Cash Management Maturity Model

Understand and assess the four pillars of cash management maturity model for you to move forward in your treasury transformation journey.

Executive Summary

Why is Cash Management important?

According to PwC in 2021, cash and liquidity management is the top priority for the treasurers and it will be the top priority for next year as well.

Cash flow management, when performed accurately:

- Provides insights on day to day management of cash

- Identifies areas where excess/deficit cash should be managed/optimized

- Prevents a no-cash situation

– If an organization does not invest its surplus cash, then they are losing out on interest

This ebook discusses why organizations should invest in reengineering their cash management processes and the role of the Treasury in this process. It also delves into the four pillars that characterize process efficiency and how organizations could use the Cash Management Maturity Model to assess where they stand and move forward in their transformation journey.

The next section focuses on the four pillars to achieve a best-in-class cash management process.

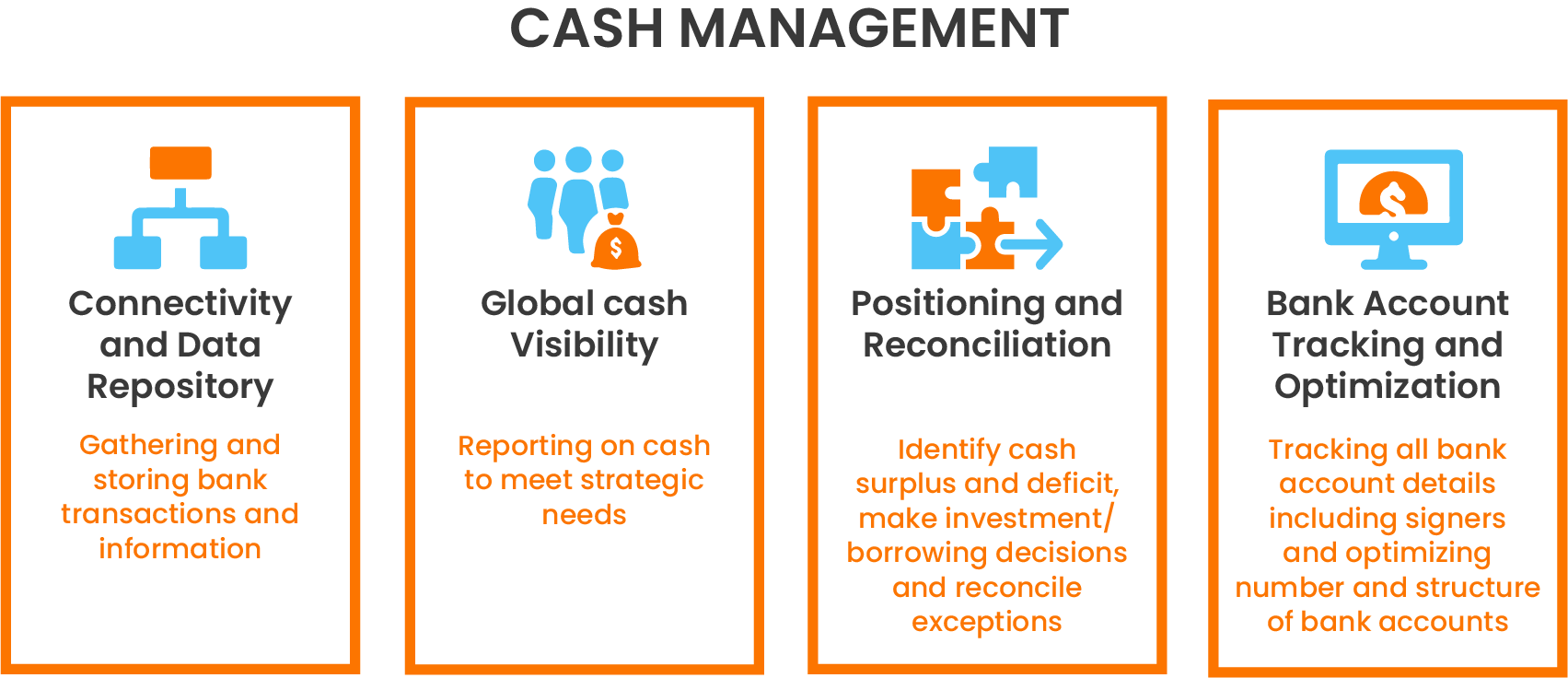

4 Pillars to Achieve Best-in-Class Cash Management

The cash management process consists of 4 key pillars which contribute to optimizing the process.

Four Pillars of Cash Management

1.1. Connectivity and Data Repository –

Organizations log in to banks at the start of the day to get previous and current day bank transactions across all the bank accounts. All this information is downloaded together and then stored in a data repository which acts as a single source of data for the organization.

Generally, banks keep records of transactions for up to 3 months but the data kept by the organization in a repository can be recorded for years.

1.2. Global Cash Visibility –

The ability to report on cash however needed by the entity, by account, by region, by the bank, by currency, etc. at any time to maintain transparency.

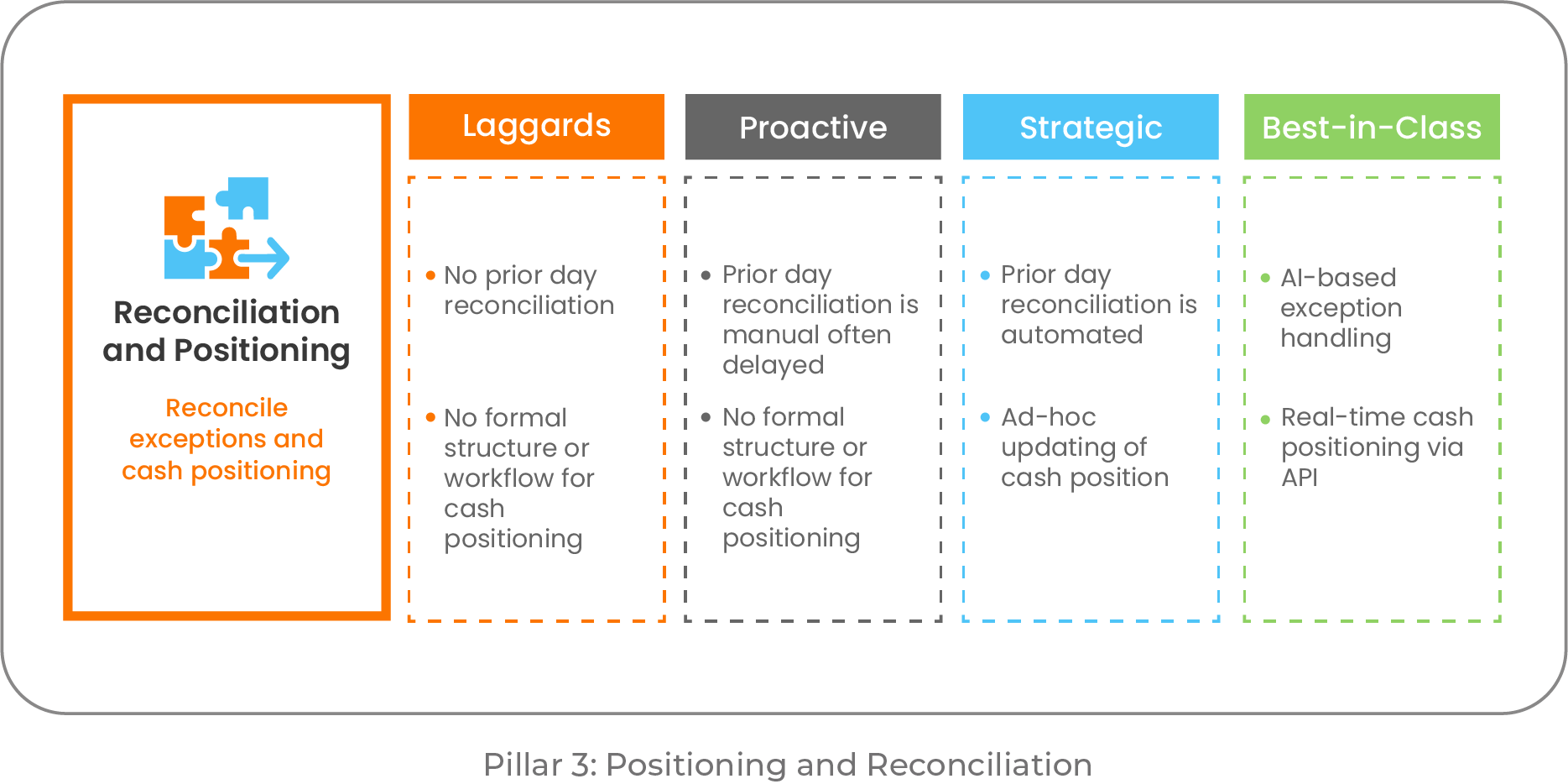

1.3. Positioning and Reconciliation –

Cash Positioning is a daily process of evaluating cash and analyzing an organization’s liquidity position. Keeping an eye on daily cash position can help C-suite make informed decisions such as paydown of debts or redeeming investments.

Reconciliation is the process of comparing the prior day transaction records with the organizations’ records and figuring any discrepancies. This is done to keep a track of their daily cash inflows and outflows.

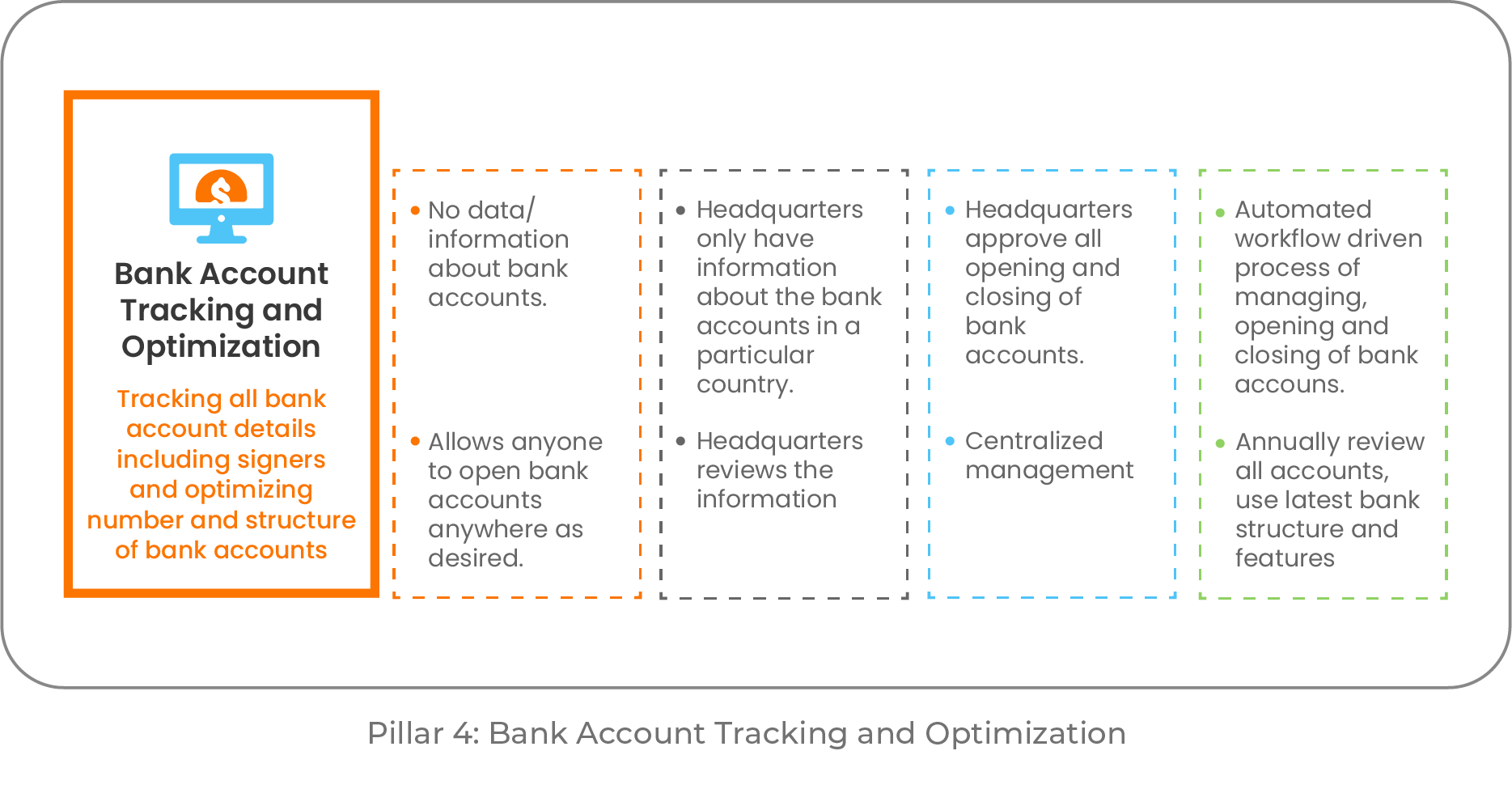

1.4. Bank Account Tracking and Optimization –

Bank Account Tracking is listing all of an organization’s bank accounts along with the resources it has and keeping a record of bank account details (entity, purpose, day opened, day closed, tax id, services, signers, etc.,).

Optimization – rationalizing the accounts to the appropriate number to make cash management as automated as feasible to meet tax regulations and improve operational performance.

The maturity of the cash management process relates to the procedure’s efficacy with the four components. The next chapter investigates how the cash management process may be improved based on the four high-impact pillars.

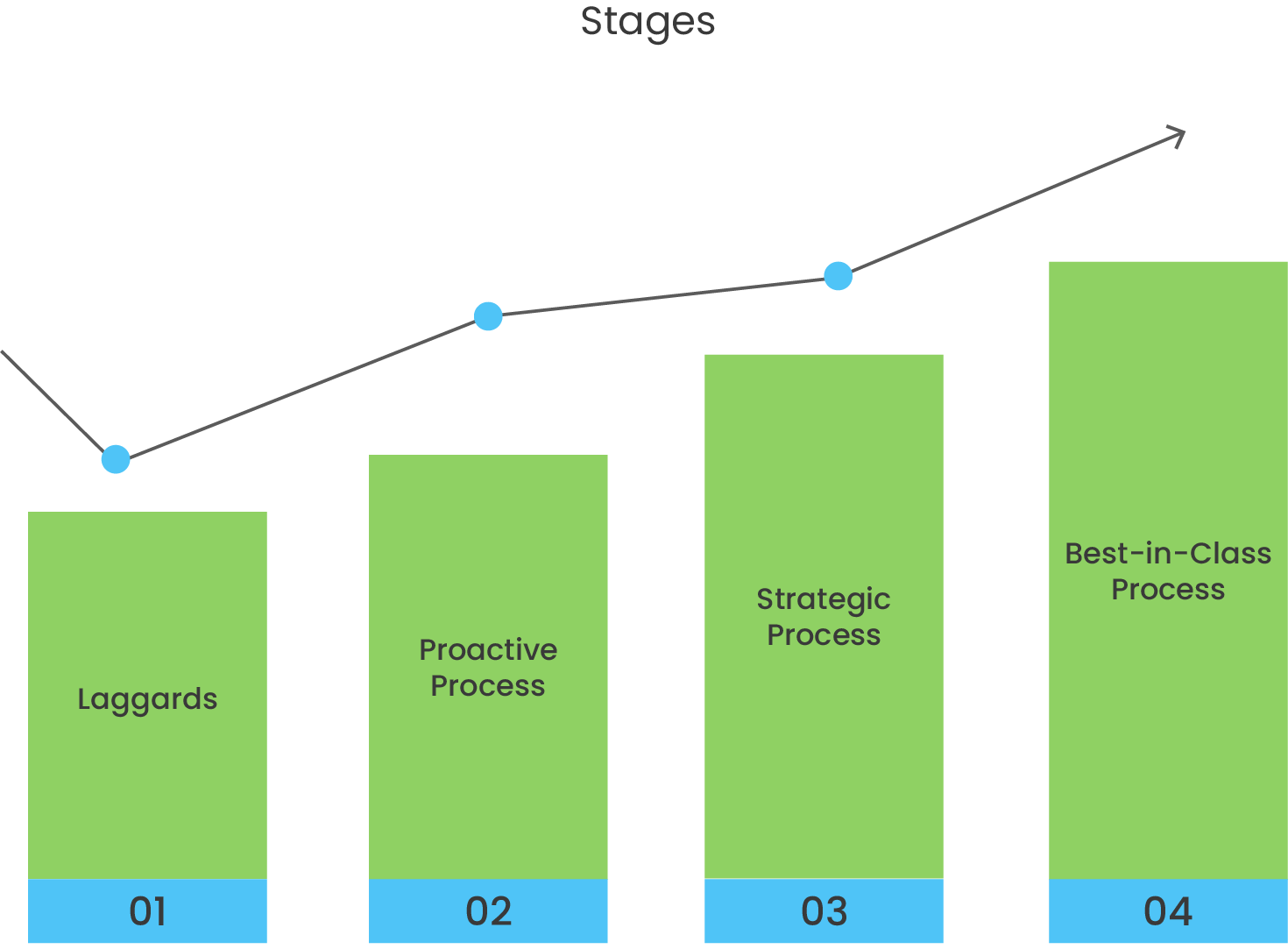

Understanding the Maturity Model

1. Laggards – The organization has some processes in place but they are inadequate as many gaps affect the day-to-day financial running of the organization.

2. Proactive – The organization practice process that is adequate in supporting the business under stable circumstances and enables it to develop but will not be sufficient in challenging times.

3. Strategic – The organization has professional practices which enable it to cope effectively in challenging times and will identify some opportunities to improve its performance.

4. Best-in-Class – The organization has processes and practices that are leading edge and allow it to anticipate both challenges and key opportunities to optimize its performance.

Now, let’s look at how cash management is handled in different organizations.

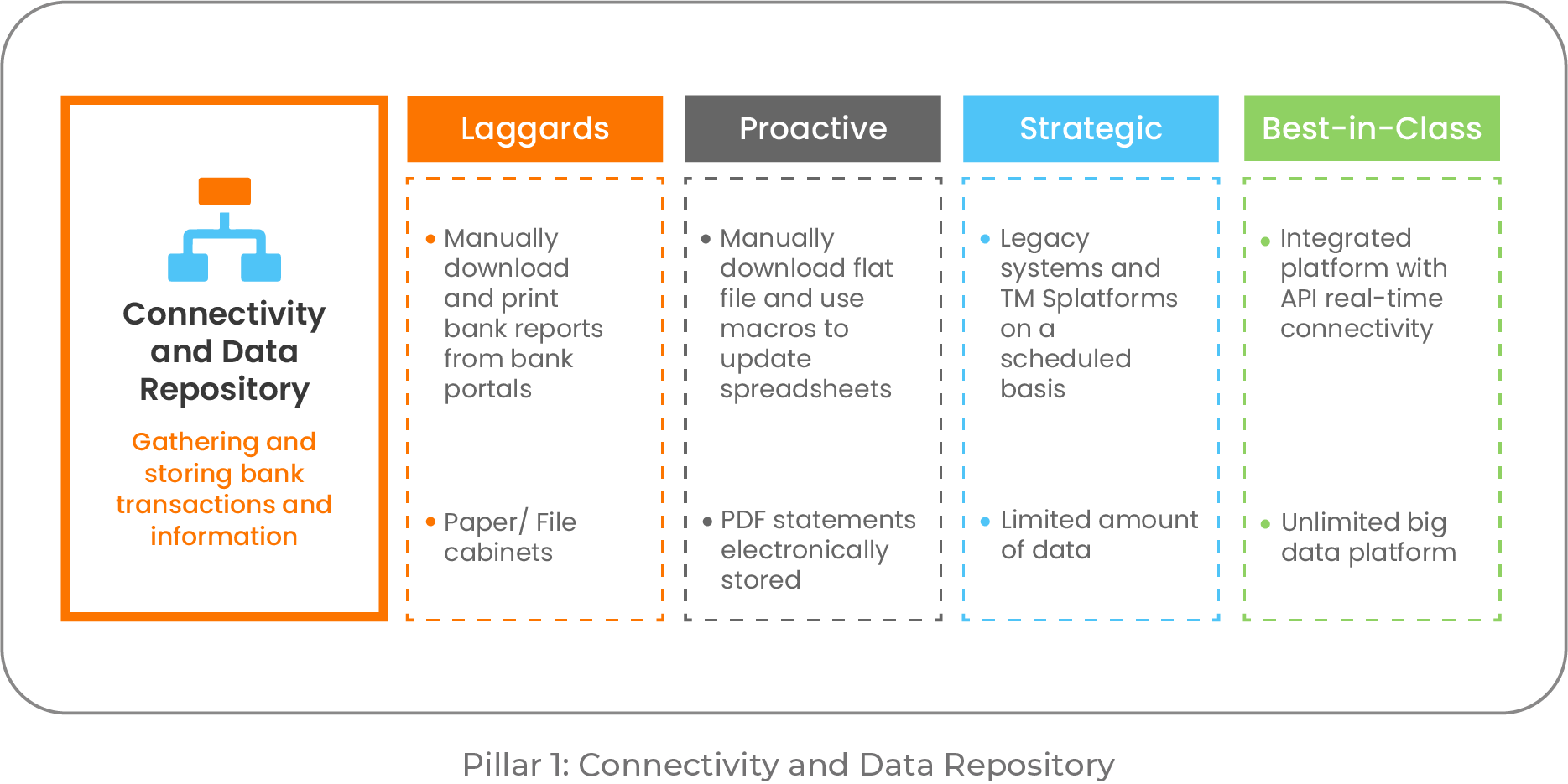

Connectivity and Data Repository:

1. Laggards – The organizations tend to get their bank reports by manually downloading and printing from the bank portals. They store their reports in unorganized file cabinets.

2. Proactive – The organizations download the flat flies from the banks and use macros to update them in spreadsheets. The reports are saved electronically in the form of PDFs.

3. Strategic – The organizations have a legacy system or a Treasury Management System that keeps a record of all the data on a scheduled basis but can only store the data in a limited capacity.

4. Best-in-Class – These organizations use integrated platforms with real-time connectivity with banks and get data in real-time. The SaaS and cloud-based platforms enable the organization to store unlimited amounts of data without any limitations.

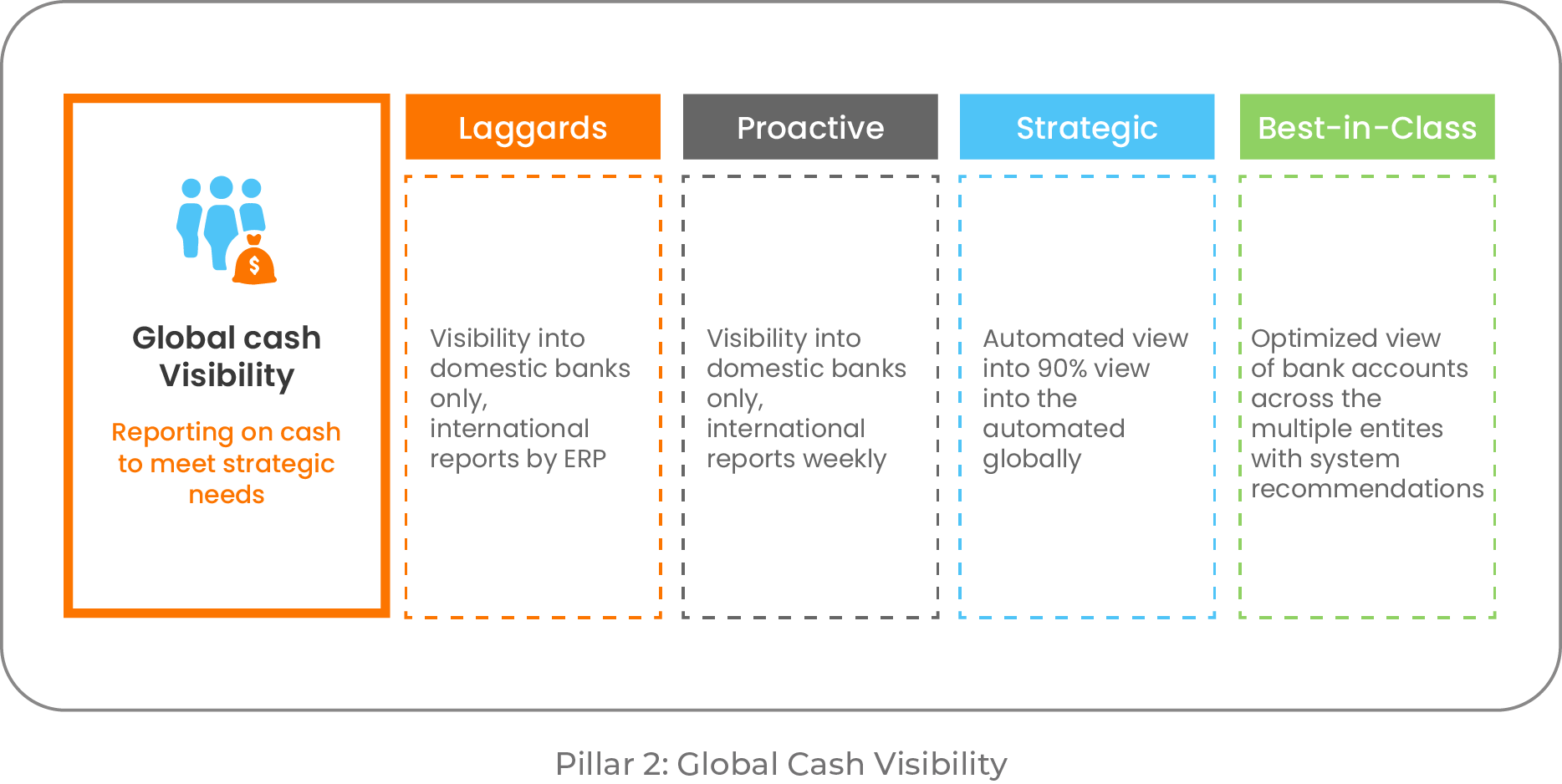

Global Cash Visibility:

1. Laggards – These organizations can only check their cash balances at local banks and pull international bank files/ reports on a sporadic basis from their ERPs

2. Proactive – These organizations are analogous to Laggards except they get the global bank reports to them once a week from the ERP.

3. Strategic – These organizations have standardized processes which enable them almost 90% visibility into their cash balances on a global level.

4. Best-in-Class – These organizations have automated processes that enable them to get an optimized view of bank accounts across multiple entities. The system also provides suggestions and recommendations.

Positioning and Reconciliation:

1. Laggards – These organizations do not use prior-day reconciliation. There is also no systematic cash-positioning structure.

2. Proactive – These organizations use a manual prior day reconciliation process, which often gets delayed. However, like Laggards, no equivalent formal structure exists for cash positioning.

3. Strategic – These organizations follow an automatic prior day reconciliation process. Ad-hoc updating of cash position is done.

4. Best-in-Class – These organizations use AI-based exceptional handling algorithms for reconciling their cash and APIs to obtain real-time cash positions.

Bank Account Tracking and Optimization:

1. Laggards – There is no information maintained about bank accounts, and organizations may create a bank account wherever they choose.

2. Proactive – The headquarters only have information about the bank account in a particular country. There is no bank account optimization.

3. Strategic – Headquarters is in charge of all information storage and tracking, as well as authorizing all bank account openings and closings.

4. Best-in-Class – The organizations use automated workflows to manage, open, and close bank accounts. These processes are audited on a yearly basis utilizing the most recent bank structure and features.

Summary

Summary: Cash Management Maturity Model

Continuous process improvement is the key to moving an organization’s present cash management process up the ladder. To unleash working capital potential, organizations are now transferring their attention from the income statement to the balance sheet. Organizations could improve their competitive positions by cultivating a cash culture, upgrading underlying processes, and integrating cash excellence ceaselessly.

By 2022, technologies such as Artificial Intelligence(AI) will be critical for cash management and visibility. When technologies like APIs and Robotic Process Automation (RPA) are used in the cash management process, it leads to increased efficiency, profitability, and productivity.