4 Reasons Why CFOs Need to Re-think B2B Payments for Accounts Receivables

- 4 major reasons why CFOs need to change their B2B payments strategy

- A look at how customer experience affects customer attrition rates

- Explore how digital payments enhances Sage Intacct’s payment capabilities

About

Despite the many benefits of cloud based accounting software, there are some limitations that prevent mid-sized businesses from realizing maximum efficiency. In this paper, we discuss four primary reasons why CFOs should re-examine their B2B payments strategy. While the customers can fix some of it with custom tweaks, short-term resolutions will not solve the problem. The approach at HighRadius has always been to dive into the roots of the issue. Let’s figure out ‘why’ and ‘how’ successful B2B mid-sized businesses are reshaping their payment policy.

Cost of Traditional B2B Payment Methods and Invoice Processing

To run a successful business, C-suite executives need to work tirelessly to ensure there are minimum revenue leaks. But in many cases, companies look at offering multiple payment methods as a luxury rather than a necessity.

Managing B2B payments is a common pain point for many mid-sized businesses. It also costs them much more than they are ready to admit.

Some widely used B2B payment options include:

1. Checks: Printed on paper and mailed to the merchant.

2. Wire transfer: Money is transferred from one bank account to another, usually through a third-party facilitator.

3. ACH transfer: Money transferred from one bank account to another via a clearing house.

4. Credit card: Payment made using personal or company credit cards.

Amidst growing volumes of ACH and other electronic payments, accounts receivable (AR) teams at SMBs are stuck streamlining their check-heavy receivables processes, expensive lockbox services, time-consuming remote deposit capture solutions, and manual reconciliation methods.

Checks continue to remain the common payment format for many businesses. Despite checks being the Achilles’ heel for AR departments, suppliers have no alternative but to accept this payment preference of their buyers. Some of the hurdles of processing checks are as follows:

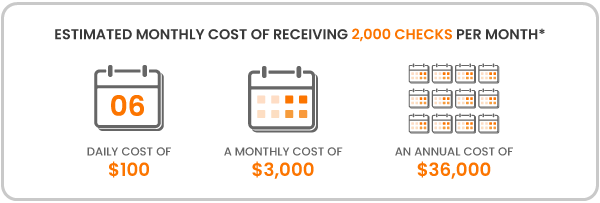

- High overhead/costs: According to a survey done by the Association for Financial Professionals, businesses spend up to $30,000 for processing 20,000 checks a month. This study states that receiving a paper check is five times as expensive as ACH! For small and mid-sized businesses with low dollar value transactions, the cost of processing checks directly eats into the profit margin.

- Capital and speed: A major disadvantage of checks for suppliers is that they come with a float of approximately three days. This buffer is also one of the reasons why buyers favor check payment. But then, several external factors come into play and further delay processing. The reason for slow processing can be attributed to scanning checks and remittances separately, depositing payments in banks, and manually keying in data for reconciliation. Together, this delays payment reconciliation by 3-5 days. This is why suppliers are reluctant to accept checks – payments hit the bank much later than the actual payment date, and suppliers end up having to support longer credit terms than intended.

As per reports by the Bank of America, there’s an estimated cost of $4 to $20 per payment for checks.

- Paper-based: In the B2B space, the analysts’ role is to negotiate maximum

payments or payment promises from customers. However, paper-based remittances are time-consuming and tedious to process. Analysts prefer electronic remittances because they are easy to track and can be scanned with OCR software to extract relevant data. Apart from its environmental implications, paper-based remittance notes are also difficult to manage and prone to get misplaced. Paper-based remittances also make it difficult for the analyst to sort through past interactions with customers.

Processing checks is low-value manual work and does not help improve credit management and collections. Being a highly manual process, it is also prone to errors. It also requires resources to be moved from credit and supply management teams without adding any value towards lowering DSO or working capital.

- There is no support for credit cards: Since many cloud based ERPs do not have a native payment portal, there is no scope to use credit card payments. Increasing the acceptance of credit card payments to all transactions allow B2B companies to:

1. Reduce risks associated with cross-border payments

2. Accelerate cash flow measures

3. Shorten long invoicing procedures

4. Receive payments immediately

5. Lower the costs involved in manually processing checks

70% Businesses that do not regularly use instant payment platforms frequently experience cash-gaps

Lower Time-To-Cash

In the contemporary B2B space, time-to-cash transactions provide a mathematical structure to businesses, which has inherent implications. A longer or complex cash conversion cycle (time-to-cash) means that it takes more time for the business to generate cash. These delays pose liquidity risks and may also lead to operational challenges for small companies.

In the US it’s estimated that $3 trillion is tied up in business’ outstanding accounts receivable (AR)

Frequently some mid-sized companies experience slow time-to-cash conversion. Let’s take a look at the reasons behind this problem.

Overview of transactions

In most cases, there is no easy way to make and receive payments and track where funds are in the overall process. This state of ambiguity leads to cash taking longer to get applied in the ledger. There’s a time lag between when a paper-check is submitted and reflected in the AR system. Such delays increase the company’s days sales outstanding (DSO).

Digital payments are faster! Customers prefer to use credit cards for additional liquidity.

Manual Reconciliation

Manual reconciliation is a challenge for finance managers and analysts. Without accurate cash application, reconciliation adds a hefty amount as the FTE costs increase. Since there is misutilization of resources, over time, the time-to-cash cycle is affected.

Businesses are now adopting optical character recognition(OCR) and email parsing technology to automatically scan through remittance or check information. There’s minimal manual intervention and helps resolve disputes and deduction claims faster. This has increased FTE’s productivity while trimming costs significantly.

Assess yourself? In your organization, how many FTEs apply cash full time?

Let’s have a better understanding of DSO and its application.

Days Sales Outstanding (DSO) – The average number of days it takes for accounts receivables to be collected. We can calculate DSO by taking a company’s AR, dividing by net credit transactions, and multiplying by 365.

Why is this metric important?

- Investors, bankers, and other financing sources often evaluate a company’s time-to-cash cycle and DSO to determine its financial health, especially its liquidity. The more ‘liquid’ a business is, the more easily it can pay back a business loan, adhere to other financial liabilities, and reinvest in growth.

- Suppliers factor in the company’s DSO when deciding whether to extend credit.

- A low time-to-cash or DSO indicates that the company is financially healthy and converts inventory into cash efficiently.

A healthy time-to-cash cycle is a short one. A short transaction cycle indicates healthy working capital and the business’s ability to repay debt. Some online vendors have a negative time-to-cash cycle since they get paid instantly when customers buy products and do not have to pay for the inventory until customers have already paid them.

Better Customer Experience

In the consumer business, digital payments have replaced check payments and paper-intensive methods that are still prevalent in the B2B realm. By providing increased options such as ACH, credit cards, debit cards, and digital wallets, businesses can make it simpler for their customers to pay on time.

COVID-19 has underscored the importance of digital payments. Embracing digital payments and optimizing the back office is now the clarion call for many businesses. In a survey done by Visa, nearly 72% of the small and micro-businesses surveyed reported that they expect their customers to continue to prefer digital payments in the future.

89% of consumers start doing business with competitors after having a poor customer experience

Let’s look at why and how payments can be made more user-friendly and accessible:

-Need for flexibility in payment options

-Self-service portal: Use first principles to create a buyer-centric purchase experience

-No hidden costs. On average, it costs customers $3 less for every invoice paid electronically vs. checks, which also exhausts customer’s time and energy.

Customer Experience Influences Customer Attrition

Customer attrition refers to customers severing relations with a business. These customers do not associate with or purchase from a company after a given period. Customer retention, on the other hand, is a valuable metric that helps track how many customers are loyal and make repeat purchases.

Studies on customer attrition show that positive relationships with customers lead to customer commitment and retention, while poor customer practices result in higher customer attrition rates and eventually lower working capital.

By growing the customer retention rate by just 5%, Businesses can witness a growth of profit in the range of 25% to 95%

-89% of consumers start doing business with competitors after having a bad customer experience

-In the United States, a predicted $83 billion is lost each year due to poor customer experiences and customer attrition.

-Suppose companies do not meet customers’ expectations. In that case, customer attrition rates increase because 95% of people share bad experiences, 54% share bad experiences with more than five people, and 58% are more likely to tell others about their customer service experiences than they were eight years ago.

-80% of churned customers identify themselves as being “satisfied” or “very satisfied” just before leaving.

85% additional growth is seen in organizations that leverage customer insights and more than 25% in gross margin

Source: McKinsey Insights

Overall, customer satisfaction is a crucial factor in determining the customer attrition rate. Learning the cause of customer attrition helps businesses make necessary changes to improve customer experiences and decrease the attrition rate.

Fraud Risk

Frauds have been increasing at a rampant rate in the AR space. There has been a 42% increase in customer fraud and cybercrimes in the financial sector in the past 12 months.

60% Total attempted check fraud increased to $15.1 billion and accounted for 60% of attempted fraud against deposit accounts

Let’s look at the key insights into the most prominent form of AR fraud.

Check Fraud

In 2018, check fraud measured for 47 percent of industry losses ($1.3 billion), according to the American Bankers Association’s 2019 Deposit Account Fraud Survey. The most common form of check fraud include:

- Counterfeit checks: Checks created on non-bank paper.

- Forged checks: Alterations of credentials or signature.

Credit Card Fraud

Credit card fraud happens in two scenarios:

- Account takeover: Someone steals the credentials of a credit card user through account phishing

- Counterfeit cards: Fake credit cards are used to start transactions. These transactions are generally small, hence unnoticed.

Email Phishing

Using deceptive techniques to log into another person’s account to place orders or send emails using their credentials.

Kiting and 3rd Party Skimming

Kiting is categorized as an external fraud, leading to the misappropriation of payments. Generally, a fraudster would withdraw money from the bank against a bounced check utilizing the float time.

3rd party skimming involves taking cash off the top of a business and reporting a lower total in records.

Internal Frauds

Internal frauds are characterized as in-house fraudulent financial reporting schemes. Some example includes:

- Fraudulent write-offs: Crediting a customer’s account to cover up a previous fraud.

- Phishing customer details: Exporting a customer’s details online for monetary benefits.

Adverse Impact

-Increased attrition rates for both customers and employees

-Squandering of the workforce’s time and efforts on low-value tasks

-Internal conflicts that lead to higher churn rates

-The company’s reputation and its working capital take a negative impact

-All of the above leads to poor customer experience

Why Add Digital Payments?

Advanced out-of-the-box solutions like RadiusOne help enhance B2B payment capabilities. With the addition of an augmented digital payments solution, businesses have experienced notable improvements. Let’s have a look at some.

With a 12.8% projected CAGR from 2019 to 2023, the total value of digital transactions is expected to reach $6.7 trillion by 2023

Source: Statista

- Reduced Payment Processing Time

Digital payments are faster to process. According to Deloitte’s PayTech Revolution report, digital payments are more than 50% faster to process than traditional payment processing. CXO’s can expect quicker payment processing, which would instantly translate to more authority over the company’s receivables. All the stakeholders can inspect the receipts in one place, making the approval process easy to manage.

- Diminished Administration Expenses

Digital payments significantly reduce reconciliation fees and effort. With little to no manual intervention needed, automated AR management processes become error-free and offer 3x higher cost efficiency than traditional payment processing. With that, the total cost-efficiency gains could go as high as 500%. All this cost reduction naturally reflects in improved EBITDA. Faster settlement of digital payments also improves cash flow. Optimized cash flow improves DSO.

- Improved Customer Loyalty

With best-in-class payment processes, there is no hidden cost, i.e., zero-fee direct bank payments. There are multiple payment options with credit cards, debit cards, and ACH. Through ‘Convenience Fee’, companies can offset transaction costs and generate a new revenue stream. With payment links and ‘Pay Now’ buttons added to invoices and billing reminders, companies can collect faster, RadiusOne gives customers self-service options to select and pay invoices whenever and wherever possible. Businesses can also use best-in-class virtual terminals to process payments on behalf of their customer’s approval.

86% of customers are willing to pay more for a better customer experience

- Advanced Compliance and Zero-Touch Processing

With best-in-class payment technology, companies unlock better compliance control with PCI DSS certification for digital payment processing. It also enables two-factor authentication, role-level access, and fund-on-file tokenization. With a fund on file token, companies can securely authorize, charge, and reprocess a customers’ payment method without obtaining their private data directly.

With ‘zero-touch processing’, companies can deliver invoices to customers with payment links. With the advanced OCR engine, remittance information is collected and matched to organizational codes directly, with minimal manual intervention. Faster cash flow ensures automated and rapid cash application.

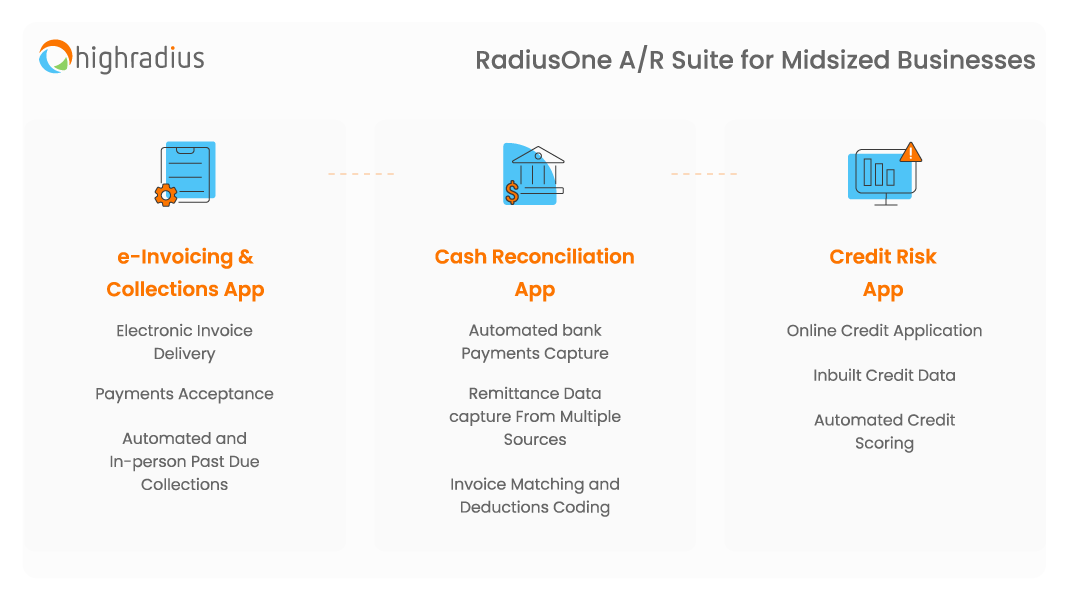

About RadiusOne

RadiusOne AR apps suit AR teams’ needs and aim to automate labor-intensive processes, maximize working capital, and facilitate faster cash conversion.

The HighRadius RadiusOne AR Suite includes automation solutions for processes including e-Invoicing & collections, cash reconciliation, and credit risk management.

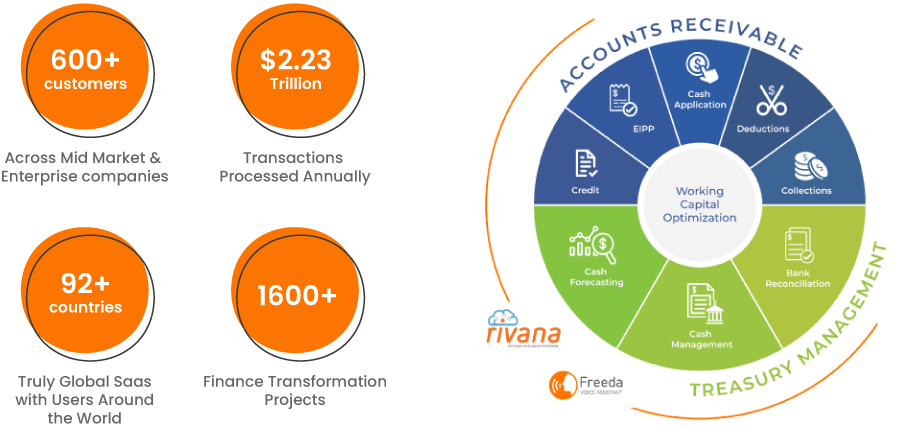

HighRadius is a leading fintech company focused on optimizing order-to-cash processes and treasury operations by leveraging automation across credit, electronic billing and payment processing, cash application, deductions, and collections, powered by AI and integrated receivables platform for major companies globally. With lightning-fast remote deployment, minimal IT dependency, prepackaged modules with industry best practices, HighRadius is the ultimate choice for your company’s order-to-cash processes.