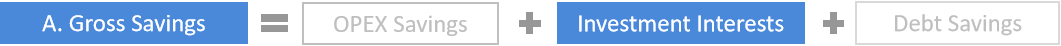

How To Calculate Gross Savings

- How to properly calculate & analyze return on investment to drive better business decisions

- How to calculate capital expenditures & operational expenditures for your business with real-life example

- 4-Steps guide on calculating your gross savings

How To Calculate Gross Savings

Calculating OPEX Savings

To get started, benchmark your current Operational Expenditures (OPEX) and set a target goal of the savings you’ll realize with a solution.

Follow this 4-Step, Adjusted Value Stream Analysis Best Practice Process

Step 1 Identify Process Tasks

The cash forecasting process tasks vary between companies. In general, they depend on the

size of the company and the organizational structure of the finance department.

Step 2 Calculate Time Spent

Review the current process and identify how many hours per week on average your team

spends on each task. This gives you the total FTEs your team expends on forecasting cash over a given period.

Step 3 Forecast Time Savings

A Sample hourly breakdown of tasks and average hour savings with automation is shown below:

Step 4 Calculate Final OPEX Savings

To calculate OPEX savings multiply the hours saved per week by the loaded labor costs.

Calculating Investment Interests

With accurate cash forecasting powered by AI, companies can reduce variance significantly and earn interest by investing proactively.

How to Calculate the Interests Gained

Calculating Debt Savings

With reduced variance in forecasts, companies don’t need to borrow as much from external sources and hence, don’t have to pay interest associated with borrowing.

How to Calculate the Savings Impact on Reduced Borrowing

As per these calculations, automating cash forecasting with Artificial Intelligence can influence the bottom-line significantly.