To generate revenue and ensure smooth business operations, companies own multiple assets, both tangible and intangible. For example, a corporate business would have to own or rent an office space for employees to work at. Similarly, a cake delivery company would need to own a delivery van to deliver goods to its customers for revenue generation.

Assets such as office spaces and company-owned vehicles are subject to depreciation as their value decreases over time. To accurately ascertain asset value over time in order to ensure precise financial overview, businesses need to determine the net book value (NBV) of the asset at the beginning of every accounting period.

In this blog, we are going to understand what NBV is, why it’s important, how to calculate it and how an automated record to report software helps in accurate accounting.

Net book value is an accounting principle used to calculate the current value of fixed assets by adjusting their original value for depreciation, depletion, or amortization. NBV helps record the correct value of an asset on the balance sheet, which ensures accurate financial reporting.

NBV is an important accounting practice as it helps businesses get an accurate assessment of their fixed assets value and provides a snapshot of their current financial position. Correctly calculating NBV is crucial for businesses for making informed financial decisions.

Companies automating accounting see 90% fewer errors and stronger ROI.

Stop risking inaccurate asset valuations.

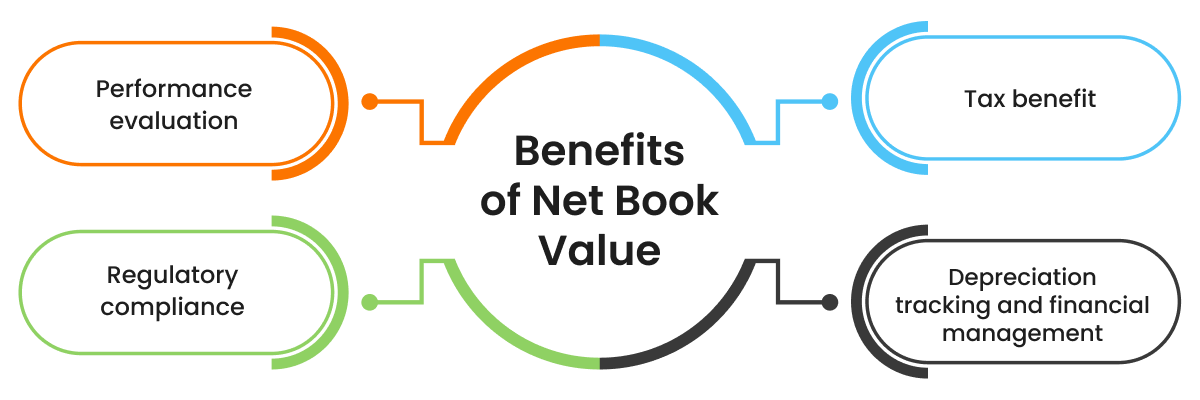

NBV is an important factor for organizations to consider due to multiple reasons, including accurate financial reporting, enhancing accounting process efficiency, and strategic decision-making.

Here are the key aspects that make NBV critical for businesses:

To calculate the net book value of a fixed asset, the accumulated depreciation value is subtracted from the historical value of the asset. The historical value is the original purchase cost of the asset.

NBV formula:

Net book value = Original asset value – accumulated depreciation

Now that we’ve understood what net book value is and its formula, let’s see how to calculate NBV.

Here are the steps to calculate NBV:

Let’s consider an ABC company that bought an asset for $12000 on January 1, 2024. If the organization uses the straight-line depreciation method, where the value of the asset depreciates evenly each year, after 3 years the accumulated depreciation value will be $3000.

Here’s how the net book value of the asset will be calculated in this scenario:

$12000 (the original value of the asset) – $3000 (the accumulated depreciation value) = $9000

There are multiple factors that reduce the net book value of an asset throughout its life cycle. Let’s take a look at the same:

As we discussed in the previous section, depreciation systematically reduces the net book value of an asset over its useful life. Depreciation recognizes the fact that an asset will lose its value over time due to its usage, resulting in wear and tear.

For instance, if a company buys a delivery van, it will be much more useful in the initial years of purchase than, say, after 5 years. Depreciation recognizes the same and prevents companies from recording the initial purchase price of the asset on the balance sheet.

To depreciate assets, the company and the asset need to meet specific criteria as directed by GAAP, or International Financial Reporting Standards (IFRS).

Broadly speaking, an asset can be depreciated if the following conditions are met:

Now let’s take a look at a few assets that can and cannot be depreciated.

Depreciable assets:

Non-depreciable assets:

The calculation of NBV depends on the depreciation method used. There are various depreciation methods; however, the following are the most commonly used:

Straight-line depreciation is the simplest way to calculate depreciation and reduces NBV consistently throughout the useful life of the asset. Formula: (Cost – Salvage value)/Useful life

While calculating depreciation through the double declining method, the assets depreciate faster in the earlier years By front-loading the depreciation expense, businesses can better match the expense with the revenue generated by the asset. Here a constant rate is applied at the beginning of the accounting period to determine the book value of the asset.Formula: 2 x (1/Useful life of asset) x Book value at the beginning of the year

To calculate depreciation through the units of production method, you need to determine the number of units the asset is capable of producing and the life of the asset in units in addition to its cost and salvage value. Here depreciation is based on the actual usage or output of the product and it’s not dependent on time. Formula: (Number of units produced / Total units the asset is expected to produce) x (Cost of asset – Scrap value of asset)

For this depreciation method, higher depreciation expense is assigned to assets in its earlier years. With time the depreciation expense gradually decreases. Formula: (Remaining life of the asset / Sum of the years’ digits) x (Cost of asset – Scrap value of asset)

HighRadius offers a cloud-based Record to Report software that helps accounting professionals streamline and automate the financial close process for businesses. We have helped accounting teams from around the globe with month-end closing, reconciliations, journal entry management, intercompany accounting, and financial reporting.

Our Financial Close Software is designed to create detailed month-end close plans with specific close tasks that can be assigned to various accounting professionals, reducing the month-end close time by 30%.The workspace is connected and allows users to assign and track tasks for each close task category for input, review, and approval with the stakeholders. It allows users to extract and ingest data automatically, and use formulas on the data to process and transform it.

Our Account Reconciliation Software provides an out-of-the-box formula set that can configure matching rules and match line-level transactions from multiple data sources and create templates to automate various transaction processing required for month-end close. Our solution has the ability to prepare and post journal entries, which will be automatically posted into the ERP, automating 70% of your account reconciliation process.

Our AI-powered Anomaly Management Software helps accounting professionals identify and rectify potential ‘Errors and Omissions’ throughout the financial period so that teams can avoid the month-end rush. The AI algorithm continuously learns through a feedback loop which, in turn, reduces false anomalies. We empower accounting teams to work more efficiently, accurately, and collaboratively, enabling them to add greater value to their organizations’ accounting processes.

NBV, or net book value, is a practice that helps businesses know the current value of their fixed assets. The accounting practice is used to calculate the carrying value of an asset. Net book value adjusts the original cost of the asset by taking into account its depreciable value.

Net book value is calculated by subtracting the accumulated depreciation value by the historical cost, i.e., the original purchase price, of the asset. This is done because physical assets lose their value over time, so companies need to adjust the original purchase value every year to show the assets’ depreciation over time.

Net book value is also referred to as ‘carrying value’ or ‘carrying amount’. The terms are used interchangeably in the accounting industry and reflect the remaining value an asset has after its use in the previous accounting period. NBV is important to accurately calculate depreciation of assets.

Net book value is a crucial accounting practice as it helps companies determine how valuable an asset is after its use over the previous accounting period. NBV calculations help companies evaluate the condition of their assets, adhere to accounting standards, track depreciation, and make better financial decisions.

The net book value is reported on the balance sheet as it helps determine the value of fixed assets at a given point in time. Since the balance sheet reports about a company’s assets, liabilities, and equity, NBV automatically becomes a part of the balance sheet.

No, net book value is not the same as fair market value. The former is used for a company’s accounting processes, while the latter is the current value of an asset as per the market conditions. Fair market value is impacted by market changes and supply & demand changes.

Positioned highest for Ability to Execute and furthest for Completeness of Vision for the third year in a row. Gartner says, “Leaders execute well against their current vision and are well positioned for tomorrow”

Explore why HighRadius has been a Digital World Class Vendor for order-to-cash automation software – two years in a row.

For the second consecutive year, HighRadius stands out as an IDC MarketScape Leader for AR Automation Software, serving both large and midsized businesses. The IDC report highlights HighRadius’ integration of machine learning across its AR products, enhancing payment matching, credit management, and cash forecasting capabilities.

In the AR Invoice Automation Landscape Report, Q1 2023, Forrester acknowledges HighRadius’ significant contribution to the industry, particularly for large enterprises in North America and EMEA, reinforcing its position as the sole vendor that comprehensively meets the complex needs of this segment.

Customers globally

Implementations

Transactions annually

Patents/ Pending

Continents

Explore our products through self-guided interactive demos

Visit the Demo Center