Drive working capital impact with credit and sales collaboration

What you’ll learn

- Discover key strategies to improve Sales & Credit collaboration

- Get insights on how faster customer onboarding and credit decisions can improve customer relationships

- How real-time access to credit data can fasttrack customer onboarding

The credit and sales team of a company can frequently end up working in isolation with one another. On one side the sales team is working towards obtaining maximum business orders, on the other side, the credit team is tasked with balancing credit exposures by applying certain credit-based rules to avoid bad-debt write-offs. Now, it is essential for an organization to utilize the potential of a collaborative sales and credit approach to generate revenue in this turbulent economy.

This blog specifically talks about the collaboration that is required between the credit and sales teams along with the best practices that can help companies to deliver working capital impact.

An Uncooperative A/R Space = A Tug Of War

Sales and credit teams have always been on the same page when it comes to acquiring new business opportunities.

The main attention of the sales team goes into closing a deal quickly without considering the risk factors related to a customer’s credit exposures. As a result, the sales team becomes disappointed when the credit team puts an order on hold while evaluating customer credit health. However, from a different perspective, the credit team is concerned with extending credit in accordance with the company’s credit policy and lowering risks so that any chances of loss or bad debts are eliminated.

Quite naturally due to this mismatch of responsibilities and the existing communication gap, customer relationships are often negatively impacted and a lot of effort put in from either of the teams is wasted.

Need for Common Ground- The Peacemaker

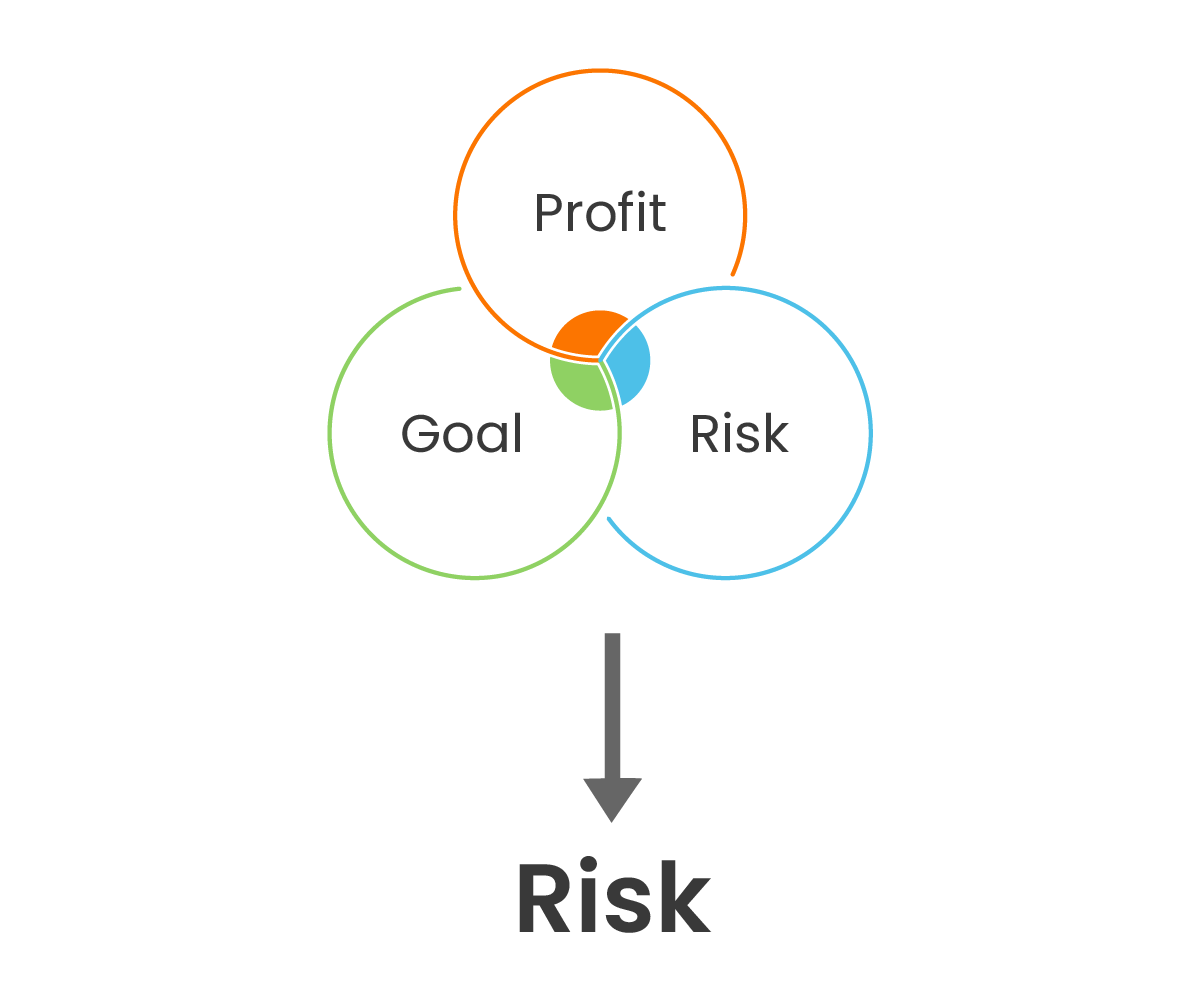

In spite of the different roles of sales and credit teams, they aim to achieve the same target, which is increased revenue and reduced risk. The biggest question arising here is: Will the sales and credit team coexist side-by-side?

It is important for both teams to understand that their efforts are of immense benefit when they work collaboratively. The first step to achieve this is to establish clear communication between the two teams. If each team has a good understanding of the various roles that the counterpart plays, then inter-team collaboration becomes a lot easier, which eventually leads to a win-win situation for both teams. This will improve the customer relationship and help both teams to onboard new as well as the existing customers faster.

On the whole, an alliance between the two teams can be considered as a necessary factor for achieving their common goal of revenue increment and risk reduction.

The Sales And Credit Team Union

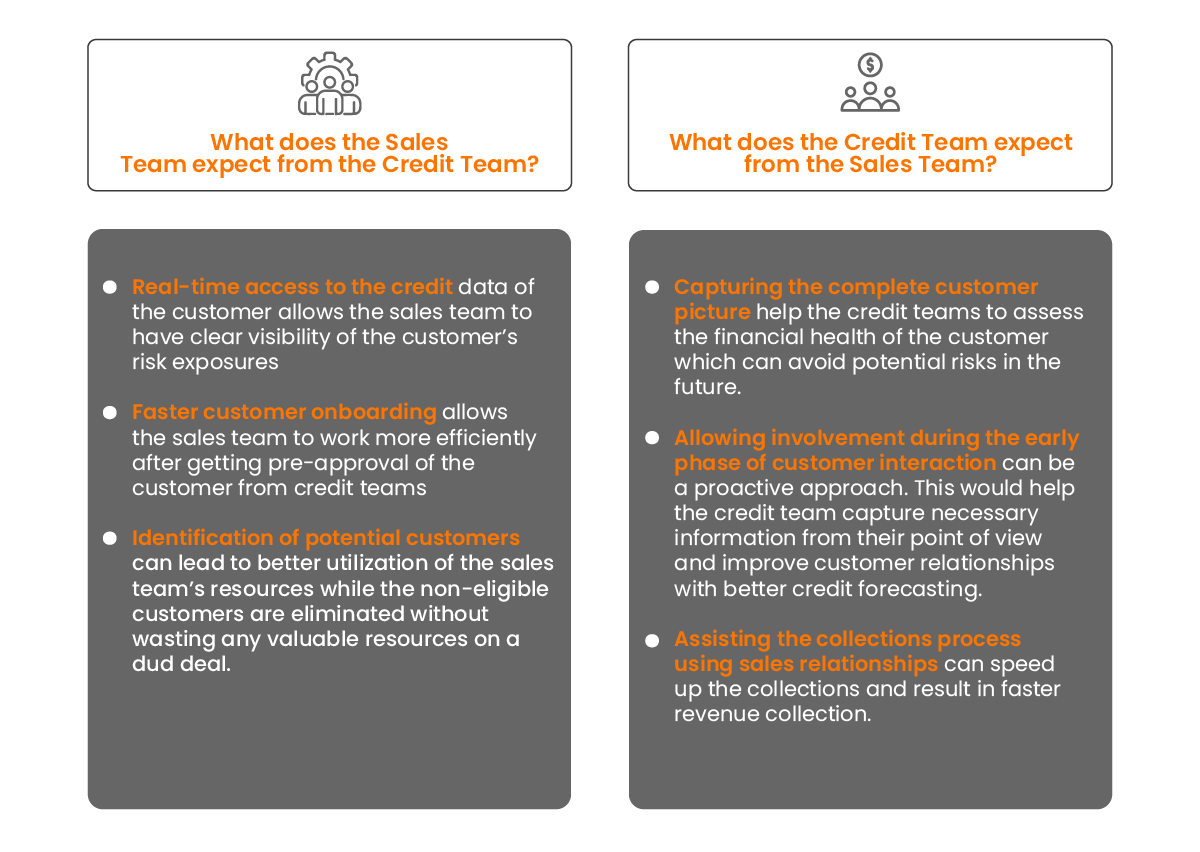

For a successful partnership between credit and sales, there needs to be a thorough understanding of the expectations of both teams from each other. For a business to grow as a whole, the expectations need to be fulfilled and communicated better among them.

At the end of the day, sales and credit cannot function without each other. The collaboration of the two is a sign of successful trade and helps to achieve the objectives of boosting revenue and risk mitigation.

How Technology Can Bridge the Gap Between Sales and Credit Teams?

Technology is the magic of the modern world. And one of the many magic tricks is automation. Technology enables online credit applications for capturing valid information while automation supports real-time credit decisions which will be very beneficial for the sales team to analyze the potential credit health of the customer and will lead to instantaneous credit approval. Automation can truly lift the weight of an uncooperative environment and kickstart the combined effort of the sales and credit teams to achieve a common goal.

Proper use of technology can help your company to achieve:

- Automated credit scoring for low-risk customers.

- Access to a single data repository.

- Integrated order management & credit solution.

More Revenue+Reduced Risk

Conclusion

The credit team and sales team collaboration will reduce manual efforts and any company could generate more revenue and optimize bad debts. By understanding the risk and profitability, credit and sales teams can expand their collaborative network beyond different segmentations to drive the best-in-class customer services.

HighRadius Credit Software automates the credit management process, enabling credit managers to make highly-accurate credit decisions 2X faster and enable faster customer onboarding with 4 primary components: configurable online credit application, customizable credit scoring engines, credit agency data aggregation engine, and collaborative credit management workflow. Along with that, there are a lot of key features that should definitely be explored some of which are online credit application, credit information aggregation, automated credit scoring & risk assessment, credit management workflows, approval workflows, and automated bank & trade reference checks. The result is faster customer onboarding, better internal collaboration, higher customer satisfaction, more targeted periodic reviews, and lower credit risk across the company’s customer portfolio.