3 Reasons for Adopting Centralized Forecasting

Learn about the three reasons why treasurers should choose centralized cash flow forecasting transformation in the new normal.

Centralized Cash Flow Forecasting Transformation in the New Normal

Companies are adopting centralized cash flow forecasting in the new normal to get an accurate view of their cash movements and create timely forecasts for making confident borrowing and investment decisions.

However, the treasury sometimes gets confused while choosing centralization and decentralization for cash forecasting. The differences between decentralized and centralized cash forecasting are as follows:

Many organizations are choosing centralized cash flow forecasting because of the following reasons:

- Rapid decision making

- Granular visibility

- Continuous data visibility

Top-down vs. bottom-up forecasting approach

Decentralized cash flow forecasting uses the top-down approach: building the cash forecasts from global to the local level. This results in low granular visibility and low accuracy. The top-down approach has a disadvantage which is:

- The sales and inventory data is averaged and generalized since forecasting is done at a top-level. Without a plan for individual items and due to the inability to capture trends and patterns, it becomes difficult to make strategic judgments.

On the contrary, centralized cash flow forecasting uses the bottom-up approach: rolling the cash forecasts from local/entity level to global level. This results in high granular visibility and accuracy. Some characteristics of the bottom-up forecasting approach are:

- Individual departments produce their own forecasts on a micro-scale.

- Trends can be identified fast, and strategic decisions can be made on a micro-level.

- Long-term planning is considerably easier when the business is evaluated at the micro-level.

- Individual item projections can be consolidated into higher-level forecasts.

- Provides more realistic and accurate results and helps build a better picture.

- Helps companies make smart budgeting decisions.

Below are the 3 reasons why companies should adopt centralized cash forecasting:

Reason 1: Continuous Data Visibility

What is Data Visibility?

Data visibility means having a good understanding of an organization’s liquidity and cash flow to be in a better position to access and control cash and manage risks. Corporate treasurers are in the best position to make informed financial decisions if they have a clear overview of the cash flows. With accurate cash flow visibility, treasurers can plan ahead and predict when available sources of credit will be insufficient to cover cash shortages.

Bottlenecks into Continuous Data Visibility

Reasons for Poor Data Visibility

Poor cash visibility can stem from a lot of reasons such as:

- Poor quality or static data- Data received is not always of the best quality and is often outdated.

- Manual data gathering and consolidation- Data gathering is often manual, which makes it difficult to consolidate all the data, and increases the scope of errors.

- Decentralization- Decentralized cash flow forecasting methods are spreadsheet-based and don’t give the correct amount of detail required to make confident financial decisions.

- Lack of proper integration- Unavailability of standardized formats and lack of integration keep businesses from achieving their objectives.

Impact of Poor Data Visibility

Here are some of the consequences of poor cash visibility:

- Inability to determine risk factors.

- Inability to determine ways to optimize business processes.

- Insufficient return on cash: Treasurers can’t effectively deploy funds if they don’t have visibility.

- Overspending or overborrowing: Treasurers may not be able to keep their budget in check and overborrow at higher interest rates.

- Inability to manage FX risk:- Poor hedging decisions lead to ineffective FX risk management.

Treasurers’ ability to create meaningful forecasts, manage foreign exchange risks, make prudent investment decisions, and stabilize borrowing costs is hampered by a lack of continuous data visibility on the company’s current and current flows.

Factors to Optimize Data Visibility

- Centralized cash flow forecasting- Create local predictions from the ground up at the entity, company code, and currency levels, then roll them up to a central treasury. This provides transactional granularity.

- Automate data gathering and consolidation to gather real-time information of the cash flows and store it in a single repository to have easy data access.

Impact of Real-Time Visibility on Business

Here are some of the consequences of poor cash visibility:

- Financial analytics- Having real-time analytics allows CFOs to drill down deep into the cash flows and focus on areas that require attention.

- Risk management- The ability to have an overview of an organization’s entire cash flow helps mitigate risks proactively.

- Scenario planning for crisis management- Treasurers are better equipped to handle crises and unforeseen circumstances.

- Payment analytics- Payment analytics enable a company to take historical data and apply it to current events, resulting in high cash flow visibility. Without transaction data and proper cash visibility, it would be difficult to track payments and forecast cash.

Reason 2: Generate Best-in-Class Global Forecasts

Drivers for Global Cash Flow Forecasting – How to Achieve Them?

1. Granularity-

It refers to the ability to drill down into invoice level data for driving course correction.

The following method can be used to achieve granularity:

Choosing centralized/bottom-up forecasting over decentralized forecasting.

The impact of centralized forecasting are:

- Improved borrowing and investment decision-making.

- Optimized strategic financing decisions with constant data visibility across all cash flow categories across different regions.

- Improved knowledge of how transaction-level activities affect global projections.

- Drill-down capability into individual customer accounts and transactions to identify potential variation sources.

2. Timeliness-

Forecasting as close to real-time as possible to drive timely business decisions

The following methods can be used to achieve timeliness:

- Continuously gathering the best data available.

- Forecasts are updated on a regular basis to provide up-to-date information for business choices.

3. Scalability-

Standardized process that can be easily replicated to other entities.

The following methods can be used to achieve scalability:

- Making the process flexible so that it can’t break when a new system or bank is added.

- Making the process easy to be replicated or halted when a new company is acquired or divested.

- Ensuring that once the system is running, resources can focus on value-added activities

4. Accuracy-

Achieving the baseline accuracy for your business to make confident decisions.

What is baseline accuracy?

Baseline accuracy is the minimum accuracy required for companies to make business decisions. It varies from business to business.

Why are most cash forecasts not accurate?

The reasons for the inaccuracy of cash forecasts are:

- Lacking the right variables related to customer behavior, historical data, etc.

- Using spreadsheets to forecast complex categories like A/P and A/R.

- Performing no variance analysis.

How can forecasting accuracy be improved?

The accuracy of forecasting can be enhanced by using Artificial Intelligence and using suitable models and algorithms for forecasting different cash flow categories.

Why is it important to understand how transactional level activities affect global forecasts?

- Most accurate and actionable insights- The treasurer must have accurate data/information about payment status updates and cash positions to make strategic decisions on investments, forex hedges, borrowing, and M&A.

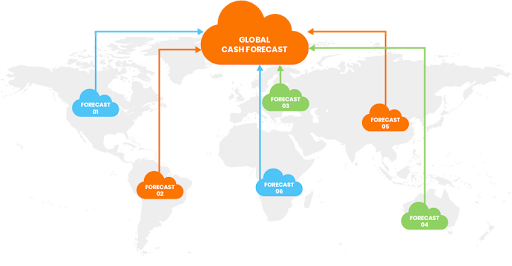

- Reduce errors- Global forecast follows the bottom-up method of forecasting making it less prone to errors. It collects information ground-up from the local forecasts, regional forecasts and then consolidates all of the data into the global forecast giving it granular visibility.

Benefits of understanding transactional level activities

- Understand reasons for variance- The root cause analysis of the variance between forecasts and actuals assists in the identification of areas that require improvement and ultimately improve the accuracy of cash forecasts.

- Mitigate risks- The benefits of liquidity management can be maximized for a corporation. Companies will be able to gain control and visibility over their cash outflows and cash inflows, allowing treasurers to better manage operational risks.

Reason 3: Improve Strategic Decisions

What are Strategic Decisions

Strategic decision-making is analyzing the advantages and disadvantages of a scenario and devising a step-by-step plan to achieve the company’s business objectives. In times of crisis, treasury needs to be a strategic advisor by assisting management with high-level decision-making rather than focusing on manual tasks.

Effect on Treasury

- Understanding company goals- Strategic planning needs accurate and timely information, and a centralized cash forecasting system gives that insight so that the treasurer sets more realistic and attainable goals in the context of financial decision-making.

- Keeping track of liquidity- Treasury plays a critical part in strategic planning by keeping track of liquidity. They analyze historical payments for cash buffer sufficiency, examine financing mechanisms, and improve the cash forecasting process.

- Identifying opportunities- Treasury can aid the organization’s growth by providing strategic insights. For instance, they can focus on business expansion, mergers, and acquisitions or reinvesting to grow their business.

- Better quality of work- A strategic management results in greater organizational performance by engaging the employees in value-added activities instead of administrative tasks. As a result, a company can become aware of the strategies it needs to employ in order to penetrate the market and adapt to the changing business environment.

Effect on the Role of the Treasurer

The treasurer can make strategic decisions for:

- Minimizing risks- Treasurers have more bandwidth to proactively identify and mitigate risks and develop a framework to communicate, compare, analyze, and respond to these risks.

- Leveraging technology- Treasurers can choose robust technologies such as AI to forecast cash flows accurately. They can also look for features such as dashboard reporting, which helps to understand cash positions and deviations for faster reporting and decision-making.

- Preventing overborrowing- Liquidity forecasts, which measure liquid assets and credit sources to estimate whether a firm will be able to pay its debts and commitments, can assist an organization to manage cash by evaluating stress scenarios for varying market situations. The daily, weekly, and monthly monitoring of cash assists treasurers in monitoring market volatility.

- Investments and M&A- Due to accurate long-term reporting, treasurers can utilize surplus cash for investments and business expansion.

Summary

Why is Centralized Cash Flow Forecasting a Better Fit

Companies should adopt centralized forecasting due to the following reasons:

- Continued data visibility- Proper data flow visibility enables treasury management to forecast when available sources of credit will be insufficient to address cash shortfalls.

- Improved scalability- When a new system is introduced, the process does not break. Furthermore, when a company is acquired, the process may be replicated/stopped. Moreover, once the system is up and operating, there is no need for regular human interaction.

- Improved strategic decision making- Centralized cash forecasting provides updated forecasts to draw real-time insights which help the treasurers in making strategic decisions on FX risks, overborrowing, investments, and M&A.