Outsourcing to Captive Centers – An Integrated Order to Cash Function is The Key to Standardize GBS

Insights from the SSON Report: State of Order to Cash in Shared Services

Introduction

SSON released the State of Order to Cash (O2C) for Shared Services survey report in 2022, where they captured the responses of 70+ Global Business Services (GBS) leaders and identified a “Big Shift” taking place in the operational models across the O2C process in Shared Services.

The report highlights how leaders plan to shift from outsourcing critical O2C operations to more captive centers in 2022 due to the varying trends across Shared Service Organizations (SSOs) like inefficient working capital optimization, operating expenses (OPEX) management, and poor customer experience. The SSON study also concluded that GBS/SSO leaders must prioritize building an integrated O2C function to make this big shift across all global operations.

This blog elaborates on the top trends observed across GBS outsourcing models as per the report and how GBS/SSO leaders can integrate the O2C processes with advanced technology capabilities to complement these trends and seamlessly transition to captive centers.

Non-Integrated GBS Functions Operate in Silos

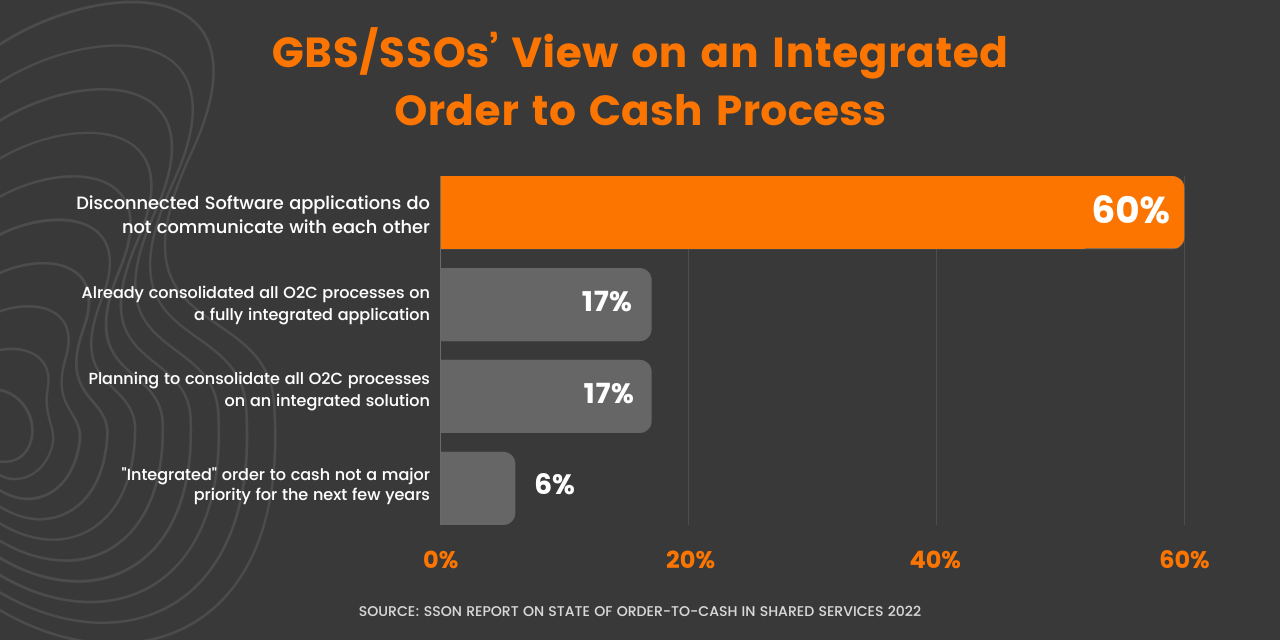

According to the SSON report, 60% of GBS/SSO leaders see a lot of value in integrated O2C solutions. Their challenge is that the software applications they use for various O2C processes do not communicate sufficiently with each other. These process silos emerge from the lack of information flow and collaboration across internal teams like sales and credit and create a poor experience for the diverse customer base.

Here are three ways integrated O2C function can eliminate operational silos:

- Leveraging Intelligent Technology Capabilities

According to Gartner, Artificial Intelligence (AI) in integrated O2C applications will automate over 50% of business decision-making within the O2C process by 2023. On top of that, digital assistants based on Natural Language Processing (NLP) capabilities in the B2B enterprise world are slowly evolving to provide similar insightful experiences for O2C teams by analyzing the end user’s intent.Leveraging the strengths of AI-powered automation and NLP-powered Digital Assistants will help GBS/SSO leaders to allocate the O2C team’s bandwidth to perform decision-making tasks like extending credit limits, and devising cash discount programs to collect faster by aggregating and processing the huge volume of finance transactional data.

- Providing 360-Degree Visibility and Access to Global A/R Data

An integrated O2C solution enables GBS teams to access global A/R data and fast-track the processes like dispute/deductions resolution, blocked order release, and cash application. GBS/SSO leaders will also have visibility across all the global processes for evaluating process efficiency and team productivity. This will help them to make more informed decisions on whether to continue operations for a particular business unit. - Ensuring Easier Maintenance, Faster Upgradation

With the data across all the GBS functions, it is easier to maintain and upgrade the technology stack seamlessly without hindering business continuity. For instance – implementing an integrated cash application module can be accomplished in as little as four weeks, whereas upgrading ERP from one version to another can take up to several months.

Robotic Process Automation (RPA) is Good for Short-term

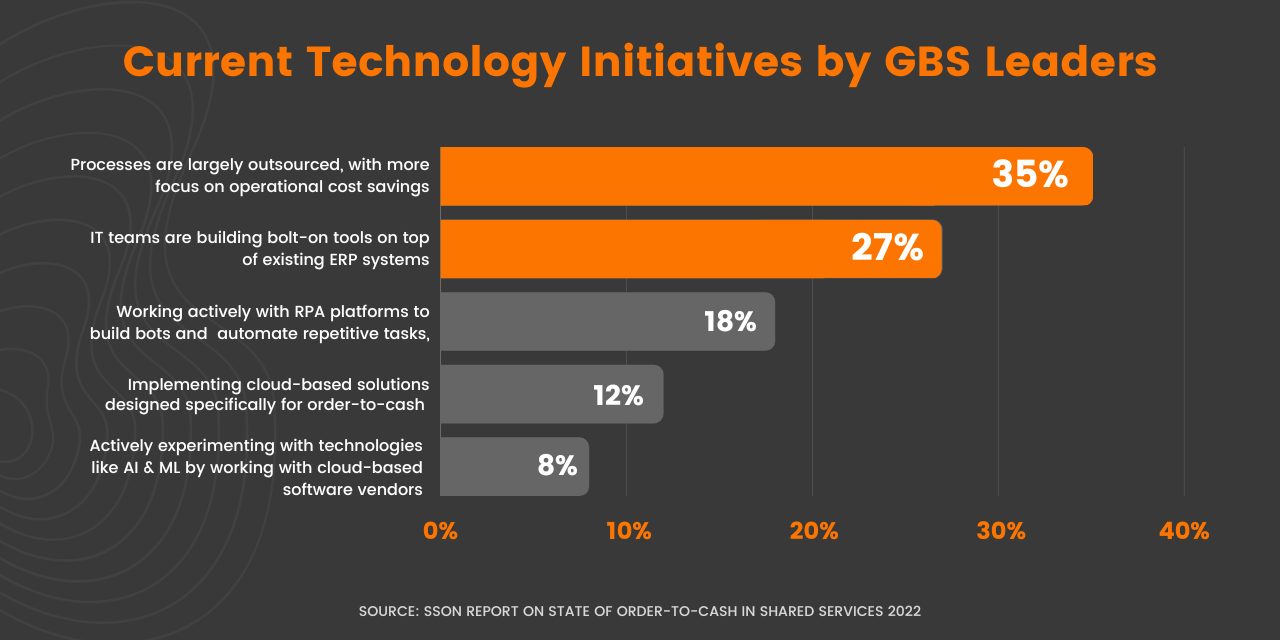

When asked about the current technology initiatives, 35% of GBS/SSO leaders claimed they are outsourcing O2C processes with an added focus on reducing Operating Expenses (OPEX). Only 18% stated they are actively working with RPA platforms to automate repetitive and manual tasks.

Most O2C processes requires a high degree of human intervention. Shared Service Organizations remain manual in extracting credit data from multiple credit bureaus, tracking invoice payment details on customer portals, and closing the open invoices by matching them with the corresponding payments. Automating these low-impact manual processes is the first step to transforming the O2C function.

While RPA might be a good starting point for automating processes, it is limited in its capabilities to drive scalable results. Deploying RPA for business operations is suitable for the short term and has a high maintenance cost as organizations need to upgrade the RPA bots based on changing business requirements.

As a result, GBS/SSO leaders must focus on application software with RPA capabilities available as out-of-the-box offerings – that means the internal IT teams don’t have to invest their bandwidth in managing the RPA bots.

GBS Teams Are Not Leveraging AI Capabilities

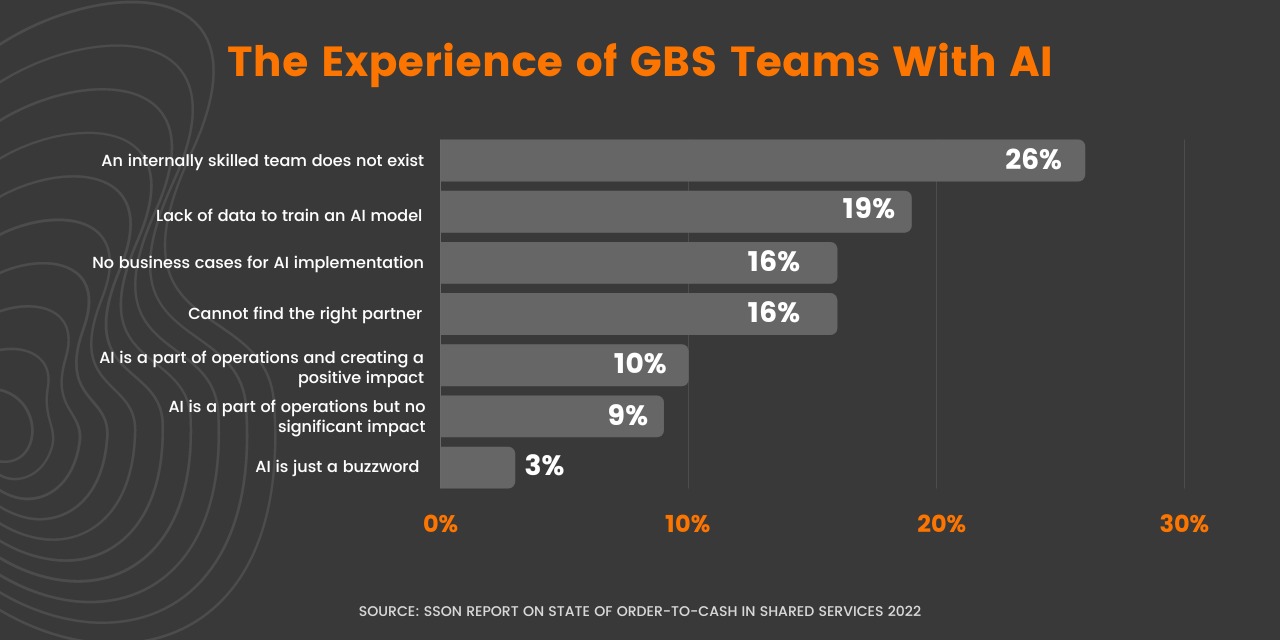

26% of leaders in the report claimed they lack the in-house skills to implement AI solutions, while 16% stated they don’t have significant business use cases to implement AI.

To leverage AI capabilities for driving real-world business use cases, it is imperative to ensure the IT team’s technical expertise and the finance team’s subject matter expertise are leveraged.

This will help build more robust AI and Machine Learning (ML) models that can learn from financial transaction data and analyze customer payment trends to share recommendations and predictions for improving decision-making quality.

Conclusion

The SSON survey report on the State of O2C in Shared Services denotes a significant decline in the O2C process performance levels across GBS organizations and the lack of technology adoption. GBS/SSO cannot overcome challenges like inefficient working capital optimization, OPEX management, and poor customer experience by simply shifting their O2C processes from outsourcing to captive centers.

They must prioritize investments across integrated solutions to eliminate O2C silos across O2C processes and improve process efficiency and cash flow. GBS/SSO leaders need to take it upon themselves to drive digital transformation across their operations with advanced technology capabilities like AI and RPA.

There's no time like the present

Get a Demo of Integrated Receivables Platform for Your Business

Request a Demo

HighRadius Integrated Receivables Software Platform is the world's only end-to-end accounts receivable software platform to lower DSO and bad-debt, automate cash posting, speed-up collections, and dispute resolution, and improve team productivity. It leverages RivanaTM Artificial Intelligence for Accounts Receivable to convert receivables faster and more effectively by using machine learning for accurate decision making across both credit and receivable processes and also enables suppliers to digitally connect with buyers via the radiusOneTM network, closing the loop from the supplier accounts receivable process to the buyer accounts payable process. Integrated Receivables have been divided into 6 distinct applications: Credit Software, EIPP Software, Cash Application Software, Deductions Software, Collections Software, and ERP Payment Gateway - covering the entire gamut of credit-to-cash.