Your accounts payable (AP) process is at the heart of your business operations, but is it as efficient as possible? For enterprises, where every dollar counts, manual AP processes aren’t just costly & outdated; they hold you back from focusing on other processes. Delays, errors, and inefficiencies can cost your business more than just time; they can impact vendor relationships, cash flow, and overall financial health.

So, how can you tackle this? The answer is - by leveraging the best accounts payable automation software.

In this guide, we’ll explore 2026’s best accounts payable automation vendors, giving you a clear view of which AP tool to opt for your organization with more confidence.

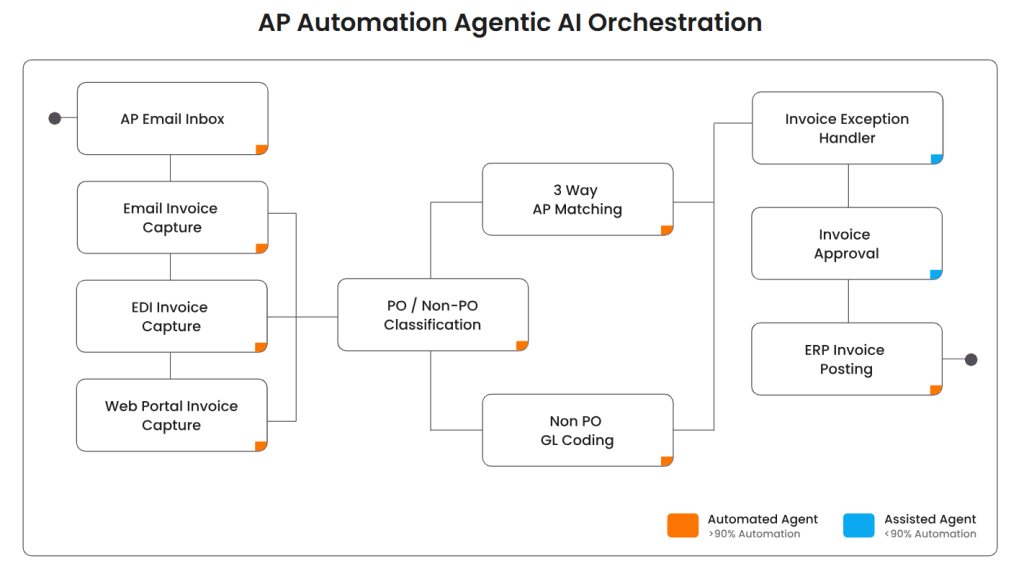

AP automation solution digitizes and automates the end-to-end accounts payable cycle, from invoice capture to approval workflows, ERP posting, vendor payments, and reconciliation. These solutions reduce manual effort, eliminate data-entry errors, shorten processing cycles, and improve visibility over payables.

As more businesses modernize their payables processes, AP automation companies are playing a key role in streamlining invoice processing, approvals, and payments. Below is a quick snapshot of the best accounts payable automation companies in 2026, helping you see which AP platform fits your business and delivers the best results.

| Platform Name | Best Suited For | Standout Feature | Pricing |

| HighRadius | Mid-to-large enterprises with high invoice volume and complexity | Template-agnostic AI-led data capture and end-to-end accounts payable payment automation with automated exception handling. | Check pricing |

| Tipalti | Companies managing international suppliers and compliance | Supports global payments and compliance automation | Contact for pricing |

| QuickBooks Online | Small to mid-sized businesses needing simple AP automation workflows | Offers straightforward invoicing and integration options | Contact for pricing |

| Sage Intacct | Enterprises requiring GAAP compliance and advanced reporting | Provides configurable financial reporting | Contact for pricing |

| NetSuite | Growing enterprises looking for scalability | Offers ERP-connected invoicing and workflow management | Contact for pricing |

| Microsoft Dynamics 365 | Businesses already using Microsoft products | Integrates ERP and CRM with AP workflow support | Contact for pricing |

| Acumatica | Midsize companies with large teams | Focuses on team collaboration and workflow access | Contact for pricing |

| Epicor | Manufacturing, retail, and distribution sectors | Industry-focused AP processes with payables visibility | Contact for pricing |

| Oracle EPM Cloud | Large enterprises with complex reporting needs | Integrates analytics with Oracle ERP | Contact for pricing |

| SAP | Businesses of all sizes need scalability | Offers flexible deployment and standard AP automation | Contact for pricing |

| Stampli | Teams needing hands-on invoice approvals | Facilitates collaborative invoice processing | Contact for pricing |

| FreshBooks | Freelancers and small businesses | Simplified invoicing and expense tracking | Contact for pricing |

| Melio | Small businesses on a budget | Basic invoice capture and approval with a free option | Free plan available |

An accounts payable platform is a technology solution that streamlines the process of handling vendor invoices, approvals, and payments for companies. By automating these tasks, an AP automation platform reduces manual effort, prevents errors, and ensures faster and more reliable payment cycles.

These platforms go beyond simple invoice tracking. A modern accounts payable platform combines automation, intelligence, and compliance to provide finance teams with end-to-end control over payables. Below are the key features that define an effective AP automation platform:

1. Automated invoice capture: An AP automation platform uses OCR and AI to capture invoice data from different formats like PDFs, emails, or scans. This reduces manual entry, minimizes errors, and accelerates the process, ensuring data accuracy and allowing finance teams to focus on more valuable tasks.

2. Purchase order matching: The platform automatically matches invoices with purchase orders and receipts to check accuracy. This three-way matching process helps avoid duplicate payments, reduces discrepancies, and ensures that suppliers are paid the correct amount on time, thereby improving financial control.

3. Streamlined approval workflows: Instead of chasing approvals through emails or paper, invoices are routed digitally to the right stakeholders. This creates faster approval cycles, provides clear visibility into pending tasks, and maintains an audit trail that strengthens accountability and compliance throughout the AP process.

4. Fraud detection and compliance: Built-in controls such as duplicate invoice alerts, segregation of duties, and tax checks reduce fraud risk. The platform ensures compliance with tax laws, corporate policies, and industry regulations, providing businesses with greater security and peace of mind in their operations.

5. Supplier self-service portals: Suppliers can log in to a portal to check invoice and payment status without contacting AP teams. This transparency reduces manual inquiries, saves time for finance staff, and builds stronger supplier relationships by providing visibility and faster resolution of concerns.

6. Cash flow optimization: With faster invoice approvals and better visibility into outstanding payables, companies can negotiate early payment discounts and optimize working capital. This improves cash flow management, reduces financing costs, and creates long-term financial stability for businesses.

HighRadius is an AI-powered AP workflow software designed to streamline invoice processing. With seamless ERP integration, advanced invoice data capture and matching, and robust exception handling, it provides a centralized solution for validating invoices and managing payments efficiently, making it ideal for enterprises & midmarket businesses of all sizes.

Which AP Automation Software Is Right for Your Business?

Use our free checklist to evaluate vendors and choose the solution that best fits your goals.

Get the Free ChecklistBy automating invoice capture, coding, validation, matching, and approval, HighRadius enables up to 90% straight-through processing, reducing exceptions by up to 30% and cutting invoice processing costs by 50%. Enterprises benefit from faster cycle times, improved compliance, real-time visibility, and strategic focus for AP teams.

HighRadius empowers enterprises to achieve 2X faster invoice processing, 40% higher analyst productivity, and up to 90% automation across AP processes. By combining AI-driven capture, auto-coding, automated approvals, and advanced reporting, it frees finance teams from manual tasks, reduces costs, ensures compliance, and drives measurable impact on working capital and profitability. For enterprise AP automation, HighRadius is not just a tool; it’s a strategic platform that transforms accounts payable into a scalable, efficient, and high-performing function.

Tipalti is a cloud-based AP automation platform that helps businesses efficiently manage global payments, streamline supplier onboarding, and ensure compliance with international tax regulations. Its tools aim to simplify cross-border transactions while maintaining regulatory standards. Companies with extensive vendor networks and international operations often find it beneficial to automate manual efforts in their payables processes.

QuickBooks Online is a user-friendly accounting platform ideal for small and mid-sized businesses seeking basic AP automation. It provides core invoicing and payment tools while offering integration options with third-party AP solutions. Its simplicity makes it accessible for teams without dedicated finance resources.

Sage Intacct is a cloud-based ERP designed for enterprises that require advanced financial management and GAAP compliance. Its AP automation software is integrated with robust reporting and customizable workflows, supporting detailed financial tracking and approvals. Companies with structured accounting needs leverage it for streamlined operations.

NetSuite provides scalable ERP solutions with AP automation integrated across finance and operational processes. Its real-time invoicing data and comprehensive reporting support growing enterprises that require accurate and timely financial insights. The platform is ideal for businesses seeking comprehensive end-to-end AP visibility.

Microsoft Dynamics 365 combines ERP and CRM features with AP automation, enabling businesses to streamline workflows within the Microsoft ecosystem. Its integration capabilities support scalability and operational efficiency. Teams already using Microsoft products can benefit from a unified environment.

Acumatica is a cloud ERP built to scale with growing businesses, offering AP automation software and extensive collaboration tools. Its unlimited user model supports large teams, and its flexible workflows adapt to evolving business needs. Midsize companies often leverage it for operational efficiency.

Epicor offers AP automation solutions tailored for the manufacturing, retail, and distribution sectors. It offers end-to-end visibility into payables and customizable workflows that help businesses control cash flow and operational efficiency.

Oracle EPM Cloud is designed for large enterprises seeking AP automation software integrated with advanced financial planning, forecasting, and compliance tools. Its close connection with Oracle ERP allows better data-driven decisions and operational control.

SAP offers scalable ERP solutions with AP automation software that cater to businesses of all sizes. Its flexible deployment options and strong reporting capabilities make it suitable for diverse organizational needs, from small companies to large multinational enterprises.

Stampli is an accounts payable automation vendor that focuses on collaboration within AP processes, making it easier for teams to manage invoice approvals and exceptions. Its AI-assisted workflows reduce manual work while improving visibility and communication.

FreshBooks is a simple accounting tool designed for freelancers and small businesses with minimal AP automation needs. Its focus is on ease of use and essential features, such as invoicing and expense tracking.

Melio is a free AP solution for small businesses, providing essential invoice capture and approval workflows. Its simplicity and cost-effectiveness make it ideal for teams with limited budgets or basic automation requirements.

These top accounts payable automation companies cater to a range of business needs, from small startups to large enterprises. You can choose the right accounts payable automation vendor that best fits your operational goals by evaluating your company's specific requirements, including scalability, integration capabilities, and reporting needs.

Manual processes can feel manageable at first, but as invoice volumes increase, the cracks start to show. Without modern accounts payable management software tools or AP automation tools, finance teams often struggle with inefficiency, poor visibility, and compliance risks. Here are the biggest ap automation challenges companies face:

Manual data entry increases the risk of duplicate invoices, incorrect amounts, or mismatched details. These errors not only slow down approvals but also strain vendor relationships and create reconciliation issues that AP automation vendors help eliminate.

Invoices often sit in inboxes or get misplaced, causing delays in approvals and late payments. This slows down cash flow management and can damage supplier trust. Accounts payable tools streamline approvals and speed up payment cycles significantly.

With manual systems, it’s hard to track the status of invoices in real time. This lack of visibility makes forecasting difficult, increases the chance of missed discounts, and prevents finance leaders from making timely, data-driven decisions.

Paper-based processes make it harder to maintain audit trails or meet tax and regulatory standards. Without reliable records, businesses face higher compliance risks. AP automation tools provide the controls and documentation to stay audit-ready.

From paper storage to manual labor, the cost of processing invoices without automation is high. Manual workflows drain resources that could be better invested elsewhere. AP automation software reduce these costs with faster, digital-first workflows.

Modern finance teams are shifting from manual processes to digital-first systems, and the reason is clear. By adopting accounts payable tools or AP automation tools, businesses gain better control, speed, and accuracy in their payables. Below are the key benefits companies see when working with leading accounts payable automation vendors :

Accounts payable tools minimize manual entry mistakes by automating invoice capture and matching. This ensures fewer discrepancies, faster reconciliation, and stronger accuracy across transactions, leading to more reliable financial reporting and smoother audits.

With automated workflows, invoices move through the system without bottlenecks. AP automation tools shorten approval times, helping businesses pay vendors on schedule, capture early payment discounts, and maintain stronger supplier relationships. This seamless transition from approval to disbursement is the core advantage of modern accounts payable payment automation.

Accounts payable automation vendors provide dashboards and real-time reporting to track invoices at every stage. This visibility enables finance leaders to forecast cash flow accurately, identify bottlenecks, and make informed decisions faster than with manual methods.

Accounts payable tools reduce processing costs by cutting down on paper handling, manual labor, and storage needs. By streamlining workflows, AP automation tools let teams handle higher volumes at lower cost, improving overall financial efficiency.

Leading AP automation tools build audit trails, tax compliance, and regulatory safeguards into their platforms. Businesses benefit from accurate records, audit-ready financials, and reduced compliance risks without the overhead of manual monitoring.

Selecting the right accounts payable automation vendors is important because not all accounts payable tools are built the same. The best accounts payable software combine automation, compliance, and scalability to match your business goals. Here are the steps to evaluate and select the right accounts payable automation vendor:

Start by mapping your invoice volume, approval workflows, and compliance requirements. This helps narrow down accounts payable automation company that align with your scale and complexity, rather than choosing generic tools that may not fit long-term growth.

The best accounts payable automation software offer seamless integration with ERPs, CRMs, and banking systems. Strong integration ensures your financial data flows without disruption and reduces the need for manual reconciliations or duplicate entries.

Look for AP automation vendors that provide advanced features like invoice capture, three-way matching, approval routing, and audit-ready trails. The best accounts payable vendors also include dashboards for visibility and compliance safeguards.

Choose the best AP platform that can scale as your business expands. Many accounts payable automation vendors offer modular upgrades, so you can start small and add advanced features like AI-driven analytics or multi-entity support as your needs grow.

The best accounts payable automation companies provide transparent pricing that matches your invoice volume and feature requirements. Compare subscription tiers across AP automation solutions to find a balance between cost efficiency and functionality.

Evaluate how responsive the vendor is during onboarding and ongoing support. The best accounts payable vendors offer training resources, dedicated account managers, and quick resolution of issues to ensure smooth operations post-deployment.

By choosing the best accounts payable tools, businesses can expect ROI through reduced processing costs, faster invoice approvals, and improved cash flow visibility. By adopting the best accounts payable platforms, companies also cut manual errors and gain efficiency. Partnering with strong accounts payable automation vendors further boosts accuracy and scalability.

Yes, mid-sized businesses can greatly benefit from AP automation tools. These platforms streamline invoice handling, reduce approval delays, and free finance teams from manual tasks. The best accounts payable vendors provide scalable solutions that support growth, compliance, and better supplier relationships without heavy upfront investments.

Yes, modern accounts payable platforms integrate seamlessly with ERP and accounting software, reducing disruption to finance operations. Top AP automation vendors ensure secure data flows, improved accuracy, and efficient invoice processing. The best accounts payable tools help businesses maintain control while enhancing overall financial productivity.

Key criteria for choosing accounts payable automation vendors include: ease of implementation, vendor experience, feature relevance (invoice capture, PO matching, approvals), ROI estimates, integration depth, scalability, support/training, and vendor reputation/ratings.

The best AP automation software combines intelligent invoice processing, configurable approvals, secure payment capabilities, real-time reporting, and seamless ERP integration to support scalable, compliant, and efficient accounts payable operations.

The best AP automation companies are those that leverage AI and machine learning to automate invoice processing, approvals, and payments while ensuring accuracy and compliance. Leading providers like HighRadius stand out for their ability to integrate seamlessly with ERP systems, eliminate manual data entry, and provide real-time visibility into payables.

Accounts payable automation solutions should offer invoice capture, intelligent approval workflows, ERP integration, payment automation, and real-time visibility. Advanced solutions also include controls, audit trails, and analytics to reduce risk, improve efficiency, and scale AP operations

Ranked among the Top 15 Accounts Payable solutions in The Hackett Group’s 2025 report, HighRadius is recognized for excellence across implementation, scale, and AI-led intelligence, highlighting its ability to support complex, enterprise-scale AP operations

Positioned highest for Ability to Execute and furthest for Completeness of Vision for the third year in a row. Gartner says, “Leaders execute well against their current vision and are well positioned for tomorrow”

HighRadius stands out as an IDC MarketScape Leader for AR Automation Software, serving both large and midsized businesses. The IDC report highlights HighRadius’ integration of machine learning across its AR products, enhancing payment matching, credit management, and cash forecasting capabilities.

Forrester acknowledges HighRadius’ significant contribution to the industry, particularly for large enterprises in North America and EMEA, reinforcing its position as the sole vendor that comprehensively meets the complex needs of this segment.

Customers globally

Implementations

Transactions annually

Patents/ Pending

Continents

Explore our products through self-guided interactive demos

Visit the Demo Center