Streamlining Deductions Operations: Resolving Deductions 2x Faster

This e-book presents information on deduction automation that every A/R leader should know before starting their automation journey.

Executive Summary

Deductions volumes have been growing over the years, making it more challenging for companies to handle the work with existing resources. According to the 2018 Customer Deduction Survey, 32% believe overall deduction dollars as a percentage of sales in the past 12 months have increased.

While deductions continue to surge, the main concern for managers and supervisors is to ensure adequate coverage and research for the incoming deductions and to meet targets with a lean and effective team. Companies will continue to lose millions of dollars if the gaps in deductions research, write-offs, and invalid deductions processes are not identified and filled. The threat is also amplified by the fact that customers are becoming more stringent in their deductions policies, sometimes engaging third-party services to explore discrepancies in transactions and raise disputes post-audit.

Automation plays a crucial role in helping companies return their focus to high-value activities. A majority of the constraints hampering credit and A/R managers could be overcome by identifying low-value manual activities in deductions processes and automating such wasteful steps. Keeping that as a focal point of discussion, this article analyzes the nature of deductions and the low-value manual tasks that are taking up valuable time and resources. Best-in-class automation options available for speeding-up the resolution process will also be explored.

Introduction

The complex buying and selling of products in a B2B environment has many challenges. Manufacturers identify distribution channels, composed of retailers, distributors, dealers, service providers or other manufacturers, to sell their products. Complexities arise due to the following practices:

- The flow of goods and the flow of money have different end-points and cycles as various departments and teams are involved in bulk delivery, payments, procurement and so forth.

- The unit price of the product varies based on customer reputation, sales, volume, promotions and seasonality.

- A gap exists between the shipment of goods and the receiving of payments which has to be accounted for by the receivables team in the form of day sales outstanding (DSO).

Managing deductions, disputes and chargebacks are among the challenges that arise due to this complex buying and selling process. During the payment process, the customer may pay less than what is outlined in the invoice due to earned-discounts, faulty deliveries etc. The amount that is short on the invoice in the payment process is termed a deduction.

Typically, deduction practitioners divide the incoming deductions into two types:

- The deductions which arise from promotions, discounts, markdowns and advertising are called trade deductions. Such deductions are easy to investigate and resolve because the promotions and discounts are generally planned in advance and tracking a deduction against a trade promotion is easier to navigate. Even though the vast majority of trade deductions are valid and the process to resolve is clear, they still take significant resources and time due to the highly manual nature of the research involved.

- Non-trade deductions make up all other types of deductions such as shortages, damaged deliveries, invoice errors, etc. Such deductions might be mixed types and are often unpredictable and complex, requiring collaboration from teams across the organization.

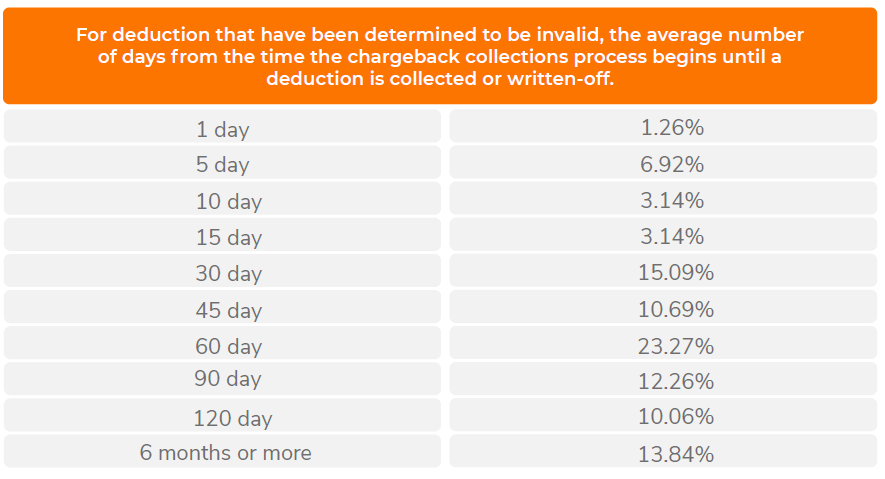

A rise in deductions volume is indicative of a various circumstances. It could mean that retailers and distributors have become more aggressive in claiming deductions. It could also mean that the suppliers and manufacturers have not been able to successfully avoid preventable deductions. Deductions left unaddressed could make a significant dent in the bottom line. But the heavy manual effort required to resolve deductions has traditionally meant that the cost of fixing the issues overruns the benefits. A deduction takes anywhere from a few days to more than six months to get resolved, depending on the nature of the deduction. Many manufacturers prefer to write-off low and medium value deductions to simplify things and save on resource costs. These write-offs add up over time, leading to significant losses in the long-term.

As deduction volumes continue to rise, the problems demand a fresh perspective. Companies have had to increase their efforts on the timely review and follow-up of deductions, and establish cross-functional teams for better accountability. However, all these undertakings are resource-intensive and the costs run high.

Therefore, the value to automate processes for deductions management is tremendous, especially for trade deductions, which account for the largest proportion of all deduction types.

Trends

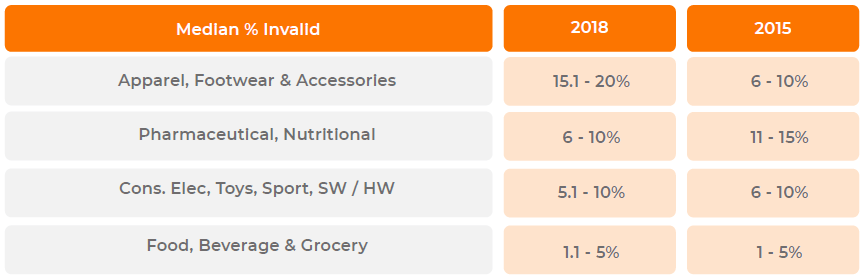

The Credit Research Foundation (CRF), in collaboration with the Attain Consulting Group, monitors the trends in deductions across industries. A recent survey collected data from 2015 and 2018 and put forth many significant findings for the deductions practitioners. The survey report was analyzed to understand the state of deduction management for various industries.

Figure 1: % of companies reporting an increase in deductions dollars in past 12 months

32% of the respondents in 2018 have observed increasing deductions compared to 30% in 2012.

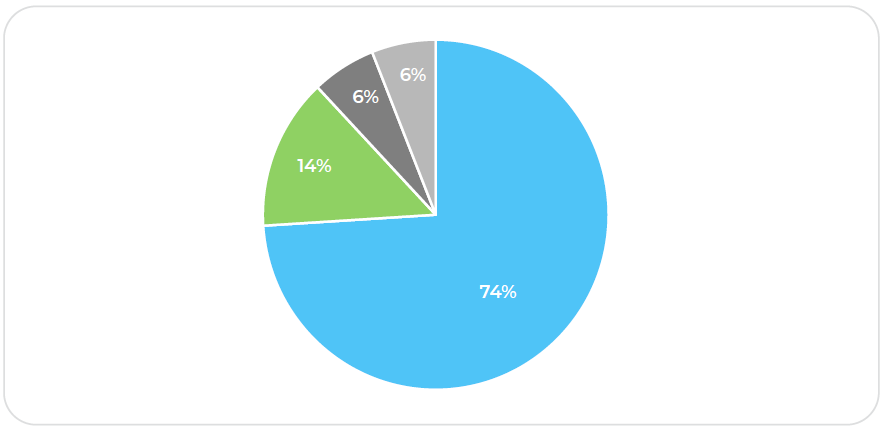

Figure 2: Invalid deductions as a % of overall deductions

Over the same period invalid deduction have increased from 6-10% to 15-20%, while at the same time the recovery of invalid deductions dollars has become less effective.

Figure 3: Invalid Deductions Recovered

Finally, fewer companies are able to complete a chargeback in less than 45 days while more companies are taking 60 days or more.

Key Challenges

While some of the trends are not encouraging, the data still does not give a clear picture of the precise issues companies are facing in managing the inflow of deductions. Some of the major issues that A/R leaders are facing in this space are:

- Cross-department cooperation

- Inefficient processes

- Access to information

- Lack of resources

- Senior management buy-in

All of the above issues have to do with internal processes and teams – internal to the organization’s capability to rectify the issues in deductions management. Unfortunately, it is often determined that deductions are not an area to focus transformation for an organization as the impact on business is low. Hence, creating the buy-in for reforming deductions is often difficult as it is seen as a low priority activity for CFOs compared to other problems with more visible impact. Regardless, reforms in deductions should still be considered.

For deductions, cross-department cooperation is one of the most complex issues. Although deductions are a company-wide problem, the major responsibility to resolve a deduction remains with the credit and A/R department. This creates a complex scenario because the investigation responsibility is with the A/R team while the investigation execution may include one or more different teams. To solve this contention, companies have been experimenting with increased accountability for different teams. Cross-functional teams and vendor compliance groups have been deployed by many large firms to improve communication, both internal and external, and resolve deductions.

Inefficient processes are a major issue in deductions management as well because of the high percentage of manual tasks and the high variability in workflows for different types of cases. But even though deductions management has many challenges, it also presents many opportunities. When the gaps are large, technology helps to rapidly close the holes and allow businesses to realize considerable efficiency gains in a short time.

Access to information is another definitive component necessary to resolve deduction cases. Deduction research has to be backed by documentation. But collecting all the documents and keeping them in order incurs significant costs. The rapid retrieval and association of backup documentation in a timely manner is a game-changer for deductions.

Lack of resources has also been a consistent issue for the deductions team.

Challenges in Deduction Resolution

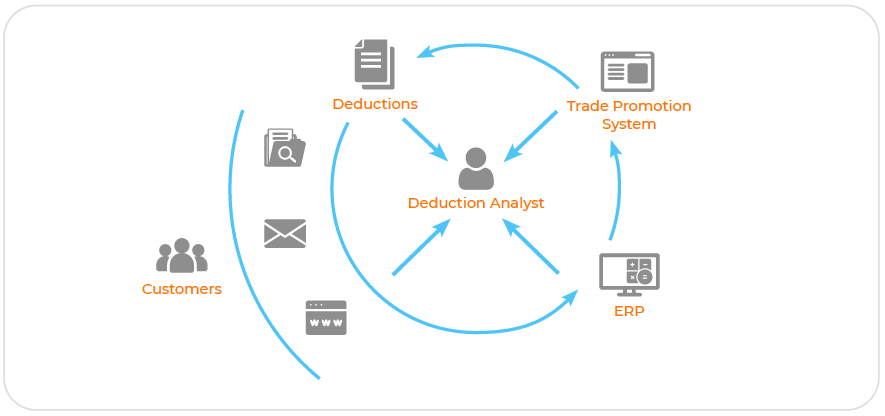

Figure 6: Resolution Process for Deductions

Typically, a deduction proceeds through a set of stages for resolution (Error! Reference source not found.). After the deduction arrives, the back-up documentation, including claims, proof-of-deliveries, and others, need to be collected from different sources. Once all the information and associated proof of documentation have been compiled, the individual deductions need to be researched and validated. Additional cross-team research, typically involving the sales teams, needs to be carried out, usually before verifying a trade deduction. If the deduction is found to be valid, credit is issued or the amount is written off and the deduction is closed. If the deduction is found to be invalid, the deduction is denied and the amount is sent back for collections.

Deductions teams face several challenges at various stages in the process as outlined below.

5.1 Identify Types of Deductions

With many different types of deductions arriving from various sources, each deduction needs to be identified and coded for processing either together or separately from other deductions or claims. Customer codes need to be mapped to internal company codes to be sure the deductions are aligning with the correct internal reason codes.

Working capital can be used to forecast plausible financial difficulties that may arise. Insufficient levels of working capital might cause financial stress on a company leading to borrowing loans, late payments to banks and suppliers thereby resulting in a lowered credit rating. A low credit rating leads to higher interest rates from banks and obstacles in doing business.

5.2 Maintain the Document Backups

Downloading, sorting, indexing and linking deduction documentation is an onerous and time-consuming task. The multiple, varying sources from which the claims and POD documents need to be retrieved (website, email, EDI, mail) make the task difficult to standardize. Additionally, for trade deductions, significant time is spent extracting relevant promotion and deduction data from the aggregated documents before the research is even able to start.

5.3 Match Deduction Cases to the Corresponding Trade Promotion

In most manual scenarios trade deductions are a separate business process, and deductions analysts have to toggle between the ERP, trade promotions management and deductions management systems to figure out the trade promotion from which the deduction has been taken. Data from the trade promotion, such as the promotion ID, committed amount, disbursed amount, and so on, need to be carefully matched before approving the deduction.

5.4 Research the Deduction Cases

Deduction cases may require follow-up with the sales, marketing, operations, and customer relationship teams. Without a systematic way to track the case, scrolling through thousands of deductions becomes extremely difficult. The end result is delayed resolution and poor accountability.

5.5 Customer Correspondence

Deduction correspondence letters such as denial correspondence or follow-up on invalid deductions need to be composed, scheduled and tracked across thousands of cases. Manual handling of correspondences leads to poor customer relationships, irregular or no follow-up and low deduction recovery.

Automation Techniques

Automation of manual, repetitive and low-value tasks is a very successful method to speed up deduction resolution. In the resolution process discussed earlier, each step of the process contains many repetitive tasks that could be automated to free-up resources to then focus on high-value and complex activities instead. Automation also brings down the cost of processing deductions drastically. The sections below cover the automation of low-value tasks in detail.

6.1 Backup Aggregation

Many medium and large customers upload their claim documents to a web-portal and provide the suppliers/manufacturers with the login. Other customers use formats, such as emails, EDI, and paper documents to share the details of the claims. Backup aggregation involves downloading and maintaining documents such as claims and PODs from these various sources before starting the deductions research. Collecting backup for thousands of deductions cases every day becomes a time-consuming and tedious task. Moreover, extracting the associated deductions documentation is only the beginning of the overall deductions research workflow.

Fortunately, backup aggregation is a routine task with fairly consistent steps for most of the incoming debit memos. Modern technology provides options that allow analysts to shift their attention from these mundane tasks to more valuable tasks. Best-in-class backup automation solutions identify the source, read and understand the source message, extract the data and standardize it.

6.2 Critical Properties for Backup Automation

Efficiency

The purpose of implementing backup automation technology is to free-up as much resource time as possible by automating manual tasks. It is important to measure and benchmark the percentage of the manual work being eliminated in this fashion. For example, if someone is required to manually identify sources before the automation technology is able to download it, it is not efficient enough.

Additionally, businesses are looking to rapidly implement solutions and realize the benefits faster. Only a few vendors are able to provide a plug-and-play solution for backup aggregation in deductions management.

Versatility

Versatility is the degree to which the technology is source-agnostic. In selecting a solution, be sure to find one that supports extraction from all types of sources such as websites, email, images, and EDI. Check for accuracy in standardizing the document backups to simplify research for deduction analysts. Also, be sure the solution provides pre-integrated download facilities to all the major retailers’ claim websites in the customer portfolio.

A solution with end-to-end process automation could automate as much as 95%, if not more, of the A/R tasks to resolve trade deductions. Additionally, about 20% of the time spent by deductions teams could be freed-up using automation technology.

6.3 Documentation Collection and Sorting

Downloading backup documentation in a source-agnostic, efficient and accurate way is only a part of the whole solution. Linking these documents to the original deduction case and sorting, indexing and categorizing the documents must also be addressed. At times the volume is so immense that companies with a large inflow of deductions need to employ additional teams to handle the document management overflow.

Every deduction document needs to be sorted and indexed so that the analyst is able to easily locate the piece when required. This is done based on various parameters, for example, the type of deduction (trade or non-trade), the responsible department (operations, sales, or warehouse), customers by buying volume (large and small), customers by-products, and so on. This quickly becomes very complex when all deduction categories are added together for thousands of customers.

The next step in the process is the linking/matching of each document to a particular deduction. Again, this is a manual process that involves identifying attributes on debit memos, including claim ID, debit memo number and dates, searching the open deduction in the ERP or other applications, and tying the document to a particular deduction when a match is found. Current technology reduces this humongous scale of work to three easy steps as follows:

Identification

The type of document and the details within, such as customer ID, amount and type of deduction, purchase order, and invoice number, need to be identified to link it to the appropriate deduction case. However, most existing software solutions are unable to accurately extract the information due to legacy technology issues. Consider the claim document image shown in

Figure 7: Sample Claim Document

The information elements that a deduction analyst would require are the claim #, the claim date, PO #, claim amount and so on. Optical Character Recognition (OCR) is widely used to read the image document and extract the data details. A typical OCR engine divides the document into capture rectangles, aligning each data piece on the image into a box. The OCR reads the data pixel by pixel from each box and converts it into human-readable text. However, a number of difficulties arise with OCR, including:

- Not every claim document is formatted in the same way

- Not every claim document has same information

- Other formatting differences occur – font type, color, size, printing clarity, etc.

Hence, the accuracy of OCR is low and dedicated resources may be required to check for errors and exceptions for the documents being processed.

The use of Artificial Intelligence (AI) and Robotic Process Automation (RPA) are the keys to solving the problems not resolved by OCR. AI is a machine learning-enabled system that processes even the most complex and non-tabular, mixed structured data from a multitude of formats. AI is able to capture the content, extract the information, make sense of the data and correct for quality issues. If the concept of AI is applied to the A/R challenge, some unique solutions could be visualized. For example, by repeated reading of claim documents, the AI engine begins to understand the typical invoice number locations, how many digits, in general, are present in the claim number and which data type is preceded by a “$” symbol to represent dollars, and so on. The more documents the AI engine processes, the greater its accuracy becomes.

RPA modularizes the automation steps and provides end-to-end process automation by emulating real-world business steps. The solution operates as several “process automation units” performing in tandem to enhance the task output for the business users. RPA orchestrates across all the automation steps for the various types of deductions and related processes and steps.

Linking

Once the information is successfully extracted from the document, the claim needs to be linked to the actual deduction or dispute case. The open A/R details are acquired by the linking software to match it to the data extracted from the claim and POD documents. A robust linking engine would extract the required details from open A/R and align it to the matching claim document.

Research-Ready Deductions

Displaying the completely matched deduction case with the documents and details is the final step in preparing the deduction case for research and analysis. Deductions analysts are able to review each deduction item upon login to the solution with all the details and documents readily available.

6.4 Trade Promotions Matching

Customers often negotiate rewards, discounts, rebates, and other promotions, then use short payments to recoup the reward benefits. However, this creates extra work for the deductions team as every trade deduction needs to be validated against the promotion to which it applies. Deductions analysts have to find, match and analyze the trade deduction to validate the short payment. Automation plays a critical role in helping the deductions analyst clear the trade promotion deductions rapidly, and also frees additional time for the analysts to review the more complex deduction items and resolve them. See

Figure 8: Deductions Analyst Tasks – Researching Trade Deductions

The deduction analyst is at the center of the resolution activity. The analyst has to gather information from various sources, such as:

- The incoming claims and deductions

- The ERP which contains the details on the deduction

- The customer systems from where the claim document is to be downloaded

- The trade promotion management system which contains the details of the promotion against which the customer has taken a deduction

The time taken to collect the relevant details and the monotony of doing the same activity over-and-over for every trade deduction drastically reduces the efficiency of analysts. As a result, trade deductions, which are easy to process, take more time while the more complex and time-demanding deductions related to shortages, compliance and others are not allocated enough time for quality analysis (Error! Reference source not found.). Furthermore, due to the aging limits on a deduction, the critical items are written-off leading to an unwanted revenue loss.

Figure 9: Tasks delayed due to manual processes

Technology helps match the claim details to the trade promotion details automatically and provides suggestions to enable deduction analysts to make quick decisions and close the deduction. The time savings are immediately available to analysts to investigate critical deductions and reduce write-off.

6.5 Research and Workflows

The most critical parts in the lifecycle of handling deductions are the research, root-cause analysis and decision-making on the open deduction cases. These activities require expert investigation because of the variability and complexity in the nature of deductions. A/R teams perform deductions research in 66% of companies, while sales teams approve deductions in 55% of companies. Various other departments may also be involved in linking deductions within the organization.

Keeping track and following up on hundreds of deductions simultaneously across departments is not only expensive but also time-consuming. Ultimately, much of the dollar amount associated with deductions is written off because of the rising cost of investigations. This creates a strong case for conducting a deductions workflow with the following attributes:

- Coordination and Collaboration: Employ easy assignment, access and approval methods to help teams organize their activities, prioritize the cases and communicate the resolutions rapidly.

- Visibility and Accountability: Utilize comprehensive tracking and reporting mechanisms to remove bottlenecks in the approval and investigation chain and thereby improve accountability and efficiency.

- Speed: Streamline deductions processing using workflows to reduce DDO, improve deductions resolution time, and boost the coverage and recovery for more deductions.

- Automation: Integrate robotics to perform the manual, clerical tasks freeing up resources to investigate more deductions and reduce write-offs.

6.6 Correspondence

Traditionally, correspondence templates have been a nightmare for the A/R department. To a large extent, this arises from dependency on IT to incorporate any changes in the letters and template.

Correspondence letters need flexibility around the email format, attachment options, and content. Correspondence solutions should provide the following benefits to the credit and A/R teams:

High Accuracy

Irregular or inaccurate notifications impact customer relationships and deduction recovery rates significantly. Every correspondence template requires specific types of documents or information attached or copied with the emails. For bulk mail, a system’s ability to accurately create and send letters is essential for analysts to remain productive.

Ease of Setup

The ease with which correspondence is set up and executed has an impact on the level of automation achieved in the dunning process. Best-in-class solutions should be able to execute the correspondence effort in a few clicks, allowing business users to manage them on their own and eliminate the need for IT involvement.

Improved Tracking

Being able to systematically track history and fine-tune correspondence strategies is a powerful functionality for credit and A/R teams. Correspondence history and tracking provide many benefits, including:

- A quick summary of interactions with customers

- Details on customers who are not responsive to email communication

- Details on the correspondence that work the best

- Optimized time-gap between correspondences

This intelligence and other benefits that could be realized with an automated correspondence solution improve the correspondence strategy and help adopt best practices for customer communication.

Potential Savings from Deductions Automation

The success of any automation project should be measured similarly to other business process alignment and outsourcing projects. For example, an outsourced project could be measured in terms of costs, quality, and timeliness. Similarly, a KPI alignment project could be measured by comparing the achieved KPI improvement against the targeted improvement.

The success of a deductions automation project should measure:

- Operational efficiency in terms of throughput – deductions resolved per unit of time

- KPI improvement using software automation – Days Deductions Outstanding, # open deductions, dollars of open deductions, etc.

The automation of deductions will generate savings in the following categories:

- Process improvement savings

- DDO improvement savings

- Deduction recovery improvement savings from non-trade deductions

- Deduction recovery improvement savings from trade deductions

7.1 Process Improvement Savings

We have discussed the low-value tasks related to deductions in the previous sections. Automation could eliminate these low-value tasks and provide improvement in the following eight areas:

- Identifying deductions

- Retrieving and associating backup documentation

- Researching and validating deductions

- Issuing credit and clearing deductions

- Generating deduction denial and other correspondence

- Improving interdepartmental communication

- Improving customer communication

- Reviewing other / ad-hoc deductions

Each of the steps above have a certain percentage of manual activity associated with it that could be automated. For example, backup retrieval automation could reduce manual tasks by 40%-60% and deductions research automation could reduce manual tasks by 20% to 30%.

7.2 DDO Improvement Savings

For deductions team, DDO is an important KPI to track and measure. A higher DDO is an indicator of lax processes in the deduction resolution cycle. Best-in-class automation helps to decrease DDO by reducing:

- The time taken to determine the validity of deduction once it arrives

- The time taken to recover an invalid deduction

The median time taken for determining validity is around 30 days, while the time taken for recovering an invalid deduction is approximately 60 days[1]. Streamlined and automated business processes could help reduce DDO by more than 30%.

7.3 Deduction Recovery Improvement Savings

Invalid deductions for some industries go beyond 10% of the overall deductions, while the recoveries could be a meagre 50%. Due to lack of resources, follow-up is not systematic and invalid deductions are often not recovered.

From our experience of working with multiple customers, we have seen that a 10% improvement in deduction recovery for a $1 billion company would roughly result in hundreds of thousands in savings annually. With the right solution, the coverage of deductions and the percentage of deductions recovered could be improved to a considerable extent.

Other Considerations

Below are outlined a few other noteworthy factors to consider.

Implementation Duration

The implementation cycle could take a few hours to several months based on vendor capabilities. A quick go-live is mission critical and a must for a positive ROI on an automation project.

Degree of Flexibility

Not all businesses are the same, therefore, the software application needs to be configurable so that it is able to easily be fine-tuned to the requirements of each organization. Business users should be able to make configurational changes without involving IT to make backend code changes.

User Adoption

A good understanding of what type of ramp-up is required for new users is needed for a successful implementation. It should also be determined how much time would be required to train users on the new system.

Reporting and Analytics

Check the reporting mechanism for the software and determine if the solution provides out-of-the-box dashboards to review deductions management performance.

Summary

The key factors to keep in mind while planning a deductions automation project are the business needs, automation needs and opportunities, expected ROI and robustness of the technology. Best-in-class solutions employ Robotic Process Automation (RPA) and Artificial Intelligence (AI) to achieve higher automation percentages and reduce the manual, low-value tasks to a bare minimum.

Additionally, business value for deductions automation should be measured by three different indicators to include operational efficiency, DDO reduction and improvements in deductions recovery. The ROI model should take these improvements into consideration and measure the dollar benefits to determine the success or failure of the project.

About HighRadius

Order to Cash & Treasury

Automation, prediction & insights

powered by Artificial Intelligence

Learn More