Debunking myths about cash forecasting automation

What you’ll learn

- Learn the myths around cash forecasting automation.

- Understand the capabilities of automated cash forecasting.

Why are companies hesitant to adopt cash forecasting automation?

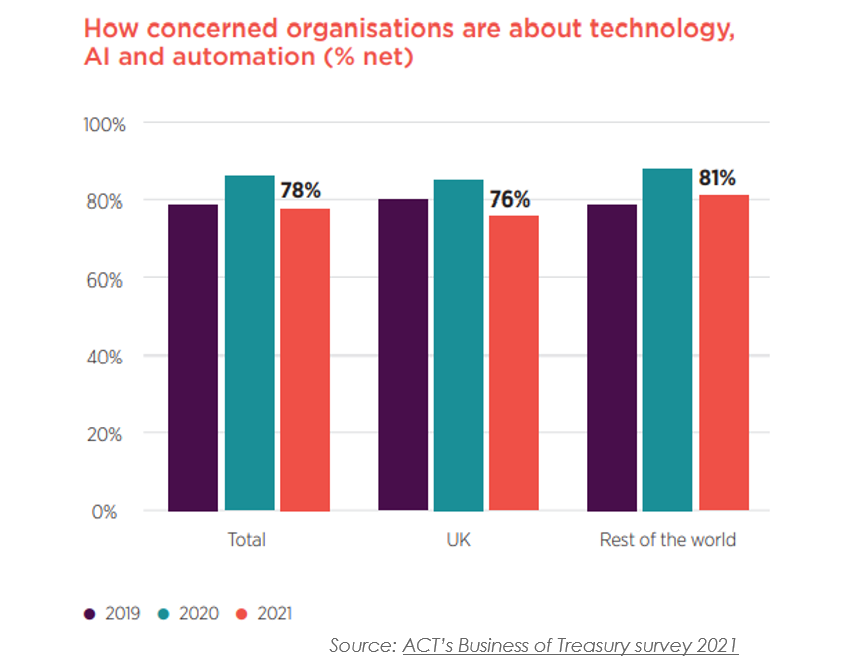

There are significant performance benefits for businesses with automation, but why are companies still holding back from leveraging automation? ACT’s 2021 Business of Treasury survey stated that companies’ concerns on technology and automation have dipped but are still very much there. Some factors that contribute to the low adoption rate are:

Some factors that contribute to the low adoption rate are:

- Lack of proper knowledge on automation

- Cost of developing or deploying an automated solution

- Technical feasibility

Myth 1: Cash forecasting automation is not worth it unless it’s accurate

Some companies neglect automation in cash flow forecasts thinking that A/R can’t be forecasted since different customers have different payment patterns, and A/P can’t be forecasted because invoices get stuck at the approvals stage. However, an effective cash flow forecasting software is perfectly capable of capturing the customer payment trends, seasonality, and short-term and long-term debts, resulting in accurate cash forecasts.

However, it is important to have realistic expectations when it comes to generating results from automated software. A lot of users expect that once data is entered, the solution will generate accurate results from the get-go. In actuality, users must be aware that the solution will train itself over time to generate accurate results.

Myth 2: Cash forecasting automation needs to be managed by an IT department

This notion stems from the perception that anything regarding software is related to IT. However, cash flow forecasting has always been a top focus for treasury teams which is why it only makes sense that they choose software that meets their business needs.

Treasury teams are the best judges to choose which external systems the solution should integrate with such as ERPs, bank portals, TMS, and FP&A systems for easy data access – not IT. At the end of the day, who uses the software is who manages it. In some cases, IT might play a minor role in implementing the software, but they won’t decide what’s best for treasury teams.

Myth 3: Spreadsheets are better than cash forecasting automation software

Using spreadsheets for cash flow forecasting might save software license costs, but the cost-benefit analysis is low as it is completely manual and time-consuming.

In terms of integration with external financial systems, spreadsheets fall short. The finance/ treasury team needs to manually update the data from various sources and teams (Payroll, A/R, A/P, FP&A teams). Despite the painstaking process of uploading, aggregating, and updating data, the results are not accurate due to human errors. This affects the confidence of liquidity decisions. Automation, on the other hand, provides better results.

Myth 4: Cash Forecasting automation is hard to implement (takes too long, high learning curve, or is too expensive)

SaaS-based solutions don’t take long to implement. However, your input determines your output. Companies need to realize that if you dedicate some initial implementation time, the end result will be worth it. If you have an understanding as to what data you need to upload, then you don’t need a lot of IT intervention or technical resources. Once the system starts to function, it requires minimal human intervention. There is a subscription fee associated with SaaS-based solutions, but there are no additional costs for capacity expansion or ongoing operating expenses that are associated with on-premise solutions.

So what is the truth about cash forecasting automation software?

The following is what cash flow forecasting automation software CAN do:

1. In cash flow forecasting, leveraging automation for time-consuming tasks, such as data gathering, is beneficial. It helps free up employees’ workload and allows them to focus on strategic tasks.

Once fed with historical and recent financial data, an automated cash forecasting solution provides accurate short-term and long-term results. Complex categories such as A/R and A/P can be forecasted accurately using machine-learning models. It also helps increase the forecasting cadence so that treasurers can regularly track cash movements and make well-informed decisions.

2. Cash forecasting automation software doesn’t have to require IT involvement. It integrates easily with disparate financial systems, providing continuous data access to draw real-time insights.

3. Automation increases the accuracy of cash flow forecasts, reduces the turnaround time, and provides seamless integration. This allows CFOs to make timely and confident decisions.

4. Cash forecasting automation is not difficult to implement in treasury departments or train new employees onto the system.

When implementing cash forecasting automation software, keep the following in mind:

- The solution learns from data and evolves with time. The output is entirely dependent on the input- if the models are fed with quality data, the solution will generate accurate results.

- The solution can’t predict accurately with limited data inputs since it analyzes past results and makes adjustments based on those results.

- Cash forecasting automation generates accurate results with a higher forecast frequency.

There’s no time like the present

Get a Demo of Cash Forecasting Cloud for Your Business

The HighRadius™ Treasury Management Applications consist of AI-powered Cash Forecasting Cloud and Cash Management Cloud designed to support treasury teams from companies of all sizes and industries. Delivered as SaaS, our solutions seamlessly integrate with multiple systems including ERPs, TMS, accounting systems, and banks using sFTP or API. They help treasuries around the world achieve end-to-end automation in their forecasting and cash management processes to deliver accurate and insightful results with lesser manual effort.