How to leverage treasury cloud for improving growth within an organization?

What you’ll learn

- Learn the difference between manual and automated cash forecasting.

- Learn the key benefits of cash forecasting automation.

- Learn how automated cash flow software helps in better budget allocation and detecting cash shortages proactively.

Manual cash forecasting vs. automated cash forecasting

Treasury has been prioritizing cash flow forecasting for more than a decade. It’s also an area where the treasury department spends a lot of time. To stay on top of cash flow fluctuations, organizations must use automation and Artificial Intelligence to improve cash forecasting accuracy. RPA helps in automating repetitive and manual processes with precision and speed. On top of that, Artificial Intelligence minimizes the variance between forecast and actuals by analyzing historical data.

How do you automate cash flow forecasting?

These are the best practices to automate cash flow forecasting:

- Make a list of the resources needed to develop the corporate treasury software solutions.

- Allocate the work among the team members after compiling a list of all the requirements.

- Specify blackout days when some or all team members will be unavailable.

- Pick a team, analyze the metrics, and allocate work before transferring the project to production.

- Check whether the project is heading on the right path

How does automating your cash flows aid growth in your company?

A 2021 survey of treasurers by EACT cited cash flow forecasting as their topmost priority (63%), followed by the digital transformation of treasury (43%), managing risks for FX, interest rates, and Libor (33%).

Markets around the world continue to be volatile, and accounting for sudden uncertainties has become the norm. Today, the priorities for CFOs and treasurers have shifted towards:

- Transparency, control & visibility

- Data integrity

- Real-time access to data

- Audit / compliance

- Adoption of new technologies to enhance and optimize the overall operations

To keep up with the times and become strategic advisors in the business, treasurers should embrace corporate treasury software. A suitable cash flow software enables company growth due to the following reasons:

-

Automates time-intensive and error-prone processes

A system with poor integration reduces visibility into cash position and future cash flows. Corporate treasury software solutions help in streamlining the treasury process by reducing the administrative burden and helping to focus on strategic tasks such as liquidity and risk management. This helps boost team efficiency and productivity.

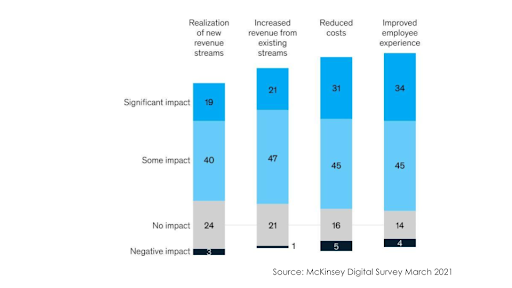

A recent survey by Mckinsey addresses how corporate treasury software contributes to a company’s growth:

What are the benefits of cash forecasting automation?

- High granular visibility: Cloud treasury management and automated data collection results in timely data access and granular visibility.

- Accurate modeling: Accurate modeling for complex cash flow categories such as A/R and A/P results in less unpredictability.

- Ease in identifying variance drivers: Improved accuracy and frequency of variance analysis helps treasurers identify the sources of variance, and make adjustments to build more accurate cash forecasts.

- Automated reporting: Data-driven reports can be sent out to the CFOs in a timely manner. This helps CFOs make confident decisions on borrowing, investments, M&A, and repatriation.

-

Better data leads to better budget allocation

Treasury cloud provides accurate insights into a company’s future financial health and helps companies budget wisely.

Timely and accurate data are critical for confident financial planning and budgeting. However, obtaining data can be challenging. Firms frequently rely on antiquated systems that fail to offer reliable information. With the help of treasury cloud, firms can generate reliable reports and make better decisions around liquidity and funding.

What are the benefits of accurate budgeting?

- Instills confidence in investors by staying prepared for unforeseen occurrences that could affect revenue and budget.

- Establishes better understanding and control over different internal and external factors that can have both short and long-term consequences.

- Notifies corporate leaders proactively of any unexpected event that could have a negative influence on their business performance.

-

Enables treasury teams to detect liquidity shortages in advance

Corporate treasury software helps treasury prevent cash crunches as it helps businesses to:

- Recognize and prepare for liquidity crisis: Cash forecasting provides the company the foresight to take remedial action. Additionally, companies will be able to predict future cash gaps and minimize missing payments if they have a precise cash forecast.

- Allocate surplus cash: Cloud treasury management can assist in identifying prospective surpluses and allows cash managers to properly allocate excess funds. This helps companies to invest or use the extra cash to achieve a competitive advantage.

- Run scenario analysis: Scenario planning aids companies in capturing ‘what-if’ possibilities and developing business strategies to avoid losses.

- Prevent FX risks: It helps manage and limit the risk associated with foreign exchange. By using cash forecasting software, the treasury department can anticipate cash demands and reduce FX losses.

- Minimize debts: It allows the treasury and finance teams to safely redeploy any current or future available liquidity to reduce outstanding debts or interest.

Schedule a demo to learn more about how cash flow automation helps treasury maximize growth.

The HighRadius™ Treasury Management Applications consist of AI-powered Cash Forecasting Cloud and Cash Management Cloud designed to support treasury teams from companies of all sizes and industries. Delivered as SaaS, our solutions seamlessly integrate with multiple systems including ERPs, TMS, accounting systems, and banks using sFTP or API. They help treasuries around the world achieve end-to-end automation in their forecasting and cash management processes to deliver accurate and insightful results with lesser manual effort.