Achieving Best-in-Class Treasury Operational Excellence

Enhance treasury operational excellence by focusing on core treasury functionalities - cash visibility, cash management, and forecasting.

Executive Summary

According to a Citi bank survey, 63% of respondents admitted to having their priorities set on looking for transformative opportunities for their organization. Out of which, 87% wanted to optimize their treasury process.

These results suggest that many organizations are at a point where they need optimized treasury processes to attain best-in-class performance in productivity, quality, and delivery of services. The inefficiency of the current processes marks this paradigm shift. However, achieving treasury operational excellence will not happen overnight and requires changes at a granular level.

This eBook will help you understand how best-in-class organizations achieve operational excellence in treasury by:

- Evaluating six key treasury functional areas to optimize to achieve operational excellence

- Improving core treasury functional process using:

- KPIs/metrics

- After leveraging the right set of technology

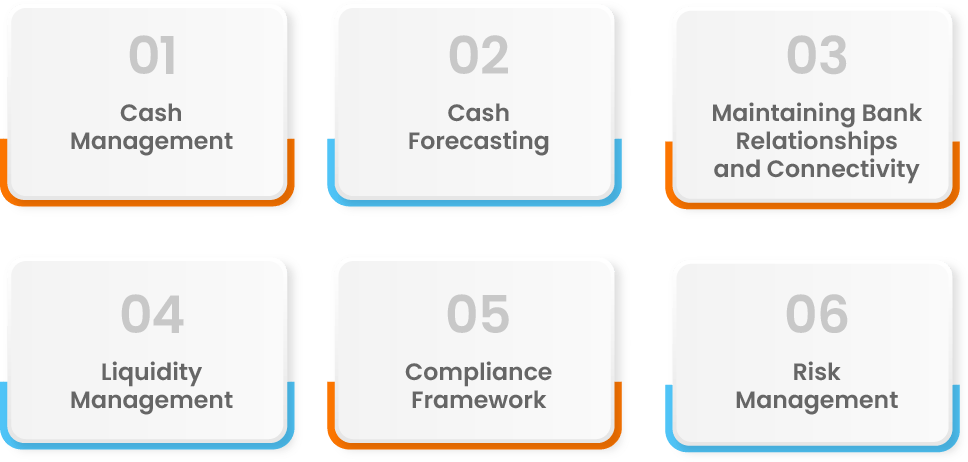

6 Key Functional Areas To Achieve Treasury Operational Excellence

To achieve treasury operational excellence, optimize the six treasury functional areas with a proper strategy to improve current processes by leveraging available treasury technologies to achieve treasury operational excellence.

Cash Management

Organizations need the leading edge in an increasingly competitive business environment. Cash management will help the organization to improve operational efficiency, working capital, global visibility, budget tracking, cash positioning, and effective decision making.

Technology can streamline the process to optimize cash management, but before that, it is essential to have the right processes in place.

Here are some best practices to optimize the cash management:

- Invest idle cash

Idle cash is of no use to the organization. A dedicated cash management system will recommend organizations to make investments that generate profits if they are in cash surplus positions. Surplus cash will also help avoid a cash crunch and ensure the organization’s financial stability. - Optimize your bank structure

Organizations should establish APIs with their banks and rationalize their banking systems to help the bank to manage critical accounts more effectively. - Have an emergency cash reserve

It is always essential to have an emergency cash reserve for your organization, allowing you to have some flexibility and security during an economic crisis. - Become more informed about cash flows

It is critical to have real-time knowledge about your global cash position to secure enough liquidity, avoid expensive borrowing, and take advantage of investment opportunities. - Invest in a cutting-edge cash management solution

Automating cash management operations ensures error-free cash management and better liquidity decisions, along with many benefits given below:- Provides global cash visibility:

A view to understanding the cash positions across different banks and regional entities in foreign currency types to help understand cash positions in real-time. - Reconciles transactions automatically:

The cash management system will auto recommend the reconciliations, ensuring consistency in data requirements and quality. - Minimizes manual errors:

Gathering data manually is error-prone and time-consuming. A cash management system reduces errors by raising accuracy and saves time by collecting data automatically with APIs, boosting workers’ productivity. - Enables real-time view of cash position:

Provides a centralized view of your end-of-day and end-of-week cash positions across multiple cash categories. - Ensures business continuity:

Cash management automation helps keep track of cash in transit, deposited cash, and the status of cash holdings. - Integrates processes using API:

Software for automating cash management process files in various forms, including XML, BAI2, MT940, ISO20022, XLS, and CSV, by establishing seamless connections with all banks ERPs and independent market data sources.

- Provides global cash visibility:

Cash Forecasting

Cash Forecasting is a critical process that should be at the center of every well-structured treasury, yet it is the most challenging task. Working with spreadsheets is error-prone and time-consuming. Also, the unpredictability of A/R and A/P due to different payment terms, business cycles, seasonal demand, etc., makes forecasting difficult.

Leveraging the best tools, models, and new aged KPIs & metrics with the right technology set will provide optimized cash forecasting results. Follow the steps given below:

- Identify the purpose of cash forecasting

The objective of forecasting cash depends on the situation of an organization.For example, organizations with debt will find value in creating a cash forecast tailored to longer-term debt repayment, and they may not need to build a forecast that supports short-term liquidity planning unless they’re also tight on cash. There is a different granularity as you can appreciate depending on your purpose.

- Select a forecasting method

There are two primary types of forecasting methods: Direct and Indirect. Choosing the suitable forecasting method depends on the cash forecasting period, the horizon, and the kind of data available to build the forecasting model.Direct forecasting provides the most remarkable accuracy. However, it’s often unreliable for reporting periods longer than 90 days because actual cash flow data isn’t always available beyond that window.

- Analyze and evaluate the data

- Analyze the data properly because It’s necessary to gather relevant and good-quality data to perform cash forecasting.

- The quality of the gathered data will decide forecast accuracy.

- Add relevant variables in cash flow forecasting by evaluating the data; this will improve the accuracy by a large margin.

- Pick the right technology for the treasury

Choose the suitable technology that aligns with the processes to generate fruitful results. The five relevant and popular technology options and their use cases are:- Robotic process automation (RPA):

To automate repetitive manual tasks. - Artificial Intelligence(AI):

To capture and analyze the relevant pattern while looking at historical data and the behaviors of the appropriate categories to produce accurate forecasts, improving results over time. - Data Lakes:

To access and handle large amounts of data in an unstructured way. - BI/Dashboard:

To enhance the visualization and communication of the periodic results in a meaningful and actionable way.

- Robotic process automation (RPA):

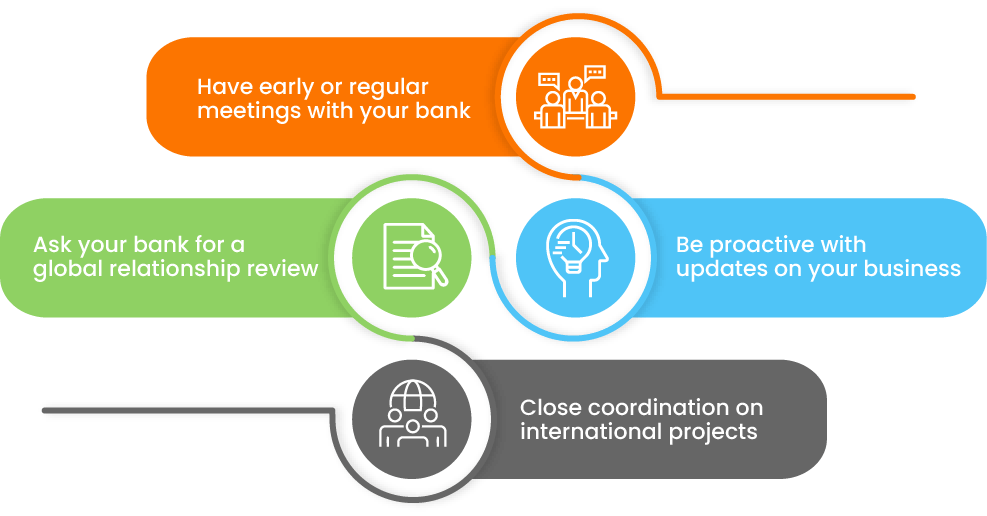

Bank Relationship

Maintaining bank relationships has become more crucial post-COVID-19 due to the unpredictable market and cash crunches. A healthy connection between the treasurer and the bank can assist the financial stability and resilience of the organization. For treasurers, banks are crucial partners. Thus, both parties must be proactive in nurturing their relationship.

Essential factors to take into account when managing bank relationships:

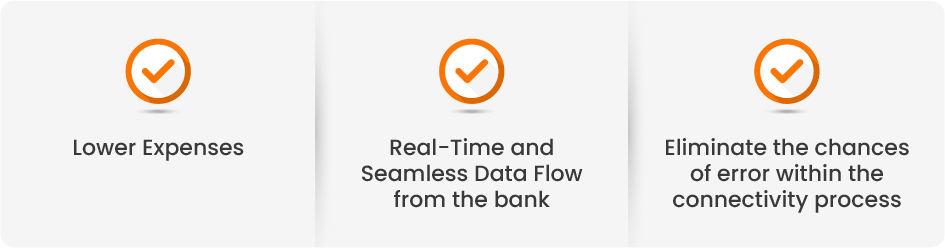

Regarding bank connectivity, APIs can provide a more secure link between enterprise resource planning (ERP) systems, treasury management systems (TMS), and bank portals. By leveraging bank APIs, organizations can achieve the following benefits:

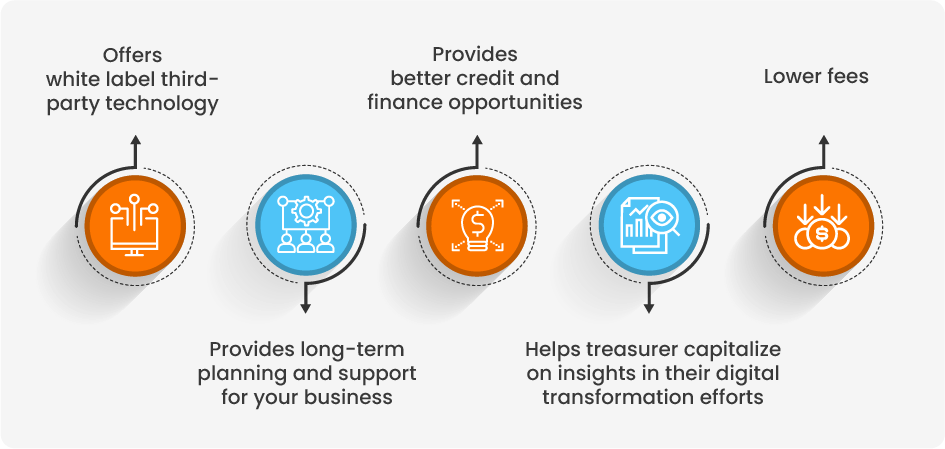

Hence more information a bank has about the organization, the better. An annual audit of business plans, financial records, and tax filings can give banks the information they need to offer advice and services to help achieve the objectives. Strong banking relationships can provide many benefits:

Liquidity Management

It’s highly imperative to optimize liquidity effectively in today’s economic environment. It has vitality in a company’s growth, from maximizing returns to maintaining the flexibility to execute capital expenditures when the time is right.

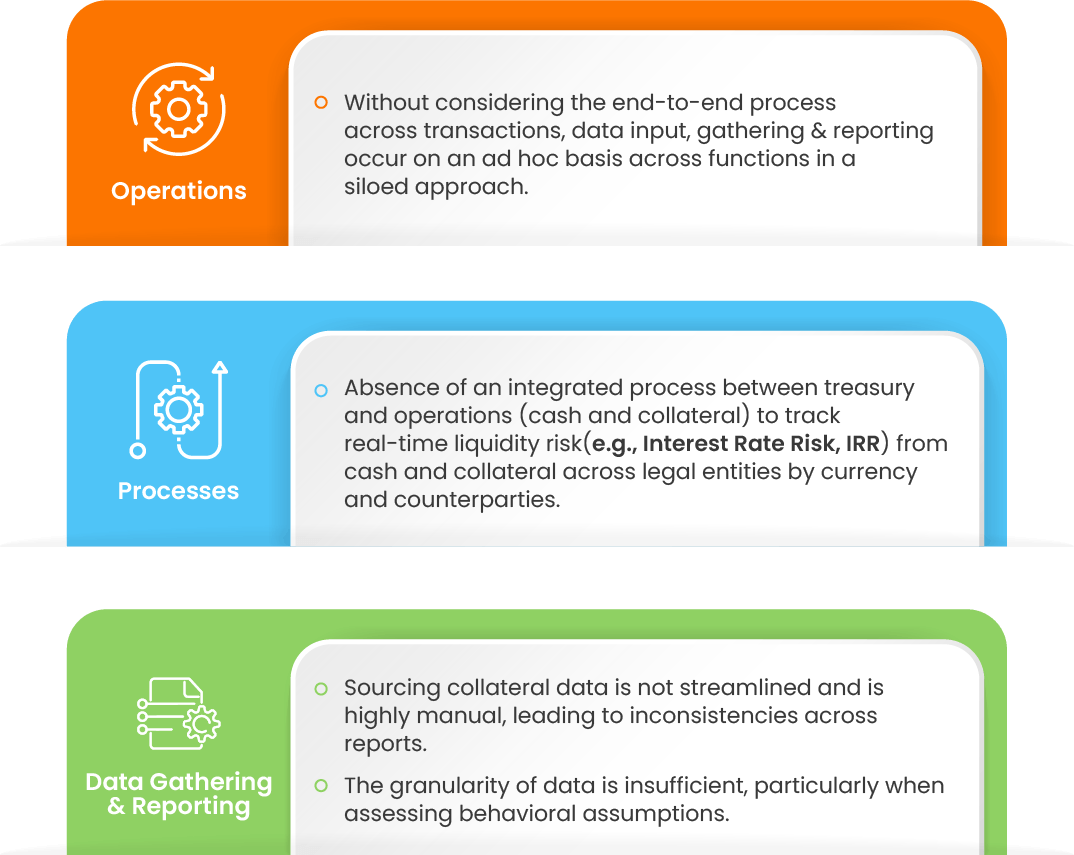

Challenges with a sub-optimal liquidity management

However, firms are tackling several difficulties while managing liquidity that spawns across operations, processes, data gathering & reporting.

How To Overcome These Challenges?

Here are some best practices for optimizing liquidity management

- Perform precise, accurate cash forecasting

Opt for rolling forecasts to achieve long-term debt/leverage reduction, interest expense reduction, and financial plan optimization. - Improve cash conversion cycles

A 360-degree view of your cash conversion cycles will give you the working capital necessary to meet short-term investment opportunities and funding requirements. - Have an appropriate review and approval process in place

Outputs from reporting should be presented to senior management, making it easier for them to use optimization tools accordingly since it gives an aggregate view of liquidity. - Include integrated processes

With the move toward real-time payments, firms should address changing requirements of collateral management and intraday liquidity with clarity on assumptions and scenarios (e.g., Customer behavior). - Periodic review of technology

Automating the collection and collation of cash data and transactions amplifies your cash visibility, empowering you to make faster, data-driven decisions.

Treasury Compliance Framework

Due to the risks and sensitivity surrounding the cash movements in a treasury, having proper operational protocols is a must to prevent the firm from losing money & reputation. A set of controls such as standard instructions, frequent reconciliations, and segregated roles and responsibilities should be the ideal choice.

It is essential to have a robust treasury policy and controls defined for the treasury department. Here are some of the best practices:

- Include treasury controls in board policy

Get management backing for treasury policies, ensuring they understand the risks and the responses to these. - Separate Front & Back office duties

Segregation of duties is a primary way to ensure a check on activities. - Have delegation of authority

Have an approved DOA structure to ensure decision-making and power are in the right hands. - Segregate the duties accordingly

Beyond a front/back-office separation, this further enforces checks on transactions. - Allow scope for more Automation (STP)

The more automation, the less chance for error. - Timely reconcile the identified error

The sooner a mistake is noticed, the easier it is to get money back, and there is less chance that the markets have moved. - Involve senior management

Treasury committees allow for diversity of opinion, sharing views, and minimizing personal risk. - Have a zero-tolerance policy:

There should be zero tolerance for any breach of procedures and controls.

Risk Management

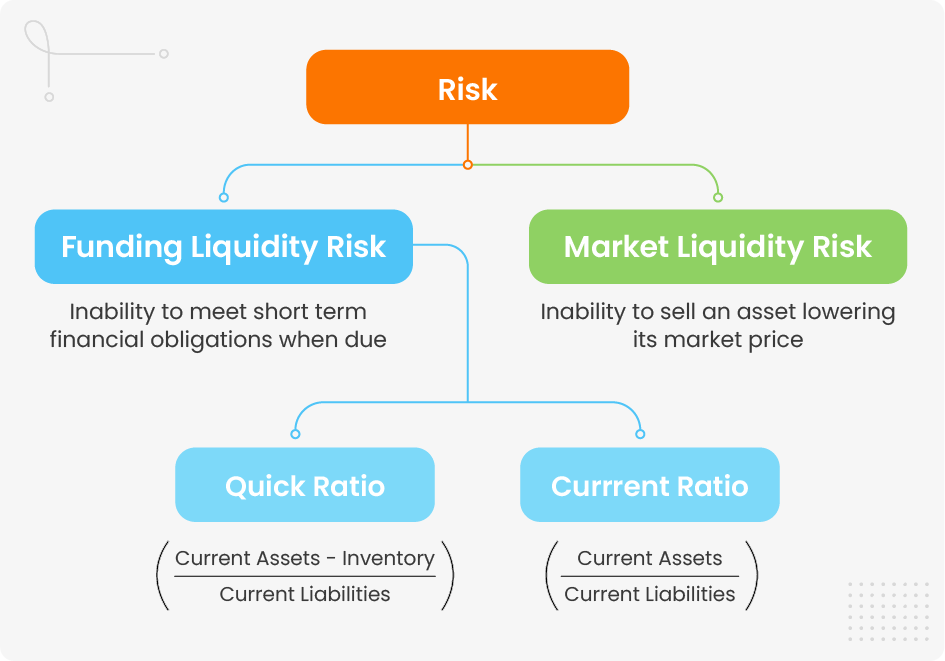

Treasury risk management involves limiting liquidity risks and working with the cash and liquidity management division to ensure the business consistently has enough cash to meet its financial obligations.

How to handle treasury risks?

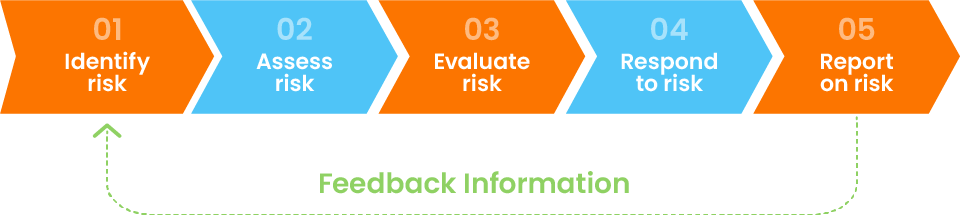

1. Identify the risks

It involves identifying and classifying an organization’s treasury risk exposures and sources. It is also essential to capture emerging risks which are potential risks that the organization may face in the future.

2. Assess the risks

Treasurers must assess the likelihood of each risk occurring and its potential impact on the organization.

3. Evaluate the risks

Risk evaluation requires the organization’s appetite for that risk to be considered and compared with the current and potential risk exposure.

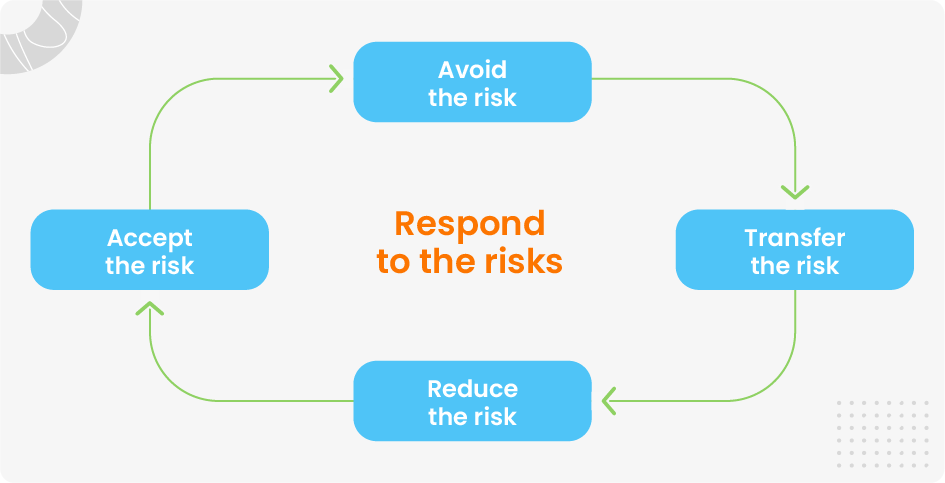

4. Respond to the risks

After evaluating the risks, the treasury should develop a plan of action. The reaction to a treasury risk includes the following options:

- Avoid the risk (by adjusting the business strategy, although, in practice, this may not be possible)

- Transfer the risk (by insurance)

- Reduce the risk (by introducing controls or other mitigation)

- Accept the risk (if the organization actively seeks this type of risk because it has expertise in the area)

5. Report the risks

This phase helps to ensure that risks are being managed as agreed, i.e., that methods and processes are being correctly applied and carried out and checking that the responses have the desired effect. Risks must be reported and reassessed regularly to ensure risk exposures are within the organization’s risk appetite and that internal controls are operating correctly.

Managing treasury risks with Treasury management software

A TMS assists in regularly monitoring the cash inflows and outflows. Automatic reconciliation to find inconsistencies or fraud in transactions or payments helps the treasury manage risks. This aids in maximizing the use of funds and avoiding unnecessary debt. Also, treasurers can recommend better financial plans and investment portfolios for their firms.

Benefits for treasurers using cash management software:

Conclusion

To achieve treasury operational excellence, treasury departments need to review a more comprehensive set of processes to achieve optimization. However, when seeking process reengineering, review and map existing processes so they can be redesigned — optimizing processes before automation will ensure maximized efficiency.

Additionally, optimized processes will be more flexible in the future. Improving treasury operational processes allows the treasury to make better decisions and effectively improves visibility over cash positions so that the treasury can optimize funding and investment decisions. It will enable the treasury to sustain itself through changing market dynamics during turbulent times.