Simplify Accounts Receivable with NetSuite and RadiusOne

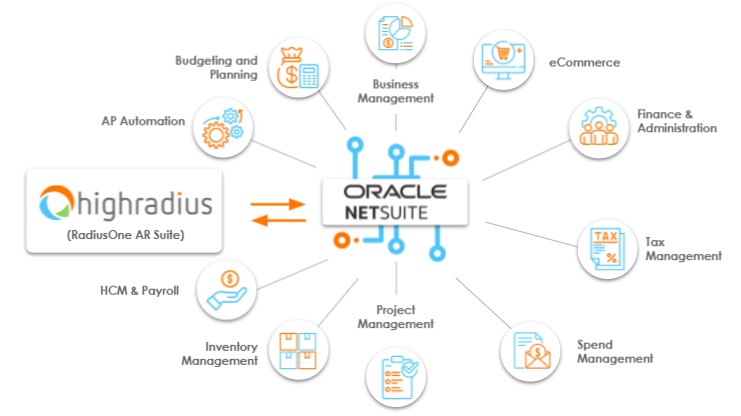

NetSuite is a new generation, cloud native ERP that has seen tremendous adoption across industries. Thanks to its rich open API ecosystem, finance leaders are leveraging best in class out-of-box solutions to optimize processes. Learn how to simplify AR with Netsuite and RadiusOne.

About

The rise of SaaS based platforms for business management has accelerated digital transformation across industries, specifically for mid-size businesses. A big reason for this shift is the focus towards integrated technology stacks. SaaS based products like customer relationship management (CRM), enterprise resource planning (ERP) and specialized point solutions can seamlessly integrate and drive value.

Given the new focus and increasing need to optimize business processes, cloud native solutions are being built to cater to the needs of mid-size businesses. This development is a testament to the direction in which mid-size businesses are evolving i.e optimizing processes, improving collaboration and focussing on data-driven decision-making.

Hyper growth businesses looking to scale are moving from on-premise to cloud native ERP options. Notably NetSuite, a pioneer in cloud-based business management software, has seen accelerated adoption across the globe.

NetSuite is a new generation ERP and has seen tremendous adoption across industries. Here are a few reasons why-

- Supports out-of-the-box functionality- NetSuite has a robust ecosystem of open APIs, to support domain-specific solutions

- Standard processes and easy integration- The product does not need an army of IT professionals to configure and implement

- Functionally rich- The platform is easy-to-use and offers hassle-free access to information

- Focus on mid-size business- Although a lot of large organizations use NetSuite, it has transformed mid-size businesses across industries

In this e-book, we will explore how to enhance accounts receivable processes with out-of-the-box functionality that fit with NetSuite seamlessly.

Charting the Path to Accounts Receivable (AR) Automation

NetSuite users find it difficult to customize the ERP as per their requirements and usage. It’s tricky to model the system to support all operational, reporting and functional requirements.

External consultants assist organizations to navigate issues with standard processes and to bridge functional gaps. However, this approach may result in sub-par processes as consultants rely on replicating existing workflows in NetSuite. A band-aid fix approach hinders organizations from deploying best in class processes. Other inherent shortcomings of this approach include added costs and increased system complexity.

API economy

Technology usage and deployment strategies are evolving with the rise of standard cloud native ERPs like NetSuite. In line with Gartner’s vision of Postmodern ERP, organizations are looking to automate and link core business processes with best-in-class solutions through open integration.

Given the IT resource constraints, mid-size organizations need to identify digital transformation programs that help attain desired results. At the same time the solutions also need to seamlessly plug into existing systems like ERPs with minimal disruption and resources.

Complement NetSuite with out-of-the-box (OOTB) support to simplify accounts receivable

NetSuite, in addition to encompassing core functionality, is also a strong base to deploy OOTB functionality.

What is OOTB support?

OOTB support can be defined as an add-on that enhances the process-level functionality of the base technology. In the AR context, OOTB functionality seamlessly plugs into NetSuite through its rich API eco-system and automates the function.

Show me the value!

Other benefits of OOTB AR functionality include:

- Reduction in days sales outstanding (DSO)- Significant improvement in collections with automated workflows

- Lower operational costs- Less manual intervention and drastic reduction in errors resulting in cost reduction

Additionally,

- Reduction in FTE deployment by 60%- Zero touch processes save precious FTE hours spent on tactical and repetitive tasks

- Improved strategic focus- Finance heads can focus on more strategic activities such as budgeting, forecasting and cash flow optimization

Upgrading NetSuite: Unlock Additional Value with RadiusOne

Let’s dive deep into your accounts receivable in NetSuite to diagnose gaps and access corrective actions. We’ll also look at how integrating Netsuite with OOTB AR apps improves functionality.

Enhance AR functionality within NetSuite by improving collections, cash reconciliation, and credit risk management

Collections and eInvoicing

“Firms that rely on manual processes take 67% more time to follow up on overdue payments than those that use automated AR processes” -Pymnts- B2B payments innovation readiness

- Central collection processes and dunning strategies

NetSuite does not have a central native collections management system. Users have the option to buy a standard add-on from NetSuite but this add-on only supports basic functionality. The lack of a collections module results in limited visibility into AR status and makes it difficult to manage delinquencies.

Only Safesearch based filters can be used in NetSuite to access AR based on age.

RadiusOne can help centralize your collections processes.

How?

RadiusOne’s built-in dunning strategies can be leveraged and customized to suit business needs. The tool helps to have a proactive collections approach and provides suggested follow- up actions, frictionless e-invoicing and faster e-payments.

A centralized dashboard with intuitive tabs gives full visibility into collections. You also get real-time visibility into process health metrics (bad debt, DSO, CEI) for effective collections strategies.

- Prioritized worklist

NetSuite supports a basic worklist. Often this results in challenges like difficulty in identifying critical accounts, haphazard communication, and increased risk of write offs. Given the limitations, collections is a more reactive process than a proactive one in NetSuite.

RadiusOne can optimize your collections processes.

How?

Prioritized collections help AR analysts automatically prioritize high risk customers and predict delinquency. AR teams can then follow up on communication options based on priority and customer risk. This saves time, provides high visibility into cash flow, and lowers risk

RadiusOne provides a real-time worklist with prioritized accounts and recommended actions. The prioritized list is created based on various parameters and scores to optimize collections.

- Automated correspondence and VOIP calling

NetSuite does not support auto-correspondence. Users can create workflows to send out templated emails based on the age of accounts receivable. The workflow lets you send the emails at specified intervals but the process is largely static and difficult to track.

However, a few functional enhancements can make the process automated. Given the volume of follow-ups, dunning processes need to be prioritized and supplemented by additional means like voice calling from within the system.

RadiusOne can automate dunning.

How?

Automated dunning allows smooth communication with all accounts. Since all active accounts can be reached easily, risk of write-off decreases. Customer data is automatically pulled from the ERP. It also has the ability to auto attach invoices.

Auto correspondence- RadiusOne allows you to segment customers on different parameters based on your business need.The collection strategies such as automated correspondence and prioritized workflists are then auto-defined based on your customer segments.

Volume of Automated correspondence, saving precious FTE time

In-app calling helps analysts easily pursue high risk customers. Notes and tasks can be set up based on the call and payments made on behalf of customers if they share credit card details.

- Buyer portal

NetSuite supports payments in your customers’ preferred formats including checks, cash, credit card, and funds transfer. However, limited support of a central payment portal hampers customer experience and makes the payment process less efficient. Customers can’t view overdue invoices or accounts without a self-service portal.

RadiusOne improves efficiency of the payment processes.

How?

Central customer portal enables clients to manage invoices, view account statements, and make payments. It also supports the sharing of payment links.

Self-service customer portal enables automated invoice delivery, setting up of auto-pay options and payment for multiple invoices at the same time. All this helps in faster payment processing.

- Dispute management

Managing customer disputes is a major pain point for AR teams due to their time sensitive nature, complexity, and limited visibility. With no central method to log and view disputes, NetSuite relies on ticket method and requires additional support for case management.

RadiusOne can automate dispute management processes.

How?

RadiusOne offers a central self-service portal that allows customers to log, view and track all disputes. Similarly, AR teams can create and identify disputes as well as assign a team member for faster dispute resolution. Quick dispute resolution lowers the risk of bad debt and improves customer experience.

Supplier side access to log and view disputes

Cash reconciliation

“AR departments dedicate 24.5% of their staff to supporting invoicing and 23.2% to managing payments” -Pymnts- B2B payments innovation readiness

- Automated remittance gathering and OCR

NetSuite supports remittance gathering but the process is largely manual. Financial analysts aggregate and update payment processes from various sources like emails, web portals and lockboxes. The process is time-consuming and error-prone.

RadiusOne can automate this process end-to-end.

How?

Advanced data aggregation engines in RadiusOne can capture all payment information from configured channels.

Email parsers gather remittance information received by email. These emails are auto-forwarded from analyst email-Ids to secure domains and mapped to the respective accounts.

Web aggregation engines help capture information from the customer and bank portals periodically.

The OCR engine is capable of scanning checks and capturing data seamlessly.

- Automated matching of invoices, payments, and remittances

The final leg of a commercial transaction is to close the invoice once the payment is received. This process requires a lot of manual intervention in NetSuite. The remittance has to be matched to payment and both need to be matched to the open invoice.

RadiusOne can automate invoice matching end-to-end.

How?

Zero touch cash posting into NetSuite (ERP) can be done via RadiusOne’s automated matching system. It supports customer identification and multi-variant invoice matching with payments and remittances.

The total amount of open invoices is pulled from the ERP and the payment amount is gathered from the remittance information. Both amounts are matched and updated in the base system.

Credit risk management

NetSuite does not support any credit risk assessment functionality for potential and existing customers. This process of risk-mapping is entirely manual and error-prone.

A well-defined credit risk management structure backed with specific functionality and workflow can mitigate credit risk liabilities.

- Online credit application (OCA)

Onboarding a new customer is a hassle for finance analysts as it involves conducting thorough background checks and ascertaining creditworthiness. With the existing setup, the OCA form in NetSuite needs to be sent out to potential customers for their onboarding. This is done outside of the NetSuite system.

RadiusOne can automate the on-boarding process.

How?

RadiusOne provides OCA templates that can be sent to customers via email or be hosted on the company website. On-boarding customers with the integrated form is seamless and saves time. Additionally, this ensures mandatory fields are filled and a workflow can be enabled for approvals from senior management.

- Automated credit scoring

Assessing creditworthiness and deciding credit limits of potential customers is largely a manual task in NetSuite. Credit analysts rely on existing commercial knowledge or credit agencies for this. Analysts need to manually browse multiple data sources to pull relevant data and plug it into the credit score formula.

RadiusOne can automate the credit assessment process.

How?

RadiusOne’s automated credit data aggregator supports workflows that can be set to fetch information from banks and trade references provided by customers in the OCA form. The system can access trusted financials and data sources, allowing visibility into customer’s credit history.

All aggregated information is processed through a formula that generates a credit score. The credit score is the basis for credit allotment, directly enabling risk mitigated business development.

- Credit utilization tracking

Keeping track of credit utilization enables the AR team to forecast cash flow and map exposure. Credit utilization is also an essential metric for further credit allocation. With no credit module available in NetSuite, keeping track of credit information is manual and cumbersome.

RadiusOne can automate credit utilization tracking.

How?

RadiusOne’s credit data aggregators track credit utilization data centrally in real-time. This data forms the basis to assess additional credit allocation requests. Credit analysts save significant time with automated tracking.

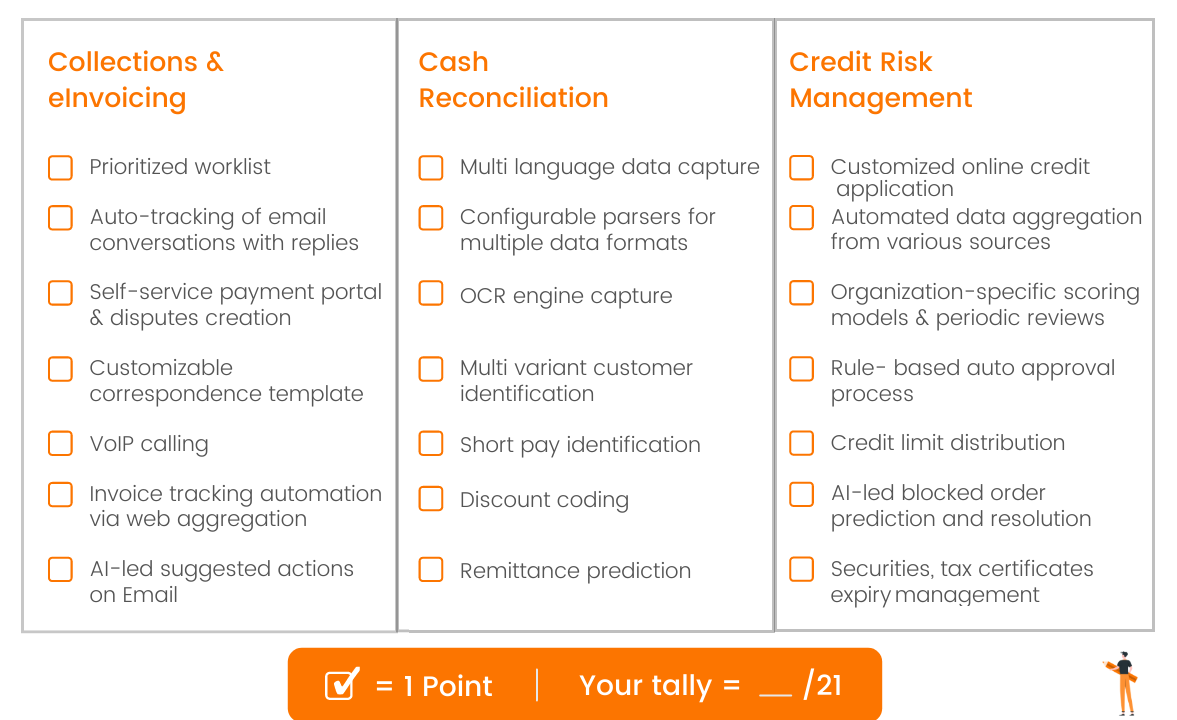

AR Benchmarking Checklist

Here’s a quick checklist to benchmark and identify the level of functional automation support with your NetSuite set up.

Taking the Leap with RadiusOne

The return on investment (ROI) and intrinsic value of supercharging your ERPs like NetSuite with advanced out-of-the-box tools is quantifiable. RadiusOne, a leader in AR automation, is specifically built for mid-market businesses. RadiusOne AR suite is affordable, quick to deploy, and functionally rich.

Finance heads can create a clear business case for automation when facing decisions to scale operations.

These decisions include—hiring additional FTE vs automation and prioritizing strategic initiatives. The competitive market is amplifying operational problems as firms struggle to reconcile their invoices and minimize their own cash flow crunches. Investments in automation can alleviate many of these issues.