Cash flow projection 101: A guide towards better planning for mid-markets

Monitoring the cash flow and knowing how to run periodic cash flow helps to avoid future financial difficulties. This guide will explain everything you need to know about cash flow projections.

Why do mid-markets need cash flow projections during market volatility?

Why is cash flow projection important for small businesses?

Running regular cash flow projections is crucial since it can direct the company’s future outcome. Rather than making key decisions solely on current conditions, cash flow predictions use historical data to help develop more accurate plans. Without using spreadsheets or manual computations, the appropriate cash projection tools can assist in producing accurate cash flow forecasts.

A cash flow projection is a method business owners or managers can use to forecast revenue, expenses, and cash balances over time. A cash flow projection enables a business owner to expect a cash shortage and to make the required adjustments to keep the operation running smoothly.

How is cash flow forecasts different from business cash flow projections?

While the concept may seem similar to cash flow forecasts, a cash flow projection determines a value using hypothetical scenarios. A cash flow projection example: a company may anticipate raising product prices, hiring more personnel, or cutting operational expenditures. These schemes aid in determining how cash flow will alter due to specific modifications. Additionally, it establishes the best and worst case scenarios for a business to anticipate declines and boost revenue.

How to conduct a cash flow projection?

While all businesses should make an effort to estimate cash flow, mid-markets can benefit from understanding their financial positions and distinguishing between profitable and depleting operations.

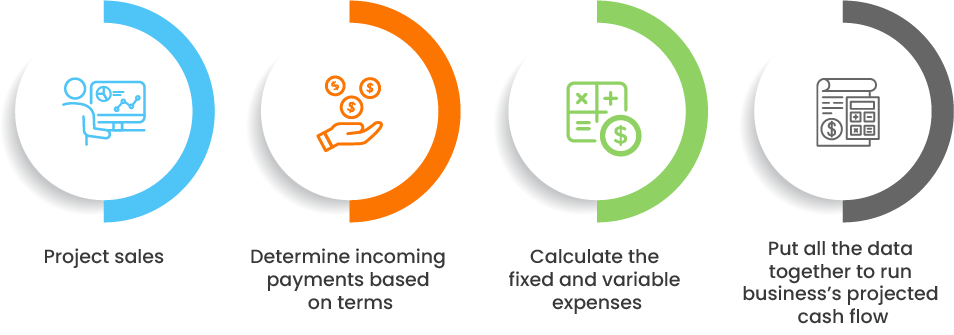

By performing a cash flow projection in the following four processes, management can:

-

Project sales

Forecasting sales is the first stage in developing a precise cash flow projection. Start by using the financial statements to review the data from the previous year. These can aid in projecting the company’s potential monthly cash inflow for the following year. Although the past serves as the strongest indicator of the future, consider some changes as well.

For example, you might wish to lower your sales projections if a rival is advancing on your territory. However, if you’re expanding your product or service offerings, you might anticipate a temporary increase in cash flow.

-

Determine incoming payments based on terms

This stage is for business owners that offer credit lines to their clients, issue invoices, or collect payments from several clients for a single purchase. Calculating when you will earn money from your sales is the goal. You must determine your day’s sales outstanding to do it (DSO).

The DSO formula first divides your monthly credit sales by your monthly accounts receivable. The number is then multiplied by the number of days in a month. Following is the DSO formula:

(Monthly Accounts Receivable ÷ Monthly Credit Sales) x Days in the Month = DSO

This equation determines how many days it will take to get a customer’s payment. For instance, a company made $7,500 in credit sales in July and owed $5,000 in receivables.

($5,000 / $7,500) x 31 = 20.7

The company’s DSO is 20.7, which indicates that it takes about 21 days to turn sales into cash.

-

Calculate the fixed and variable expenses

The fixed costs of a business (such as rent, employee pay, insurance, etc.) are constant. A company’s sales typically fluctuate with the variable expenses. For example, the amount of merchandise you sell and the ship will affect your shipping rates. Your costs for packaging, raw materials, commissions, and labor may also rise due to your sales volume. You must project your fixed and variable expenses for each month of the following year, just like you did for sales.

- Put all the data together to run business’s projected cash flow

Finally, add all the previous data to calculate the business’s projected cash flow. Managers must start with the cash balance from the last month and add the anticipated income for the current month, depending on the DSO. Next, the estimated expenses are deducted to determine the projected cash flow for the current month.

Current month’s projected cash flow = (Last month’s balance + Current month’s projected income) – Estimated expenses

For instance, a pharmacy expects to make $3,500 in sales this month, but its monthly expenses are typically $800. Their anticipated cash flow for the current month is $4,700-$2,000, with $2,000 remaining from the prior month.

($2,000 + $3,500) – $800 = $4,700

Management can divide or multiply the predicted monthly cash flow value to arrive at the projected weekly, quarterly, or annual cash flow. It is better to avoid forecasting cash flow too far in advance because any changes could significantly influence the estimate. Therefore, anytime a new variable is included, businesses should regularly calculate their cash flow and formulate it.

Using a business cash flow projection model to automate the creation of cash flow projections could be helpful for treasury and finance teams. It manages cash flows and provides real-time visibility through dashboards and reports. By eliminating manual and laborious tasks, it makes it easier to control finances and understand trends based on historical data.

What are the advantages of carrying out cash flow projections?

Making accurate projections of expected cash flows can help a mid-market business succeed. The benefits of estimating future cash flows are numerous. Making a cash flow estimate has some advantages, including as:

- Forecast cash surpluses and shortages

- View and contrast historical business income and expenses

- Calculate the impact of business change (e.g., hiring an employee)

- Demonstrate to lenders that you can make timely payments

- Check to see if any adjustments are necessary (e.g., cutting expenses)

The bottom line is that cash projections help to see your business’s future direction more clearly.

Read the eBook on “Five ways to make your cash flow projections more accurate” and learn how to enhance your cash flow projections to make better liquidity decisions.

Understanding the benefits of projected cash flow forecast

Cash flow projection gives organizations various advantages that can boost operational effectiveness and long-term financial stability and raise awareness of expenses and income.

- Early awareness of potential cash flow decreases

Management can forecast decreasing cash flow by constantly computing predictions based on modifications and new measurements. This allows businesses to increase revenue while reducing expenses to avoid cash constraints.

For example, if a company has additional money, it might pay off loans early if it has extra money. However, the business would wish to save more money if forecasts indicate that cash flow will soon start to drop.

- Transparency among stakeholders

Before making an investment or approving a loan application, banks, investors, and other interested parties will want to know a company’s cash flow to ensure they will get their returns. Companies can be open and honest with stakeholders to earn their respect and confidence by presenting cash flow figures and projections.

- Optimize operations

Understanding how cash flow will fluctuate allows management teams to employ and invest without endangering the organization adequately. Companies without a cash flow forecast risk further limiting cash flow by making bad financial choices.

- Identify income needs

Cash flow projections warn companies if they lack the resources to support operations and finance investments. This enables management to find additional revenue sources from investors, lenders, or loans.

- Designate ownership

Accurate cash flow projections can improve financial planning by allowing directors to distribute equity more effectively to increase profitability.

- Capitalize on opportunities

Projections help businesses determine when to start investing. A projection data allows management to investigate transactions and make financial preparations to take advantage of an increase in cash flow.

How HighRadius’ cash projection model helps with projecting cash flows?

With an automated cash flow projection model, mid-market companies can:

- Get a better understanding of changing patterns and generating cash flow estimates.

- Identify new demand, sales, and revenue trends using historical financial data.

- Automate data aggregation from multiple sources with the help of APIs and RPA.

- Analyze the best and worst-case situations using the manual override function, which offers an Excel-like user interface.

- Assist the treasury in accurately tracking scenarios in real-time so that the team can respond quickly in the future.

- Compare forecasts to actuals regularly to identify deviation sources and categories and implements continual changes to reduce variance and enhance forecast accuracy.