Cash Forecasting Maturity Model

Read the eBook to know insights on why organizations are investing in re-engineering their cash forecasting process & the role of the Treasury in it.

Executive Summary

Why is Cash Flow Forecasting Important?

In the wake of the last global financial crisis, providing strong and accurate cash flow management has become a top priority for treasury teams. While methods have been implemented to improve cash liquidity, effective cash forecasting remains one of the biggest issues that corporate treasury teams grapple with today.

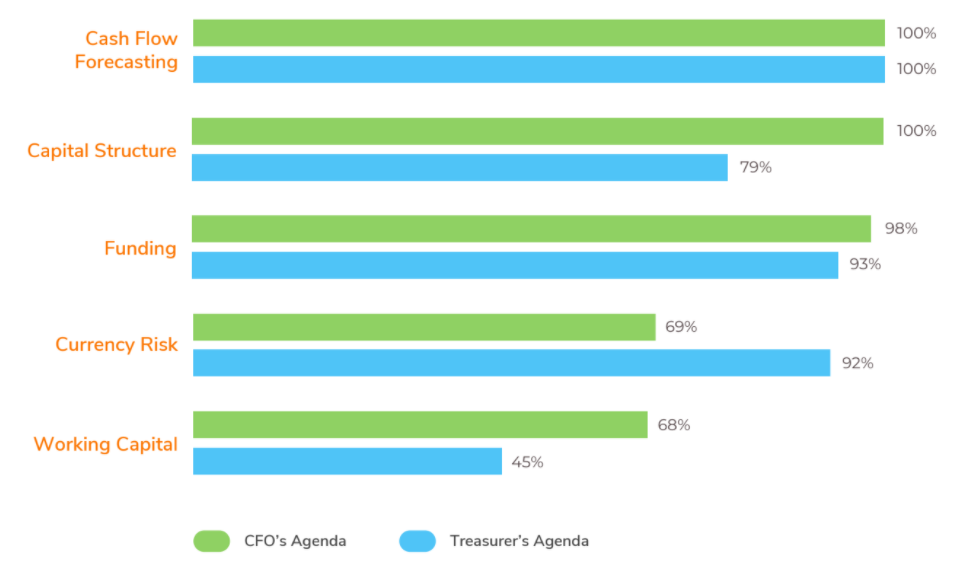

Treasurers now need to think more than ever about cash forecasting and how that might help them identify pockets of surplus cash that can be put to better use. This is where the problem lies. According to a PwC survey, both the CFO and the Treasurer said that cash forecasting is their top priority and challenging one.

Top Priorities on the CFO’s agenda vs the treasurer’s agenda (weighted ranking)

Number of respondants: CFOs- 222; Treasurers- 185

Accurate Cash Flow Solutions

Longer term investing making decisions

Reduced borrowing costs, more effective hedging programs

Manage daily liquidity to ensure

– shortfalls are covered

– Surpluses are concentrated to earn some yield on excess cash

This ebook provides a lot of insights into why organizations are investing in re-engineering their cash forecasting process and the role of the Treasury in it. It also explores the key pillars which define the process efficiency and how organizations could leverage the Cash Forecasting Maturity Model to gauge where they stand and advance in the right direction. The next section will help you understand the four key focus areas to concentrate on to achieve best-in-class forecasting.

4 Pillars to Focus to Achieve Best in Class Cash Forecasting

There are 4 important components of the cash forecasting process which play a critical role in making the process faster and more efficient.

Approach – Art vs Science – The approach in which the cash forecasting is done defines the accuracy of the forecasting. So it is important to define and have an approach based on the type of cash forecasting you do. There are essentially two main types of cash forecasting methods – direct or indirect.

- Direct cash forecasting is a method of forecasting cash flows and balances for short term liquidity management purposes, typically less than 90 days in duration.

- Indirect cash forecasting is often longer term in nature and it relies on various indirect methods of building up a cash forecast such as using projected balance sheets and income statements.

Data Gathering –

- When creating cash forecasts, treasury must rely upon a number of different sources. This often involves communicating with multiple departments and staff members internally to obtain the desired information

- If an organization does not communicate well internally, or has an outdated or legacy tech infrastructure, this part of the process may be one of the most difficult

Modeling –Once the treasury team has collected and aggregated all the relevant data, they may create their forecast

- Typically, the treasury has already selected the forecast method before gathering and

collecting data, as the type/amount of data collected will depend on the forecast method used - Often, the length of time for the forecast plays a significant role in the type of forecast used The amount of information available for forecasting and the availability of any applications/solutions will also impact the type of forecast utilized

Variance Analysis –

- Variance Analysis involves comparing forecasted cash flows for a given period to the actual cash flows that occur during that period to identify discrepancies and evaluate the accuracy of the forecast

- This process can help identify shortcomings within the forecast and aid treasury in improving the accuracy of their forecasts moving forward

Improving the strength of these pillars can go a long way in building reliable cash forecasts. The following discusses how these are key success factors in building an accurate and reliable forecast.

The maturity of the cash forecasting process corresponds to the effectiveness of the process with respect to the four components. The next chapter explores how the cash forecasting process could be evolved on the four high impact pillars.

Understanding the maturity model

1. Laggards – The organization has some process in place but they are inadequate in that there are many gaps which affect the day to day running of the organization.

2. Proactive Process – The organization has in place process practices that are adequate in supporting the business under stable circumstances, and enable it to develop but will not be sufficient in challenging times.

3. Strategic Process – The organization has in place professional practices which enable it to cope effectively in challenging times and will identify some opportunities to improve its performance.

4. Best-in-class Process – The organization has processes and practices that are leading edge and allow it to anticipate both challenges and key opportunities, in order to optimize its performance.

The Stages in Cash Forecasting Maturity Model

Now, let’s understand how the process of cash forecasting is done across organizations.

Approach:

1. Laggards – Based on opinions, judgements, experiences from the past. You take last year’s data, apply basic metrics and use for this year

2. Proactive – A group of collaborative deal between many managers/partners of company, could use data coming from local controllers to build forecasts

3. Strategic – Top-down forecasting approach, taking in FP&A data, building distribution rules and building forecasts

4. Best-in-class – Building forecasts bottoms-up from a granular level, costly from a data acquisition and effort perspective to gather the proper rules

Pillar 1: Approach

Data Gathering:

1. Laggards – Have a very manual process. Often just utilizing what happened last year, and using it as a basis of forecast for this year

2. Proactive – Using the similar process like Laggards, but adding forward looking information, and using this information to make adjustments to incorporate the changes in trajectory of operations of the company (current data)

3. Strategic – Proactive + Using RPA to automate gathering of data from multiple sources.

4. Best-in-class – Utilizing API for connectivity between systems so that it stays up-to-date with the current data available and also using forward-looking information from FP&A, Sales, ERP. No manual effort involved.

Pillar 2: Data Gathering

Modeling:

1. Laggards – Excel-based global approach for all categories, last year’s actuals is used

2. Proactive – Averaging-based approach for all categories, past data representing different periods (1 year, 1 month, etc) is used

3. Strategic – Models of some categories such as AR and AP are based on due dates which might be adjusted, for which ERP and bank data is used

4. Best-in-class – Uses AI for complex categories such as AP and AR, current and past data is used for forecasts

Pillar 3: Modeling

Variance Analysis:

1. Laggards – No/very little variance analysis

2. Proactive – Performed at global level only, and only done for single duration, difficult to do multi-duration analysis

3. Strategic – Performed at entity and cash flow category-level, for single duration only

4. Best-in-class – Performed at entity, region and cash ow category-level, for multiple durations (today’s actual vs forecast done 1 month/3 months/6 months ago)

Pillar 4: Variance Analysis

Summary

About HighRadius

HighRadius is a Fintech enterprise Software-as-a-Service (SaaS) company which leverages

Artificial Intelligence-based Autonomous Systems to help companies automate Accounts

Receivable and Treasury processes. The HighRadius® Integrated Receivables platform

reduces cycle times in your order-to-cash process through automation of receivables and

payments processes across credit, electronic billing and payment processing, cash

application, deductions, and collections. HighRadius® Treasury Management Applications

help teams achieve touchless cash management, accurate cash forecasting and seamless

bank reconciliation. Powered by the RivanaTM Artificial Intelligence Engine and FreedaTM

Digital Assistant for order-to-cash teams, HighRadius enables teams to leverage machine

learning to predict future outcomes and automate routine labor-intensive tasks. The

radiusOneTM B2B payment network allows suppliers to digitally connect with buyers, closing

the loop from supplier receivable processes to buyer payable processes.