7 Essential Customer Segmentation factors for 150% Faster Collections

This ebook outlines seven key essential customer segmentation factors collected from 500+ receivable projects. These factors can assist O2C executives to improve dunning strategies which could positively impact A/R KPIs in 2022.

Executive Summary

Over the decades, the collections process has evolved from a ‘dial-for-every-dollar’ operation to high-value, strategic processes where executives rely on the collections team to reduce DSO for efficient working capital management. In today’s dynamic and aggressive economy, enabling a proactive collections management process that inculcates standardization and industry best practices and ensures quality customer experience, is of paramount importance given that each analyst is assigned thousands of accounts for collections.

However, with increasing expansion, collections team of all companies across the financial business spectrum are feeling the pressure to deal with an exponential increase in the number of customers and become agile in terms of customer collaboration and collection strategies. The collectors can no longer deal with customers on a case to case basis and have to rely on customer segments for customized customer communication and collections operations.

This e-book, with research on more than 500 receivables projects, concludes that credit and A/R leaders are more likely to positively impact A/R KPIs if they segment customers based on key dynamic and static factors.

What is Customer Segmentation in Collections?

Customer segmentation refers to the strategy of dividing customers into groups based on static and dynamic factors including credit score, type of account and payment method, to improve customer correspondence and compliance to credit policy. It is important for collections departments to segment customers to personalize customer correspondence and help collectors in upgrading their collection efforts. Invoice level segmentation is also one of the trending methods adopted by leading companies to prioritize invoices based on invoice value and due-date.

Traditionally, the collectors called the customers for outstanding invoices and overdue payment commitments. This was feasible because of 1) Limited number of assigned accounts and 2) Personal acquittance of collectors with the buyer A/P teams.

However, today it is not uncommon for collections analysts to get assigned to hundreds or thousands of accounts. It has become important to bucket customers into segments with similar attributes so that the collections analysts can not only scale collections process with an increasing number of customers but also keep the communications personalized.

As per McKinsey’s report, more than 70% of collection calls are wasted! These calls are made for accounts where the customer would have paid even in the absence of these calls. This fact clearly underlines the undeniable threat to the scalability and seamless working of the collections process due to ineffective customer correspondence strategies.

Customer segmentation helps in optimizing resources to recover more receivables at less cost. Customer segmentation is based on the fact that every customer stands differently in terms of financial stature, market trends and business relation with the company and the collection efforts. However, many organizations could be categorized into buckets by taking into account a certain set of attributes to finetune the collections process.

The next section explores the key benefits and takeaways of customer segmentation in the collections process.

Benefits of Customer Segmentation in Collections

As discussed in the previous chapter customer segmentation significantly boosts collections output. The following explores the key benefits of customer segmentation.

Improve Customer Experience

In the current world with cut-throat competition, customer experience is the only differentiator and providing a world-class experience with invoicing and collections will go a long way in sustaining competitive advantage.

The collections process encompasses a multitude of touch-points with the customers in day-to-day operations. However, traditionally collections process has been solely about money with little or no focus on individual financial conditions or limitations of a customer.

Customer segmentation ensures a holistic approach towards this outdated motto and helps the collections team to correspond with the customers using targeted and tailored collections strategies to address their multi-faceted needs. For example, customers who need paper invoicing may require invoice delivery 15 days prior as compared to customers who opt for e-invoicing.

Customer satisfaction is often the number one driver for competitive advantage and profitability, and post-sales customer experiences in A/R processes go a long way in providing a strategic lift to businesses.

De-clutter the Collections Worklist

As stated in the previous chapter, McKinsey’s report states that more than 70% of collection calls made by collectors are wasted as these are made to the customers would have paid even in the absence of these calls. An easy way to deal with these wasted efforts could be to create a customer segment- “fast paying customers” that would refocus the collections activity on high-risk accounts. These focused strategies for individual buckets include proactive invoicing, zero-touch automation and escalated correspondence measures. This, in turn, helps in refining account prioritization and collections worklist.

Customer segmentation, therefore, is imperative for generating prioritized worklists and removing redundant items in the worklist to improve collector productivity. For instance, a customer with a history of multiple disputed invoices would ideally need a collections strategy which helps in identifying potential disputes as soon as possible. This strategy would contribute towards re-prioritization of worklist eliminating (or reducing the priority of) disputed invoices.

This would not only enable collectors to focus on more strategic, ‘at-risk’ accounts but also help calibrate collections effort to tap the low hanging fruits with more clarity in the worklist.

Adopt to Dynamic Changes in Customer Behavior

With the evolving economy, it is imperative for collections strategies to be elastic and adaptable to the changes in customer behavior and market trends. To give a small example, in 2009, Nokia was the #1 mobile handset manufacturer in the world. A company that supplied display panels to Nokia would have treated it as a strategic account at that time. However, within 5 years Nokia was nowhere to be seen in the top mobile handset manufacturers. This example shows the importance of being nimble with the credit and collections process and keeps tabs on the changes in the market and the industry.

Customer Segmentation helps collections teams take dynamic factors into account while segregating customers and formulating strategies for different combinations of these factors. Another example could be, a mid-market customer with a double-digit growth rate has evolved from a low risk, non-strategic account to a low (or medium) risk, strategic customer, the collections strategy for this customer should reflect the leniency in prompt follow-ups and less frequent reminders. Segmentation ensures that the dynamic changes in customer behavior are well-incorporated and addressed in the collections strategies.

Improve Productivity and KPIs

With a de-cluttered worklist, the analysts have a smooth process and workload of focusing only on the critical accounts while sending mass correspondence and emails to less critical accounts. This approach not only improves account coverage significantly but also enables analysts to focus on the ‘at-risk’ accounts in a timely fashion.

Customer segmentation has a two-fold role in easing the pre-correspondence workload of collectors:

- It helps collectors deal with the idiosyncrasies associated with each customer segment

- It prevents the need to formulate a communication strategy for each INDIVIDUAL customer

It also helps improve the Collector Efficiency Index that measures the amount collected during a specific period of time against the amount of the total receivable during that same period, and Profit Per Account (PPA) which measures how much profit is generated on average by each account in collections.

Segmentation Dimensions

An ideal collections segment comprises both dynamic factors such as the past-due amounts and static factors such as the current mode of invoicing. This chapter outlines the seven key static and dynamic variables that 200+ collections teams use to segment customers and collect 150% faster when compared to the industry average.

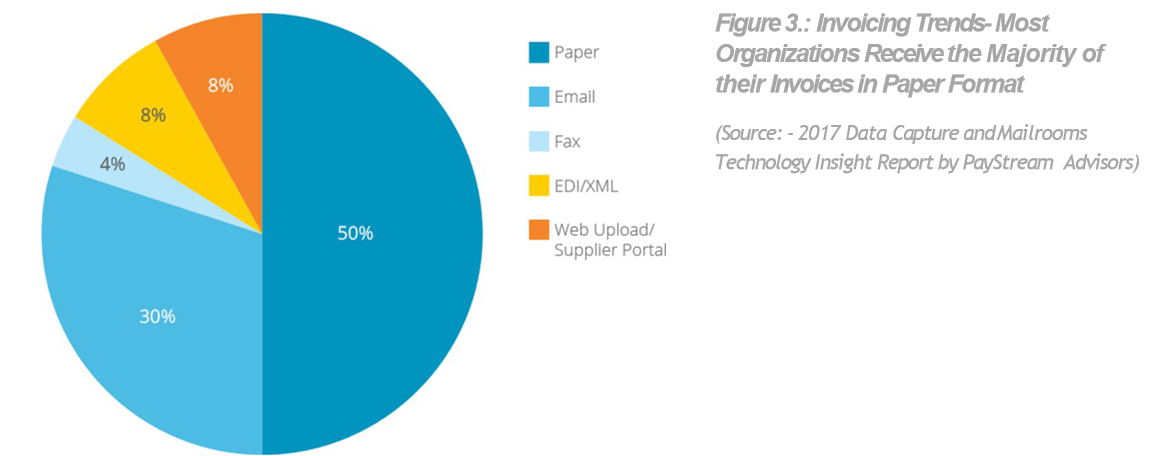

Mode of Invoicing

Customers could be segmented based on whether they have e-invoicing or paper invoicing. Customers who need paper invoices would need proactive invoice delivery as printing and sending the invoice via snail-mail would take more time. Moreover, paper invoicing is erroneous and prone to getting lost or stuck before reaching the customer. The process would further be more complicated for a customer with many invoices.

In comparison, customers with e-invoicing would receive invoices in real-time with instant notifications. Moreover, the evolving technologies make room for tracking invoice delivery and integrate invoicing with customer A/P portals.

This deep etched difference calls for a different strategy in the collections process. The mode of invoicing is considered to be an important segmentation dimension.

Fast Paying Vs. Slow Paying

As a member of the collections team, you would agree that fast paying customers would not require as many reminders and notices as a slow-paying customer.

The payment trends could be arrived at using Average Days Delinquent (ADD) metric. ADD is the average number of days the invoices are past due i.e. the amount of time between invoice due date and the date it is paid. The calculation of this figure will help your company evaluate, along with other calculations, the overall performance of your collections department and your ability to convert A/R to cash.

It is self-explanatory that a slow-paying customer would need more collection efforts and have a higher priority in the collections worklist. This segregation is hence important for better collections output.

High Risk Vs. Low Risk

Identifying high-risk customers and initiating appropriate customer correspondence is one of the top priorities for collectors to reduce receivables risk and prevent past-due A/R. This risk classification could be based on credit scores and risk categories of the customers.

By using improved modelling and customer management strategies to target ‘At Risk’ customers, progressive collections teams could reduce bad-debt write-offs by decreasing their portfolio’s overall exposure levels and by helping customers with proactive contact before they reach the highest stress point with piling up past- due A/R.

This differential and focused approach help companies reduce delinquency in the early stages. Segmenting customers based on risk level and exposure is one of the primary measures adopted by leading A/R teams.

Type of Account: Large Vs. SMBs

The 80-20 Rule in collections states that 80% of the revenue comes from the large accounts which account for 20% of the total customers. Collectors more often than not focus only on the invoice value while identifying ‘who to call’ from the collections worklist and prioritizing accounts for correspondence. This misguided approach means that the mid-market collectables fall through the cracks as they are many in number but have lower invoice values.

The collectors can enhance the collections process for SMB accounts by dispatching bulk emails for mass correspondence. The trending technologies in the market allow mass correspondence with account-level customization which further enables personal engagement with the customers. The large accounts, however, may demand tailored communication on a case to case basis based on factors such as invoice value and the number of days after the invoice is past-due.

This distinctly marks the prerequisite of different collection strategies for different types of accounts.

Percentage of invoice dollars greater than 30 days past-due

Percentage of invoice dollars greater than 30 days past-due accounts for the dollar value of the invoices that are 30 days past due out of the total dollar value of all the past-due invoices. This parameter gives a measure of the number of high-value invoices that are due for more than 30 days. Monitoring ageing bucket value for 30-60 days and 60-90 days is especially important given that 52% of invoices that are beyond 90 days past-due are written-off according to Atradius.

Payment Method: Check Vs. ACH

Check payments are widely prevalent in the USA and even now account for more than 46% of all B2B transactions by volume. Customers who pay through checks need to be sent reminders earlier than those who pay via electronic mediums for invoices that are approaching due-date. This is because the check payments need time to hit the bank. This not only poses the threat of time lag between collections process initiation and cash posting but also leaves room for inaccuracies in customer correspondence.

In comparison, the payments made by customers via ACH, wire or Credit Cards hit the bank near real-time and it is feasible to apply cash same day and update open A/R. Moreover, these customers could be provided with self-service portals to make payments. These self-service portals could solve the twin problems of invoice deliveries and payments.

The vast difference between collections approach for customers paying through different mediums calls for different collection segments and strategies.

Number of deductions and invoice disputes

If the number of deduction line items generated by a customer is very high, it showcases the reluctance of the customer in making full payments and the tendency of disputing invoices. From a collections point of view, processing invoices with unresolved or valid deductions may not be as fruitful as expected. Two scenarios come into picture here:

- The whole invoice is disputed

- The customers are ready to make a short-payment

The best approach towards these scenarios would be either to try and identify pre-deductions or to collect the feasible short-payments as soon as possible and further create a deduction. This would help in early creation, and sharing of the disputed invoice with the deductions team and further ensure that the collections worklist is not clogged with such line items.

Typically, the disputed invoices, while being managed by the deductions team, get stale knocking one ageing bucket after another and end up increasing past-due A/R in a larger ageing bucket like 90+ days. In this scenario, the collectors should correspond early (even before the due date for a large invoice amount) with such customers to minimize the number of days for which the invoice is past-due and be proactive with writing- off of genuine cases of invoice disputes.

Clearly these customers need a strategically cut approach to ensure fruitful collections efforts with minimum cost.

The above characterizes the key segmentation dimensions a collections process must embrace. The next chapter delves deeper into how to alter strategies and figure out actions based on customer segmentation.

Collection Segmentation Clusters and Strategies

The subsequent sections detail how the customer segments can be clubbed to generate customer portfolios and strategies. These segment clusters serve as the underlying foundation for any collections action. Some sample segmentation clusters are listed below. By using a combination of all of the above variables, an organization could come up with many more collection clusters and strategies.

Digital Enablement

This strategy illustrates the level of digitalization in the A/P processes of the customers. Customers who have e-invoicing options and opt for e-payment like ACH, Wire or Credit Cards are considered digitally enabled.

Collections Risk: High or Low

Collections risk is based on three factors:

- Credit Risk

- Slow Paying Vs. Fast Paying Customer

- Percentage of invoice dollars greater than 30 days past-due

The fast-paying customers with low credit risk and a small percentage of invoice dollar value in 30 days + past- due bucket can be deemed as customers with low collections risk. On the contrary, the slow-paying customers with high credit risk and high percentage of invoice dollar value in 30 days + past-due buckets could be characterized as customers with high collections risk.

The business rules and priority for different segmentation dimensions decide the collection risk category for customers with other combinations of these factors.

Large and SMB Accounts

This strategy takes into account whether it’s a large customer or a small to medium business enterprise. Different companies have a different perspective on the classification of accounts into large or SMB accounts. Dividing the segments into strategic and SMB accounts helps collectors in choosing either the high-touch collections call approach or low-touch email correspondence approach.

Disputes

The number of disputed invoices is another crucial and dynamic component that could prove to be vital in analyzing the collections’ actions based on customer behaviour. One indicator of customer satisfaction is the number of short-payments or invoice disputes that the customer has.

For a high dispute-prone account it makes more sense for the collections team to form a tag-team with key account managers and use a high-touch personal approach for collecting open A/R. An example here could be a retailer such as Walmart or Target who tend to order goods from say P& G in millions of dollars. Given the size of the orders, there tend to be a lot of deductions too.

Including the volume of deductions is also critical for segmenting customers better.

The next chapter probes into collections approach and actions based on clusters of collection strategies and segments. There can be many combinations and permutations of these clusters and the following explores a few of them.

Sample Strategies Based on Segment Clusters

These sample strategies are based on whether the customer is digitally enabled, the level of collections risk the customer poses, the type of account and the average number of disputes raised by the customer.

Example 1:

The following illustrates the customer position with respect to the given collections segmentation dimensions:

This sample cluster scrutinizes the large, digital-ready accounts which have low collections risk but a larger share of disputes. As these customers constitute a major chunk of the total invoice value of collectables, the collectors must ensure the quality of customer experience. For this portfolio, the collections process should kickoff early for with concentrated efforts on identifying pre-deductions, confirming A/P invoice approval and addressing invoice-related queries. Since the large customers are seamlessly integrated with automation and e-trends, a ‘self-service portal with a grievance dashboard’ can serve well to ensure early tagging of disputed invoices, in turn, accelerating the collections process. Here the customers could view all their invoices, and create and share disputed items.

The action for these customers should follow ‘Key Accounts Management with Low Touch’ maxim. This customer segment is vital and challenging to the business, yet due to low risk and digitization, automation coupled with prompt correspondence can be leveraged as a strategy to overcome a large number of deduction items generated by these customers.

Example 2:

The following illustrates the customer position with respect to the given collections segmentation dimensions:

The above represents one of the worst-case scenarios where a large customer has high collections risk and a large number of disputes. Owning a big chunk of receivables, these customers need focused collections efforts as they come under the crucial or ‘at-risk’ category. The collectors should indulge in sincere follow-ups via emails and phone calls while ensuring satisfactory customer experience.

These accounts should be prioritized in the worklist and dedicated collections efforts should be made towards these customers. The collectors should implement a ‘High Touch Key Accounts Management’ strategy for these customers.

Example 3:

The following illustrates the customer position with respect to the given collections segmentation dimensions:

SMB customers who are digitally adaptive, pose low collections risk and have fewer disputes, enable the collectors to leverage ‘no-touch collections automation’ to process their collections operations. With e-invoicing and ACH payments, the burden of pro-active correspondence for collectors is significantly trimmed down. The collections process can further be expedited and made proactive, with a self-service payment portal where the customers can submit payment commitments, make payments and get real-time notifications and reminders about their invoices. Moreover, the collectors could dispatch templatized bulk emails to these customers, improving account coverage.

This customer segment essentially narrates the best-case scenario, and engaging in the above-said actions can strategically reduce the burden on collectors, increase their customer reach and enforce ‘doing more with less’ maxim in the collections process.

Example 4:

The following illustrates the customer position with respect to the given collections segmentation dimensions:

This cluster explores the customer segment with SMB account, high collections risk, few disputes and where the customers have not yet embraced digitalization. Due to the absence of e-invoicing and e-payments, the collectors need to enforce proactive correspondence strategies like early invoicing, telephonic confirmation of invoice delivery and advanced reminders ahead of due-date. Moreover, as the dunning process would be paper-based (print and mail/fax), extensive manual collections efforts would be needed for collectors to be on top of these accounts.

However, since this segment includes small to medium businesses, they would not land a huge impact on the bottom line or past-due A/R. So, the collections operations should be optimized based on the worklist and volume of customers in other strategies such that the collectors are ‘proactive but not unduly invested’ in this segment.

Tools to Deploy: Key Criteria

Formulating and structuring strategies only gets as far as segmenting and prioritizing accounts. Execution of these strategies and identifying tools to execute these strategies are the key factors required to unlock strategic benefits, fulfilling timelines and resource optimization. Executives across business spectrums would agree that with the abundance of tools available today, identifying the right tool needs extensive research and analysis. The following enlists the key aspects to consider while evaluating tools for deploying customer segmentation and collections strategies.

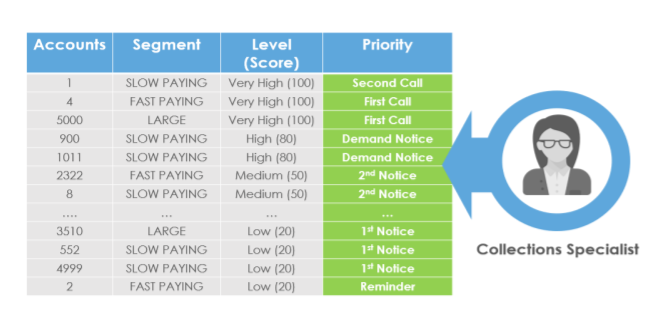

Prioritized Worklists

The ability to generate a prioritized worklist automatically is one of the primary concerns for a collections automation tool. Businesses today are looking forward to a scalable solution, which easily integrates with the ERP system, ensures compliance with the business rules of the company and is capable of embedding dynamic collections rules and strategies. Leveraging real-time data is vital criteria, for addressing the changes in customer behavior and securing its reflection in the collection efforts by the company.

Automated Correspondence

With the progressive drive towards e-adoption, email correspondence is enveloping a major lump of customer collaboration reducing the burden on collectors to call every customer. Automated dunning via email, fax, and print and mail with easy-to-create correspondence templates as well as packages to include invoices and account statements is the inevitable recipe to cope with the increasing volume of collections. Mass correspondence, templatized dunning letters and custom data capture are the golden rules to bridge the gap between the current process and a self-sustainable collections management solution.

Self Service Portal

Implementing an autonomous solution with a self-service portal where the customer can view and download invoices and account statements, create disputes, make payments, submit payment commitments and share claims and POD documents is the must-have in this millennial A/R generation. It not only reduces the collectors’ workload and speeds up the collections process but also ensures quality customer experience by empowering them with key functionalities.

Tracking Performance

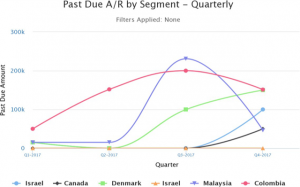

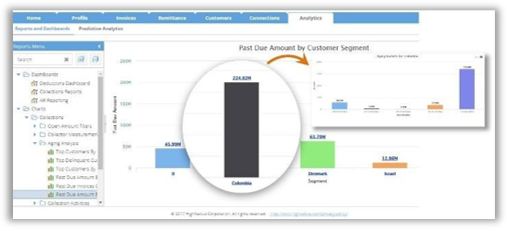

Businesses today, need to monitor performance and draw insights to take corrective actions, modify A/R strategies, and make proactive decisions in their collections operations. They can no longer solely depend on traditional excel or spreadsheet reports and metrics like DSO to evaluate their process. Real-time reporting and analytics not only save time but also provides organizations with the tools to implement a fully optimized collections management process to assess customer segmentation, account prioritization, and worklist generation.

The Scalable Solution

The ideal collections management solution encompasses all the features discussed in the previous chapter and provides scalability in terms of evolving market trends and changing the economy. HighRadius Collections Cloud solution provides a complete set of tools to optimize and automate the collections management process. All the information you need like invoices, dispute information, PODs, claims, tracking info, etc. on each case is automatically presented in a collections work-space and ready for use with a single click.

Key Features Include:

- Rules-based Collections Optimization automatically prioritizes and assigns collections activities to analysts based on predefined business rules.

- Integrated Collections Work-space tracks promises-to-pay and tasks and reminders for every account and collection effort.

- Predictive Risk Scoring Model identifies ‘at-risk’ customers who might be current on their account and integrates the risk level into prioritization.

- Dunning Correspondence Automation generates and sends out correspondence packages containing needed documentation based on predefined templates.

- Easy integration with ERP, Accounting, and other systems

About HighRadius

HighRadius is a Fintech enterprise Software-as-a-Service (SaaS) company. The HighRadius™ Integrated Receivables platform optimizes cash flow through automation of receivables and payments processes across credit, collections, cash application, deductions, electronic billing and payment processing.

Powered by Rivana™ Artificial Intelligence Engine and Freda™ Virtual Assistant for Credit-to-Cash, HighRadius Integrated Receivables enables teams to leverage machine learning for accurate decision making and future outcomes. The radiusOne™ B2B payment network allows suppliers to digitally connect with buyers, closing the loop from supplier receivable processes to buyer payable processes.

HighRadius solutions have a proven track record of optimizing cash flow, reducing days sales outstanding (DSO) and bad debt, and increasing operational efficiency so that companies may achieve strong ROI in just a few months. To learn more, please visit https://www.highradius.com/.

HighRadius’ Integrated Receivables Platform

Integrated Receivables is a solution to optimize accounts receivable operations by integrating all receivable and payment modules to work as a unified business process. At the core of the Integrated Receivables platform are solutions for credit, collections, deductions, cash application, electronic billing and payment processing – covering the entire gamut from credit-to-cash. The HighRadius™ Integrated Receivables platform is a stand-out as it enables every credit and A/R operation to execute real-time from a unified platform with an end goal of lower DSO, reduced bad-debt, faster dispute resolution, and improved efficiency, accuracy for cash application, billing and payment processing.

HighRadius™ Integrated Receivables leverages Rivana™ Artificial Intelligence for Accounts Receivable to convert receivables faster and more effectively using machine learning for accurate decision making across credit and receivable processes. The Integrated Receivables platform also enables suppliers to digitally connect with buyers via the radiusOne™ network, closing the loop from the supplier A/R process to the buyer A/P process.