Finance teams handling credit operations often face more complexity than expected. Credit analysts are occupied with different tasks like deciding which accounts to approve, determining which ones need further review, and trying to spot risk before it becomes a problem. But things tend to slip when information is all over the place and most of the work is still manual. High-risk accounts aren’t always easy to catch, and keeping decisions consistent across the team takes effort.

Even with good systems, a lot of time still goes into doing the same things over and over. That’s where agentic AI can step in for help. It tracks customer activity, picks up early warning signs, and shows you what needs attention without waiting for someone to ask. This way, analysts can focus on the accounts that need action, not get buried in reports.

In this blog, we’ll explore how agentic AI helps credit teams gain a clearer picture of customer risk and act faster, without compromising control or consistency.

There’s no denying that traditional processes still get the job done. But they leave a lot of room for delay and inconsistency. Most credit evaluations involve pulling data from multiple sources, reviewing reports manually, and making decisions based on static rules, or sometimes, just gut instinct.

These workflows take time. And they introduce not just credit risk, but process inefficiencies that impact cash flow, team productivity, and customer experience.

Agentic AI addresses those gaps by giving the teams tools that not only process information faster but also understand how that information fits into the bigger picture.

Agentic AI refers to AI systems capable of independent decision-making and action execution without constant human intervention. It doesn’t just follow a rulebook—it makes its own playbook as it goes. In credit management, that means handling tasks like risk scoring, customer onboarding, and monitoring accounts without someone constantly checking in.

Compared to typical automation (which needs a set of if-this-then-that instructions), Agentic AI is more flexible. It takes in new data, learns from outcomes, and adjusts its actions over time. Imagine a credit analyst who never sleeps, keeps learning, and doesn’t need to be reminded to follow up.

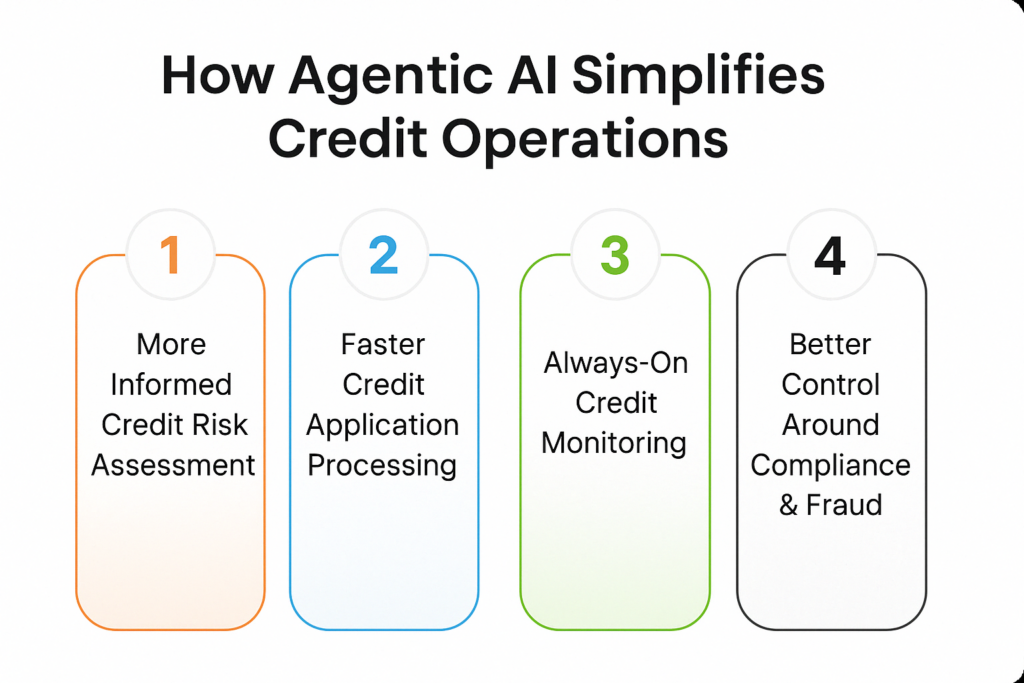

Agentic AI streamlines credit management by stepping into four critical areas where finance teams often face bottlenecks: risk assessment, application processing, credit monitoring, and compliance intelligence. Here’s how it works across each.

Relying solely on financial statements or credit reports gives an incomplete picture. These sources are static and often lag behind reality. In fast-moving markets, that lag can cost companies.

Credit teams today need visibility into what’s changing, not just what happened last year. That’s where AI comes in—not just scraping more data but reading signals like recent payment behaviors, macroeconomic indicators, and even news sentiment tied to a customer or their sector.

The result? A more realistic view of credit risk. One that reflects what’s happening right now, not what happened twelve months ago.

Every credit team has seen it—an application gets held up because one field is blank or a contact couldn’t be verified. These delays seem small, but across hundreds of accounts, they add up fast.

With Agentic AI in place, the review process becomes more fluid. Data from forms, attachments, and even emails is automatically checked against internal records and third-party sources. When something’s missing, the system points it out and suggests what to do next.

No bottlenecks. No unnecessary back-and-forth. Just a clearer path to faster approvals.

Too often, risk reviews happen after the fact. A customer misses a payment, or finance notices a sudden drop in order volume. By then, the problem’s already in motion.

Agentic AI watches continuously. It tracks changes—subtle ones most teams would miss. A slow shift in buying behavior, a pattern of slightly late payments, even changes in the tone of customer emails.

This kind of monitoring lets credit teams act sooner. They’re not reacting to problems—they’re catching them before they grow.

Regulatory pressure is rising. So is the complexity of global credit operations. Mistakes that once passed unnoticed can now trigger audits, fines, or worse.

AI doesn’t replace oversight, but it helps strengthen it. By analyzing patterns in how customers interact, pay, and order, it highlights activity that seems off—something that doesn’t fit the usual pattern.

This gives compliance and risk teams better coverage. It means fewer surprises and more time to respond when something isn’t right.

HighRadius’s credit application software brings together multiple AI agents that handle credit-related work behind the scenes. Here’s what it does:

As a result of integrating the agents, the onboarding time is reduced by up to 70%. Credit analysts can review three times more accounts in a day and experience a significant drop in blocked orders. It’s not just efficiency, it’s a real shift in how the function operates.

Agentic AI is still evolving. It’s already helping credit teams work faster and smarter, but it’s not a plug-and-play solution for everything. Teams need to adapt how they work. There’s still a learning curve, and concerns like data security and AI transparency need to be addressed.

But the direction is clear. As finance functions become more data-driven and customer expectations grow, traditional tools won’t be enough to keep up. Teams that adopt Agentic AI will have an edge, not because they’ve automated more but because they’ve freed themselves to focus on what matters most: managing risk with insight, not just rules.

If your credit processes still rely on spreadsheets, disconnected emails, or rigid scoring models, it’s worth considering where things could go from here. As the landscape shifts, the question isn’t just about efficiency, it’s about how credit teams can evolve to meet changing demands with more intelligence and less friction.

1. How will Agentic AI shape the future of credit management?

Agentic AI enables real-time credit monitoring, automatic limit adjustments, and personalized risk strategies—replacing static models with proactive decision-making. It empowers finance teams to act faster, reduce risk exposure, and support growth without manual oversight.

2. Can Agentic AI improve credit risk analysis?

Yes. Agentic AI continuously learns from customer behavior, market signals, and payment trends to predict risk. It flags issues early and adapts scoring dynamically—making risk analysis more accurate, timely, and data-driven.

3. Why is Agentic AI critical for the future of finance?

Agentic AI helps finance teams manage rising data complexity by automating judgment-based decisions. It scales credit risk workflows, enhances responsiveness, and supports smarter, faster financial operations—making it essential for modern finance functions.

4. How is Agentic AI different from traditional credit risk assessment?

Agentic AI is proactive, adaptive, and context-aware—unlike traditional models that rely on static data and fixed rules. It continuously monitors behavior, uses external signals, and can autonomously act on risks. This enables finance teams to assess creditworthiness in real time and personalize risk strategies at scale.

Positioned highest for Ability to Execute and furthest for Completeness of Vision for the third year in a row. Gartner says, “Leaders execute well against their current vision and are well positioned for tomorrow”

Explore why HighRadius has been a Digital World Class Vendor for order-to-cash automation software – two years in a row.

For the second consecutive year, HighRadius stands out as an IDC MarketScape Leader for AR Automation Software, serving both large and midsized businesses. The IDC report highlights HighRadius’ integration of machine learning across its AR products, enhancing payment matching, credit management, and cash forecasting capabilities.

In the AR Invoice Automation Landscape Report, Q1 2023, Forrester acknowledges HighRadius’ significant contribution to the industry, particularly for large enterprises in North America and EMEA, reinforcing its position as the sole vendor that comprehensively meets the complex needs of this segment.

Customers globally

Implementations

Transactions annually

Patents/ Pending

Continents

Explore our products through self-guided interactive demos

Visit the Demo Center