How to Go an Extra Mile with a Tech-Led Lean Finance Team

- Why do lean teams struggle to keep pace with the growing business demands?

- What are the key challenges faced by finance professionals on a daily basis?

- How automation is empowering lean teams and transforming the finance landscape?

Executive Summary

At HighRadius, we talk to hundreds of mid-market CFOs every year. And we understand the challenges they face across key finance functions like accounts receivable, treasury, and accounting. From our conversations with CFOs in 2022, we identified one of the most important responsibilities of CFOs in the coming months will be to support efforts in digitally enabling their workforce—and to raise the bar on talent development so that organizations reach and sustain their full potential.

For CFOs today, solving labor shortages, managing talent, and reassessing skills have become top priorities. With new and disruptive technologies entering the market, today’s CFOs are left with no choice but to keep technology at the core of their business strategy to accomplish these priorities.

According to a recent survey by Gartner, 94% of finance leaders say they need to understand and adopt the latest technology innovations to make a definite impact on business. Mid-sized businesses recognize the need for a digital-first culture to increase employee productivity, but many lack the vision to empower teams with the right tools.

This ebook is the first part of a three-part series that dives into the challenges that lean teams encounter in growing companies. We also look at the benefits of incorporating technology to support team and business goals.

The second and third parts of the series will delve into the various technological solutions that CFOs can leverage to digitally transform their finance landscape and empower their lean team to go the extra mile toward making a positive business impact.

The Status-Quo of Lean Finance Teams in Rapidly Growing Businesses

Unlike enterprises, small and mid-sized businesses(SMBs) do not have the luxury of heavily investing in a large workforce for managing company finances. They either have a lean team handling the entire finance function or rely on outsourcing their finance & accounting (F&A) operations. In a majority of the cases, SMBs prefer to have lean teams because of greater accountability, autonomy, and ease of communication.

A lean team can effectively manage finance operations when the business has a relatively smaller base of customer accounts and transaction volumes. As the business grows, the increasing number of customer accounts demands more attention and time from the team. A lean team then gets overburdened with manual and repetitive work and struggles to focus on high-value functions such as customer experience management that impact the business.

Since it becomes difficult for CFOs to grow their finance operations with a lean team, they tend to choose technology as their ally and look for scalable solutions to empower their team and support business growth.

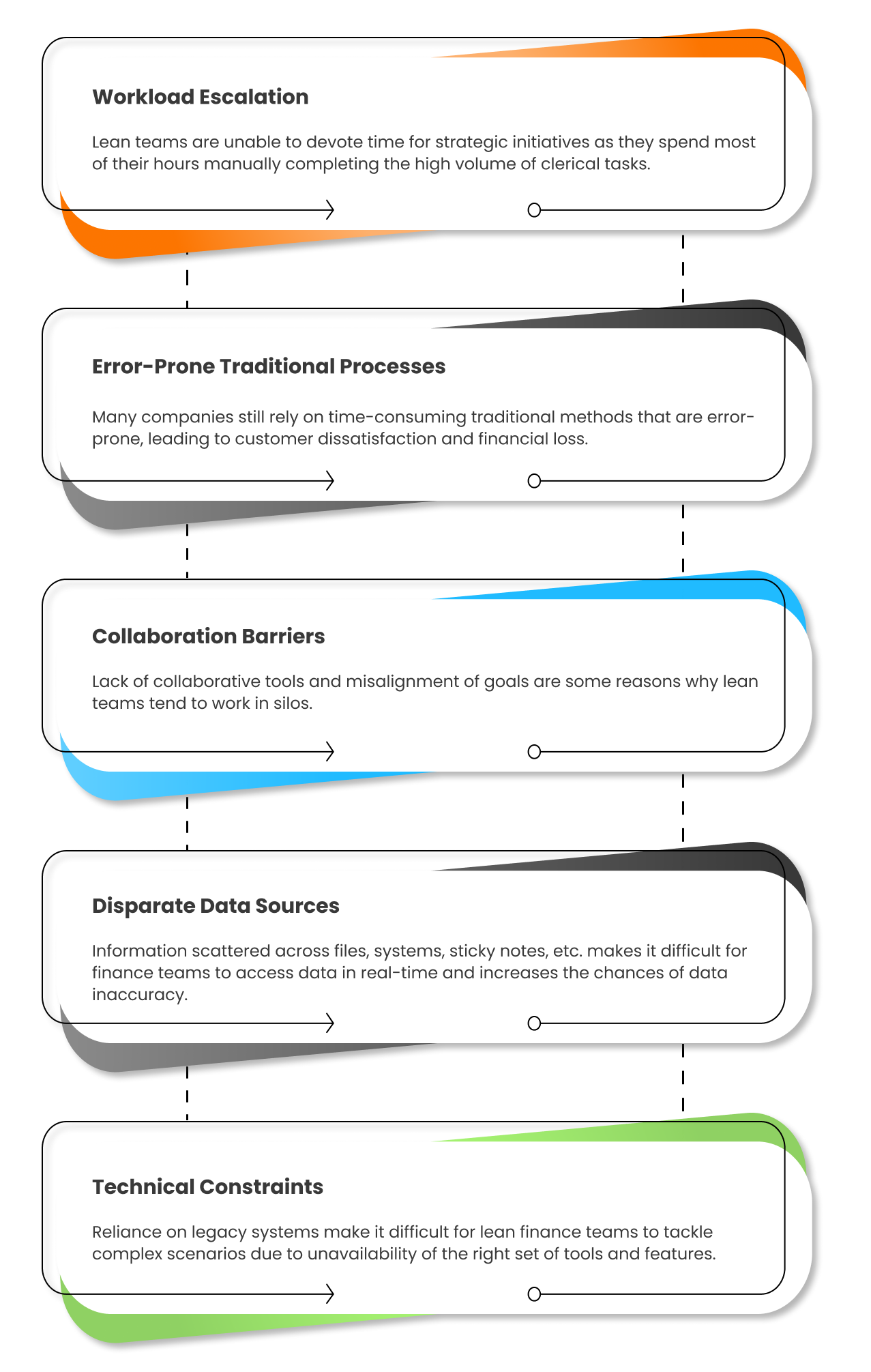

Why Lean Teams Struggle While the Business Grows?

Lean teams are considered more efficient with less bureaucratic controls and faster completion of workflows. But once the volume of operations crosses a threshold level, lean teams may find it difficult to support the growing needs of the business. Here’s some reason why it is so:

Challenges: A Day In the Life of a Finance Professional

This chapter looks at the key challenges that finance professionals face on a day-to-day basis in completing the various finance management tasks such as collections, cash forecasting, and account reconciliation. Read ahead to learn what CFOs of major mid-sized businesses have to say about the finance challenges they face on a daily basis.

Credit Management

- Hectic credit data aggregation

Establishing the credibility and creditworthiness of customers requires your credit team to analyze a lot of information such as credit scores, past payment behavior, and company financials. Manually gathering and assessing credit applications, client records, trade references, and credit bureau reports is a time-intensive process for lean teams.

Reason behind the challenge: Customers often provide incomplete or incorrect information while filling out credit applications. Furthermore, credit information gathered from different credit bureaus has different scoring models and formats. Not having an online credit application system that integrates with credit bureaus makes the process tedious for the accounts receivable team. - Difficulty in setting credit limits

Credit limits determine how much credit should be provided to a customer to avoid bad debt. The finance team has to invest a lot of time and effort in research and analysis to arrive at the right credit limit levels for each customer. It is a tedious task when done manually. Any errors might result in setting incorrect credit limits, thus putting the company at risk of revenue loss.

Reason behind the challenge: Many credit teams use a one-size-fits-all scoring model for all accounts. This is an inefficient scoring method since businesses differ in various aspects, such as industry type, geography, local laws, etc. The finance team often fails to account for the unique traits of each customer, resulting in setting faulty credit limits. - Inability to keep track of critical accounts and conduct periodic credit reviews

With the number of customers rising, performing periodic checks manually becomes challenging. The finance team has to contact credit bureaus for the latest information and reach out to the customers to get relevant data. This time-consuming process leads to several reviews being delayed and the team having no means to stay on top of critical accounts.

Reason behind the challenge: Due to the lack of real-time data on customers’ credit health, the finance team is unable to analyze the credit risk of the entire customer base accurately. With no real-time risk alerts for bankruptcy or credit rating downgrades, the team has limited visibility over critical customers and often overlooks re-evaluating and revising customer credit limits.

Billing & Payments

- Delay in sending invoices

Accounts receivable teams generate and send thousands of invoices monthly. Manually producing such a huge number of invoices takes a substantial amount of time for finance teams since it requires accurately filling in all the details, thus frequently resulting in delayed invoice delivery.

Reason behind the challenge: Despite technological advancements, many companies rely on paper-based invoicing. The process of printing each invoice and then sending it to the customers through postal mail is time-intensive and expensive. Moreover, paper invoicing can be difficult to integrate with electronic systems. Re-typing invoice details correctly from paper to customer portals and accounting systems consumes a majority of the finance team’s time and is also error-prone. - Inability to track invoice status

A hybrid model of delivering invoices through a mixture of digital and traditional channels creates complications for the finance team to track invoice statuses in real-time. Moreover, the accounts receivable team has no means to track invoice discrepancies.

Reason behind the challenge: Invoices sent through postal delivery have a significant risk of getting lost or not being delivered to the correct address. Manually logging into client portals to check the status of invoices is tedious and time-consuming. Finance teams often have no visibility over invoices delivered through email and fax due to a lack of confirmation from the customers’ end. Tracking invoice errors becomes stressful and time-consuming as the team relies on conventional tools like spreadsheets and handwritten notes. - Inability to manage disputes

The accounts receivables team usually discovers disputes only after contacting a customer about a past-due invoice. From manually working on a range of disputes and corresponding with sales, warehouse, and other teams for dispute resolution— the accounts receivable team fails to expedite the process.

Reason behind the challenge: With the lack of a self-service portal, finding the right invoice to verify the dispute is labor-intensive as manually sent invoices are typically scattered across physical warehouses and spreadsheets. The process becomes more complex due to the absence of proper tools to log disputes, prioritize cases, and manage dispute resolution workflows.

Collections

- Delayed correspondence

Handling a huge volume of correspondence daily is challenging. Legacy systems and manual procedures do not provide the flexibility that a modern finance team needs to be successful. As a result, analysts are often unable to revert to customers on time.

Reason behind the challenge: Accounts receivable teams have to manually search through account lists, prioritize customers, customize each correspondence, attach the associated invoices, and send them to customers manually. In absence of a proper worklist and dunning outreach, the risks of write-offs, higher DSO, and bad debts also increase. - Inability to stay on top of at-risk customers

It is necessary to identify the customers who fail to make payments on time to improve the recovery rate. Not knowing which are the high-risk accounts and how to reach out to them eats up a valuable share of the team’s time. High-dollar-value outstanding invoices that are high-risk accounts need to be prioritized.

Reason behind the challenge: In the absence of proper analytics tools and dashboards, it is difficult for finance teams to track and analyze customers and have visibility over account-level metrics such as invoice aging buckets. Due to a lack of actionable insights and customer segmentation strategies, lean finance teams often fail to contact high-risk accounts on time. - Unable to track customer information

The expectation of having a detailed overview of every customer seems unrealistic given the large number of accounts each collector handles. Inaccurate customer data is one of the underlying reasons why payments get delayed.

Reason behind the challenge: It is difficult for analysts to track customer master data in real-time without a unified data source. The accounts receivable team struggles to collate customer information while sending out correspondence since the task requires details of previous correspondence, payment history, invoice details, and account status. The absence of quick access to this data delays the process considerably.

Cash Application

- Manual remittance aggregation

A significant portion of the complexity of cash application arises from the fact that remittance information is provided separately from the payment. As remittance advice is not mandated, remittances may arrive without other corresponding details such as invoice number. As a result, gathering remittance data is a major burden for the finance team.

Reason behind the challenge: Due to multiple sources and formats of remittances, finance teams face difficulty aggregating the data from checks, emails, web portals, bank files, pdfs, etc. Every day analysts log into customers’ websites, search for remittance information, and download the data. This method is laborious and error-prone, resulting in a prolonged cash application process. - Time-intensive invoice matching

The process of mapping payments to open receivables includes matching payments to customer accounts and invoices, recording the payment, figuring out remittance data mismatches, and coding all exceptions accurately. This process is time-intensive and prone to human error.

Reason behind the challenge: When remittances are sent separately, manual intervention is required to link remittances to invoices and handle exceptions. Finance teams need to manually extract data from backup documents, enter details into spreadsheets, and match it to payments, thus increasing the overall time to cash. In the event of short payments, analysts have to manually code the short payment with an appropriate reason code. - Delayed cash posting

Following the matching of the invoice with the payments, cash is applied to the ERP, and the open AR is updated. Due to the high volume of work, accounts receivable teams are unable to execute same-day cash posting in the absence of systems that directly integrate with the ERP solution.

Reason behind the challenge: When posting cash to ERP, accounts receivable teams manually detect short payments and map customer-specific reason codes to ERP-specific reason codes. Different ERPs and legacy systems have their own set of configurations. Analysts have to reconfigure each file before posting it to the ERP system, causing the process to be delayed.

Treasury Management

- Obstacles to treasury growth potential

The more time the finance team spends reviewing transactions, the less time they have to assess their cash flow and cash position. As a result, it becomes difficult for finance teams to discover new investment opportunities, optimize working capital, and improve the cash conversion cycle.

Reason behind the challenge: In most mid-sized businesses, treasury operations are carried out by a lean treasury team, or in some cases, the CFO alone is responsible for managing all treasury-related operations. Due to the lack of a defined treasury role and the absence of task segregation, lean teams often fail to uncover new cash insights. - Delayed data accumulation for cash forecasting

Treasurers have historically prioritized cash forecasting, and their primary goal is to enhance forecast accuracy to manage cash flows better. Before projecting cash, finance teams must collect accurate data from multiple sources such as treasury management systems, ERPs, bank portals, and sales order systems which further increases the process complexity.

Reason behind the challenge: The primary reason behind delayed data accumulation is the lack of global cash visibility. Due to a lack of visibility into real-time data and non-standardized processes, the finance team often faces repercussions such as insufficient cash return, poor hedging, and unexpected expenditure. - Inaccurate variance analysis

The finance team spends hours gathering and matching data for cash forecasting, thereby leaving little time for variance analysis. When variance analysis is conducted in a hurry, the finance team may forget to factor in crucial data, leading to erroneous variance calculations.

Reason behind the challenge: Variances are often documented incorrectly as a result of the manual compilation of accounting data in spreadsheets. Spreadsheets do not provide finance teams granular visibility into cash inflows and outflows, which makes variance analysis inaccurate. As a result, the finance team often fails to determine the root cause behind trapped working capital.

Record to Report

- Delay in the financial close process

Gathering, analyzing, reconciling, and adjusting account balances, financial transactions, and data from multiple sources is key to completing the month-end financial close process. The process often takes longer to complete since it necessitates a comprehensive assessment of the financial activities and performance for the entire month.

Reason behind the challenge: Auditors typically require a lot of documentation to sign off on the financial statements. These documents are required as support for regulatory and compliance filings (tax requirements). It takes the finance team a significant amount of time and manual effort to comply with the documentation requirements, resulting in a delayed financial close process. - Error-prone account reconciliation process

To perform account reconciliation and put together the balance sheet, the finance team needs to record financial transactions throughout the year in the general ledger. Due to clerical errors, the general ledger entries might not always be accurate. Any inaccuracy in the data can lead to reporting errors, and in some cases legal issues.

Reason behind the challenge: The whole process of account reconciliation is highly prone to error when performed manually. Multiple data sources and formats, hundreds of accounts, and dozens of individuals with interdependent tasks all add to the process complexity.

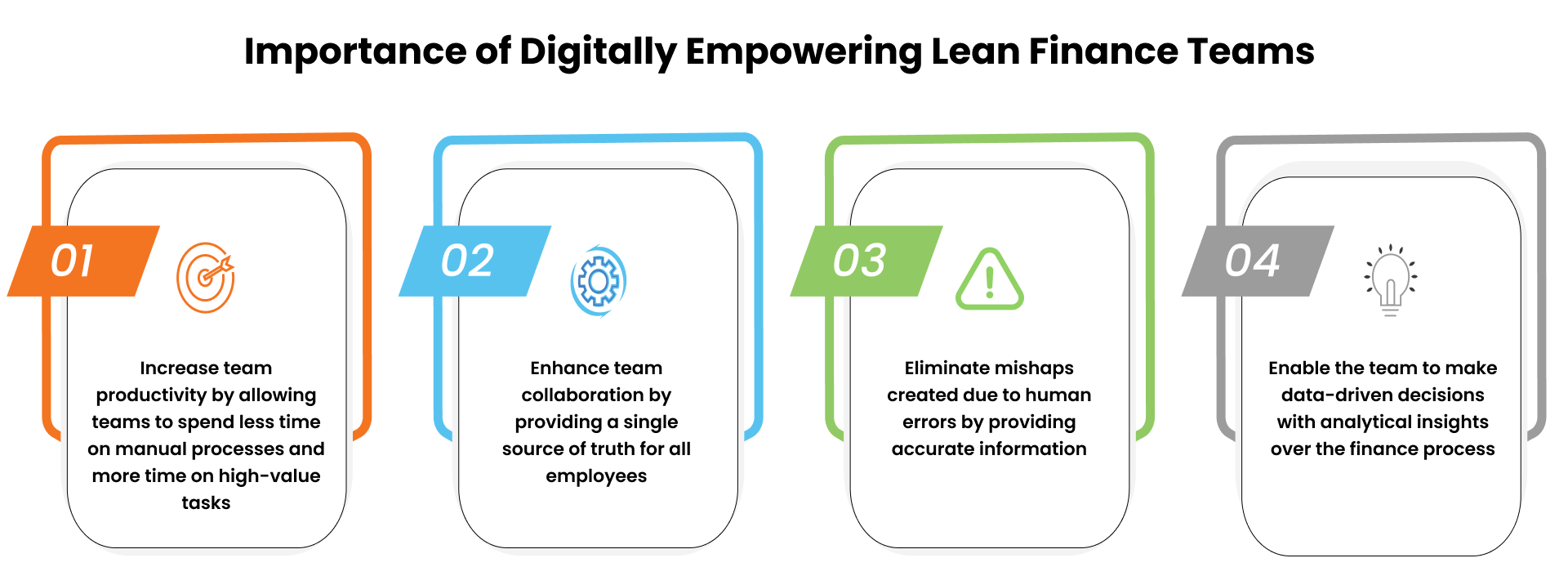

How Automation Enables Lean Finance Teams To Do More with Less?

Let’s take a look at how automation is empowering lean teams and transforming the finance landscape:

- Ensure Faster Customer Onboarding with Online Credit Application

Provide an easy-to-use, configurable online credit application to customers to accurately capture complete credit information. The lean finance team can then avoid the hassle of going through stacks of paper-based credit applications and reduce the time needed to onboard customers. - Leverage Analytics to Make Well-Informed Credit Decisions

Standardize credit assessment with automated credit scoring and gain real-time visibility into changes in the customer profile, payments profile, and filings. Get automated periodic reviews and system-triggered risk alerts to empower your team to make informed decisions. - Shift from Paper-Based Invoices to Digital Billing & Payments

Automated invoicing enables finance teams to track invoice statuses, electronic payment of invoices, statement delivery, and dispute management. Electronic invoicing allows lean finance teams to save time and eliminate inaccuracies by automatically delivering invoices via emails and to customer portals. As a result, a two-hour activity can be performed in a few minutes with better accuracy. - Automated Collections for Faster Payment Recovery

Accounts receivable automation systems assist in setting up customized messaging triggers for dunning, follow-ups, and other correspondences. It also helps to segment customers into risk categories and set up a prioritized worklist. As a result, finance teams can plan dunning outreach accordingly, collect payments faster, and stay on top of delinquent customers. - Track and Analyze Critical Metrics with Intelligent Reporting

Leverage out-of-the-box reports and dashboards to get actionable data-driven insights into critical metrics such as DSO, DDO, and AR turnover ratio. With the help of readily available finance tools, lean finance teams can visualize the performance of order-to-cash KPIs and predict future performance based on historical data. - Gain Real-Time Visibility with a Centralized Repository

Automation solutions offer a centralized repository that provides real-time visibility across customer portfolios and finance processes. It acts as a single source of truth and ensures all information is arranged systematically, thus improving inter-team collaboration. As a result, finance teams can easily access customer data, transaction details, payment commitments, and correspondence history. - Focus on High-Value Tasks by Eliminating Redundant Cash Application Tasks

By adopting a cash application solution, redundant tasks such as remittance aggregation, invoice matching, and cash posting can be automated. This allows lean finance teams to focus on high-value tasks such as deduction management and exception handling. - Resolve Exceptions Faster with Automated Remittance Prediction

Automation simplifies the exception handling process by accurately predicting line-item level data, identifying remittances, and suggesting reference numbers accordingly. It improves productivity by resolving exceptions faster and frees up the finance team’s bandwidth. - Forecast Cash Accurately with Automation to take Better Finance Decisions

To increase forecast accuracy, the treasury management solution provides a collaborative interface and reliable forecast data. Cash forecasting automation eliminates manual work and limits the scope for errors, allowing teams to focus on higher-value tasks. - Achieve Faster Month-End Financial Close with the Power of Automation

Reduce the burden of having to manually enter accounting entries and burn the midnight oil during month-end close with the power of automation. By leveraging financial close automation, teams can accelerate the month-end close process by identifying errors that could have taken place as part of business operations.

Conclusion

The increasing volume of work will undoubtedly create the need for an increase in headcount to keep up with the finance processes. However effective a company may be at hiring new talent, getting them up to speed with the growing business needs is hard to achieve.

Autonomous finance solutions solve the common challenges faced by lean teams to enhance efficiency and boost company growth. Automation vastly improves finance management and offers the flexibility to scale with the business. Adopting solutions like HighRadius’ Autonomous Finance serves as an accelerator to enable lean finance teams to go the extra mile towards achieving business excellence.

The next part of the series- ’Transform Finance Landscape with Digital-First Teams in 2023’ will delve into the various technological solutions that can be leveraged to combat the challenges faced by a lean team in meeting the growing business demands and provide ways to achieve business excellence.

About HighRadius

HighRadius offers cloud-based Autonomous Software for the Office of the CFO. More than 700 of the world’s leading companies have transformed their order to cash, treasury, and record to report processes with HighRadius. Our customers include 3M, Unilever, Anheuser-Busch InBev, Sanofi, Kellogg Company, Danone, Hershey’s, and many more.

Autonomous Software is data-driven software that continuously morphs its behavior to the ever-changing underlying domain transactional data. It brings modern digital transformation capabilities like Artificial Intelligence, Robotic Process Automation, Natural Language Processing, and Connected Workspaces as out-of-the-box features for the finance & accounting domain.

Finance business stakeholders have been led to believe that they have only two choices: pick an application software vendor that digitizes a paper or Excel-based process to an electronic system of record, or, choose a middleware platform for AI or RPA to build and maintain in-house, domain-specific capabilities. In contrast, HighRadius Autonomous Software combines the best of both worlds to deliver measurable business outcomes such as DSO reduction, working capital optimization, bad-debt reduction, reduce month close timelines, and improved productivity in under six months.