2021 Playbook for B2B Credit Risk Management

Built with inputs from 200+ A/R leaders across North America and Europe. Details on the five biggest trends impacting the Credit world and the perfect plays to counter the thread.

The Biggest Credit Trends in 2020

Perhaps unsurprisingly, credit management industry in 2020 has been affected significantly

2020 has influenced almost every trend in the space, and looks set to continue to make an impact. Economic uncertainty is the biggest challenge and threat to any credit organization — and 2020 has brought economic uncertainty on an all-encompassing level.

The year has driven job losses, business closures, massive industrial disruption, and radical changes to the way we live, work, and spend money.

Faced with this sudden chaos, many credit organizations have responded by tightening control on extending credit limits and ramping up the number of credit reviews they conduct each month.

To begin this whitepaper, we’ll take a look at some of the key trends in the credit management industry this year and what we can learn from them.

1.1 Executive Summary

4x increase in high risk category customers compared to last year

8x increase in June and July alone in the number of order lockouts (or blocked orders) compared to the same period in 2019

4x more time spent by credit teams in completing credit reviews of new customers

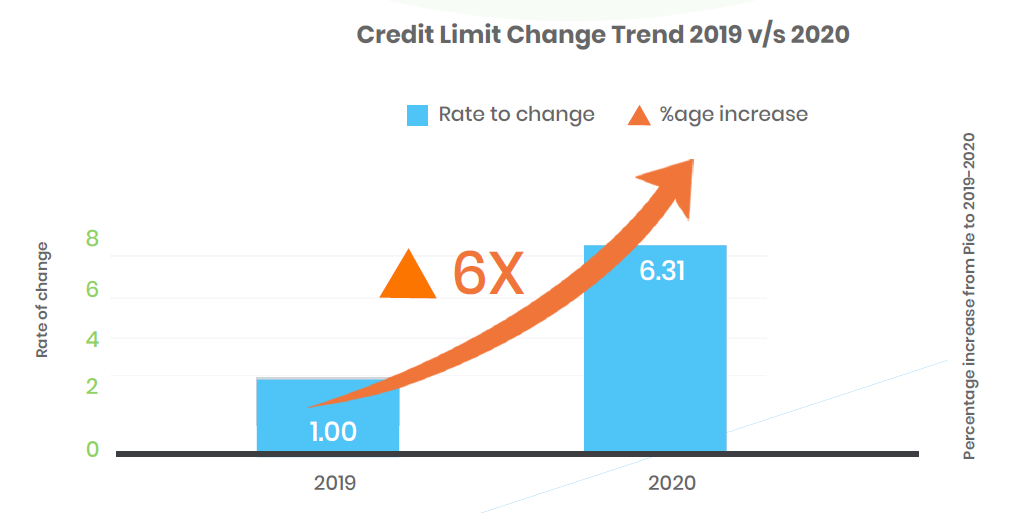

1.2 Sixfold Increase in Number of Credit Limit Changes in Summer

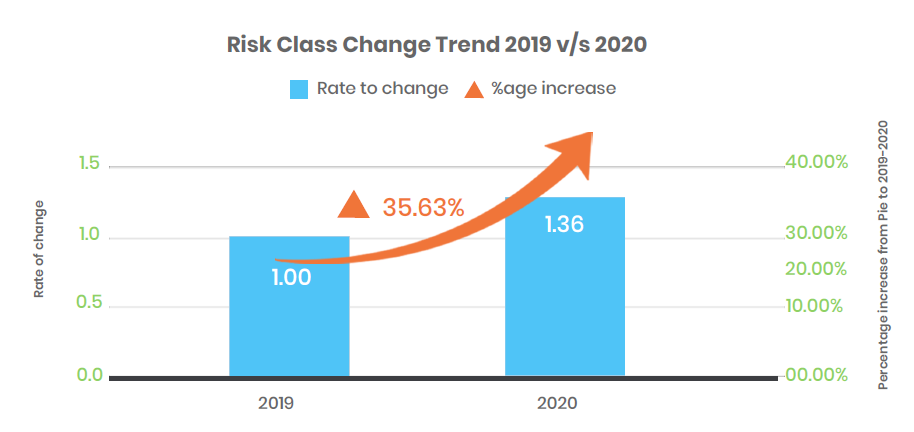

One major trend this year has been the sheer number of risk class and credit limit changes. We took a randomly selected subset of customers across our 500+ customer base and studied the trends.

- We discovered that companies, on average, changed the risk classification of around 2000 customers in the months of July and August 2020 alone

- In the months of June and July alone, the number of risk class changes increased by 36% compared to the same period in 2019

- One out of every three credit organizations has updated their risk metrics on a monthly or more frequent basis

- These risk class changes were mostly in the same direction: the number of customers in the high-risk category increased by almost 4x in 2020

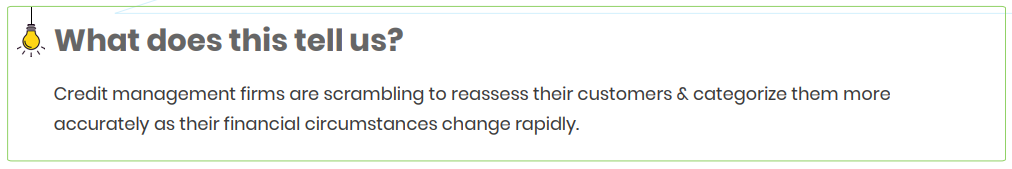

1.3 Fivefold Increase in Number of Order Lockouts/Blocked Orders

Between March and August 2020, we recorded 77,600 order lockouts. The number of orders being blocked by organizations each month increased by 5x compared to 2019. In June and July alone, we saw a staggering 8x increase in order lockouts.

1.4 Twofold Increase in Due Diligence in Conducting Credit Reviews

One of the main characteristics of the financial crisis has been a surge in remote work. 60% of credit teams around the world have been working remotely in 2020.

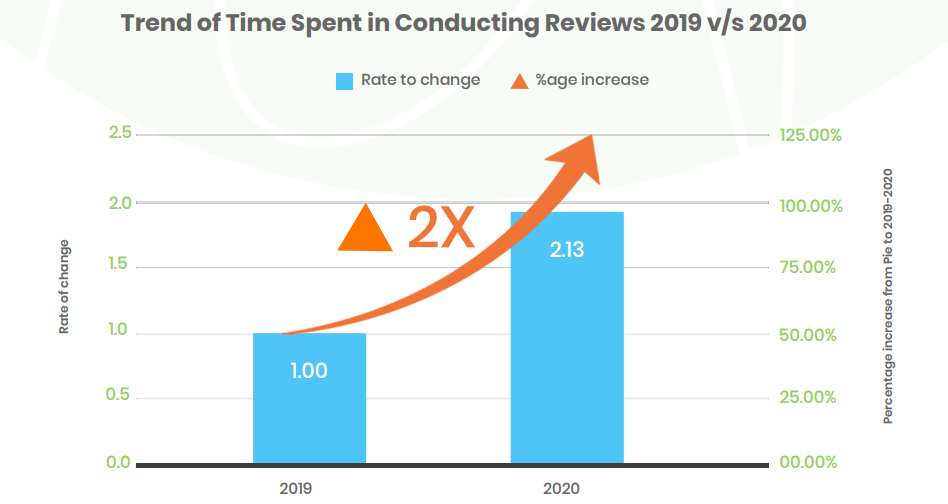

This presents new challenges — especially around the already time-consuming task of doing credit reviews. In 2020, credit teams spent double the amount of time on this activity compared to 2019.

In 2020, the number of credit reviews done by companies, on average, increased by 2x compared to the previous year. This increase was especially pronounced in April.

The amount of time spent specifically on credit reviews for new customer accounts increased by 4x, and the time to review a blocked order by 35%.

The types of credit reviews that were most popular and time-consuming in 2020 were:

- New customer credit reviews

- Blocked order reviews

- Periodic reviews

- Sales requesting reviews

There are two possible reasons for this trend:

- Credit analysts are being more diligent and taking more time

- Credit analysts are working more slowly due to bottlenecks in working efficiently as a result of a remote work environment

1.5 Twofold Increase in the Need for Latest Credit Data

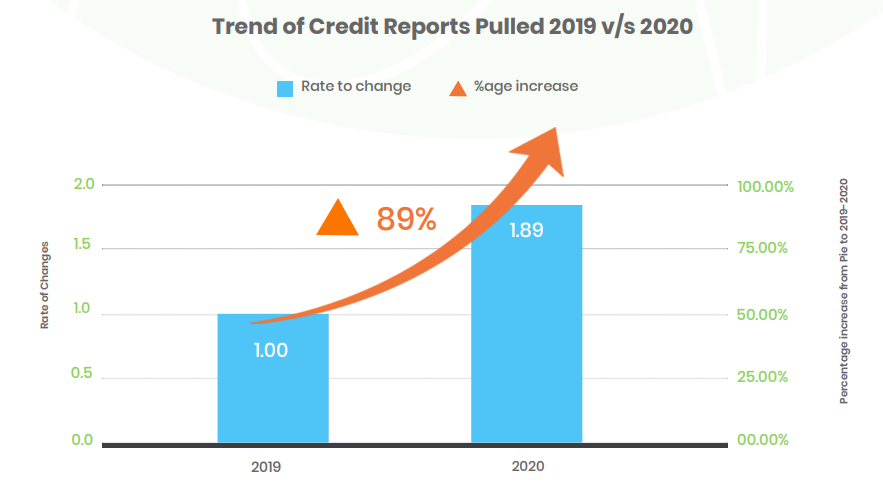

The amount of data needed to arrive at a decision increased twofold in April 2020, and the need for the latest credit data also increased twofold in June and July.

Data is ubiquitous in the modern world, and it’s a powerful asset for credit teams. In a risk-prone world, with changing customer financials and uncertainty, teams were forced to rely on credit and financial reports more than ever to ensure the right credit limits were always assigned to customers.

The number of credit reports pulled by organizations to review the creditworthiness of customers increased by 89% in 2020. Plus, the average number of financial reports pulled by credit teams increased by 4x.

1.6 Lessons for the New Decade

2020 has had a profound impact on the economy and the way credit management firms function. Above all

else, it’s been a wake-up call — a reminder of why certain checks and processes (such as frequent credit checks) exist and their importance.

The events of this year have forced organizations to analyze and rethink their credit risk strategy, policies, and practices like ever before.

A question for the future is, if this is the new normal, how can credit leaders ensure this new level of diligence and responsibility is scalable enough to work well long term?

Adjusting to New Dynamics in Credit Risk Management

2.1 Executive Summary

In the first few months of 2020, credit departments were forced to switch rapidly into survival mode, taking actions such as:

- Re-evaluating the credit risk of customers

- Tightening credit controls

- Holding more orders

- Increasing monitoring of external risk factors

- Aggressively collecting on past-dues

However, pressure soon mounted on credit leaders to balance this healthy level of risk with a push to enable and support sales teams to drive cautious growth of the pipeline.

With a growing workload and an unpredictable economy, credit leaders need to think about how to manage credit departments as this new future unfolds.

This whitepaper contains distilled insights from 100+ credit leaders, from different industries around the world, on how to counterattack the most prominent concerns in credit risk management in the new economy while also supporting their revenue functions. Many of these practices are already part of the DNA of healthy credit organizations. Less advanced credit teams must catch up-fast.

2.2 Credit Management as the Strategic Enabler of Cautious Growth

Credit teams are enabling profitable growth, even in a volatile economy

Credit managers have always played a pivotal role in helping companies avoid unnecessary risks. They do this largely by providing clear-eyed analyses of prospective customers, managing risks, and collecting payment from existing customers.

In the new economy, corporations are under pressure to conduct sales while simultaneously reducing costs and mitigating risks.

It’s no longer enough for credit departments to simply prevent bad credit decisions. Now, they’re expected to support sales teams and play an active role in meeting growth targets.

Here are the popular strategies applied by credit leaders in 2020

2.2.1 Extending Credit Limits and Grace Periods On A Case-By-Case Basis

Perhaps unsurprisingly, the economic turmoil of 2020 hindered customers’ ability to make payments on time. As a result, credit teams found themselves extending credit limits, revising payment terms, and giving one-time grace periods.

2.2.2 Securing Credit Insurance on New ARs and Extending Terms on Current Sales

The Senior Credit Risk Manager of a company that is a global leader in access solutions (their offering covers products and services related to openings, such as locks, doors, gates and entrance automation solutions), was worried about what awaits businesses in Q1 and Q2 2021.

The construction projects which were underway arrived before the pandemic hit, but the planning and bids for next year’s projects had grounded to a halt in the midst of the economic uncertainty.

To prepare for this troubling scenario, he turned to tactics outside the norms of standard credit management.

Securing Credit Insurance on New ARs

In one possible scenario, a customer had $200,000 of AR exposure from a job completed in March which they were unable to pay. Now, they needed an additional $200,000 in materials for a new project about to begin.

“Situations like this will create an avalanche of requests for extended terms and increased credit limits,” he points out. “What will we do? Will we say,‘Here’s another $200,000 on top of the $200,000 that you haven’t paid?

Instead, he believes, credit managers should work together with customers to enlist the services of insurance brokers and secure domestic credit coverage on ongoing sales.

This is neither easy nor inexpensive. Credit teams need to work closely with customers, with both providing the necessary documentation to cement a policy that works for everyone.

“You must have a buy-in from the customer whom you are trying to insure. When a customer comes to you asking for more credit or extended terms, the first thing out of your mouth now should be,‘Okay. Let’s get together, put together a financial package, and lobby it to the insurer. If they approve, you’ve got the extra line.

“You can work together on paying the premium and working out agreeable terms—terms that may have to be

extended as an added incentive to make this happen.”

2.2.3 Developing A Culture For Fulfilling Fiscal Responsibility in Credit Teams

Credit analysts found themselves spending more time performing credit reviews in April 2020 — double the hours compared to the same period last year.

However, the time spent doing these reviews declined rapidly over the following months.

Credit leaders now need to ensure that they maintain a culture of performing due diligence when analyzing risk, evaluating the creditworthiness of customers, and releasing the right orders. This is the only reliable way to ensure an efficient credit management system.

Greg Ottalagano, Global Head of Risk at Church & Dwight, stresses the importance of credit teams maintaining a high-performance culture:

These measures are short term solutions and contribute more as a defensive strategy rather than as driving forces of cautious growth. Let’s take a look at the big, scalable, and long-term solutions available today.

2.3 The Importance of a Globally Interconnected Credit Process

Integration of ERPs Across Multiple ERPs

In an economy that looks more uncertain than anything we’ve seen in decades, risk analysis in global enterprises is more difficult. The impact of the economic downturn on industries and regions around the world has led to some unique challenges.

Global enterprise companies have business units all over the world. These units straddle different cultures, currencies, languages, laws, and regulations.

To add to the confusion, often, different business units use different ERPs even though they share common customers — meaning credit teams have to retrieve and update data in multiple ERPs.

Evaluating the credit risks of a customer doing business in multiple regions became extremely complicated in 2020 due to different levels of socio-economic impact in different BUs and geographic regions.

Static credit scoring models quickly proved to be ineffective in accurately calculating the creditworthiness of such customers.

The result was that credit teams were forced to spend lots of time doing manual analysis of risk factors associated with these customers spread across different regions, industries, and ERPs.

As a result, the number of hours required to complete the credit review of a global customer increased by 4x in 2020, as compared to the same period in 2019.

There is clearly a need to integrate these disconnected ERPs and build better risk models to handle the growing challenges.

In fact, according to a survey by CreditToday, 42% of credit executives with sales over $1 billion believe in the need to have all their ERPs integrated. They stress the need to gain a global view into all customer data, consolidated in one place, to enable a faster and more accurate credit risk assessment at all times — from anywhere in the world.

2.3.1 The Need for Real-Time Credit Risk Monitoring

A fluctuating economy demands more credit data in real-time.

The most common and immediate response in 2020 by credit teams has been the reassessment of customers’ creditworthiness,

The months of June-July 2020 saw a whopping 6x increase in the number of credit limit changes done on average by any company.

Executives need to know which customers are likely to default on a daily basis, and the short-term solution used by most companies worldwide was simply to pull more financial and credit reports, analyze them, and conduct frequent credit reviews.

As a result, the number of credit reports pulled by an organization, to review the creditworthiness of a new/existing customer increased by 89% in 2020, compared to the same period in 2019.

This was a good approach for survival in the moment, but in the long run the need for more frequent credit reviews means an increase in cost, as credit reports need to be pulled from credit agencies like Experian, D&B, and Equifax.

What credit teams really need is a commercially viable solution to capture and analyze different risk indicators like credit agency data, news alerts, and payment behaviors.

This way, they can monitor credit risk for every single buyer in real-time and proactively identify at-risk buyers, reassess creditworthiness, and reduce bad debt.

An example: Huntsman Corporation

Huntsman Corporation, a manufacturer and marketer of differentiated and specialty chemicals with 2019

revenues of approximately $6.8 billion, were facing challenges with credit management.

Their A/R department performed credit reviews through manual aggregation of credit reports and financial data from 3rd party websites. It relied on time consuming, manually entered excel sheets.

To solve the problem, they used an automated solution to solve major credit management challenges.

It delivered the following:

- Real-time credit risk monitoring

- Efficient workflows for automatic credit, group, and opportunity reviews

- Seamless integration with external agencies with 1-click access

2.3.2 The Right Order Lockouts Are a Necessity in a Risk Prone World

Maintaining the synergy between credit and sales is crucial — now, more than ever

Economic forecasts can change quickly in 2021. Credit teams around the world are monitoring the

creditworthiness of customers more carefully and frequently, and working hard to protect the business against portable risks from delinquent customers.

One of the ways they’re doing this is by locking and holding orders until outstanding receivables can be collected.

The number of orders being locked (in hold) by an organization every month on average has increased by 5x in 2020 when compared to the same period in 2019.

However, at the same time, sales leaders need to adjust how their organizations sell in the face of new customer habits and unprecedented economic circumstances.

Sales teams are under huge pressure to meet targets and maintain revenue, especially in hard-hit industries like mining, construction, and automotive manufacturing.

This creates possible tension between credit teams and sales departments. If credit teams are being too generous with credit extensions and grace periods, it could negatively impact sales and lead to problems for the organization.

How can both teams solve this problem? The best solution is to predict when customers are about to exceed their credit limit and collect proactively, avoiding the need to lock the order in the first place.

It’s crucial to analyze past order patterns and payment behavior of customers in real time. Done right, this will lead to faster collections and reduce bad debt. Many companies are turning to AI to implement this solution, avoid disruptions to the sales cycle, enable better customer experience, and improve cash flow.

2.4 Importance of Global Visibility in the New Economy

Credit executives today need real-time, data-driven analysis for decision making.

In a survey conducted in Q1 2020, 62% of CFOs identified monitoring team performance as a key challenge in the 2020 economy.

The majority of credit departments were then working remotely — as much as 60% in Q1 and Q2 This makes it tough to monitor important metrics like: DSO, bad debt, ADD, identifying risk concentration areas, customers likely to default, and the productivity of credit departments.

With the economy constantly fluctuating, credit executives must stay on top of their process and the performance of their teams. It’s crucial to make smart and fast course corrections based on the changing dynamics of the economy.

Credit Executives today need more in-depth visibility into day to day finance operations. This is only possible with customizable reports with a 360-degree view of their global credit risk performance — delivered in real-time.

2.5 Maintaining the Synergy between Credit and Sales

For credit executives, it’s vital to stay on top of emerging trends around key credit metrics, such as:

- Credit utilization

- Bad debt

- Customer onboarding time

- Blocked order resolution speed

- Periodic review coverage

Executives need crystal clear visibility into the day-to-day activity of local credit teams. In a workforce that’s often completely remote, it’s important to maintain productivity and keep tabs on the daily goals and achievements of credit analysts. Encouraging a high-performance culture at all times must be a constant priority.

Credit executives also need to be empowered with ready-to-use, intuitive data visualization. They’ll need to drill down into individual reports, identify bottlenecks or issues, and make course corrections accordingly.

It’s important to conduct internal and industrial benchmarking analysis on key metrics and process health. For example — executives should stay on top of risk concentration levels (how many customers are likely to default?) across a range of different regions and industries, and make course corrections based on what they observe.

It’s important to conduct internal and industrial benchmarking analysis on key metrics and process health. For example — executives should stay on top of risk concentration levels (how many customers are likely to default?) across a range of different regions and industries, and make course corrections based on what they observe.

2.5.1 Importance of Using the Right Tools to Maintain Global Visibility

New information is always valuable to credit teams. However, without the right software, you’re severely limited in how you can use it. You’ll be stuck looking at one account or one dimension at a time, and missing out.

Credit teams that are already using the right tools are seeing impressive results, such as:

- Improvements in accounts receivable performance

- Mitigation of risk

- Opportunities to increase sales for creditworthy accounts realized much faster

If you haven’t yet started making the most of the tools available, you’re putting your organization at a disadvantage compared to your peers.

Without specialized software or tools, it’s much more difficult to monitor the performance of the credit department. It’s harder to perform the all-important course corrections and improvements needed to survive in 2021 economy, and when you do take these actions they’re more limited.

The global visibility capabilities embedded in ERP and accounting software are much more effective and easy to use compared to spreadsheets or periodic, standalone feeds.

2.6 The Need for A Scalable Digital Foundation for Your Credit Operations

In a world turned upside-down by the financial crisis of 2020, credit leaders are finding themselves forced to juggle multiple roles, responsibilities, and goals — working to ensure not just risk mitigation but also sales success and revenue growth.

To consistently deliver in this new landscape, credit leaders will need to adopt new processes, priorities, and tools.

Credit Executives don’t have a crystal ball. But it is their job to be aware of micro and macro economic risk indicators, no matter how uncertain the economy is currently.

2020 has made Finance Leaders realize the importance of having an efficient, practical, and up-to-date credit risk management process more than ever. Simply increasing the number of credit reviews being done or credit reports being pulled is just a last-minute survival tactic, and cannot become your organization’ s credit strategy. This outlook needs to change quickly and drastically.

Black-swan events like the now-global coronavirus crisis are always sudden and just around the corner. Your credit management process needs a reliable and long-term solution to ensure your business is not deterred by unpredictable incidents and factors.

It is the utmost responsibility of credit leaders to guide their organization on the right path to ensure intelligent credit risk management, preventing bad debt, and enabling profitable growth. This requires discarding outdated methods, laying a scalable digital foundation, and optimizing their entire credit operations.

Playbook for Credit Management in the New Economy

3.1 Introduction

3.1.1 Rise of Expectations from Credit in the Eyes of Finance Executives

2020 witnessed the best of Credit Risk Management in a long time. The credit department, often confined to a back-office role, transformed into something much more significant.

As sales took a backseat in the early months of 2020, financial executives began to focus more on credit risk management strategies — first for protection and then to support cash recovery and enable cautious growth.

3.1.2 Diligence in Monitoring Credit Risk Started to fade in the Later Months of 2020

During the onset of 2020, credit leaders buckled down on analyzing internal and external risk factors. As the economy continued to become more unstable, credit teams were at the forefront of the battle, constantly re-evaluating the creditworthiness of different customers, increasing the number of credit reviews being done and sensitively locking down orders for high-risk customers.

As time went on, however, the urgency and importance of maintaining this highly vigilant risk management process began to wear down. Although the threats and implications of the pandemic did not subside, credit teams started to go back to the old ways of doing things.

- In March and April 2020 the average number of financial reports pulled by credit team increased by 4x compared to March-April in 2019

- However, by Aug-Sept 2020, the number of reports pulled to analyze the creditworthiness of a customer fell by 3x and turned out to be almost equal to the same period in 2019

3.2 Credit Departments Need A Long Term Solution for Future Battles

Black-swan events like the coronavirus crisis are always unexpected and happen without warning.

In 2020 alone, according to the latest survey report by Forbes, 130 major companies filed for bankruptcy. This includes discount retailer Century 21 and Chuck E. Cheese’s parent company, CEC Entertainment.

To handle events like these, short-term contingency methods like ensuring your credit team spends more and more time analyzing credit data, increasing the number of customer reviews, or blocking more orders, using the same traditional processes, tools, and resources, are not sustainable or effective solutions.

Your credit management process needs a reliable and long term solution, not just to defend when the general economic health or certain customers become volatile but also to prepare for such scenarios by ensuring that your risk mitigation is based on real, current data. You must also ensure your revenue growth functions are supported and are efficient enough to facilitate smooth operations, even under duress.

This requires:

- Discarding outdated credit strategies and scoring methods

- Laying a scalable and standardized digital foundation across all your credit operations

- Optimizing your credit evaluation process and credit approval workflows

- Having real-time visibility into the changing financial health of all customer portfolios, risk indicators, and key performance indicators

The only way to accomplish this is with the help of technologies like Robotic Process Automation (RPA) and Artificial Intelligence (AI), whose applications in the credit management process are not as complex as you might imagine.

Artificial Intelligence and other technologies have opened up new possibilities for dealing with the ever-changing risk landscape.

According to our latest Automation Survey in March 2020, two-thirds of respondents said their organizations have already implemented or are in the process of piloting automation in their credit and collection process.

3.3 The Evolution of Credit Management

Credit management’s role has changed from a back-office function, limited to assessing the creditworthiness of customers on spreadsheets, to something much more strategic. Today they are required to not just manage credit risk management, but also to support working capital optimization and enable sales growth.

In order to accomplish these objectives, credit risk management teams are getting a lot more data-savvy and using advanced tools like Artificial Intelligence (AI) and Robotic Process Automation (RPA) and moving away from excel formulas and mentally processing credit decisions based on intuition or experience.

To support working capital optimization, credit teams are spending more time studying their customer portfolios to truly understand what cash flows might look like. Now, they’re sought out as sources of insight and knowledge, becoming advisors for both sales and finance departments.

For identifying the right commercial opportunities, credit managers are analyzing information from different credit bureaus and trade groups to identify creditworthy and profitable prospects.

The latest trends and management expectations mean credit departments are required to think not only in terms of risk optimization but also pay close attention to business opportunities — and this can only be done effectively with technology.

3.4 New Playbook for An Agile and Profitable Credit Management Process

The New Credit Management Playbook outlines what a truly automated credit management process looks like, describes in detail what the latest technology today can do for you in each credit management function without getting too technical, and provides clear insight into the benefits you are likely to achieve with an agile credit management process, in layman’s terms.

3.4.1 Online Credit Application

In some organizations, in the current credit processing environment, paper still predominates.

The problem with this is that paper credit applications are cumbersome to handle. Mailing takes too long, and credit applications are often sent as an image attachment to an email or faxed. Waiting for the application to be filled out and returned is also extremely time-consuming.

The online application can be stored as a PDF, but while this saves some time it is ultimately limited in value. Any Credit Bureau Data that is printed or archived as part of the credit approval process is the same. Processing an application involves lots of back and forth between sales, customer support, and customer teams.

One possible solution is Online Credit Application. This is a self-service, web, and mobile-based credit application, supporting multiple languages and currencies. This would ensure easier collection of tax exemption certifications, financials, and personal guarantees from customers.

What’s more, Online Credit Application can be securely accessed and filled by multiple users from the customers’ end with the ‘quick-save and edit-later’ option — leading to a faster customer onboarding experience.

Credit teams can fast-track the new customer onboarding process by leveraging pre-filled credit applications from the sales teams, and online credit applications can also auto-extract existing customer data from CRM tools like Salesforce, Oracle, and Microsoft 360, saving time for customers.

Providing a standard online application where customers can fill out all the required details will significantly speed up customer onboarding time and improve customer experience. Meanwhile, it’ll lead to a productivity boost for sales teams since they no longer have to get involved in data collection. This solution also eases the burden on Master Data Management and Compliance teams by validating the information filled on the application for their relevance.

Online Credit Application captures complete and accurate credit information, tax certificates, guarantees, digital signatures with the help of mandatory fields, removing the need for credit teams to reach out multiple times to customers to capture missing or inaccurate information.

Instead, they can focus on critical credit reviews. Credit teams can track the progress of form submission and, once submitted, the data feeds directly into your credit management system.

Financial statements from public companies can also be submitted with the online credit application and can then be used to automatically generate ratios and period-to-period comparisons, which can then be inputed in credit scoring models.

3.4.2 Automated Credit Data Aggregation

The process of making credit decisions is not easy and requires manual aggregation of information from multiple third-party sites. This includes credit agencies such as Dun & Bradstreet and Experian, public financial aggregators, and insurance firms.

Logging into portals for credit agencies and digging up the right information takes up 50% of the day. To make matters more complicated, all this information is disparate, making it tough for teams to dedicate much time to spend on the critical decisions involved in risk evaluation.

With manual credit data collection, credit teams cannot maintain a ‘one-stop global information repository’ for all credit data on a customer, especially for the ones with a complex parent-child hierarchy.

Automating the credit data capture process will save time and improve the productivity of credit teams. An automated credit management solution auto-extracts credit data from global and local agencies, bureaus, and the insurer.

It’s able to extract:

- Credit reports from any agency of your choice such as D&B, Experian, CreditSafe, and Serasa

- Public financials like Yahoo, Edgar, and Bloomberg

- Credit insurance information from Euler Hermes, Coface, and Atradius

Credit teams can then review the credit information in the preferred language and currency.

Automation allows credit analysts to easily access all credit ratings and reports related to a customer in one single place. The result is faster research and decision-making — with data stored securely and indexed within the system in one place for easy referencing.

Credit teams also get automated alerts for collateral expiry and customers’ financial health, allowing for timely actions to lower credit risk exposure.

The credit management department fulfills its primary objective of business risk diminishment through credit investigations and audits, which requires data points from multiple sources. The aim is to facilitate sound credit dissection and insightful credit reviews.

There are two types of credit data:

External Data

- Data from credit reports

- Rating agencies

- Credit bureaus

- Trade groups

- Public financials

- Income statements

- Balance sheets

- Key financial ratios

- Insurance details

This data comes from a range of sources such as:

- Web searches

- Telephone calls to references

- Faxes and emails from disparate sources

Credit teams can automate data aggregation and gain real-time access to relevant customer information. This provides a one-stop-shop of research-ready info for credit analysts, saving time for insightful analysis instead of getting bogged down in low-value tasks like data scavenging and compilation.

By gaining access to critical data in real-time, it becomes much easier to track exposure to risk, accrued provisions, and cash flow, not just on a daily but an hourly basis. Teams can be quickly informed if a customer’s financial situation deteriorates, and put in place measures to mitigate the financial impact.

Internal Data

The second type of credit data involves customer-specific information, such as past orders and payment behavior forms. This can be acquired from internal business teams and forms an important part of credit score evaluations and credit reviews.

How an automated credit risk management system helps:

- Analysts gain access to all the relevant internal data in a standardized format and in one place

- Saves time that would otherwise be lost cherry-picking information from multiple systems and sources

- Allows analysts to focus on the research and analysis functions of credit review

3.4.3 Real-time Risk Monitoring

The months of June and July 2020 saw a massive 6x increase in the average number of credit limit changes undertaken by companies.

During the early months of 2020, credit teams witnessed a higher demand from executives for up-to-date

information about which customers are likely to default in making payments.

The short term solution applied by most credit departments worldwide was to pull more financial and credit reports, analyze them, and conduct frequent credit reviews. This helped them survive in the short term, however, it was very difficult for credit professionals to maintain this strategy in the later months of 2020.

This is because the immediate need for frequent credit reviews means an increase in cost as more credit reports need to be pulled from credit agencies like D&B, Experian, and Equifax. Looking at innumerable credit reports might help you be on top of risks to some extent, but it will also burn a hole in your pocket.

Also, the time and effort that goes into studying each report, identifying the right data to consider, and then updating credit information for each customer, without the help of technology demands a lot from the credit team. This should instead be spending on making actual credit decisions and not information gathering.

To avoid all this grunt work, which is also liable to oversight and human error, credit organizations need real-time risk monitoring, done by an AI-powered automated credit management solution. This is also a commercially viable solution that :

- Provides access to unlimited credit reports

- Monitors all your customers in real-time to track changes to their credit profile, payments profile, filings, and other key parameters

- Captures and analyzes different risk indicators, such as credit agency data, news alerts, payment behaviors, bankruptcy, and court filings

- Eliminates the need for periodic reviews by giving alerts and suggestions on revised credit terms, all in real-time

3.4.4 Blocked Order Management with AI

Sales departments everywhere are, more often than not, deeply concerned about credit departments slowing their growth. They are under a lot of pressure to meet their targets and increase the revenue of their organization. This is especially true in industries that experienced the heaviest impact of the pandemic in 2020, like automotive manufacturing, mining, and construction.

However, credit teams are also required to be stringent while releasing orders or extending more credit. This typically results in a conflict between the two departments, which is counterproductive for the organization as a whole.

One of the best ways to resolve this conflict could be to get predictions for a customer about to exceed their credit limit and collect from them proactively to avoid locking the order in the first place.

How is this possible? The solution is to enable an AI-powered solution that can analyze the past order and payment behaviour patterns of your customers in real-time. This also results in faster collection cycles and a reduction of bad debt.

AI functionalities of an automated credit management system also provide credit teams with recommendations on blocked order resolutions, for example, whether it is wise to release or block the order, ask for partial payments, or directly increase the credit limit.

These suggestions are based on factors such as past customer payment behavior, current amount past due, and risk class of the customer, your credit policy, and much more.

By recovering past-dues faster from customers by predicting upcoming blocked orders, credit teams can eliminate the time lost in manual blocked order resolution, let their collectors proactively reach out to customers, and have a positive impact on the company’s bottom line.

3.4.5 Configurable Scoring Models

Have you heard about the ‘cloaking effect’?

The “cloaking effect”: The credit scoring model is not able to predict bankruptcy, financial stress, or delinquent behavior.

An example: Eastman Kodak

Eastman Kodak is a company whose payment behavior to its suppliers did not reflect its financial condition. Kodak filed for bankruptcy on January 19, 2012.

The company was able to maintain a Payment Score around 8 — which indicates no evidence of severely

delinquent payment behavior — until it went bankrupt. This is known as the cloaking effect.

Along with this, high bad-debt, undetermined losses, loss of business opportunities, an increase in delinquent behavior/delayed payments, and a prolonged credit approval process are signs that your current credit scoring model has become outdated.

The accuracy and quality of credit decisions are incredibly important for determining optimum risk exposure levels and transitioning from a back-office function to a strategic driver of business growth.

If companies are stuck with inefficient, outdated methods for assessing the risk of extending credit to a customer, they can’t move past the quagmire of low-value, transactional tasks involved.

Without a standardized system, credit policies vary across the organization, and credit teams end up losing a majority of their productivity to re-work and processing ad-hoc requests. As a result, they’re unable to give much focus to making data-driven, insightful credit decisions.

Teams struggle to meet their routine targets for processing new credit applications and conducting periodic reviews, let alone assume a more strategic, business growth-oriented role.

The automation of credit decision making, on the other hand, allows for consistent decision frameworks that can be scaled and customized as needed.

This approach makes it possible to bring the most relevant internal or external data sources into the decision making, allowing for decision frameworks with the ability to generate credit decisions that are consistent across all channels and drive maximum results for your business.

The automation of credit decision frameworks and analytics also enables real-time monitoring for fraud and complete auditing for compliance purposes. An artificial intelligence-enabled credit scoring model will provide you with real-time risk assessment and a credit decision, with an immediately available credit line.

With the use of the best-in-class credit scoring model, industry leaders like Klöckner, Mercury Marine, and Parker Hannifin have been able to:

- Provide instant credit decisions for all their customers

- Significantly reduce bad debt

- Remove all manual time spent on doing manual calculations, making routine approvals, and declines

Upgrade your existing credit scoring model with artificial intelligence to simplify credit reviews across your customer portfolios globally and receive automated suggestions on credit scores and limits.

3.4.6 Workflows for Global Enterprises

Global companies have multiple business units functioning around the globe, with A/R data locked and siloed across different business units. This leads to data management challenges and discrepancies between credit teams throughout the company.

Another challenge is meeting credit compliance requirements with data scattered across multiple systems and units. This leads to limited visibility of process efficiency and credit team performance across different units.

The result is a lack of effective decision making, which impairs the ability to take timely corrective actions for credit teams. Ultimately, this causes a lack of best practice sharing between different units and delays in credit processing.

There is a need to automate credit management in global companies to combat this lack of visibility and establish a proper line of communication across business units.

The goal here is for multiple ERPs to migrate to a single ERP or for a legacy system to upgrade to a new ERP. By integrating seamlessly across multiple ERPs in large enterprises, credit teams can get a consolidated view of credit risk and exposure across geographies.

Companies can simplify global credit operations by leveraging multi-language and currency conversion support. The way to do this is by centralizing credit operations across geographies. Automation allows credit teams to automatically convert and review credit limits and exposure in local and global currencies and multiple languages, eliminating the hassle of manual conversion.

Credit processes require collaboration between teams within and outside the organization to arrive at credit decisions. Empowering credit teams with set workflows and streamlining the processes means greatly improved productivity for all the stakeholders.

It is recommended to create automated workflows for the following cases:

- Credit limit approval

- Credit limit increase requests

- Blocked orders

- Bankruptcy alerts

- Collateral expiries

Credit reviews require frequent collaboration with both finance and non-finance stakeholders for credit information and to gain approval and management sign-offs on credit decisions and recommendations.

This process involves the exchange of sensitive information between departments, making it prone to potential problems due to correspondence issues. For example, lost breakdowns, missing information, missed emails and phone calls, and misinterpreted details. This results in undue delays and lapses.

Credit management automation provides workflows that eliminate the need for time-consuming and distracting manual collaboration with business teams. The workflow manages the process flow of stakeholder collaboration, notifies them of open action items, and provides all of the supporting documents required to process the request.

Online Credit Application Workflow

The workflow encompasses the following sub-processes:

The Credit Application Workflow manages the process flow of capturing buyer credit application data, gathering and analyzing their credit data, and making and implementing credit decisions.

Receiving the credit request

This starts with the generation of the credit request by the buyer through the submission of a credit application. The workflow captures the data provided by the buyer for the analysis and processing of the request to extend credit lines.

Gathering analysis data

The workflow initiates correspondence with internal business teams and buyer references to validate the information and pulls credit reports, public financials, bank guarantees, income statements, and insurance details. This information is collected, scanned, indexed, and processed through subsequent validation checks.

Calculating credit score and assigning credit limit

The workflow calls and applies the scoring model and calculates a credit score based on the automation rules defined as per the credit policy. Risk class, credit score, and a credit limit are determined for that customer.

Initiating the approval process

The workflow notifies the designated authority of the recommendations submitted by the credit analyst after performing the credit analysis or those generated by the automation engine based on predefined rules, along with all of the supporting documents needed to accurately decide whether to grant or deny credit to the buyer.

Notifying all stakeholders

Here, the workflow sends notifications to interested parties when a recommendation is approved or rejected. The credit analyst is notified of the decision to update customer status in the system (business partner/customer master) and complete the onboarding process. An appropriate notification can also be sent to the buyer regarding their application status.

The customer onboarding process involves an exchange of sensitive information back and forth between the customers and the credit department. The process is prone to breakdowns due to correspondence issues such as lost documents, missing information, missed out emails and phone calls, misinterpreted details, management sign-off, and much more.

This results in dissatisfied customers and undue delays in application review. The turnaround time of a customer credit review can make the difference between closing and losing the deal. At the same time, accurate decisions cannot be a trade-off for faster review. Due time and diligence need to be invested in analyzing the applications and conducting thorough background validation.

The objective of the credit application workflow is to eliminate the convoluted process and time-consuming work of onboarding new customers, accelerate the approval of new customers, and improve compliance while reducing related overhead costs.

One way that companies could differentiate themselves is by adopting tools like online credit applications, standardized credit scoring rules, and e-signatures. The old days of turning in paper applications and then waiting for the mail or a phone call to arrive with the decision of whether credit would be offered or not are gone. E-processing simplifies things for creditors and customers while reducing the amount of paperwork customers are responsible for, attracting more applicants overall.

Credit Data Aggregation Workflow

The automation of Credit Data Aggregation helps credit teams achieve faster and more accurate credit research with the automatic aggregation of credit reports, credit ratings, public financials, and credit insurance data across global and local agencies. The workflow encompasses the following sub-processes:

Configuring agencies and credit information providers

Firstly, the credit teams are enabled by automation to configure and prioritize the order in which information would be extracted from credit agencies, credit insurers, and public financial websites. In case of missing data from one agency, the system would pull information from the next agency/bureau.

Retrieving credit reports and information

Analysts can use the AI-enabled credit data aggregation engine to extract credit bureau reports, credit agency ratings, insurance data, public financials, risk, and payment ratings automatically.

Creating a research-ready customer credit profile

Using automation, credit departments get a 360-degree view of the customer’s credit profile by aggregating all information in one place — credit bureau reports, financial statements, credit reference reports, and correspondence, along with complete credit application information which is appended to the customer file to create a research-ready package.

Periodically update customer credit information

Enable workflows for real-time tracking of the renewal of credit documents with fast-approaching expiry dates, customer financial health and credit rating updates, and insolvency alerts.

Real-time Risk Monitoring Workflow

The periodic review workflow automatically identifies accounts for review and places them on the analyst’s worklist. It manages the process flow of assessing the customer portfolio on multiple parameters, realigning the customer credit portfolio while reducing overhead costs.

The workflow encompasses the following sub-processes:

Analyzing payment trends

The workflow allows users to analyze the payment behavior of customers based on multiple parameters such as:

- Average days to payment

- Past due date

- Payment terms

- Open item values

- Average sales of previous months

- Average arrear details

These data points give meaningful insights for determining accurate credit limits and risk category at the account level.

Checking collateral expiry

The workflow checks for expired or expiring collateral such as bank guarantees, securities, and insurance documents. It does this by comparing the expiry date with the current date and alerts the analyst if the request for valid collateral needs to be raised for any accounts.

Checking credit data

The workflow takes reference data from credit reports, public financials, bank guarantees, income statements, and insurance details. This information is collected, scanned, indexed, and processed through subsequent validation checks.

Recalculating credit score and reassigning credit limit

The workflow recalculates the credit score based on the aforementioned data points, and the credit limit is realigned.

Initiating approval process

The workflow notifies the designated authority of the recommendations submitted by the credit analyst after performing the analysis, along with all the supporting documents for accurate decision making to modify the credit limit, if at all.

Automatic updating of account

The system is automatically updated to reflect the relevant credit limit, risk category, new review date, interest indicator, and hard block parameters.

Organizations still stuck with outdated systems for credit management fail to implement a culture that supports regular and accurate reviews of customer credit profiles. The process requires collaboration with external agencies for credit information and internal business teams for customer data, approvals, and sign-offs.

In the absence of a framework that facilitates an easy process flow, businesses are unable to lower risk exposure without bearing the cost of establishing a separate system for it. Workflows simplify the convoluted process of performing periodic reviews and accelerate the process through tighter integration with other business units while improving compliance through a taut audit trail.

Blocked Order Management Workflow

An order amount exceeding the discretionary credit limit of the customer is one of the most common reasons for a trade order getting blocked and not released to fulfillment.

The blocked order workflow manages the process flow of resolving blocked orders by expediting due to checks, approvals, and collaboration involved in the following sub-processes:

Notifying the credit department and the customer

When an order exceeding the assigned credit limit of the customer is placed, it is blocked to prevent its release to fulfillment. The workflow automatically notifies the credit analyst and also sends automated correspondence to the customer to give them an update on their order status.

Analyzing blocked order case

The credit analyst needs to analyze the case for the appropriate blocked order resolution strategy. Based on the customer portfolio and their payment history, the analyst could manually release the order by creating an exception or revise the credit limit of the customer by performing an ad-hoc credit review.

The required approvals and information exchange with other business teams for this process are facilitated by the workflow. The case can be assigned to the collections team to recover payment for previous orders and free up the credit limit. The workflow initiates automated correspondence with the right stakeholders along with all of the backup data (past orders, payments, and other order attributes) for easier and faster payment recovery.

Resolving blocked orders

Based on the outcome of the previous process, the credit data of the customer is revised in the system, and the workflow automatically updates the order management system to release the order to fulfillment.

One of the major challenges that the team faces in speeding the resolution of blocked order cases is the time lag in getting information from the order management system. In the absence of real-time information flowing in from the system, the credit department is in a constant race against time in processing and reviewing these orders.

What adds to the complexity of the situation is the lack of backup data and order statuses at the analyst’s disposal.

Customer experience also takes a hit when the customer calls to get an update and customer service agents need to cherry-pick order statuses from all of the different systems to give a straight answer. Blocked order workflows eliminate the time lag in information relay between departments. Expeditious order release is facilitated thanks to a one-stop-shop for all of the analysis data and electronic collaboration for approvals and e-signatures. The bestperforming companies are also able to enhance post-sale experiences by providing customer service representatives with the tools to effortlessly locate past orders, payments, and items based on any given order attribute – all with a few clicks.

External Events Workflow

The external events workflow is triggered whenever a customer gets any agency monitoring update and manages the process flow for updating the credit data in the system for optimum credit risk levels. The following subprocesses are performed as part of this workflow:

Capturing Agency Monitoring Data

The workflow captures real-time data from credit agency rating downgrades and the public financial results of companies and keeps a constant track of changes in the credit data of your customers.

Alerting Credit Analyst

The credit analyst assigned to that account is alerted to the event, and the credit data is collected, indexed, and made research-ready. The analyst performs validation checks and analysis of the data to arrive at the recommended actions to be taken for that account.

Initiating Approval Process

The workflow notifies the designated authority of the recommendations submitted by the credit analyst after performing the credit analysis or that generated by the automation engine based on predefined rules, along with all of the supporting documents for approval.

Updating Customer Credit Data

Based on the decision of the sign-off authority, the workflow can edit customer credentials in the system such as the agency rating, key financial information, and risk class — or calculate the credit score and assign the updated credit limit.

Access to real-time customer credit information from credit monitoring services is non-negotiable for efficient risk management in any business. The sheer amount of time and manual effort required in this process proves to be a big deterrent for companies, especially when they have a large customer base spread across multiple regions.

Failure to adopt a proactive approach to managing risk exposure could prove to be fatal in the long term with the credit department extending credit lines to high-risk customers, thereby piling on bad debts.

The external events workflow eliminates the wastage of time and resources in tracking customer credit data, provides up-to-the-minute information of changes in customer financials through multiple sources, and facilitates timely course correction through faster decision making and approval. It is an efficient, error-free, and costeffective way of maintaining optimum risk levels with minimal manual intervention.

In order to issue credit profitably to businesses, creditors need to be confident that loans will be repaid in a timely fashion, in accordance with credit covenants. Customers submit guarantees that often provide for a specific remedy to the creditor if the debtor turns delinquent and does not return his debt.

Credit guarantees are very helpful to reduce the risk of non-payment. The fact that default leads to forfeiture of the collateral reduces the chances of risky behavior or fraud. However, this guarantee does nothing if it has expired. Therefore, credit teams need to stay on top of the validity of guarantees submitted by customers.

Collateral Expiry Workflow

The collateral expiry workflow identifies securities that have expired for a partner and puts the partner in the corresponding user’s worklist. This workflow also recalculates the approved credit limit value by considering valid securities and triggers a Credit Review workflow if needed. The following sub-processes are performed as part of this workflow:

Alerting Credit Analyst

The credit analyst assigned to that account gets notified of the collateral expiry so they can perform validation checks and initiate a request for fresh securities and guarantees such as letters of credit, credit insurance, mortgages, or bank guarantees.

Requesting Valid Collateral

The workflow, at the analyst’s discretion, can initiate correspondence with the customer or third-party guarantors requesting guarantees or securities with updated validity tenures.

Revising Credit Limit

Once the updated collateral is made available, or in case of non-availability of required documents or documents with unfavorable security terms, the analyst could revise the credit limit of the customer and trigger the credit review workflow to recalculate the credit score and assign an appropriate credit limit.

One of the main challenges that make this workflow a must-have for any credit department is the current inability of teams to manually track the validity statuses of multiple documents for each of their customers. As a result, companies either have to invest resources dedicated to this process or the system falls off the grid and faces highrisk exposure.

This workflow helps businesses implement a tight grip on customer guarantees, thereby ensuring that risky customer behavior does not dig a hole in their bottom line. As a best practice, leading organizations adopt a more proactive approach in tracking collateral expirations by triggering this workflow before the guarantee or security expires.

The workflow is initiated when the validity date is at least a week in advance of the current date, so the credit analyst is able to fetch renewed collateral before the eleventh hour.

How Tech Data achieved an intelligent global workflow for credit decision making and 120%+ efficiency improvement on credit reviews

Tech Data Corporation, currently ranked #108 in the Fortune 500, is one of the world’s largest wholesale distributors of technology products, services, and solutions with $35 Billion in annual revenue and 43 years of experience.

3.4.7 Challenges in Standardizing Global Credit Management

- Disconnected systems

North America and Europe were on different Credit Management processes, and there was no global credit

management workflow. - Issues with existing legacy systems

Interaction between multiple legacy systems posed a serious roadblock. Moreover, they needed continued IT investment and support. - Manual, non-standard work

For credit scoring, data was aggregated manually, there were no standard workflows for escalation, and the system demanded large manual efforts with a semi-automated process.

3.4.8 The Solution

With credit automation software, Tech Data was able to:

- Establish a global solution for credit operations in all reporting regions, across both North America and Europe

- Achieve automated credit scoring for all customers

- Enable automated aggregation of all necessary credit rating reports from agencies

- Establish smart and customizable workflows for the delegation of credit approval

- Achieve smooth credit monitoring operations

Tech Data gained $160K/year recurring savings with an annual impact in North America and a 120% efficiency improvement in their credit operations.

3.4.9 Real Time Visibility into Credit Health Globally

In today’s world of economic downturn, it is impossible to turn a blind eye to any lack of visibility into the customer’s financial health which affects their credit operations.

It is difficult to track the overall performance of a customer account too, because of a lack of collaboration between the collection and credit teams. Credit leaders and analysts need more in-depth visibility into the customer’s financial operations to perform timely course corrections. However, they often lack the tools to support a daily, real-time analysis of customer’s credit health.

Using an automated credit management system gives credit leaders the ability to have end-to-end process visibility with out-of-the-box reports and dashboards to track team productivity and key credit metrics to get an accurate 360-degree view of their customer’s credit health.

Reports like the following can provide real value to credit departments in driving cautious growth:

Top customers with maximum credit utilization

Using this information credit teams can request prioritization of collection from these accounts to avoid new order lockouts.

Top customers with minimum credit utilization

Credit teams can support revenue growth easily as this information can be helpful to sales to ensure that customers are utilizing their credit up to their potential.

Top customers with the highest past-due amounts

Credit teams can reduce bad debt by relaying this information to the collections team and collecting from these accounts as a priority. This information will also be useful if any of these accounts place a new order.

Blocked orders taking maximum time to be resolved

If blocked orders take up a lot of time to get resolved then that directly impacts revenue and customer experience negatively. So credit teams need to have direct real-time visibility into this report.

Customers who are likely to default or go bankrupt in the next month

Credit teams should not wait for news from agencies to know if there are any drastic changes in a customer’s finances, because that might be too late and all you could do then is damage control. Credit teams today need real-time reporting services that tap into different sources online — news, financial reports, and agency

An automated reporting and analytics solution also provides the ability to do data visualization, which helps you drill down into individual reports to identify bottlenecks or issues in the credit management process.

With the reports provided by the solution, credit teams can monitor customer portfolios daily, on a real-time basis, to track any micro or macro-economic fluctuations in the customer’s credit profile. This ensures that any significant changes to the credit risk profile of all of your customers will automatically trigger ad-hoc reviews.

Credit teams also get real-time alerts and notifications based on any changes in the customer’s risk class from external financial agencies. They can also automate reviews by detecting declining payment behavior. This triggers an automatic change in the reviewing frequency of a customer based on risk class.

Automation provides an interactive dashboard with drill-down capability which helps the analysts to drill down into a specific customer’s account or invoice to gain clarity regarding the key A/R metrics. They can apply filters related to company code and customer segments to analyze the reports from various angles.

Business Impact Created by Real-time Visibility into Credit Health and Analyst Productivity: Track and improve team productivity and key credit metrics including credit utilization, bad-debt, customer onboarding time, blocked order resolution speed, periodic review coverage, in real-time, across different geographies and business units

3.5 Conclusion

Credit management is the lifeblood of all businesses, but still, executives hardly pay attention to it until a crisis shocks them into realizing the problems and pitfalls of having an outdated approach to risk mitigation.

Not long ago, credit risk management was an excel spreadsheet in the CFO’s office. Technology has come a long way since then, but these legacy solutions tend to have outdated approaches to data management with manual processes for updating data, manual collaboration with internal and external business teams, and high IT support costs for deployment and installing periodic patches and updates.

Innovative new technology solutions extend the applications and value of credit risk management across the enterprise through a cloud-based technology platform, enabled with artificial intelligence.

Cloud-based solutions offer the benefits of reliability, mobility, and scalability while eliminating IT, data infrastructure, and upgrade costs. These solutions enable dynamic credit management workflows and process improvements that result in not only lower risk but improved response times, reduced costs, and better customer experience.

Meanwhile, workflows bring transparency and proactivity to credit risk management. They can be deployed to streamline all business processes linked to credit management and help organizations deal with routine challenges in the following ways:

- Faster customer on-boarding and reduced overhead expenses

- Real-time access to critical credit data for accurate credit decision making

- Better transparency and accountability across all process hierarchies

- Instant knowledge about vagaries in customers’ financial situations

- Centralization of data across all business units, geographies, and process levels

- Enterprise-wide implementation of standard credit policies

- Increased team productivity and efficiency by reduction of errors and re-work

- Improved customer experience along with strong support to top-line business growth

The modern, technologically advanced credit management process gives organizations a proven ability to make quicker and more accurate decisions with real-time credit data. Its effects are real, immediate, and increasingly indispensable for any business looking to strive for cautious growth in today’s competitive world.