10 Easy Ways to Employ Tactics to Get Paid Faster

How Fortune 1000 companies and SMEs automate credit and accounts receivable operations to improve productivity and collect open A/R faster.

Executive Summary

CFOs rightly refers to “cash” as the oxygen for the business. However, an American Express report reveals that more than 46% of businesses experienced a cash flow crunch in the last year. In an ideal world, A/R cash, however, businesses routinely experience bad-debt write-offs and late Payments leading to a cash crunch.

Finance leaders worldwide have started with defining credit policies and driving teams towards adherence by incorporating Six-sigma process design and technology. In the process, finance leaders have also succeeded in shifting resources from tactical activities including cash application to strategic ones including credit and collections by embracing digitization of invoicing and remittance processes.

This ebook has distilled insights from a study of credit and A/R transformation projects at 300+ organizations on how Fortune 1000 companies and SMEs improved the collections process to get paid faster and thereby reduced DSO by 10%-20%.

The first four chapters focus on improving invoicing and collections process that has a direct impact on late payments, the following two chapters discuss the credit management piece that is often the root cause of delinquent accounts, chapters 7 and 8 focus on how resource-intensive operations in cash application and disputes clog A/R resources and how teams could automate these processes to move resources into credit and collections and the last two chapters focus on how to improve collaboration within the A/R team and also with the customer A/P team to ensure higher customer satisfaction and reduce delinquency.

Key Takeaways of this book include:

- Ensuring compliance with credit policy with collections strategies

- Lowering credit risk exposure through the proactive credit review process for existing and new customers

- Facilitating ways to improve electronic invoicing and payments adoption and cut costs by 90%

- Eliminating wastage in resource-intensive processes including cash application and deductions to refocus on credit and collections.

Improving the Invoicing and Payment Process

How often have your collectors called customers for payments only to receive a response that the A/P team didn’t receive the invoice? More often than not these responses are a result of paper-based processes that are dependent on too many people including the invoicing team, the customer.

Studies have said that companies are able to reduce DSO by 3-10 days with electronic invoicing. By adopting electronic invoicing credit departments are able to reduce the dependence on print and mail for timely delivery of invoices while also reducing costs in the process.

Top Challenges in the Invoicing and Payments Process

The top challenges associated with the paper-based invoicing process are listed below:

- Paper-based processes for invoicing that causes delays in sending and receiving

- Inability to track the delivery

- High cost

- Non-standardized customer experience

The top challenges associated with accepting electronic payments are:

- Expensive procedures for complying with PCI-DSS guidelines

- Lot of work for internal teams to apply cash as remittance comes in from a variety of sources including EDI, website, and email

- Expensive to accept credit card payments because of the transaction costs

- Disconnected invoicing and payments systems that cause repetitive work for collections analysts to retrieve invoices and accept payments

How Top Organizations Deal with Invoicing and Payments

Creating a self-service portal for both invoicing and payments is the first step. This removes the wastage in the collections process where roughly 20% of collector’s time is wasted in re-sending invoices to customers. This is enabled with a centralized online repository of invoices that can be accessed anytime by customers.

Top features that organizations leverage in these portals are:

- A self-service portal where customers can retrieve their invoices

- Ability to make payments through multiple options including ACH and credit cards

- PCI-DSS compliance for accepting credit card payments by enabling processor tokenization

- Lower card payment acceptance costs by leveraging Level III Interchange fees

- Tight linking into the A/R module to enable customers to create deductions right from the EIPP portal

- Ability to send/receive invoices on fax

- Automated print and mail service to customers who still demand paper-based invoices

EIPP Success Stories: Reckitt Benckiser

Reckitt Benckiser(RB) the leading consumer goods manufacturer had an expensive paper-based process for invoicing as SMBs depended on paper-based invoices while large customers were already using EDI for invoicing. By moving to an EIPP portal, RB was able to provide SMBs with lower cost e-invoicing options including e-mail and portal-hosted invoices to reduce the electronic invoicing cost by 98%.

Yaskawa America Inc, the American manufacturer of HVAC products saved $12,000 on credit card payments with a PCI-DSS compliant credit card processing solution by leveraging level III data in the ERP for maintenance and repair orders.

Ensuring That the Customer Data is Up to Date

Inaccurate customer data is one of the most underrated yet important reasons why payments get delayed. Since customer master data is used for sales orders, accounts receivable, credit and collections ensuring that the customer master data is up to date is paramount to preventing late payments.

Top Challenges with The Customer Master Data:

Top challenges with customer master data management are:

- Attrition in the A/P team that invalidates data on the single point of contact for the customer

- Mergers and acquisitions that often result in consolidation of horizontal functions including A/R and A/P

- Establishment of shared services teams for consolidating A/R and A/P teams

- Data changes and other miscellaneous changes that mandate a customer data refresh

How Leading Organizations Handle and Maintain Customer Master Data

The first step that organizations undertake is to establish a master data governance policy that establishes institutional ownership and accountability and defines the following:

- Elements and structure definition for customer master data

- Process for creating customer master data

- Process for maintaining customer master data

- Policy for access and usage

Data governance in itself is a large topic and leveraging PwC’s framework and incorporating the governance policy in the ERP could help organizations combat data corruption and ensure that the collections team reaches out to the right person for the collection of overdue invoices.

Master Data Success Story: Tyson foods

The credit and A/R team were challenged with data governance problems and unable to set the right credit limits and in some cases, reach out to the right contact for collections. This was chiefly because of Tyson foods had different customer master data for the parent organizations and the subsidiaries. Tyson embarked on a data cleansing initiative and eventually consolidated the customer data by 92%. This led to streamlining the credit and collections process and helped the team set the right credit limits.

Deciding Who to Contact on Any Given Day

On any given day, collections analysts spend up to 30% deciding on who to contact. The study states that 30% of Collections analyst’s time is spent in prioritizing and preparing for calls.

Collections analysts would rather get down to calling customers as soon as they start their day rather than waste time in preparing a list of who to contact. The lack of a collections worklist could lead to unnecessary dunning and wasted calls.

Challenges in Preparing a Collections Worklist

Most companies assign hundreds to thousands of accounts per collections analyst depending on the size of the company.

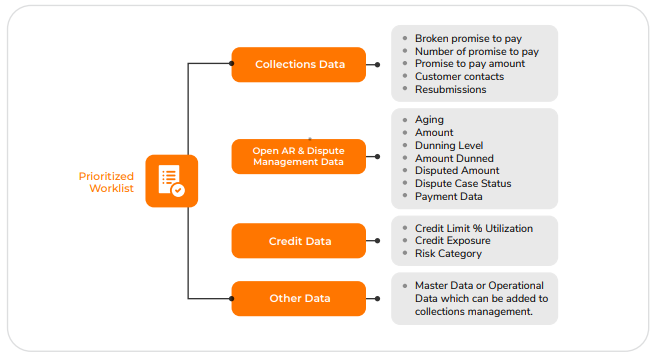

The above figure lists some of the most common attributes including dunning data, credit risk and the number of promises to pays that affect whether a collections analyst should contact a customer on any given day. It is impractical for the collections analyst to take into account so many variables and most often they only look at invoice due date and invoice amount and many of these calls go waste.

Automating Collections Prioritization Process

Most organizations already have a strong set of credit policies in place but the execution of these credit policies is mostly left to the team. Ideally, all the credit policies should be within the system and the system should be able to suggest who to collect from.

As the figure above shows, credit policies are used to assign scores for each rule the customer account/invoice satisfies and then an overall score is assigned. As an example, a credit policy could be enforced where any account whose cumulative valuation is more than 150 should be contacted on that day.

The prioritized worklist helps collectors to contact more accounts and centrally track the activity for review and followup. The result is a more efficient collections team that contributes to enhanced cash flow and reduced DSO.

Collections Correspondence Strategies

A study by McKinsey found that 70% of collections calls go to customers who would have paid anyway. This is yet another place to optimize the process to increase the efficiency of customer contact and improve DSO.

Challenges in the Dunning Process

The biggest challenge continues to be the account coverage and given the limitation in the number of collections calls that could be made on any given day. Agents are assigned too many accounts at a time and the preferred medium of communication is the phone with very limited time spent on other mediums including email and physical letters. Collections analysts focus on invoice value and aging data and make calls while ignoring a large number of assigned accounts, there are always accounts from the SMBs that makeup to 80% of the collections worklist but fall through the cracks since analysts tend to focus on high invoice value accounts. It is also impractical for collections analysts to call these customers for small amounts.

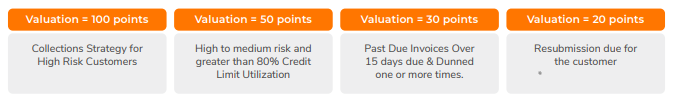

How Top Organizations Automate Collections Correspondence

As the figure illustrates, systems have to be designed so that the collections analysts call only the most critical accounts. This automation is an extension of the previous section where we talked about how to let the system handle credit policies and score customers on the risk that they pose for the organization.

Based on each account score, the system will be able to tell the analyst what the next step should be. For example, if habitual late payers belong to a customer segment, the system should suggest that collections analyst to send out email correspondence 15 days before the invoice is past-due. The system should also have ready-made email templates so that the analyst is able to send mass correspondence to all the customers in that segment with the click of a button. Taking correspondence automation further, the system should be able to automatically send proactive reminders for all accounts depending on the credit policies.

While email correspondence automation takes care of account coverage and brings the money to the bank through proactive reminders, collections analysts continue focusing on a high priority large accounts. This optimizes the collection process thereby reducing DSO.

Collections Success Story: Dr. Pepper Snapple and Yaskawa America Inc.

Yaskawa America, the leading manufacturer of HVAC equipment adopted automated prioritization of worklists and was able to contact more customers. The process improved overall to help Yaskawa in reducing DSO by 5.5 days and achieve a Collections Effectiveness Index of 90%.

Similarly, Dr. Pepper Snapple, the beverages major was able to improve collector productivity by 40% by adopting collections correspondence automation and reduce the number of accounts in a collection’s analyst’s worklist by 88%.

Customer Onboarding and Credit Approval Process

Customer onboarding is the first and one of the most important steps to reduce DSO. Most organizations ignore this step and take the word of the sales representatives or the customers to decide on credit limit assignments. Wrongly estimated credit limits could lead to bad-debt write-offs and high DSO.

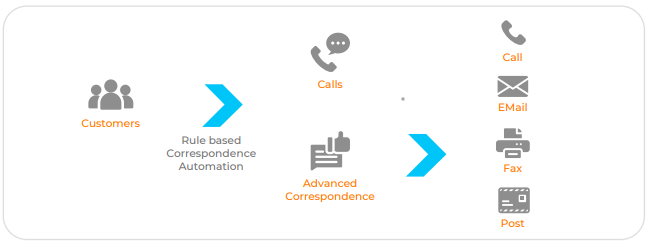

The Credit Application Process

According to a survey by NACM 33% of organizations are pressed for time to perform due diligence on prospective customers. This is because companies typically assign credit limits based on credit agency data, financials, credit insurance, and bank guarantees. All the manual processes including paper-based credit applications, gathering data from third-party agencies including D&B and Experian and credit reviews make it increasingly difficult for credit analysts to find the time and onboard new customers.

Top Challenges in the Credit Application Process

The top bottlenecks for organizations in the credit application process are:

- The volume of paper that they need to process and maintain each month

- Incomplete and inaccurate financial documents that they receive from customers

- Manual data entry into spreadsheets and ERP systems leading to errors and wastage of time

- Downloading credit reports from leading 3rd party agencies including Experian and D&B

- Calculating credit scores in excel spreadsheets

- Obtaining approvals on emails

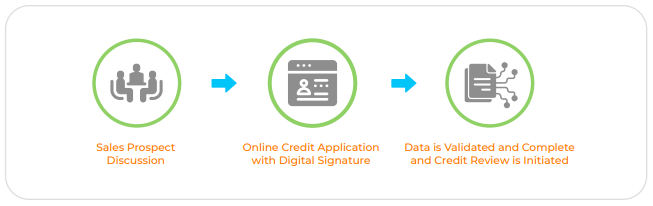

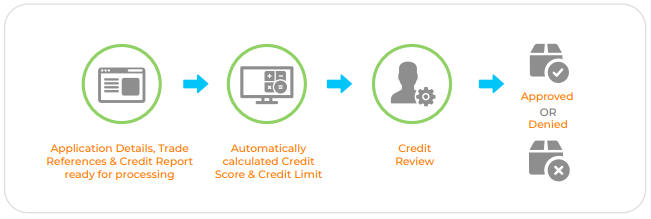

How Leading Organizations Handle Credit Applications

Moving credit applications online, integrating it with credit agencies and securing it with digital signature technology helps in eliminating manual work and incomplete documentation. It replaces a paper-intensive credit management process with an electronic one to enable better credit portfolio and risk management and to quickly onboard new customers. Credit score and credit limits are calculated automatically while workflows are assigned to relevant credit managers to review and approve the assigned credit limits.

Assigning the right credit limit to the customers helps firms to collect the payment on time thus, reducing DSO.

Online Credit Application Success Story: The Adidas Group

The Adidas group has about 10 different types of credit application formats that are filled by customers for requesting lines of credit from its various business divisions across geographies. In what was a very manual paper-based process, the credit team at the Adidas Group took more than four days to process a single credit application. In essence, what this meant was that the credit team was mostly focused on tactical activities while trying to get a complete credit application rather than spending it strategically on the credit review process.

The Adidas group started deploying credit applications one by one at each of their business units. After deploying the HighRadius online credit application, the team was able to bring the new customer onboarding time to less than 2 days with more than 90% credit applications received with complete data, right on the first attempt. The end result was that the team was able to review more credit applications per given while using accurate data to reduce the credit risk exposure and alleviate the risk of high DSO due to wrongly estimated credit limits.

Eliminating Subjectivity from the Credit Review Process

In the previous section, we discussed how inappropriate assignment of credit limits to new customers could lead to higher bad-debt and DSO. This section is about problems associated with the credit review process for existing customers.

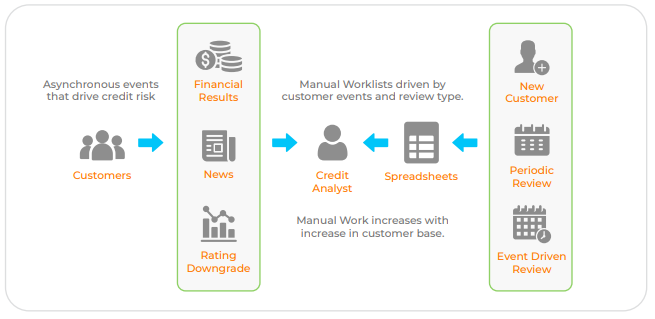

Credit analysts are assigned hundreds to thousands of accounts for reviewing credit limits, onboarding new customers and unblocking blocked orders. Since reducing credit risk exposure is a responsibility of the credit team, credit review processes need to be airtight. However, the sheer volume of accounts makes it impossible for credit teams to successfully cover all accounts which are due for periodic reviews. Constantly chasing the backlog of accounts means that credit analysts are often unable to focus on conducting a focused and accurate credit analysis.

Top Challenges in the Credit Review Process

Only after an objective analysis can a credit manager make an informed decision about extending credit [or continuing the existing credit] to the customer. While inconsistency in periodically reviewing existing customer credit lines is an issue, asynchronous events such as financial results, rating downgrades, and M&A activity could also be responsible for escalating credit risk. Figure 4 illustrates challenges related to both asynchronous events and internal SLA requirements that create a need for credit analysts to manually prioritize accounts for credit review.

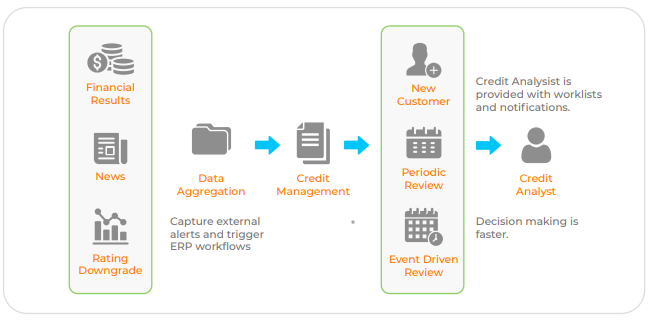

How Top Organizations Handle the Credit Review Process

The first step that organizations undertake to remove the subjectivity out of the process, is to make sure that all the credit workflows reside within a system. The system generates a worklist for credit analysts for any given day and consists of:

- New customer onboarding requests

- Periodic credit reviews

- Blocked order release requests

- Alerts from external agencies on bankruptcies and rating downgrades

Expiry alerts on internal collateral including bank guarantees, mortgages and credit insurance

The above figure illustrates how the system automates the above workflows and assigns them to the respected credit analyst or manager and allows them to scale operations to thousands of accounts.

Credit Management Success Stories: Air Products and TechData

Air Products and Chemicals is a Pennsylvania-based global leader for industrial gas and chemicals. The credit team had to deal with a fair amount of wastage in the credit operations – getting approvals on credit limits with credit managers on emails, downloading credit agency data for a large portfolio of customers and was challenged with compliance and inaccurate credit data. The team faced an uphill task of controlling credit risk exposure in the absence of the right tools. Today, the team uses a single solution to employ a global credit policy and automated credit review process for 320,000 customers worldwide.

Tech Data Corporation, currently ranked #108 in Fortune 500, is one of the world’s largest wholesale distributors of technology products. The credit team at Tech Data dealt with legacy systems and manual processes for credit reviews. Given a large portfolio of customers worldwide, the team had to daily log in to multiple portals for each geography to fetch data from credit agencies.

The team automated credit data aggregation and workflows to achieve a productivity boost of 120% in the credit review process and also saved $160,000 annually through improved efficiencies.

Doubling Down on Collections by Eliminating Waste from Cash-Application Process

Cash application is one of the more resource-intensive processes in accounts receivable and organizations are better off in automating cash application and shifting resources to higher-value activities including collections and credit. The other disadvantage of a slow cash application process is that it is an upstream process that further slows down deductions and collections process. As an example, if a customer had already paid for an invoice but the status is not updated as closed in the ERP, collections analyst will waste time by calling a customer who had already paid.

Top Challenges with The Cash Application Process

Organizations today receive payments through checks as well as electronic formats including ACH, real-time payments, and credit cards. Reconciling cash for checks and e-payments poses different challenges.

For checks, A/R teams typically receive a bank lockbox file that contains the payment details, however, ERP systems need reconfiguration to be able to read the lockbox file and apply for payments. This is a recurring problem whenever organizations either add a new lockbox service or switch banks. Also, lockbox services tend to be quite expensive to maintain as banks also charge significant key-in fees for capturing remittance data. Nevertheless, this keyed-in data is usually insufficient for successfully posting the payments. The cash application analysts still have to resolve exceptions due to incomplete remittance data or code the deductions while identifying short payments. All of these steps have been illustrated in the above figure.

Coming to electronic payments, while there is significant adoption of various formats, the cash application team is burdened with the cash reconciliation process as the remittance details are sent separately either through email, EDI or customer portals, and websites.

Though the payment itself is electronic and fast, processing the payments is highly manual and time-consuming. The analysts collect remittance from different sources, associate them with incoming payments, link them to corresponding open invoices, check for short payments and discounts and then post the cash in ERP which takes a huge amount of time and effort. All of these steps have been illustrated in the above figure.

How Top Organizations Automate Cash Application

As the challenges have highlighted, cost and resource wastage are problems that have to be addressed on the cash application front.

By leveraging machine learning, organizations are able to automatically aggregate remittances, reconcile cash and identify deductions. Figure 8 talks about how each of the steps – aggregating remittance documents, coding deductions and applying cash could be automated using an AI-based cash application system.

Cash Application Success Stories: Danone

Danone North America had four FTEs for cash application and with many North American businesses, they had both electronic and check payments that impacted their cash application process.

After leveraging an artificial intelligence-powered cash application automation solution, Danone was able to reduce the cash application team from 4 members to 1 and deployed the remaining members to other A/R functions.

Eliminating Waste from the Deductions Process

According to the study by Attain Consulting Group, about 90% of deductions are valid and about 60%-80% of the valid deductions are related to trade promotions. Irrespective of whether the deductions are valid or invalid, analysts spend the same amount of time in resolving deductions.

There’s still enough value in weeding out invalid deductions and add dollars back to the bottom-line. Automating deductions identification and research is yet another low hanging fruit to refocus resources from deductions operations to higher-value operations including credit and collections.

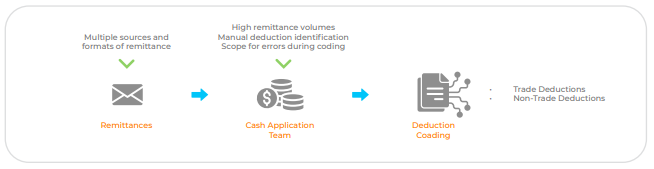

Top Challenges in the Deductions Process

The first challenge is identifying that there is a deduction. Most times, deductions could be directly identified at cash application but given the resource-intensive process and the volume of payments, this doesn’t get done. There is a second related issue of errors in entering the right deduction code into spreadsheets or ERPs because of manual work.

As the above figure suggests, right from identifying deductions and taking action, there are a lot of manual steps. One of the biggest challenges is working on diverse systems for claims download, trade promotions data and deductions to take action.

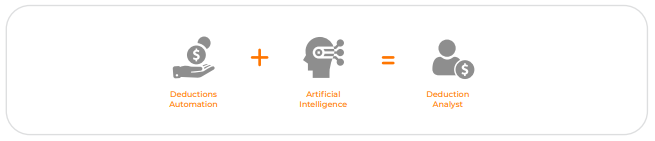

How Top Organizations Automate Deductions Operations

Deductions analysts spend an equal amount of time validating both valid and invalid deductions so a lot of wastage could be eliminated by automating the deductions process to eliminate all the valid deductions from an A/R analyst’s worklist.

Automating the deductions back up aggregation for claims and proof of delivery and attaching these to open deductions could significantly reduce the time to take in backup retrieval and research. After leveraging the data aggregation bit, integrating the ERP with trade promotions system and empowering the analyst with AI based algorithms to search for patterns invalid deductions will further help the analyst focus only on the invalid deductions.

To be safe from invalid deductions an organization needs to perform a root-cause analysis and lower the allowance for doubtful accounts by using analytics to isolate the cause of recurring disputes. Faster deduction resolution results in faster collections, thereby lowering DSO.

Deductions Automation Success Story: Dr. Pepper Snapple

Dr. Pepper Snapple, the beverage manufacturer had a high volume of deductions before leveraging automation. By leveraging automation to reduce deductions workload and focus on root cause analysis, Dr. Pepper Snapple was able to recover an additional $1.4 Million in invalid deductions and also reduced the volume of deductions by 13%.

Collaborating with Buyer A/P teams

One of the biggest challenges in the credit-to-cash cycle is a supplier-buyer collaboration for processes across credit, billing, collections, payment processing, and dispute resolution. Since teams collaborate manually over email, it proves to be a huge challenge to maintain a system of record especially on past communication and patterns in problems.

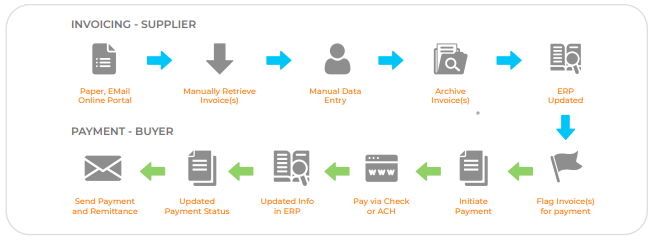

Top Challenges in A/R-A/P Collaboration

A/R and A/P collaboration is very important right from the credit application process where the credit terms are set to the collections process where the A/P team pays the dues and reaches a settlement on deductions.

The above figure outlines, the number of manual steps from the invoicing process to the payment process. An error in even one of the steps will result in a late payment and an increase in DSO.

How Top Organizations Facilitate A/R and A/P Collaboration

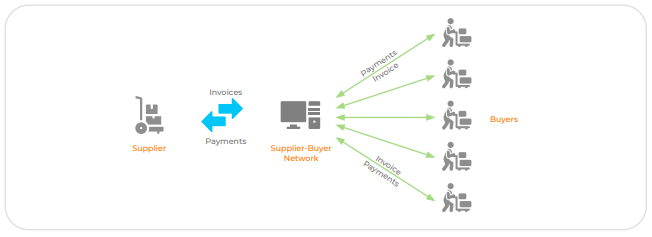

Establishing a digital collaboration portal between buyers and suppliers is the first step that organizations have undertaken. The platform is able to link the supplier ERP with the buyer ERP so that with a single click the supplier is able to post invoices directly into the buyer’s ERP.

The figure outlines what the new process will be. A billing analyst generates an invoice for a product/service and posts it on to the network which in turn posts it directly on to the ERP of the buyer. This results in faster invoice delivery, seamless payment from the accounting system and straight through cash posting as the payment happens through the portal.

Leveraging a Connected Platform for All of Credit-to-Cash

As the previous sections show, there could be significant gains from optimizing each of the individual processes in the credit-to-cash cycle. However, credit and accounts receivable teams could unlock gains in multiples if they start breaking departmental silos and work as an engine.

Top Challenges with Disconnected Credit and A/R Operations

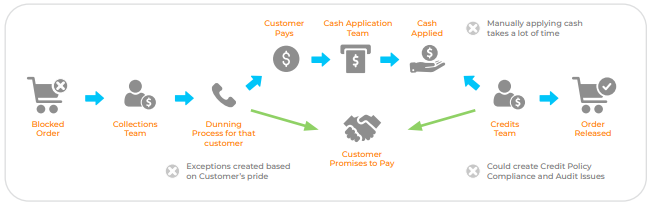

Starting with the credit team, blocked orders directly affect the top-line of any company. Since the credit and collections teams work in silos, accounts that near credit utilization might get missed out by collections and the new orders get blocked. Sometimes, the case is only that the customer didn’t remember about the existing credit limit.

Similarly, lack of clarity on deductions means that collections teams either call customers with open deductions and get nowhere or ignore resolved deductions and ignore low hanging fruits for collections.

The figure above outlines all the different people who need to coordinate together to resolve a blocked order. The end result is that the blocked order process is always a reactive process and along with delaying revenue realization, it also is responsible for compliance problems in credit policies.

How Leading Organizations Break Silos in Credit and A/R Teams

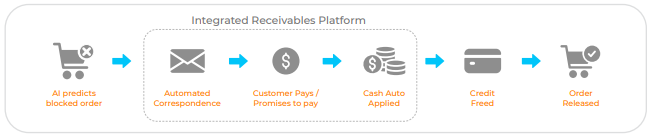

Leading organizations are strengthening process collaboration by leveraging integrated technology. To elaborate, systems are able to read patterns based on past sales orders and triggering a workflow for potential blocked orders to either send automated correspondence or for the credit analyst to notify the customer about delivery blocks. The customer is then able to directly view the invoice in a buyer-supplier collaboration portal and pay through the same. The credit limit is then automatically freed and orders don’t get blocked.

Summary

To summarize, all of these strategies fall into the following three buckets:

- Fixing the root cause of late payments: Delinquent accounts could either be because of the customer in question is not worthy of such credit or simply because the customer was not contacted on time. Addressing customer onboarding and credit review process will take care of the former and addressing the invoicing process, master data correctness and collections bottlenecks will take care of the latter.

- Eliminating Wastage in A/R Operations: Sometimes, even after all the optimizations within invoicing and collections, organizations don’t have enough resources for collections. Addressing wastage in resource-intensive processes including cash application and deductions will give organizations enough leeway to increase FTEs working on collections while flatlining the A/R team headcount as a whole.

- Breaking Silos in Operations and Facilitating Collaboration: Collections as a process involves communicating with internal and external stakeholders. Addressing how information flows within the A/R team for example from cash application team to the collections team and collaboration between buyers and suppliers will further unlock opportunities to reduce DSO and improve accounts receivable turnover.

As the success stories show, organizations of all sizes right from Fortune 1000 companies including Dr. Pepper Snapple and Danone and SMEs including Marketo and ShurTech brands have been able to deploy these 10 tactics to collect faster and thereby reduce DSO and past-due A/R.

About HighRadius

HighRadius is a Fintech enterprise Software-as-a-Service (SaaS) company. The HighRadius™ Integrated Receivables platform optimizes cash flow through automation of receivables and payments processes across credit, collections, cash application, deductions, electronic billing and payment processing.

Powered by Rivana™ Artificial Intelligence Engine and Freeda™ Virtual Assistant for Credit-to-Cash, HighRadius Integrated Receivables enables teams to leverage machine learning for accurate decision making and future outcomes. The RadiusOne™ B2B payment network allows suppliers to digitally connect with buyers, closing the loop from supplier receivable processes to buyer payable processes.

HighRadius solutions have a proven track record of optimizing cash flow, reducing days sales outstanding (DSO) and bad debt, and increasing operational efficiency so that companies may achieve strong ROI in just a few months.

To learn more, please visit https://www.highradius.com

HighRadius Integrated Receivables Platform

Integrated Receivables optimizes accounts receivable operations by combining all receivable and payment modules into a unified business process. The Integrated Receivables platform provides solutions for credit, collections, deductions, cash application, electronic billing, and payment processing – covering the entire gamut from credit-to-cash.

The HighRadius™ Integrated Receivables platform stands out by enabling every credit and A/R operation to execute real-time from a unified platform with an end goal of lower DSO, reduced bad-debt, and faster dispute resolution while improving efficiency and accuracy for cash application, billing, and payment processing.

HighRadius™ Integrated Receivables leverages Rivana™ Artificial Intelligence for Accounts Receivable to convert receivables faster and more effectively by using machine learning for accurate decision making across both credit and receivable processes. The Integrated Receivables platform also enables suppliers to digitally connect with buyers via the radiusOne™ network, closing the loop from the supplier Accounts Receivable process to the buyer Accounts Payable process.