%), sending invoices immediately (37%), and doing better customer credit checks (37%) are the top measures that CFOs plan to take to improve cash flow. And technologies such as AR automation can help here. 71% of CFOs mention that slow manual processes or outdated technology is a challenge in managing accounts receivable, a key part of the cash flow process. Scaling for growth (67%

of respondents say it is one of the key challenges in managing AR) can be difficult without automation tools in place.

When asked specifically which AR functions they place to automate in 2022, most CFOs mentioned invoicing, cash application or reconciliation, and collections. Invoicing is the most automated function, followed by deductions or dispute management, and cash reconciliation. ~43% of the firms also mention that they have already automated reporting and tax management.

Limited technology skills are the biggest skill gap that CFOs face in their AR/AP teams. 80% of CFOs say they plan to upskill or train employees to reduce this skill gap while 78% say they intend to empower their employees with the relevant tech tools.

CFOs also see technology investments as a potential means to differentiate their business from competitors and provide customers with unique selling points that enhance their experience. Thus, 4 out of 10 CFOs agree that falling behind the curve in adopting AR technology leads to customer frustration (42%) and competitors providing superior customer service (41%).

Appendix

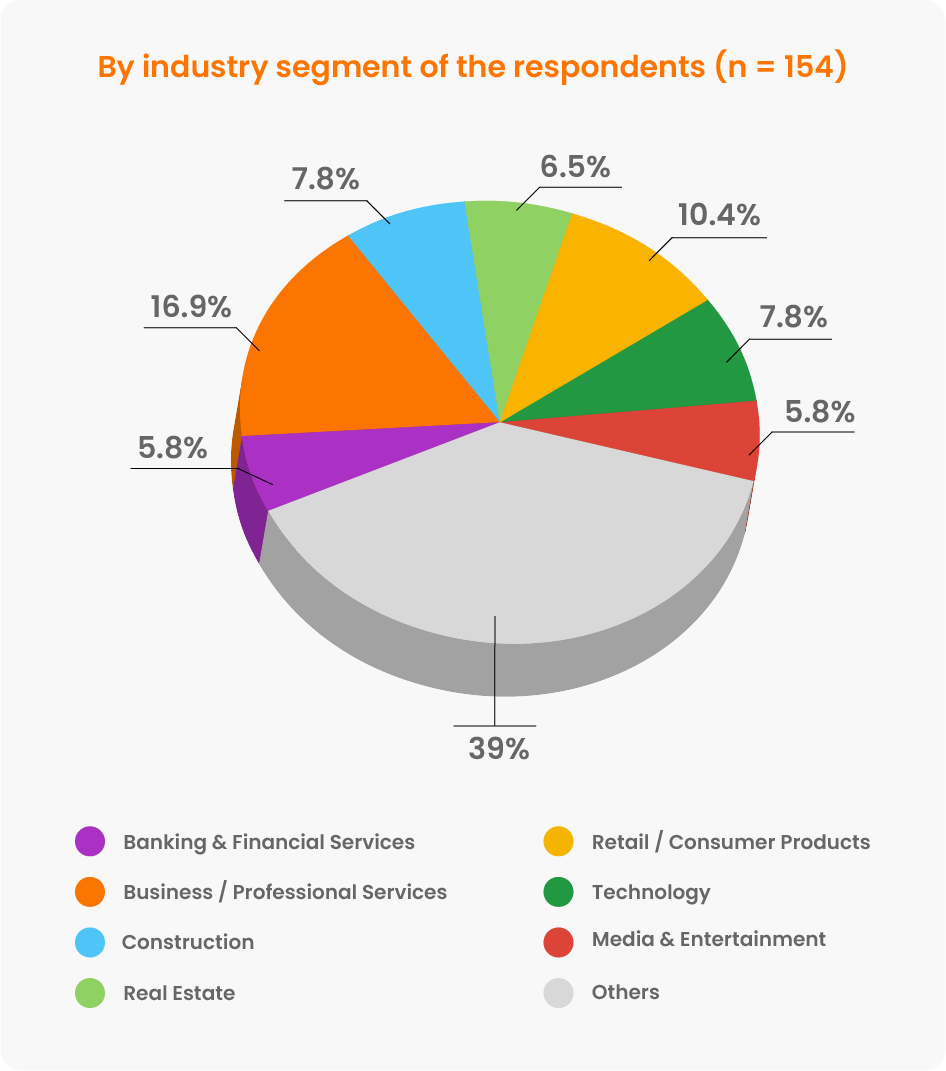

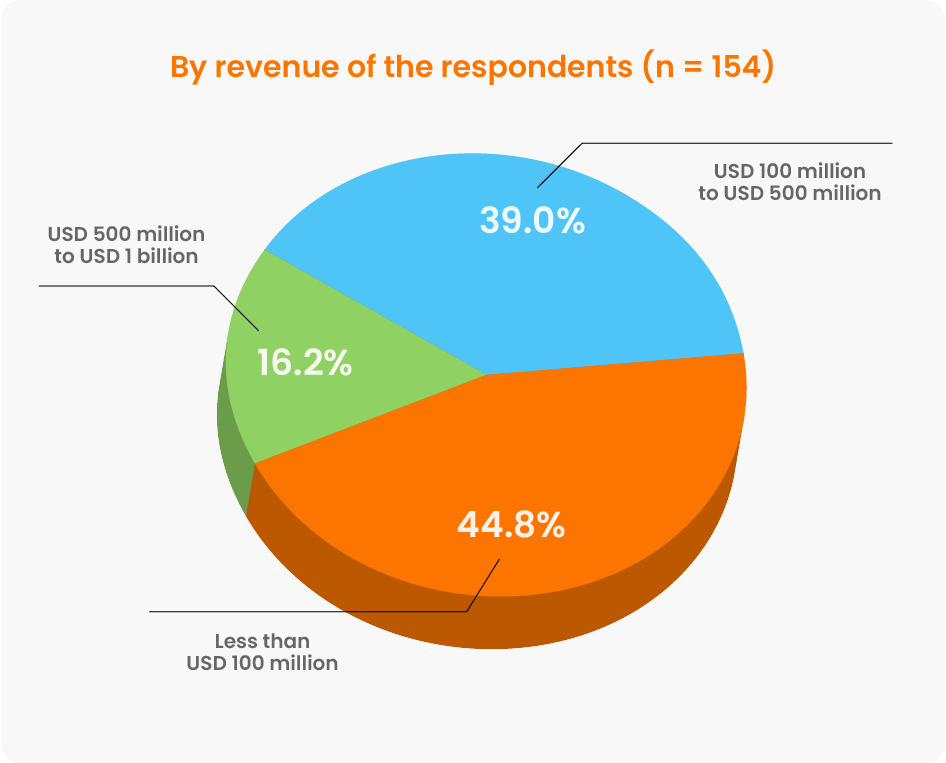

Respondent Profiles