Why does Month End Close Take Time?

- Learn about the various financial close bottlenecks

- Discover how financial close software can simplify the month end close process

Executive Summary

This is the first ebook from a series that analyzes why the month end financial accounting close takes time. In this ebook, we set the stage by identifying the importance of the monthly financial close and discussing the key bottlenecks slowing the process. In subsequent ebooks, we will analyze each of the bottlenecks and suggest solutions.

What is the month end financial close?

The month end close is an accounting process that ensures all financial transactions have been accounted for in the appropriate month. The month end closing process is required to fulfill the matching principle of accounting which requires expenses along with their associated revenue to be recorded and recognized in the same period.

As an example, expenses paid out after the period they were incurred and the revenue received must be matched and recorded in the period. It is the accountant’s responsibility through the month end closing process to recognize the expense has not been recorded and accrue for it in the correct period.

Importance of a strategic financial close system

Month close is a significant activity in the finance function. It is important to close the books as quickly as possible and with the highest accuracy possible because accurate monthly financial statements assist business owners in measuring progress toward objectives, they are required to perform accurate cash flow predictions, they assist in making strategic business decisions, and facilitate financial planning and taking action to guide the company’s future. Also, any error in the financial system has a significant impact on a company’s reputation.

Ways in which month end closing is crucial to businesses

The month end close process is important to businesses and results in the following ways:

Financial close bottlenecks

The month end close process is a complicated process requiring the gathering, analysis, reconciliation, and adjustment of account balances, financial transactions, and data from various systems. Within the process is a complete review of the financial activity and performance for the entire month and adjustments for accuracy to have confidence that the financial statements accurately reflect the financial activity for the month.

Bottlenecks occur in the financial close because:

- Without month end close automation, the close process is a fire drill at the end of the month rather than processed through the month.

- There are different processes for different types of accounts and transactions:

- Some accounts like cash are reconciled

- Some accounts like prepaid expenses and open purchase orders by account are analyzed

- Some transactions have to be matched like intercompany transactions

- Some transactions just need to be reviewed against what is “normal”

- Poor collaboration, workflow, and visibility to the status of the closing processes as work is coordinated across all departments involved in the financial close

- Many tasks are manual, require analysis in Excel, and are outside of the ERP but require time-consuming error-correcting adjustments posted to the ERP or EPM solution

- No visibility in upstreaming errors or outlier transactionsCapacity constraints balancing accuracy against labor cost and time to close

Reasons behind financial close bottlenecks

Lack of access to real-time data: Many finance firms get access to precise data only at the end of the month, which makes rectifying errors a challenging task. It is challenging to provide real-time data with disparate systems, which is where financial close automation and technology assist CFOs in their quest to deliver real-time data to the organization.

Lack of financial close automation: A financial close software improves the closing process in the following ways:

Tasks are often delayed in firms that lack automated capabilities due to a key stakeholder being on leave, or consistent delays on routine chores due to competing priorities. For finance leaders looking to incorporate more automation into their operations, beginning with basic, repetitive tasks- areas, where it is relatively straightforward to make a meaningful impact quickly, is a good place to start.

Lack of a defined process: According to a survey by Deloitte, “the month-close process is often run by institutional memory rather than clear and specific protocols. Different people involved in the process ‘just know how things get done’— and have done it that way for years.” It is impossible to automate operations unless a business has a good grasp of dependencies, task time, and other factors. During the closure process, each task in the close process must be evaluated for its value and purpose, since without visibility into the bottlenecks limiting the month-close process, financial close automation can’t be very useful.

Lack of standardization across the business: Another major issue in automating records to report is the number of stakeholders involved and the lack of defined processes. When external teams other business units provide information to the finance teams, the information offered often varies greatly. People prefer to do things their way, which becomes an issue for processes that need to be uniform across all sectors of a business.

Manual creation of financial statements: For a variety of reasons, whether a company is publicly or privately held, financial statements must be prepared. The conventional method for creating such reports entails a lot of ‘cutting and pasting’ from the previous month’s report, including bits of information from different coworkers. It’s difficult to maintain track of various versions and modifications, making it difficult to verify the authenticity and accuracy of the report.

Manual processes are also used in the approval process, and in many firms, executives need to sign off on manual paper copies, which are subsequently maintained for audit purposes. But manual processes are prone to human error. Moreover, any error in the financial statement has a significant impact on a company’s credibility.

What can the finance team do?

According to a survey, business leaders attribute challenges in shortening financial close times to a range of issues- 40% of executives say it’s because of internal levels of scrutiny, 35% say it’s a growing need to find and consolidate more detail for financial statements, and 20% say it’s because more time is required to check for errors. Fortunately, technology has come a long way. The majority of the toughest portions of closing – data input, tracking down receipts – can now completely be automated using financial close software.

What can the finance team do to shorten financial close times

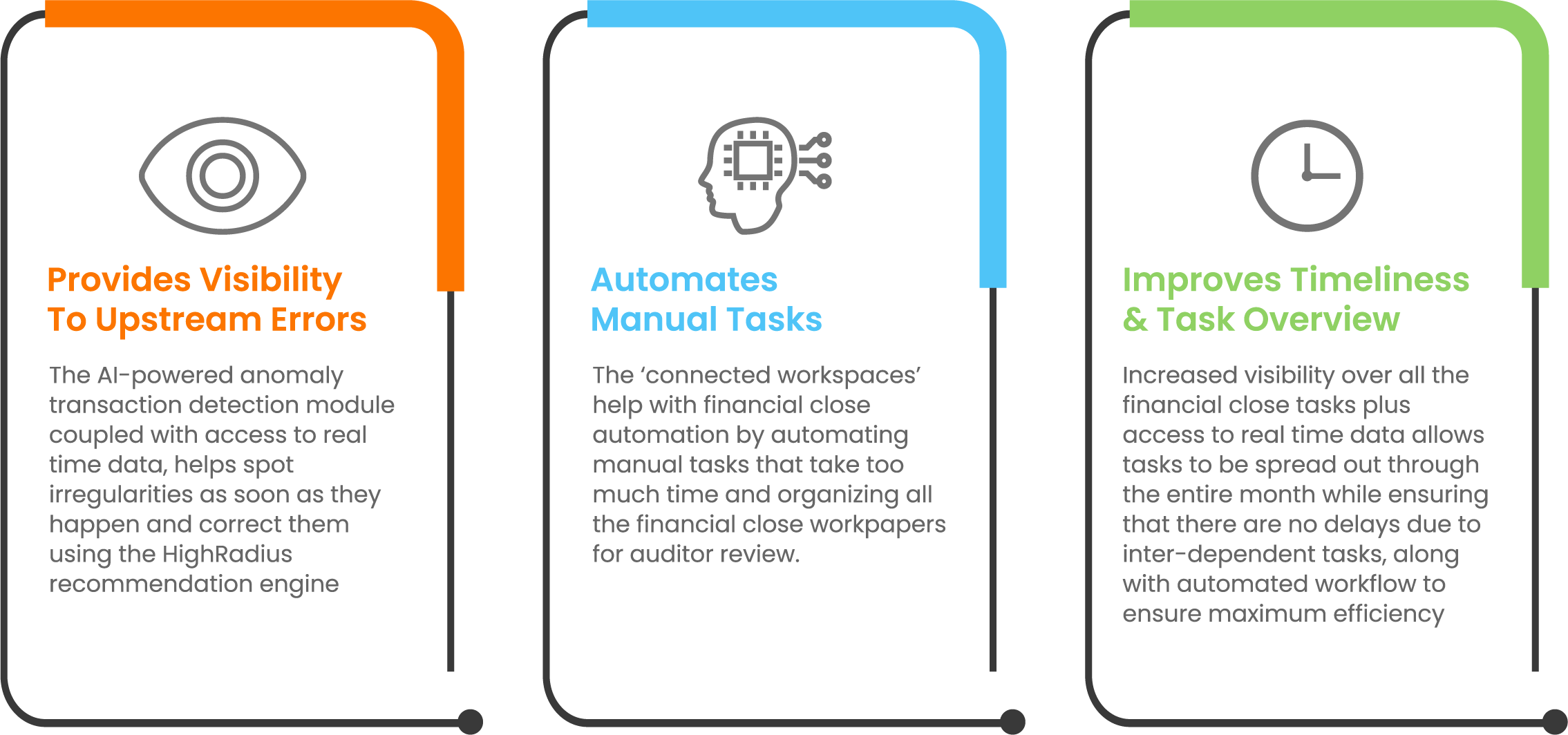

Ways in which the HighRadius Autonomous Accounting helps in automating record to report are:

Provides visibility to upstream errors: The AI-powered anomaly transaction detection module coupled with access to real time data, helps spot irregularities as soon as they happen and correct them using the HighRadius recommendation engine.

Automates manual tasks: The ‘connected workspaces’ help with financial close automation by automating manual tasks that take too much time and organizing all the financial close workpapers for auditor review.

Improves timeliness and task overview: Increased visibility over all the financial close tasks plus access to real time data allows tasks to be spread out through the entire month while ensuring there are no delays due to inter-dependent tasks, along with automated workflow to ensure maximum efficiency.

Conclusion

CFOs and finance leaders must lead organizational decision-making processes with insight, speed, and confidence in today’s volatile and disruptive economic environment. Nonetheless, many finance departments still face inefficiencies in routine processes during the month-close and reporting cycle. As a result, shifting time to value-added analysis and decision support is difficult.

Learn how to make day-zero financial close automation a reality through immediate and accurate decisions.

In our next ebook, we will analyze what it takes to move the month end close to a continuous process through the access to real time data rather than a month end fire drill. In subsequent blogs we will address:

- Organizing the process

- Reviewing all transactions against what is “normal” in real-time

- Automating account analysis of prepaids and purchase orders

- How to automate the account reconciliation process with real-time data

- Automatic Matching transactions