3 Industry Experts Highlight Strategies for Deductions Management That Impact Revenue & Working Capital for CPG companies

What you’ll learn

- 2022 latest trends and challenges in handling payment deductions

- Best-in-class strategies to manage remote deductions management workforce

- Tips to improve transparency, reporting, and root-cause analytics.

Deductions expertsJessica Butler (Founder of Attain Consulting Group), Kim Zablocky (Founder at Retail Value Chain Federation), and Kimberly Erickson (CEO of Consultant at Optimize Receivables)spoke with HighRadius about the biggest deduction challenges that exist today for suppliers working with the big-box retailers of the world.

Today, CFOs are looking to achieve cash excellence, but revenue leakage emerges as a challenge. This blog is a summarized version of the interview. It contains their best practices for A/R leaders in the consumer packaged goods (CPG) industry to mitigate deduction related obstacles and optimize their cash flow.

Major Deductions Management Challenges for CPG A/R teams

#1 Inability to handle the rising volume of compliance issues: Experts highlighted that retailers today have become much better at identifying compliance issues on the supplier’s end and charging them for them.

According to Kim Zablocky, most big-box retailers today have sophisticated inbound audit solutions that allow them to track compliance violations from suppliers more accurately. As a result, while these retailers were able to go after only 80-85% compliance deductions back in the 2000s, they can now spot almost 95% of all compliance issues.

HighRadius also found that many retailers give suppliers less time to resolve a compliance dispute. In contrast, the number of compliance deductions has significantly gone up at the same time.

#2 Lack of documentation to quickly resolve post-audit claims: Retailers leverage post-audit deductions to recover money they might have left by failing to claim funds due to the freight charges, the policies of the trade agreement, or shortages. Most big-box retailers have internal teams and third-party agencies looking for post-audit opportunities.

Since they typically take more than a year to audit after the shipment is received, post audits can be challenging to research and validate because suppliers may not quickly find the information needed to support or dispute the claim. Therefore,suppliers must have a strategy to resolve post-audits proactively.

Four Best Practices from Experts To Fast-track Deductions Resolution Today

- Performing root-cause analysis to validate claims faster: Root-cause analysis can help suppliers identify underlying issues causing non-trade deductions. This way, they could take corrective actions proactively and reduce many preventable deductions. Doing it regularly and thoroughly can see small incremental improvements in their team’s approach to deductions management.

- Standardizing the policies to eliminate the operational silos:The communication gap between suppliers and retailers is often a primary cause of disputes.Kim Zablocky shares a typical example where a retailer sends a purchase order change after a supplier has already started working with the retailer’s original purchase order.

There are no limitations to the number of times a purchase order can be changed. This results in retailers changing it sometimes after the supplier has already shared the advanced shipment notice.

In such cases, the supplier can miss a POD change, ship the wrong quantities of the product, and be charged back for a shortage and an overage. To resolve issues like this, both parties must collaborate well and standardize their policies

- Promoting cross-team collaboration: Resolving disputes requires the concerned team to collect relevant backup documents and process them to identify the validity of disputes. But the majority of the team’s bandwidth most often gets spent on aggregating data due to the to-and-fro in the process.

A/R leaders should create an environment where their teams can collaborate with other finance functions like sales to collect necessary data faster and make more informed decisions.

- Communicating with peers in the industry for better insights:Reaching out to other suppliers who work with the same retailers over public forums will help the leaders gain more visibility over a customer’s payment history.

Across these forums, leaders can brainstorm collectively on the best strategies for managing deductions, share best practices and insights on what works for a particular big-box retailer vs. what doesn’t, and so much more. They can then share that intel with their teams to help them effectively identify the validity of the made by the customers.

Conclusion

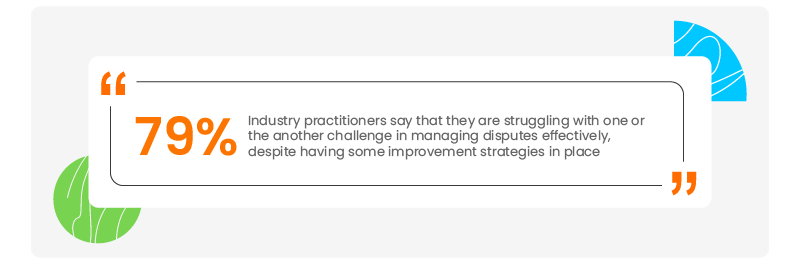

Deductions managementis a key priority for most CPG A/R leaders today. Over the past couple of years, finance executives have realized the real impact of poor deductions management on their bottom line.

The solution to these A/R related challenges for the long term must be automation. Kimberly, Jessica, and Kim have all agreed that digital transformation is instrumental in ensuring the deductions department’s success in the new economy.

HighRadius Deductions Software acts as a powerhouse for proactive deduction management to prevent bottom-line erosion. It provides automation, process standardization, and a platform for cross-departmental and customer collaboration. It supports deduction management by providing some key features like back-up document capture which captures deduction data from customers and supplies the information required for resolution; auto-capture proofs of delivery (PODs), bills of lading (BOLs) from carrier portals & emails; structured deduction resolution, collaboration & approval workflows to streamline the communication and approval process; along with automatic deduction correspondence, and automatic data push to customer portals. The result is a proactive deduction management operation that recovers revenue normally lost to invalid deductions.