Evolving Landscape of Women in Finance and Leadership Roles

- Dos and don’ts for women in the fintech industry

- How women can use analytical approaches using the latest technologies like AI and ML to complement their leadership styles

- Steps to re-shape finance processes with capable talent and the latest technologies

1.1 An Introduction to Women in Finance and Leadership Roles

Women account for more than half of the employee base across the global financial services industry. However, a lot of them still struggle to gain traction in their finance careers beyond a certain level, either due to personal or professional constraints. On the professional front, most women workforce find it challenging to advance in their profession due to the rapidly changing industry landscape, lack of new skills, and inadequate networks.

In today’s economic world, women must step up and lead rather than follow because they bring a lot to the table in terms of emotional intelligence. As a female finance leader, women must put forward more than numbers. The finance industry is one where a deliberate effort is needed to develop potential female finance leaders. It won’t happen by accident; there needs to be a plan to ensure that incoming talent is prepared to take on this sector’s new challenges.

1.2 Women Finance Leaders Exclusive Panel Session

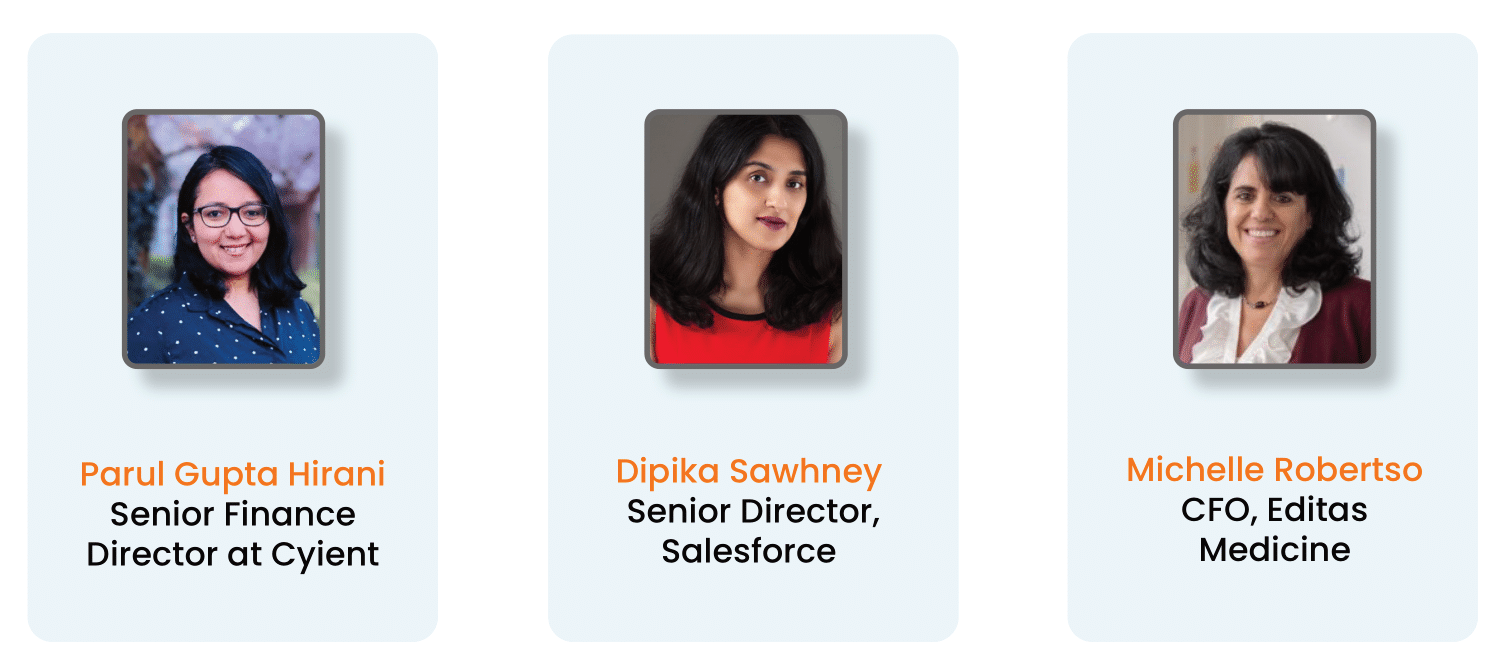

On the occasion of Women’s Month in March 2022, we hosted a virtual discussion to highlight the changing times and promote women in fintech. In the session, three prominent female fintech executives spoke about how they overcame obstacles and advanced their careers. Our outstanding speakers shared their finance industry knowledge and provided interesting career insights. They also talked about the latest fintech trends, AI and machine learning in banking, and AR automation.

The panelists shared insights on what worked for them for them, what didn’t, and how they overcame various obstacles. This discussion is to help women in finance comprehend how to progress up the ladder. The goal was to get female leaders to talk about pressing challenges they confront in their profession. We hope to encourage more women to pursue leadership positions and contribute their unique blend of empathy and intelligence to the sector.

In the roundtable, we discussed the following subjects, which are also at the heart of this dossier:

Challenges in the finance Industry

Critical problems faced by female fintech leaders and their solutions

We wanted to bring in a CFO-centric perspective from a variety of industries and experience backgrounds, so we chose a speaker lineup that included people like:

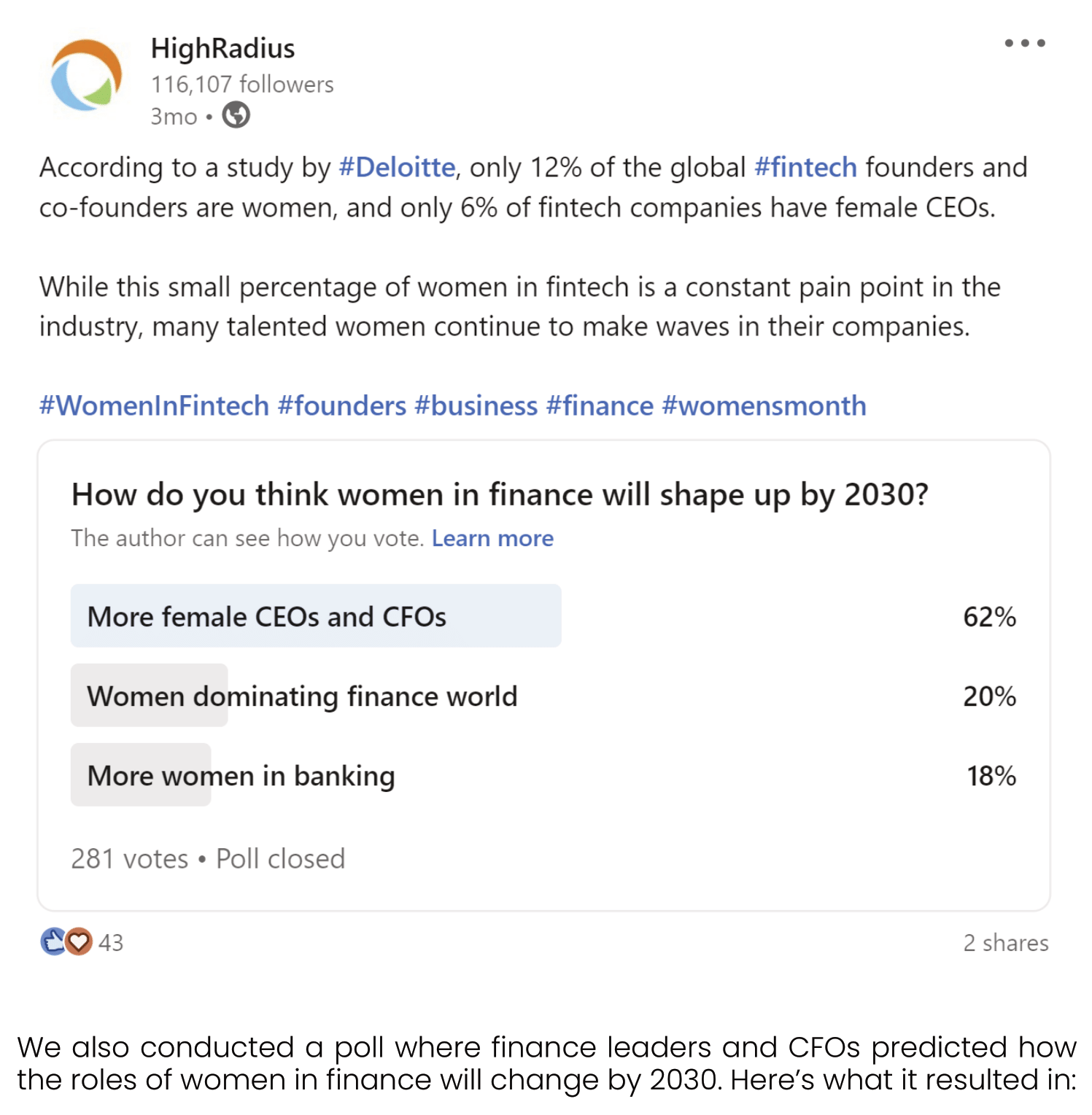

How do you think women in finance will shape up by 2030?

- More female CEOs and CFOs – 62%

- Women dominating finance world – 20%

- More women in banking – 18%

Chapter 2: Parul Gupta Hirani- Senior Finance Director at Cyient

Q1. Elaborate your experience and expertise in the finance domain!

I have over 14 years of finance experience, focusing on financial planning and analysis. I help businesses manage their profitability, margins, while maintaining the top and bottom lines. I recently took responsibility for global operations for one of Cyient’s semiconductor industry verticals. It is a fascinating role that combines finance and operations.

Q2. How has your journey been so far?

What has aided me in my journey is being very clear about what I want out of life. So far, having a clear head and goals has helped me. I’ve learned to overcome the challenges that life throws at me and keep going in the direction I want to go. Because I come from a household where practically everyone is a doctor or an engineer, I began fighting biases from a young age. I was adamant in my desire to pursue a career in finance, even though it isn’t traditionally associated with women. When I reflect on the journey, it’s something that makes me grin.

Q3. What are your views on women in finance and leadership roles?

If I look at Fortune 500 company or S&P 500 corporations, just approximately 13% of leadership positions are held by women, and men make up 85%. That means just roughly 90 female CFOs compared to more than 500 male CFOs. However, we’ve recently noticed an increase in the number of women pursuing finance-related positions and careers. In contrast to other professions, fewer women succeed in finance, and the numbers speak for themselves. This is a topic that I am passionate about, and I would like to see more women grow in the finance sector.

Q4. Which tools and technologies do you think mid-market companies should utilize to manage their finances effectively?

Many solutions are on the market, but companies struggle to understand their business requirements and adopt the appropriate tool. While technology can be tailored to specific industries, there are solutions such as HighRadius for properly handling accounts receivables. That’s one thing that every company has in common. Cash is king in any business, whether its a small restaurant or a manufacturing corporation.

Chapter 3: Dipika Sawhney- Senior Director at Salesforce

Q1. What is your top advice to fellow women professionals in the finance domain?

Your career will last 30-35 years. So treat this journey like a marathon rather than a sprint. My first piece of advice is to unwind and plan your next steps. Take a long-term approach rather than focusing on short-term advantages. Secondly, recognize that bias exists in various forms, sizes, packages, people, organizations, and procedures. Be conscious of what you can and cannot change. Never be fearful since there will always be biases, and you will never work in an ideal atmosphere where everyone follows the rule book. Finally, when you’re in need, ask for assistance. I genuinely believe that it takes a village to raise a child. Our workplace follows the same logic. You must network, seek guidance, and identify your coaches and mentors at work. It’s better to make a little progress every day than to make no progress.

Q2. Have you had any experiences in your career when you had to deal with a perception problem or the inability to handle a leadership position?

As a woman and a mother, I encountered prejudice. It has happened to me at some of the world’s best institutions that promise to be open to women. Accepting and understanding that people are not flawless has helped me deal with biases. Biases are frequently caused by a sense of ignorance, perception of threat, or a lack of information about you as a person. I go out and ask for a promotion if I want one. I get things done if there’s a customer to deal with. You may need to have those conversations at times to assist you in eradicating those biases.

Q3. Is it because women are afraid of taking chances that we don’t see more women in leadership positions, particularly in finance?

I wish I could say I’m not afraid of taking risks, but I’m probably in the minority of women who are. Today’s women are trailblazers. You’ve entered the room, leaving the door open for other women to follow in your footsteps. Looking at the numbers, I discovered that women hold only 4.9% of senior positions in venture capital and 16% of women faculty in elite colleges.

Being a CEO as an adult and being bold, vocal, and ambitious hasn’t always been considered cool. Women now account for 41% of full-time MBA students. Things are shifting, but are they shifting quickly enough? Will it help us is if we meet all of the criteria and check all of the boxes? Yes, there will be disparities when you first start your job, but you will find equality as you progress up the ladder and through the ranks.

Q4. Which technology, in your opinion, will have the greatest impact on the financial industry?

It’s hard to pin on a single technology. We have several Big Data and AI-based solutions at Salesforce. So that is what we and many others in this industry are doing. Above all, it’s critical to comprehend how automation works in a given firm and what it means for the finance function.

Technology will alter everything about how you work. Your skills will never be obsolete once you’ve accepted them and overcome your fear. I’m confident that technology like mine will sew together all of the necessary processes for you. You’ll be fine if you figure out how to run it.

Q5. Have you ever had to learn or deploy new technology to keep up with the changing environment?

Absolutely! I believe that technology is changing right now. What I know today will be obsolete tomorrow, and what I know after that will change. So, rather than how technology is disrupting things, I believe it is more important to be informed of and educated about your subject.

Let’s say you are a biotechnologist, so do you know which companies employ technology to enable it? Could artificial intelligence assist? Is there a solution that has already been packaged? If the answer is yes, enquire about their work to see if it is a suitable fit for you.

I’m getting better at being a company leader, so I try to ask myself, “Is it fixing my problem?” Data questions are more important than technology in other cases, and the percentage improvement is significant. You won’t be able to use HighRadius very often if your data is flawed. That’s a big red flag and a reminder to clean up your place. It’s not an excuse not to automate your procedures because you have bad data.

Chapter 4: Michelle Robertson- CFO at Editas Medicine

Q1. What have been some of the most challenging situations you’ve faced on your path to becoming a CFO?

When I had my third child, it was assumed that I would not return to work and that I would not be promoted to Controller. At the time, I was an Accounting Manager, and plans were in the works to replace the Controller with someone other than myself. I simply had to walk in and tell them that this was not where I saw my position, and I had to request what I desired.

I’ve always known that I need to balance the best of both worlds. I have a family, and I want to be there for them. But I also want to excel at work, and I had envisioned myself as a Controller and, eventually, a CFO. Those biases are difficult to overcome at first, especially as a young woman who wants to start a family, or even if she doesn’t want to start a family but still excels in her work.

Q2. Is it because women are afraid of taking chances that we don’t see more women in leadership positions, particularly in finance?

I am a risk-averse woman, so I am speaking from personal experience. I heard somewhere that when a woman applies for a job, she possesses approximately 95% of the required skills and experience. When a guy applies for the same position, his chances are about 50%. So, I believe that men are sometimes more willing to take risks or have faith in their ability to learn on the job. I undoubtedly held back on some roles at my former company, including the CFO position. When the CFO went on leave and decided not to return, I failed to step up. I didn’t think I had the experience back then.

However, I believe that women are less comfortable with risk than men. Until they have children, some of the younger women who work for me seem more comfortable and confident. In terms of a hybrid workplace and remote-friendly culture, the financial and job world 15 years ago was not as flexible as it is today.

Q3. Many manual processes-oriented positions like Accounting jobs in the finance department are expected to become obsolete. How do you think this will affect your own work? Also, as a woman leader, what do you believe is a critical skill that we all need to adapt, in an ever-changing world?

I’ve always been curious about new technology. The accounting system isn’t usually the first place a company wants to put its money in the biotech industry. Simultaneously, a robust accounting system becomes increasingly important as a company grows or becomes multinational. Particularly with some of the more complex manufacturing and supply chain firms.

We’re cross-training young people in my team to become conscious of new-age systems rather than feel threatened. My accounts payable department is moving away from manual data input and more towards customer service. To handle internal and external stakeholders, the team is adding more value.

I never hire someone specifically for a job. Instead, we need to do more cross-training and ensure that the person hired is ready for process automation. Rapid technological advancements are occurring, and this opens up a slew of options for female professionals to move into more male-dominated roles.

Q4. What are your views on the importance of accounts receivable management for an organization?

We had large accounts receivable teams in previous global companies where I worked. We manually managed our DSO and reported on it. The adoption of unified accounts receivable systems resulted in significant improvements. For increased productivity, better reporting, and analytics automation is the key.

However, finance automation is also very dependent on business requirements. One must implement, automate, and then upgrade the accounts receivable job to become more analytical and deliver real-time indicators.

Q5. In 2022 and beyond, are you looking to adopt any automation in the finance division to increase team efficiency?

We’ve implemented a few modules and are attempting to make the most of them. However, first we are evaluating the need for automation in financial planning and analysis for quarterly budgeting and forecasting. It’s all about the capital allocation for us, and we have research programs to help us decide on the tools and technologies we’ll need.

This information document is an exclusive content of HighRadius, a data-driven AI software platform to lower DSO, optimize working capital, fast-track financial close, and improve productivity.

Special Thanks:

Parul Gupta Hirani– Senior Finance Director at Cyient

Dipika Sawhney– Senior Director at Salesforce

Michelle Robertson– CFO at Editas Medicine