Strong supplier relationships start with a smooth onboarding process. Before any invoice is paid or product delivered, businesses need to collect the right information, verify documents, and ensure compliance, all while keeping things efficient and consistent.

But for many teams, supplier onboarding still means endless emails, missing forms, and time-consuming manual work.

In this blog, we’ll walk you through what supplier onboarding involves, how to streamline each step, and what best practices can help you avoid delays or compliance gaps.

Supplier onboarding is the process of collecting, verifying, and approving a new supplier’s information before they can start doing business with your company. It includes gathering legal documents, setting payment terms, and entering the supplier into your accounting or procurement system.

For example, if your finance team decides to work with a new IT services vendor, they’ll need to collect the vendor’s W-9 form, agree on payment terms (like net-30), and add them to your accounts payable system before any invoices can be processed.

When done manually, this process often leads to back-and-forth emails, missing documents, and setup delays. That’s why many teams turn to supplier onboarding software to streamline supplier onboarding, improve accuracy, and reduce onboarding time.

A well-structured supplier onboarding process ensures data accuracy, protects against compliance risks, and creates a smooth starting point for long-term vendor relationships.

A well-planned supplier onboarding process is more than a checklist of tasks. It plays a strategic role in strengthening vendor relationships, reducing compliance risks, and laying the foundation for efficient accounts payable operations.

When supplier onboarding is treated as a strategic priority, businesses gain better control over vendor data, improve internal collaboration, and reduce time-to-pay. It also helps companies scale their operations without introducing unnecessary risk or manual overhead.

A strategic onboarding approach ensures that:

1. All supplier data is accurate and verified before transactions begin

2. Internal teams follow a consistent process across departments

3. Compliance requirements are met from the start, reducing audit and fraud risks

4. Suppliers experience a smooth entry point, improving long-term collaboration

Organizations that invest in building a strong supplier onboarding process often see improvements in operational efficiency, data transparency, and supplier satisfaction, all of which support broader accounts payable goals.

Supplier onboarding and supplier performance management are closely connected but serve different purposes within the procurement and finance cycle.

Supplier onboarding is about getting new vendors set up in your system. It focuses on collecting business information, verifying compliance documents, and ensuring payment terms are in place before any transactions begin.

Supplier performance management, on the other hand, happens after onboarding. It involves tracking the supplier’s ongoing performance, like delivery timelines, invoice accuracy, service quality, and responsiveness.

Here’s a simple comparison:

| Aspect | Supplier Onboarding | Supplier Performance Management |

| Purpose | Set up new vendors | Monitor ongoing vendor performance |

| Timing | Before transactions begin | After onboarding is complete |

| Key Activities | Collect documentation, verify data, set payment terms | Track KPIs, review delivery timelines, evaluate quality |

| Goal | Ensure vendor readiness and compliance | Improve supplier reliability and outcomes |

Both are essential. Onboarding ensures you start the relationship on the right foot, while performance management helps maintain and improve it over time.

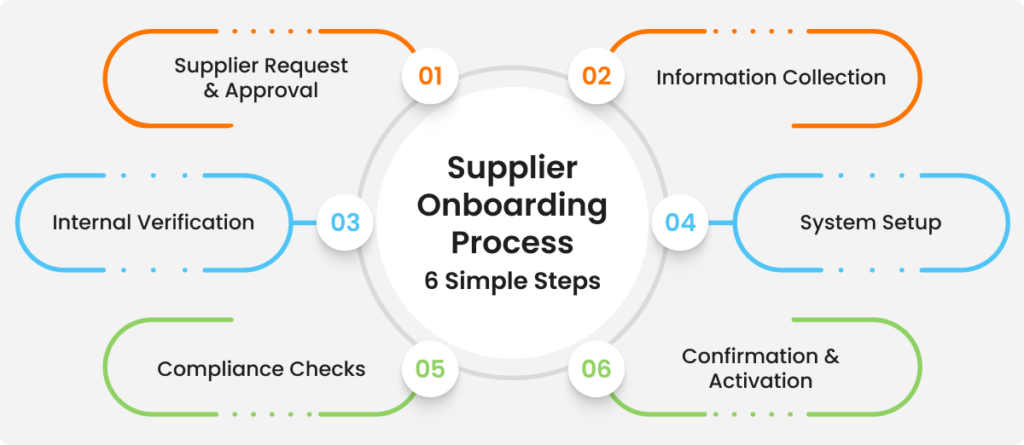

A well-structured supplier onboarding process ensures vendors are set up correctly from day one, reducing delays, compliance risks, and payment errors. Here’s how the process typically works:

It starts when a department requests to work with a new supplier. The finance or procurement team reviews and approves the need for onboarding.

Once approved, the supplier is asked to submit the required documents such as:

The submitted documents are reviewed for accuracy and completeness. Any missing or mismatched information is flagged and sent back to the supplier for correction.

Once verified, the supplier is added to your ERP or accounts payable system with their tax ID, payment terms, contact details, and banking information. A clean, structured setup at this stage sets the foundation for more accurate accounts payable reporting down the line.

Additional checks, like blacklist screening, data validation, or risk scoring, may be performed to meet internal controls or regulatory standards.

The supplier is notified once the setup is complete. From here, they’re eligible to receive purchase orders, deliver goods or services, and submit invoices.

This flow helps ensure new suppliers are onboarded quickly, correctly, and with minimal back-and-forth, laying the foundation for a smooth accounts payable process.

While supplier onboarding seems straightforward, many finance and procurement teams face bottlenecks that slow the process or create long-term issues. Here are some of the most common challenges:

When supplier information is collected via emails or spreadsheets, it often leads to missing documents, inconsistent formats, or delays in processing.

Without a clear process or checklist, each team may onboard suppliers differently—leading to errors, duplication, or missed steps in compliance..

Approvals and document checks often get stuck in email chains or require multiple follow-ups, extending the onboarding timeline.

Finance, procurement, and compliance teams often operate in silos, making it hard to track onboarding status or spot bottlenecks early.

Incomplete or outdated documentation increases the risk of payment errors, audit failures, or working with non-compliant suppliers.

Even after documents are approved, getting the supplier into the system can take days or weeks due to IT backlogs or manual entry.

Recognizing these challenges is the first step toward fixing them. Let’s explore how to build a supplier onboarding process that’s smooth, consistent, and scalable.

Building an effective supplier onboarding process starts with simplifying the workflow, reducing manual steps, and ensuring alignment across internal teams, including finance, procurement, and compliance.

Here’s how to make the process work better from day one:

Create a clear, step-by-step supplier onboarding checklist that outlines all required documents and approvals. This promotes consistency and helps prevent errors during setup.

Rather than relying on email chains, set up a shared portal or onboarding form where suppliers can submit documents in one place. This approach improves data accuracy and speeds up the supplier onboarding process.

Assign specific responsibilities for each stage of the onboarding process. Procurement can manage initial supplier vetting, finance can review payment terms, and compliance can handle risk assessments and documentation reviews.

Use automation tools that handle document collection, data verification, and ERP integration. This reduces manual work and ensures a smoother supplier onboarding process flow.

Use onboarding dashboards or trackers to monitor each supplier’s status. Visibility adds accountability and helps identify bottlenecks before they slow down the process.

Getting supplier onboarding right the first time can prevent downstream issues like payment delays, compliance gaps, and strained vendor relationships. Here are some best practices that can help finance and procurement teams streamline the process:

Define what documents and details are needed from every supplier, such as tax forms, payment terms, bank details, and compliance certificates. A consistent checklist keeps the process structured and audit-ready.

Before collecting documents, assess whether the supplier meets your business needs and compliance standards. This avoids wasting time onboarding vendors who aren’t a good fit.

Use shared portals or onboarding tools to keep all onboarding communication in one place. This reduces email threads, improves visibility, and helps suppliers know exactly what’s expected.

Involve finance, procurement, and legal or compliance teams early. Clear role definitions avoid duplicate work and help maintain process integrity.

Monitor the supplier onboarding process flow through status trackers or dashboards. This helps spot delays early and provides transparency to all stakeholders.

Your suppliers are your partners. A smooth onboarding experience builds trust and encourages long-term cooperation. Avoid overly complex steps or unclear requirements.

Following these supplier onboarding best practices helps reduce friction, speed up approval times, and create a process that benefits both your business and your suppliers. Teams that integrate these steps with automation also unlock long-term gains tied to the benefits of AP automation.

Manual supplier onboarding often involves scattered emails, inconsistent data entry, and long approval cycles. Automation helps eliminate these roadblocks by creating a streamlined, self-service process that saves time and reduces risk.

With supplier onboarding automation, vendors can submit their information through a centralized portal. The system automatically validates tax IDs, checks for duplicate entries, and routes documents to the right stakeholders for approval. No more chasing down forms or manually updating spreadsheets.

Here’s what an automated supplier onboarding process typically includes:

1. Self-service registration: Suppliers fill out forms and upload required documents in a secure portal.

2. Auto-validation: The system verifies tax information, bank details, and compliance documents in real time.

3. Workflow routing: Tasks are automatically assigned to the right teams, procurement, finance, or compliance, based on predefined rules.

4. ERP integration: Once approved, supplier data is synced directly into your ERP or AP system, avoiding duplicate data entry.

5. Real-time status tracking: Dashboards show the onboarding status of each supplier, making it easy to identify delays or incomplete steps.

By automating the supplier onboarding process, companies can reduce onboarding time from weeks to days, improve accuracy, and ensure a more professional experience for their vendors. Many teams use purpose-built supplier onboarding software to manage the entire process more efficiently.

HighRadius offers a purpose-built supplier onboarding software as part of its Accounts Payable Automation suite. It helps finance and procurement teams streamline the onboarding process, reduce manual effort, and shorten turnaround time, all while maintaining compliance and control.

Here’s how HighRadius supports supplier onboarding:

Vendors can securely submit tax forms, bank details, and compliance documents through a single portal. This removes the need for email follow-ups or scattered spreadsheets.

The system checks for completeness, duplicate entries, and formatting errors automatically. This reduces manual reviews and speeds up approvals.

Onboarding requests are routed to the correct internal teams based on your company’s rules and process flow.

Once approved, supplier data is pushed directly into your AP or ERP system. This improves accuracy and eliminates rework.

You gain full visibility into your supplier onboarding process. This makes it easy to track progress, spot delays, and keep things moving.

With HighRadius, companies can improve onboarding speed, reduce errors, and create a more professional and consistent experience for suppliers, setting the stage for long-term success.

Supplier onboarding is the process of collecting, validating, and approving vendor information before beginning transactions. It ensures that suppliers are properly set up in your ERP or accounts payable system to meet compliance, payment, and documentation requirements.

To onboard new suppliers, collect tax forms, payment details, and compliance documents. After verifying the information, set them up in your system and assign internal approvals. A consistent supplier onboarding process ensures accuracy and faster collaboration.

Manual supplier onboarding may take several days or weeks due to back-and-forth communication. Using supplier onboarding software speeds up the process significantly by automating verification and approvals, often completing onboarding within hours.

Costs depend on whether your process is manual or automated. Manual onboarding requires more staff time and increases risk. Automated supplier onboarding reduces delays, improves accuracy, and lowers administrative costs by streamlining the entire workflow.

A supplier onboarding checklist includes business registration, tax forms, banking details, compliance documentation, and internal approvals. It ensures a structured, repeatable process for setting up new vendors and reduces the risk of errors or incomplete data.

Positioned highest for Ability to Execute and furthest for Completeness of Vision for the third year in a row. Gartner says, “Leaders execute well against their current vision and are well positioned for tomorrow”

Explore why HighRadius has been a Digital World Class Vendor for order-to-cash automation software – two years in a row.

HighRadius stands out as an IDC MarketScape Leader for AR Automation Software, serving both large and midsized businesses. The IDC report highlights HighRadius’ integration of machine learning across its AR products, enhancing payment matching, credit management, and cash forecasting capabilities.

Forrester acknowledges HighRadius’ significant contribution to the industry, particularly for large enterprises in North America and EMEA, reinforcing its position as the sole vendor that comprehensively meets the complex needs of this segment.

Customers globally

Implementations

Transactions annually

Patents/ Pending

Continents

Explore our products through self-guided interactive demos

Visit the Demo Center