As businesses scale and process complexity increases, most enterprises realize that managing workflows, particularly finance ones, using only spreadsheets becomes cumbersome and error-prone. One critical decision most businesses grapple with at this stage is selecting between ERP and accounting software.

The choice between an ERP vs accounting software is an important decision as it has major financial and operational implications. This makes it crucial for businesses to understand how both tools vary in their functionality and scope, identify the major processes or workflows that they aim to streamline, and define the end goal they want to achieve post-implementation. The stakeholders need to ask themselves key questions, such as, are they looking for a system that enables them to ensure regulatory compliance and deliver audit-ready financial reports? Or do they need a system to automate and optimize operations by centralizing data across departments?

In this blog, we will understand the key differences between ERP and accounting systems, factors to consider while selecting between them, and how integrating accounting software with ERP can provide additional benefits for businesses.

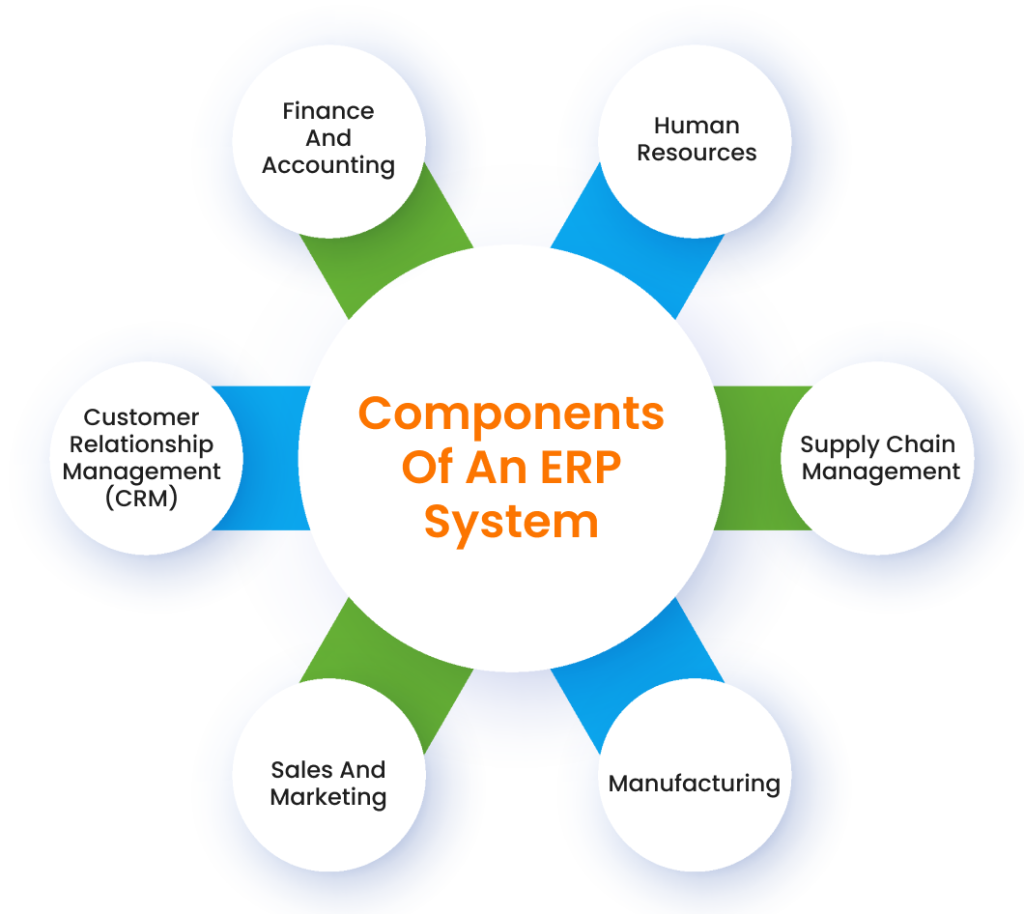

ERP (Enterprise Resource Planning) is integrated software that enables the management of core business processes, including finance, human resources, supply chain management, and customer relationship management. It ensures real-time data visibility by centralizing data from across departments and enhancing collaboration. It also automates several repetitive tasks, such as inventory management, improving efficiency.

Disconnected systems inflate close timelines and audit risk.

Drive real-time visibility with faster and accurate close with automated consolidation.

Accounting software is a specialized tool that ensures robust financial management by accurately recording, reconciling, and tracking all financial transactions. It helps businesses generate timely financial reports and statements that provide key insights about their financial health and performance. By automating key processes such as payroll processing, general ledger management, and expense tracking, accounting software enhances compliance, efficiency, and accuracy.

An ERP accounting system is a subcategory of ERP software that focuses primarily on accounting and managing financial transactions. It ensures the integration of financial management with human resources, supply chain logistics, manufacturing operations, sales efforts, and customer relationship management, providing real-time data visibility.

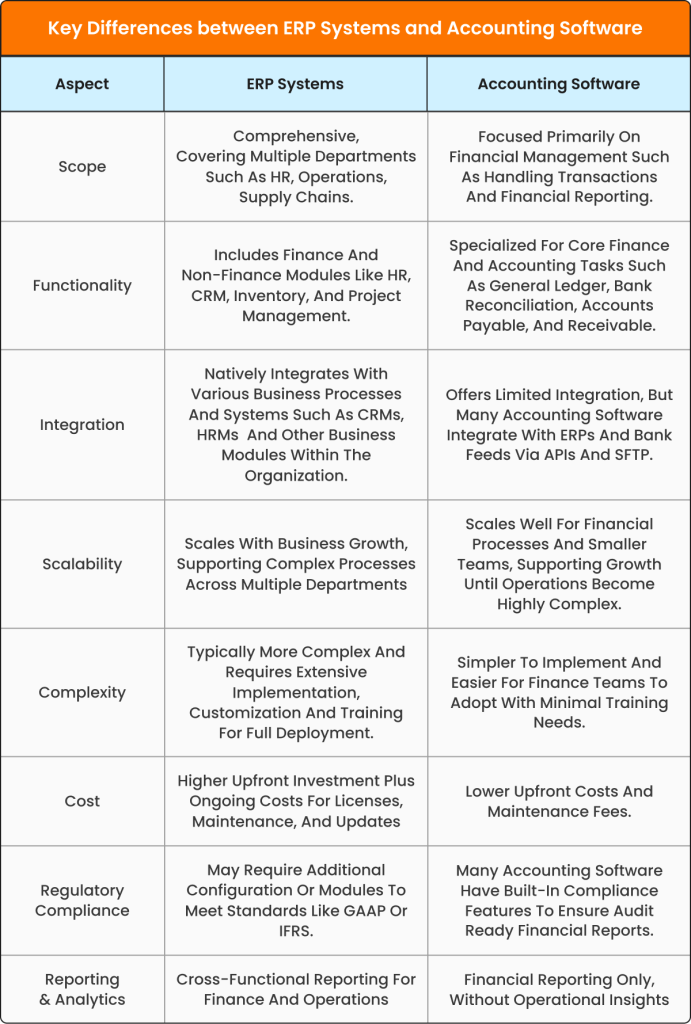

The major differences between accounting software and ERP come down to their scope and functionality. While accounting software is a stand-alone tool that focuses solely on finance and accounting, ensuring the management of day-to-day transactions and financial reporting, ERP systems offer a wider range of functionalities beyond finance and accounting, covering core business areas such as HR, CRM, supply chain management, and operations.

Below, we will look at eight key differences between ERP systems and accounting software:

ERP systems automate and streamline important business activities like inventory control, order processing, and customer relationship management. By integrating data from various functional areas into a single database, they promote decision-making, enhance productivity, and provide visibility into corporate operations.

Let’s break this down to understand better:

Among the biggest benefits of ERP accounting systems is that they centralize data. An ERP eliminates data silos by ensuring that data from across departments is stored in a single database, which is updated in real time and made available to accredited users within the organization. This eliminates the need for manual data entry and ensures data integrity and accuracy.

ERP systems help businesses store information about customers, the history of purchases, and payment records.

ERP systems provide real-time insights about the business’s financial performance, cash flow, and profitability. These systems generate reports customized to the organization’s needs, thereby allowing analysts to analyze trends and areas for improvement and make strategic decisions based on accurate data.

ERP systems are crucial for corporate operations, connecting multiple elements seamlessly to improve procedures and enhance efficiency. ERP systems are based on finely designed modules, each of which serves a specialized role indispensable for organizational performance. Let’s understand these components:

As businesses negotiate the complicated landscape of digital transformation, using an ERP system emerges as a critical approach for attaining operational success. ERP systems have several benefits, allowing firms to streamline processes, improve decision-making, and drive growth. However, along with these benefits, there are also some challenges and obstacles that should be carefully considered. Understanding the benefits and drawbacks of ERP is critical for firms looking to deploy ERP solutions.

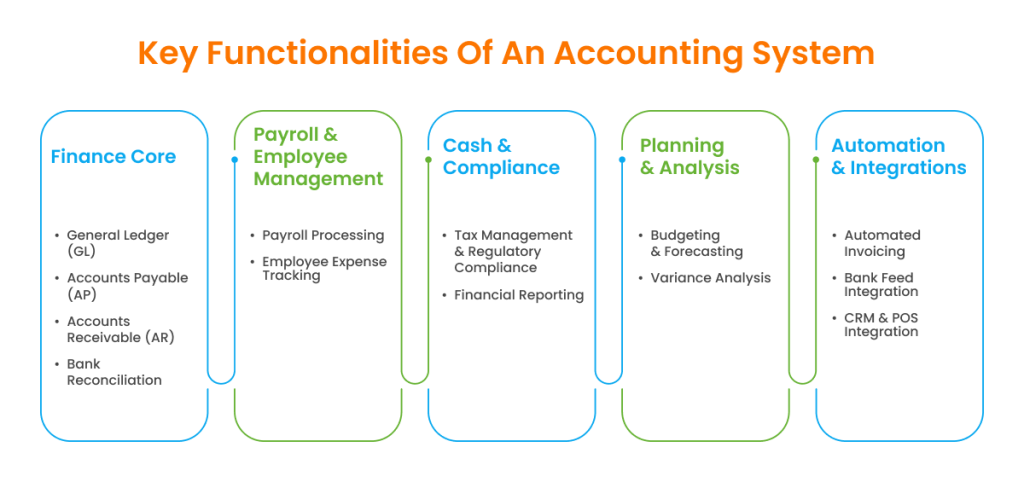

Modern accounting software is designed to streamline financial management by bringing multiple functions into a single platform. Key components typically include:

These components work together to ensure accurate, compliant, and efficient financial operation

Accounting software plays a crucial role in streamlining financial management by automating key tasks like transaction tracking, reporting, and reconciliation. While it offers several benefits that improve efficiency and accuracy, it also comes with certain limitations that businesses should consider before implementation.

Selecting the right solution between an ERP system and accounting software is a critical decision that can significantly impact your company’s operations, costs, and growth trajectory. To make the best choice, carefully evaluate these factors:

Begin by analyzing your company’s unique requirements, including its size, industry, and operational complexity. Identify the top challenges your organization is facing, whether it’s compliance, financial reporting, or cross-departmental inefficiencies and match these to the capabilities of each system.

Determine what you aim to achieve with the system.

Clear objectives will guide your decision and help prevent over-investing in features you don’t need.

Consider how well the solution can grow with your business.

Examine how easily the solution integrates with your existing systems, such as CRMs, HR platforms, and banking systems.

Research vendors thoroughly before making a decision. Look for:

A well-established vendor is more likely to provide consistent updates and strong customer service.

Go beyond the upfront price. Consider:

This holistic view helps you make a cost-effective decision and avoid budget overruns later.

Ease of use plays a major role in user adoption and productivity.

Your business processes may evolve over time, so the solution should be flexible enough to adapt.

With sensitive financial and operational data at stake, robust security is essential.

Before finalizing a decision:

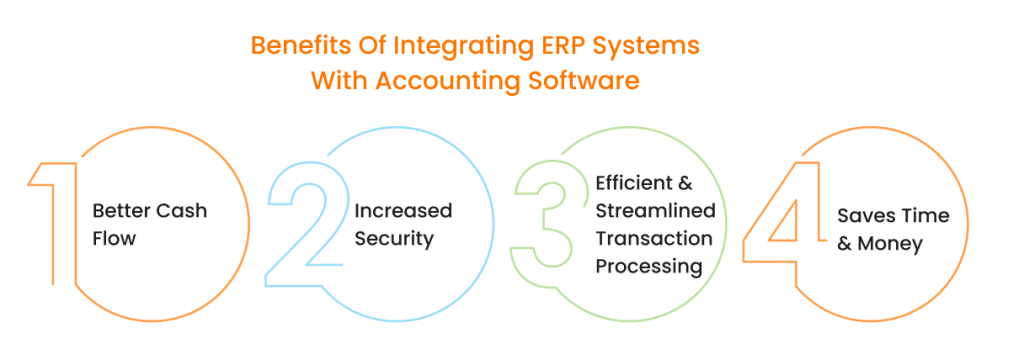

For many businesses, the choice often comes down to either investing in a full-scale ERP or relying solely on accounting software. While ERP systems excel at managing cross-departmental workflows and centralizing operational data, they may lack the specialized features and compliance-ready reporting required for complex financial management. Conversely, accounting software offers robust capabilities for tracking transactions, payroll, reporting, and compliance, but it may not fully address broader operational needs like supply chain or inventory management.

This is where integrating ERP with accounting software emerges as a third, more balanced option. By connecting the two systems, businesses gain the operational visibility of an ERP while retaining the precision, automation, and compliance benefits of a dedicated accounting solution. This approach ensures that financial data flows seamlessly across the organization without compromising accuracy or efficiency. It allows companies to scale intelligently, reduce manual work, and make smarter, data-driven decisions, all while leveraging their accounting software as the financial backbone of the business.

If you hadn’t considered it before, you can and should combine your ERP system with your accounting software for a number of reasons.

Integration enables direct syncing of journal entries, balances, and transactions from the ERP into accounting software. This accelerates collections by providing clear visibility into what’s been paid and what’s overdue, helping teams resolve late payments quickly. Real-time data also drives faster financial closes by eliminating batch updates and spreadsheet uploads, ultimately improving cash flow and freeing up working capital.

By using secure, encrypted data transfers and role-based access, businesses can protect sensitive financial data and reduce the risk of fraud or breaches. System-generated audit trails ensure compliance with internal controls and regulatory requirements. This level of transparency builds confidence in financial reporting and safeguards against internal and external threats.

With integration, invoicing, payments, reconciliations, and journal postings all occur within a single connected workflow. This ensures one source of truth by aligning ERP master data, such as the chart of accounts, entities, and currency conversions, with accounting software. Teams spend less time chasing mismatches and more time analyzing performance.

Automating repetitive tasks like journal entry posting, intercompany reconciliations, and approval workflows eliminates manual intervention and reduces errors. This not only saves significant time and labor costs but also allows finance teams to focus on strategic initiatives rather than administrative tasks, driving overall operational efficiency and growth.

Many finance teams face significant challenges during the close process due to partial integrations between their ERP and financial tools, often leading to delays, errors, and time-consuming manual work. HighRadius addresses this issue by offering seamless, pre-built integrations that connect ERP systems and banking platforms directly with our Financial Close Software. This enables a continuous close process, reduces manual intervention, and ensures that data flows accurately between systems

With 100+ multi-bank connectivity and ERP integrations, our clients achieve:

HighRadius integrates with leading ERP systems such as SAP, Oracle ERP Cloud, Microsoft Dynamics 365, NetSuite, and Infor, as well as industry-specific solutions. By leveraging open APIs and two-way data flows, our platform ensures seamless communication between ERPs and our Account Reconciliation Software, simplifying the entire process—from data mapping and reconciliation to validation and posting—without requiring complex IT involvement.

Once connected, ERP data such as the chart of Accounts, GL balances, sub-ledger transactions, and supporting documents is automatically synchronized with HighRadius. Our AI-driven automation then reconciles accounts, highlights exceptions, and streamlines approvals. Approved journal entries flow back into the ERP automatically, keeping the books accurate and up to date. With role-based controls and centralized monitoring, finance teams gain greater compliance, scalability, and transparency across every stage of the close.

By integrating accounting software with existing ERP systems, HighRadius empowers businesses to replace manual, spreadsheet-driven processes with automated workflows. This not only speeds up the financial close but also provides leadership with actionable insights and a clear, real-time view of the company’s financial health—helping them stay competitive in a rapidly evolving business landscape

An ERP integration, once deployed, would have the integrated systems feed automatically into a central repository environment every time the data is updated. The three most common approaches are:

ERP stands for enterprise resource planning, a type of business management software that automates accounting processes. It is used in accounting to automate financial processes, manage accounts payable and receivable, generate financial reports, and ensure regulatory compliance.

Yes, the integration can be customized to meet specific business needs, including data mapping, workflow automation, and user interface customization. Custom ERP systems can be integrated with existing applications and workflow systems, providing a better user experience for customers and employees.

An integrated accounting system is software that incorporates key financial accounting functions into a single application. HighRadius offers flexible integration options and can work with a wide range of systems.

No, ERP doesn’t completely replace accounting software. While ERP systems include accounting features, dedicated accounting software offers deeper financial management capabilities like reconciliation, compliance, and reporting. Many businesses use both together for complete operational and financial control.

Yes, ERP and accounting software can coexist. Integrating both systems allows seamless data flow, eliminates manual data transfers, and provides real-time visibility. This setup combines ERP’s operational oversight with the accounting software’s specialized financial management for greater efficiency and accuracy.

For small businesses, accounting software is usually the better choice due to lower costs, easier implementation, and essential features like invoicing, payroll, and reporting. ERP systems are ideal for larger organizations with complex operations that require cross-departmental integration and advanced process automation.

ERP implementation typically takes 6–12 months due to its complexity and customization needs. Accounting software, on the other hand, can often be implemented in a few weeks to 2 months, depending on the size of the business and integration requirements.

To estimate a 3-year Total Cost of Ownership (TCO), factor in upfront licensing or subscription costs, implementation expenses, training, ongoing support fees, and system upgrades. Include indirect costs like maintenance and employee time to get a realistic view of long-term expenses.

HighRadius stands out as a challenger by delivering practical, results-driven AI for Record-to-Report (R2R) processes. With 200+ LiveCube agents automating over 60% of close tasks and real-time anomaly detection powered by 15+ ML models, it delivers continuous close and guaranteed outcomes—cutting through the AI hype. On track for 90% automation by 2027, HighRadius is driving toward full finance autonomy.

HighRadius leverages advanced AI to detect financial anomalies with over 95% accuracy across $10.3T in annual transactions. With 7 AI patents, 20+ use cases, FreedaGPT, and LiveCube, it simplifies complex analysis through intuitive prompts. Backed by 2,700+ successful finance transformations and a robust partner ecosystem, HighRadius delivers rapid ROI and seamless ERP and R2R integration—powering the future of intelligent finance.

HighRadius is redefining treasury with AI-driven tools like LiveCube for predictive forecasting and no-code scenario building. Its Cash Management module automates bank integration, global visibility, cash positioning, target balances, and reconciliation—streamlining end-to-end treasury operations.

Customers globally

Implementations

Transactions annually

Patents/ Pending

Continents

Explore our products through self-guided interactive demos

Visit the Demo Center