21 Credit & Collection Email (Letter) Templates

This e-book provides templates for 21 most effective credit and collection letters that will help you communicate better with your customer. The e-book is a culmination of our work with credit and collection experts over more than 700 credit and A/R transformation projects across the world.

Executive Summary

The primary responsibility of any credit / collection’s representative is to stay in touch with customers and make sure buyers would pay ‘in full and on time’, every time. A regular day for any credit and collections analyst is quite tiresome from keeping a close tab on the health of the receivables to performing monotonous but important tasks such as sending out hundreds of emails.

Credit and Collection analysts typically spend about 30% of their time catering to ad-hoc requests such as unblocking orders, sending out additional invoice copies, account statements and other order related documentation. Managing these duties through formal correspondence is important but very tiresome as the analysts have to find relevant information, check contact details, compose emails and finally, send them. Scaling this process is especially difficult as credit and collections analysts are assigned hundreds of accounts with constantly increasing volume of open A/R.

This e-book will help credit and collections professionals improve productivity of the email correspondence process through best-performing email templates that we compiled from more than 700 collections and credit transformation projects across the world.

Don’t have the time to go through the e-book? Download these ready to use templates in a zip folder

The 10 Unbeatable Credit Email (Letter) Templates

2.1 Welcome email/ Credit approval

Sample email 2.1 is written to welcome and establish credit terms with the customer.

Best-practices:

- Be warm and clear – remember this is the first email which the customer is going to receive

- Clearly specify the credit terms with details such as <due-dates>, early payment discounts, service charges for late payments

- Attach the credit policy

Click on the icon to download the email templates

Click on the icon to download the email templates

2.2 Request for trade reference

Sample email 2.2 is written to get credit information from trade references

Best-practices:

- Clearly specify the required information from the customer

- Remind the customer to attach the required document

- Clearly redirect the customer by providing link to the portal

Click on the icon to download the email templates

Click on the icon to download the email templates

2.3 Request for bank reference

Sample email 2.3 is written to get credit information from banks.

Best-practices:

- Request for all the information required from the bank

- Clearly mention that the customer’s credit application has been attached for their reference

- Specify the link where they can fill in the information

- Provide a link to the portal to upload the bank reference document

Click on the icon to download the email templates

2.4 Collateral certificate renewal

Sample email 2.4 is written to remind the customer to renew the collateral certificate before the expiry date

Best-practices:

- Clearly inform about the expiry of the previous document

- Clearly spell out the date by which the certificate will expire

- Remind the customer to attach the required document

Click on the icon to download the email templates

Click on the icon to download the email templates

2.5 Tax certificate renewal

Sample email 2.5 is written to remind the customer to renew the tax certificate before the expiry date

Best-practices:

- Clearly inform about the expiry of the previous document

- Clearly spell out the date by which the certificate will expire

- Remind the customer to attach the required document

Click on the icon to download the email templates

Click on the icon to download the email templates

2.6 Credit information letter

Sample email 2.6 is written requesting the customer for some additional credit information required to complete the credit application

Best-practices:

- Clearly specify the credit information that you require

- Redirect them to the portal to fill in the details

Click on the icon to download the email templates

Click on the icon to download the email templates

2.7 Refusal of credit extension

Sample email 2.7 acknowledges the request for a credit extension by the customer, but then informs the customer why it cannot be set up

Best-practices:

- Inform about rejection of credit extension

- Clearly specify the reason for rejection of the customer’s request

- Call out for the total value of the outstanding or past-due invoices

- Offer convenient payment options

- Attach the original invoices to avoid further to and fro in requesting invoice information

Click on the icon to download the email templates

Click on the icon to download the email templates

2.8 Credit limit upgrade

Sample email 2.8 is written to inform the customer regarding the extension of their credit limit

Best-practices:

- Clearly mention the existing credit limit

- Specify the extended credit limit

- Offer reaching out directly to you

Click on the icon to download the email templates

Click on the icon to download the email templates

2.9 Blocked order

Sample email 2.9 is written when the customer’s order gets blocked due to outstanding payments

Best-practices:

- Use this as a polite reminder regarding the approaching credit limit

- Include the details of the invoices, amount and promised payment date

- Offer convenient payment options

- Attach the original invoices to avoid further to and fro in requesting invoice information

Click on the icon to download the email templates

Click on the icon to download the email templates

2.10 Sales notification (Internal)

Sample email 2.10 is written to the sales team regarding new customers and extended credit limit for existing customers

Best-practices:

- Clearly specify the account name

- Clearly Specify the corresponding updated credit limit

The 11 Unbeatable Collection Email (Letter) Templates

3.1 Pro-active payment reminders

Sample email 3.1 is written to inform the customer regarding payment dues

Best-practices:

- Be polite – remember that this is just a pro-active reminder; do not assume that the customer will default

- Clearly specify the invoices and the due-dates

- Urge them to make a payment with their earliest A/P run

- Share options for easy payment methods through an EIPP portal

Click on the icon to download the email templates

Click on the icon to download the email templates

3.2 Early-payment discount reminders

Sample email 3.2 is written to inform the customer regarding early payment discounts they can avail

Best-practices:

- Clearly call out the offer – a discount on early payment

- Clearly spell out the date by which payment must be made

- Detail any invoices with the actual amounts to be paid – this clears any confusion in buyers manually calculating final amounts

- Urge them to make a payment with their earliest A/P run

- Provide convenient payment options

Click on the icon to download the email templates

Click on the icon to download the email templates

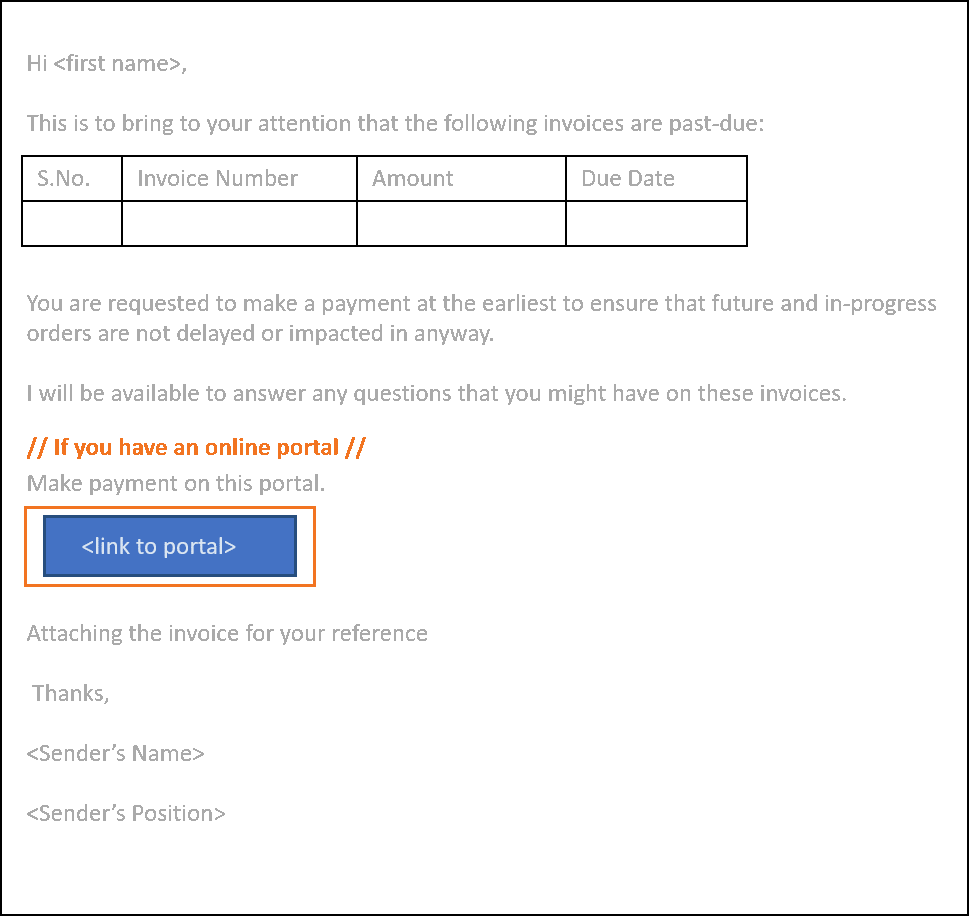

3.3 First past-due reminders

Sample email 3.3 is written as the first reminder for the customer’s past-due invoices

Best-practices:

- Clarify whether the customer has received any previous invoice copies

- Call out the invoices for which payment has been delayed – specify the actual date

- Ask the customer to reach out to customer serivce in case of any issues

- Offer convenient payment options

Click on the icon to download the email templates

Click on the icon to download the email templates

3.4 Second past-due reminder

Sample email 3.4 is written as the second reminder for the customer’s past-due invoices

Best-practices:

- Clearly inform about the delay in payment

- Call out the email as a ‘second’ past-due reminder

- Remind the customer to make a payment at their earliest possible

- Offer the option of making a payment commitment through your EIPP portal

- Offer convenient payment options

- Attach the original invoices to avoid further to and fro in requesting invoice information

Click on the icon to download the email templates

Click on the icon to download the email templates

3.5 Third past-due reminder

Sample email 3.5 is written as the third reminder for the customer’s past-due invoices

Best-practices:

- Call out the possible outcomes for further non-receipt

- Drop any non-essential courtesy or flowery language

- Remind the customer to make a payment at their earliest possible

- Offer convenient payment options

- Offer the option of making a payment commitment through your EIPP portal

- Attach the original invoices to avoid further to and fro in requesting invoice information

Click on the icon to download the email templates

Click on the icon to download the email templates

3.6 Suspension of credit

Sample email 3.6 is written to inform the customer that the credit for their account has been suspended due to prolonged delinquency

Best-practices:

- Inform about discontinued credit

- Clearly specify the reason for discontinuation of credit to the account

- Call out the total value of outstanding or past-due invoices

- Offer reaching out directly to a customer service representative as the first option

- Offer convenient payment options

- Offer the option of making a payment commitment through your EIPP portal

- Attach the original invoices to avoid further to and fro in requesting invoice information

Click on the icon to download the email templates

Click on the icon to download the email templates

3.7 Default on payment commitment

Sample email 3.7 is written as a reminder to the customer about the unfulfilled payment commitment

Best-practices:

- Include the details of the invoice, amount and promised payment date

- Ask the customer to contact a customer service representative for any help in facilitating the payment

- Offer convenient payment options

- Attach the original invoices to avoid further to and fro in requesting invoice information

Click on the icon to download the email templates

Click on the icon to download the email templates

3.8 Escalation notice

Sample email 3.8 is written in an extra-ordinary circumstance in which the recipient is being reached out to for long outstanding dues

Best-practices:

- Highlight all the information they need to help process the payment

- Offer convenient payment options

- Attach the original invoices to avoid further to and fro in requesting invoice information

- Use this template sparingly to avoid diluting its impact and value

Click on the icon to download the email templates

Click on the icon to download the email templates

3.9 Collecting from key accounts

Sample email 3.9 is written as a polite reminder to the customer to clear few invoices that have outstanding payments

Best-practices:

- Appreciate the relationship with the customer

- Be polite and helpful with any additional details they may need in processing the payment

- Offer convenient payment options

- Attach the original invoices so that all information is available in one place

Click on the icon to download the email templates

Click on the icon to download the email templates

3.10 Collecting from Slow-paying customers

Sample email 3.10 is written to collect from customers who are very slow in their payments and have outstanding invoices

Best-practices:

- Share all information required in a single place

- Be up-front about the implications of continued delay in payments

- Offer support in answering any questions

- Offer convenient payment options

Click on the icon to download the email templates

Click on the icon to download the email templates

3.11 Collecting from Fast-paying customers

Sample email 3.11 is written as a polite reminder for customers who are usually fast-paying but have some outstanding invoices

Best-practices:

- Be polite – these customers have always paid you on-time

- Offer the benefit of doubt and ask them to reach out to customer service for any help

- Offer convenient payment options

- Attach the original invoices so that all information is available in one place

Summary and Next Steps

By creating ready-to-use templates out of the most commonly used communication across customer accounts, it is possible to significantly reduce the amount of time taken to correspond with customers.

These standardized emails are easily identifiable and also improve credibility with the customers. Such systems make it possible for an analyst to select a group of ten customers in a batch, for example, and send an email to them via a single template which collects information relevant to each of them.

Though these templates are pre-written and ready to use there is still some level of manual intervention. A major load could be removed from credit and collections analysts by enabling these systems to respond to the ad hoc information requests from customers. Copies of due-invoices and other necessary documentation are automatically attached to the main correspondence.

Correspondence is the cornerstone of credit and collections process; it is imperative to have an automation solution that caters to this particular requirement. Ideally, a correspondence automation system should handle and maintain multiple correspondence templates that are needed by analysts. In addition, these systems should perform correspondence activity across mediums including print and mail, email and fax, as well as keep track of all phone-based credit and collection touchpoints. It should also be capable of completely automating manual work involved in creating correspondence, selecting accounts and contacts and sending out emails or dunning notices.

To learn more about technology solutions used by leading companies for credit and collections management, visit www.highradius.com

About HighRadius

HighRadius is a Fintech enterprise Software-as-a-Service (SaaS) company. The HighRadiusTM Integrated Receivables platform reduces cycle times in the order-to-cash process through automation of receivables and payments across credit, electronic billing and payment processing, cash application, deductions and collections.

Powered by the RivanaTM Artificial Intelligence Engine and FredaTM Virtual Assistant for order-to-cash teams, HighRadius enables organizations to leverage machine learning to predict future outcomes and automate routine labor-intensive tasks. The radiusOneTM B2B payment network allows suppliers to digitally connect with buyers, closing the loop from supplier receivable processes to buyer payable processes.

HighRadius solutions have a proven track record of optimizing cash flow, reducing days sales outstanding (DSO) and bad debt, and increasing operational efficiency so that companies may achieve strong ROI in just a few months.

To learn more, please visit www.highradius.com

HighRadius’ Integrated Receivables Platform

Integrated Receivables optimizes accounts receivable operations by combining all receivable and payment modules into a unified business process. The Integrated Receivables platform provides solutions for credit, collections, deductions, cash application, electronic billing, and payment processing – covering the entire gamut from credit-to-cash.

The HighRadiusTM Integrated Receivables platform stands out by enabling every credit and A/R operation to execute real-time from a unified platform with an end goal of lower DSO, reduced bad-debt, and faster dispute resolution while improving efficiency and accuracy for cash application, billing, and payment processing.

HighRadiusTM Integrated Receivables leverages RivanaTM Artificial Intelligence for Accounts Receivable to convert receivables faster and more effectively by using machine learning for accurate decision making across both credit and receivable processes. The Integrated Receivables platform also enables suppliers to digitally connect with buyers via the radiusOneTM network, closing the loop from the supplier Accounts Receivable process to the buyer Accounts Payable process.

Click on the icon to download the email templates

Click on the icon to download the email templates Click on the icon to download the email templates

Click on the icon to download the email templates