Fine Tune Cash Flow Management With Accounts Receivable Automation

- Understand the importance of managing cash flow proactively by digitally transforming the accounts receivable landscape

- Identify and eliminate the hidden AR operational expenses

- Learn about effective strategies to improve cash flow

Why Steady Cash Flow Is Critical for SMBs?

Cash flow is the key to measuring a company’s financial health. It indicates the amount of money coming in and going out of the organization. In SMBs, CFOs have many responsibilities, among which managing cash flow efficiently is of utmost importance. Let’s have a look at the benefits of effective cash flow management.

- Efficient business operations

Steady cash flow helps you purchase equipment, upgrade systems, pay employees and suppliers, cover monthly rent, and service other business needs. - Reinvestment opportunities

Positive cash flow allows companies to reinvest a percentage of their profits to boost the company’s value and help in expansion. - Investment in capital assets

Consistent cash flow enables SMBs to invest in capital assets to boost production, generate revenue, and act as a buffer in times of need. - Future growth

Effective cash flow management contributes to developing a healthy cash reserve, enabling companies to make long-term strategic decisions. - Sustainable growth

Strong cash flows help you achieve business goals and fund future growth plans, thus eliminating the need to seek external funding. - Getting loans

Companies might need to seek loans or capital to drive rapid growth. A strong cash flow statement enables companies to get faster loan approvals and better terms.

Battling Cash Flow Challenges

2.1 How pandemic has triggered the importance of stable cash flow

During the pandemic, two-thirds of the SMBs experienced financial challenges, while the remaining one-third barely had enough cash to cover their expenses and run the business. This affirms the fact that it is imperative for SMBs to have effective cash flow management strategies to not just survive but function efficiently during uncertain economic swings.

2.2 Why are companies struggling?

Cash flow is the lifeline of any business. Inability to access cash when in need could push businesses to borrow or use cash from a previous period to cover the shortfall. Some reasons that lead a company to struggle for cash are as follows:

Not creating an effective strategy

- Inefficient collection strategy

Not having proper strategies to collect overdue receivables increases a company’s loss due to recurring bad debts. As a result, cash gets tied up, disrupting the smooth running of your order-to-cash cycle. - Poor pricing strategy

Products and services with poor profit margins do not generate enough revenue to cover the cost of per-unit markup. As a result, companies face higher cash outflow than inflow, leaving them financially strained when updating and relaunching a product.

Insufficient cash buffer

- Lacking cash reserves

During the slow sales season, when the revenue falls, cash is required to cover expenses and maintain daily operations. Lacking cash reserves results in liquidating assets or borrowing capital to support business functioning. - Seasonal fluctuations

During peak season, business owners might face an unexpected surge in sales. Without cash, it becomes difficult to purchase additional inventory and supplies to keep up with sales.

Not keeping tabs on spending and investments

- Too much inventory

Overinvestment in inventory results in cash getting locked up. Companies then are unable to acquire additional resources due to cash being tied up in inventory. - Investing in CapEx

High-risk ventures that do not deliver adequate ROI drain the company funds, resulting in a sharp decline in cash flow. A poor cash flow statement weakens corporate ties, causing problems during business mergers and exit initiatives. - High OpEx

As your business expands, operational expenses such as overhead, equipment, and maintenance costs increase. As a result, companies face decreased profitability and a higher cash outflow.

Understanding Accounts Receivable and Its Impact on Cash Flow

3.1 How does an increase or decrease in accounts receivable affect cash flow?

Accounts receivable is a potential source of revenue for the company and a short-term liability for the client. Accounts receivable are documented under current assets on the balance sheet after an invoice is issued, indicating the company’s future cash inflow.

Increase in accounts receivable – a decline in cash in the cash flow statement

Decrease in accounts receivable – a rise in cash in the cash flow statement

A decrease in accounts receivable indicates that the payments invoiced to credit-paying clients were received in cash, resulting in increased working capital. An increase in accounts receivable suggests that more revenue has been obtained using credit payments, causing a company’s ending cash balance to decline. As a result, keeping an eye on accounts receivable is crucial. Let’s dive into accounts receivable management practices in SMBs.

3.2 What causes poor cash flow in accounts receivable?

3.2.1 Tedious manual operations

- Laborious receivables process

Accounts receivable processes such as establishing credit limits, invoicing customers manually, and tracking payments are laborious, especially if your AR team is small. To process the growing number of invoices, companies employ additional workforce, thus incurring higher expenses on office supplies, headcount, and workspace costs. - Following traditional methods

Manually preparing worklists and establishing customer credit limits are error-prone and time-consuming. It often leads to unexpected cash outflows due to employee overtime costs.

3.2.2 Limited data visibility

- Disorganized documents

Storing information in multiple systems and formats results in lost or misplaced data. This delays sending invoices to customers and other collection procedures, thus lowering the likelihood of receiving payments sooner. - Limited real-time access

It is challenging to acquire real-time insights into what is happening throughout the organization when employees manually perform data analysis. Outdated data leads to inaccurate data analysis, which results in delayed decision-making.

3.2.3 Barriers to digitization

- Technological limitation

To date, most businesses utilize Excel sheets to gather data and customer information. The limited collaboration features within Excel and the file size limitations make it difficult to use for complex scenarios. Furthermore, legacy technology incurs additional expenses due to security issues, lack of customer trust, lower productivity, and higher maintenance costs. - Inaccurate AR forecasting

Manual data aggregation from various systems for AR forecasting requires significant effort and lacks accuracy. Insufficient clarity on upcoming accounts receivable doesn’t help you accurately bucket accounts into risk categories. As a result, businesses are unable to implement the right strategies to collect overdue payments, resulting in a delayed cash inflow. - Scope of new technologies

Most companies believe that upgrading to new technology is expensive and an overwhelming process, especially when there is a risk of data getting lost or corrupted. Hence, they refuse to accept new technologies and continue to stick to their legacy systems for business support.

Hidden Costs in Accounts Receivable

The actual cost of accounts receivable includes both direct expenses such as software licensing costs and overhead costs, as well as other hidden expenses. The impact of accounts receivable on cash flow is huge for an SMB when time, finance, and opportunity expenses are evaluated. Recognizing and eliminating the hidden costs will provide the insights needed to enhance the cash flow.

4.1 Invoicing

- Paper cost

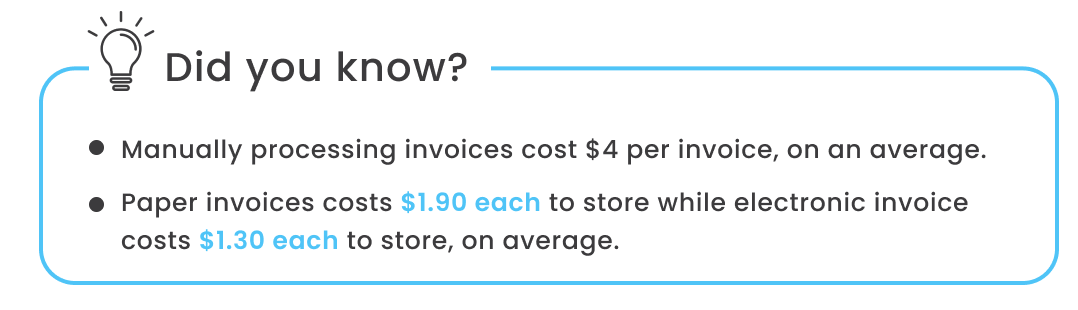

Despite technological advancements, many companies rely on paper-based invoicing. Costs of paper, ink, print, and postage associated with paper invoicing, although varying from business to business, take a hefty toll on company finances. - Storage cost

Invoices must be securely retained for auditing and reporting purposes, thus incurring storage costs. Companies spend on cabinets, scanners, and staff to organize bills, alongside shipping costs for paper-based invoices. Electronic invoices get stored in the cloud, incurring a much lower fee.

Source: IndustryWeek

4.2 Collections

- Payment processing cost

Credit card payments through portals charge convenience fees, level-III interchange fees, and processing costs. Check payments incur high transaction expenses. - Compliance cost

The PCI DSS mandates a fee for processing credit card payments. Companies spend a lot of money on payment security and compliance. Businesses that are not PCI compliant must pay an additional non-compliance charge.

Source: Merchant Maverick

- Administrative cost

Collection operations incur manual follow-ups, record keeping, personnel compensation, and supply costs. As a result, cash reserves get negatively impacted if resources aren’t used efficiently.

4.3 Cash Application

- FTE costs

Manual cash posting is time-intensive and laborious. AR teams spend a significant amount of time gathering remittance information and matching invoices from emails, web portals, etc., incurring higher costs. - Cost of lockbox fees

Banks provide expensive lockbox services for check processing. SMBs often end up paying excessive amounts to banks for these services. Processing and transmission costs result in high operational expenses. - Cost of key-In fees

Businesses incur additional expenses when using the bank key-in service to capture remittances. This method is laborious, time-consuming, and error-prone, resulting in a prolonged cash reconciliation process.

4.4 Credit

- Cost of manual processes

Credit approval is a labor-intensive procedure requiring sending and evaluating credit applications, verifying client credit records, and updating the data. FTEs invest much time and effort in these operations. - Cost of external resources

Companies often collaborate with credit bureaus to get insights into their customers and obtain trade references. Credit bureaus charge extra fees based on your urgency and the content of individual reports.

Winning Strategies for Improved Cash Flow

The key to fine-tuning your cash flow management is not just increasing cash inflows but also reducing cash outflows. Listed below are some ways to improve cash flow.

5.1 Segmentation of accounts

It is critical to segment customer accounts into risk categories to implement a strong collection strategy. A thorough evaluation of your accounts receivable portfolio helps protect your finances and build strong customer relationships.

How can tracking accounts help?

Tracking accounts enables a business to follow up with customers as soon as an invoice becomes due. This helps lower the risk of bad debt. Use segmentation strategies to create worklists to identify priority accounts for dunning and collections.

How to track accounts?

- Create aging buckets

Categorize accounts receivable by the amount of time an invoice has been overdue. There are mainly three aging buckets considered by most businesses: 0-30 days, 30-60 days, and 60+ days.- Accounts under 0-30 days and 30-60 days category can be tackled with dunning emails.

- Invoices in the 60+ category should be given top priority and recovered by following up via collection calls.

- Create customer buckets

Assess customers’ financial health and past payment trends to segment the accounts into risk categories such as high-risk accounts and low-risk accounts.- High-risk accounts: These customers are in a tight financial position. Keeping in contact with them regularly and offering them incentives or discounts can help them pay off their obligations quicker.

- Low-risk accounts: These accounts generally pay their invoices on time and pose no risk. Increasing their credit limit can help you gain their trust and loyalty.

5.2 Periodic credit reviews

Periodic credit reviews help a company update credit scores regularly and stay on top of credit-risk portfolios.

Essential information needed for periodic credit reviews

- Annual turnover: Tracking annual turnover provides insight into the customer’s current and past financial health. This helps determine a customer’s creditworthiness.

- Payment history: You can modify customers’ credit limits based on their payment history and payment trends.

- Credit data aggregation: The information collated from various channels on clients’ debts and credit ratings assists a company in reducing the risk of bad debt.

- Trade references: A company decides whether to extend credit to a customer based on trade references reflecting the payment history between the client and another supplier.

5.3 Analyzing Important Metrics for AR Performance

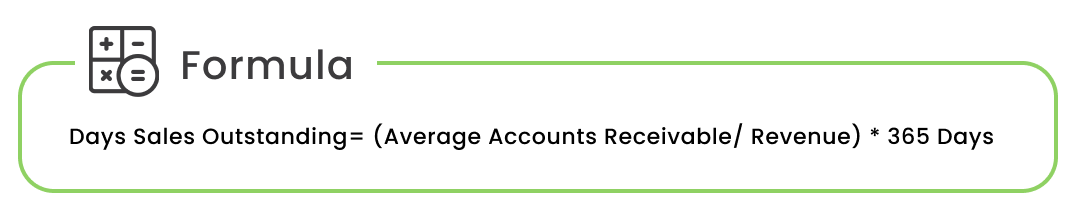

5.3.1 Days Sales Outstanding (DSO)

DSO is the average number of days a company takes to collect payments from their customers after completing a sale.

Why is it important?

DSO is directly proportional to collections. Faster cash collections help your cash flow. A higher DSO may also indicate a decrease in customer satisfaction.

How to optimize it?

- Set up payment terms with the customers beforehand to minimize late payments.

- Identify delinquent customers and analyze their payment trends.

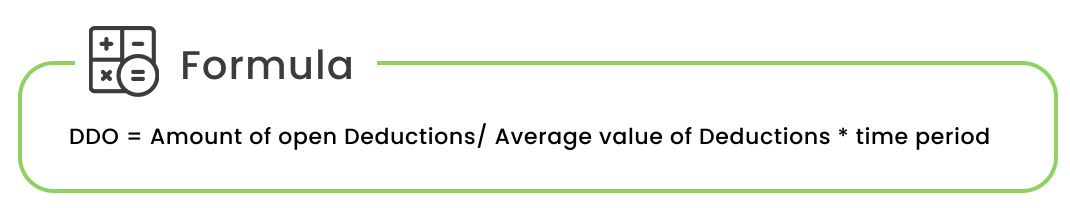

5.3.2 Days deductions outstanding (DDO)

DDO measures your financial health, indicating how well your company can resolve deductions.

Why is it important?

It indicates a company’s ability to resolve disputes, investigate claims, and collect payments. Broadly, it’s a measure of cash intake.

How to optimize it?

- Get a centralized data repository to make it easy for the deduction team to access files conveniently.

- Automate reason coding to free up time spent in examining and matching customer deduction codes.

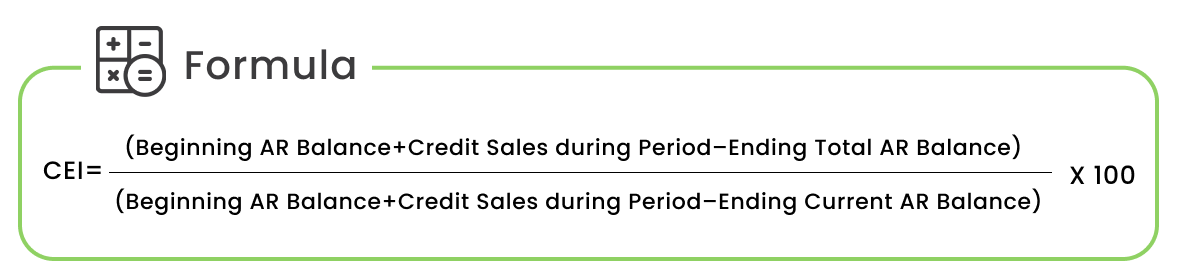

5.3.3 Collection Effectiveness Index (CEI)

CEI is a calculation of a company’s ability to retrieve accounts receivable from customers.

Why is it important?

This metric provides a clear picture of how well the company’s collection team obtains money from invoices. If a company’s CEI is low, it suggests that its collections process needs to be optimized.

How to optimize it?

- Get personalized dashboards to set custom rules to prioritize your collections worklist.

- Enable automated correspondence to reduce the time spent on sending dunning emails.

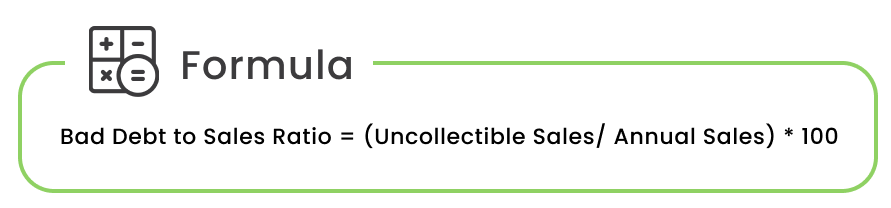

5.3.4 Bad debt to sales ratio

This ratio is the percentage of uncollectible sales to annual sales in a specific time frame.

Why is it important?

This data helps a company evaluate its accounts receivable process and ascertain its financial health.

How to optimize it?

- Review customer payment behavior to update credit policies frequently.

- Offer early payment discounts to collect payments faster.

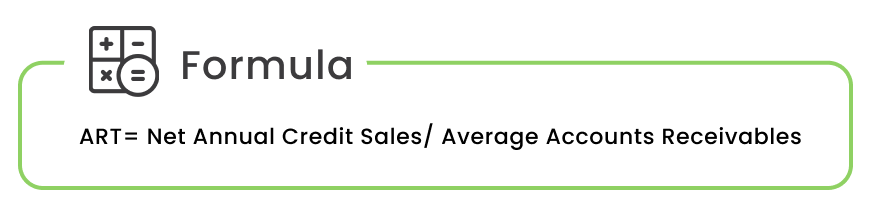

5.3.5 Accounts Receivable Turnover Ratio (ART)

ART quantifies a company’s effectiveness in extending credit and collecting debts.

Why is it important?

It helps a company know if they are being paid regularly and have positive cash flow. It also indicates whether their customers are paying invoices quickly, enabling them to make future purchases.

How to optimize it?

- Sending invoices at the correct time will spur customers to pay promptly.

- Offer convenient payment options such as ACH, card payments, or electronic payments to clients.

Achieve Cash Flow Optimization with Accounts Receivable Automation

6.1 Invoicing

Electronic invoice delivery

Adopting automated invoice delivery allows for the delivery of invoices and account statements by email. It reduces the costs of traditional paper-based invoicing approaches such as printing, storing, and sending out invoices manually. Furthermore, it minimizes the likelihood of errors and helps save up to 50% on billing expenses by removing manual efforts and human involvement.

Pull/push data from ERP and AP software

Accounts receivable automation solution facilitates integration with ERPs and AP software. It helps compile information from customer portals and third-party websites, eliminating the time and labor costs associated with manual data entry and extraction. It also eliminates the costs incurred due to error-prone manual invoicing.

6.2 Collections

Payment reminders

Accounts receivable automation systems assist in setting up customized messaging triggers for follow-up emails, reminders, and other communications. It makes the collections process faster and more convenient. It also ensures timely payments, eliminating the chances of incurring bad debt.

Convenient payment options

Accounts receivable software supports multiple payment formats such as ACH, card payments, and electronic payments. Enabling customers to make payments in their preferred mode helps boost collections.

Payment processing and compliance

A PCI-DSS compliant solution provides a secure platform to avoid payment fraud. It reduces administrative expenses and improves customer experience. Furthermore, accounts receivable automation helps process credit cards by linking ERP with the processor and the bank. Utilize level-III interchange to reduce card payment acceptance costs.

6.3 Cash Application

Remittance aggregation

An automated solution collects remittance details from portals and emails as well as scans documents with OCR to transform images of typed, handwritten, or printed text into machine-encoded text. It eliminates the bank lockbox costs, speeding up the cash conversion cycle.

Invoice matching

Accounts receivable automation solution auto-match payments with open invoices even without an invoice number using non-reference data such as sales order number, purchase order number, or shipment details. It allows AR teams to focus on exception handling, thus lowering costs significantly.

Cash posting into ERP

Generate files in ERP-compatible formats and post cash directly to the system using an automated system that includes automatic client identification and invoice matching. This saves time and improves productivity by removing the need to

change file configurations manually.

6.4 Credit

Credit integration

Accounts receivable automation solutions help auto-extract credit reports, ratings, financials, and credit insurance information from credit agencies and bureaus. Integrating several credit agencies for no separate subscription charge can allow businesses to save significantly on credit integration costs.

Online credit applications

Accounts receivable automation supports data collection via customizable online credit applications and the auto-extraction of customer data from CRM tools. It eliminates the costs of paper and stationery associated with paper-based credit applications. Furthermore, it automatically allocates credit limits to customers, thus eliminating overhead costs.

Credit risk assessment

Digitization provides real-time access to customer credit data, thus helping monitor credit risk and performing periodic credit reviews. As a result, it prevents late payments and eliminates extended credit expenses.

Impact of Digitization

Achieve cost optimization

Automation solutions can perform time-intensive repetitive tasks and reduce operational and administrative costs. Digitization allows to free up resources to focus on core business objectives.

Get 360° visibility into data

Cloud solutions help consolidate all information in one location for quicker processing. It enables better inter-team collaboration and eliminates the losses incurred due to inaccurate or misplaced data.

Gain analytical insights

AR Automation solutions help generate reports and provide insights into accounts receivable metrics such as DSO, DDO, etc. It helps get an end-to-end perspective of your overall performance. Intelligent analytics enables better cash monitoring by utilizing interactive and dynamic dashboards.

Faster cash recovery

Leveraging automation lowers DSO and shortens the cash conversion cycle by making the collections processes easy and frictionless.

Conclusion

Automation is the solution to the challenges that SMBs face in scaling accounts receivable processes to fine-tune cash flow. Digitization has enabled CFOs and finance professionals to monitor financial risks, improve operational efficiencies, and get insights into critical financial KPIs while ensuring cash flow optimization across the order-to-cash cycle.

An advanced accounts receivable solution incorporates all of the attributes covered in earlier chapters and adapts to shifting market dynamics and economies. Adopting solutions like HighRadius’ RadiusOne AR Suite serves as an accelerator for improving business performance growth and establishing a sustainable cash flow. Streamline repetitive tasks, cut costs, and generate working capital with accounts receivable automation.

About RadiusOne AR Suite

RadiusOne AR Suite by HighRadius is a complete accounts receivable solution designed for small and mid-sized businesses to put their order-to-cash on auto-pilot. It offers three accounts receivable modules — eInvoicing & Collections, Cash Reconciliation, and Credit Risk Management to improve productivity, maximize working capital, and enable faster cash conversion. Affordable, quick to deploy, and functionality-rich, the solution is pre-loaded with industry-specific best practices and ready-to-plug connectors for popular ERPs such as NetSuite, Sage Intacct, and Microsoft Dynamics.