2021 Ultimate Playbook for Collections Management

The game is changing for Accounts Receivable. To support recovery from a historic economic downturn and to keep pace with advances in digital technology, collections teams will have to embrace new strategies and prioritize securing working capital and cash-on-hand.

Introduction

The game is changing for Accounts Receivable. To support recovery from a historic economic downturn and to keep pace with advances in digital technology, collections teams will have to embrace new strategies and prioritize securing working capital and cash-on-hand.

1.1. The New Economic Landscape is a Formidable Opponent.

Imagine your organization is a football team; under normal circumstances, you function pretty well. Yes, there’s a small rivalry between your star quarterback and one of your wide receivers, and maybe your general manager is a traditionalist who takes a “don’t fix what’s not broken” approach to strategy. Despite these small quibbles, your team manages to bring in enough wins to stay beloved and relevant to your hometown fans.

Then along comes a rival with completely new plays – the likes of which you’ve never encountered. Everyone on the opposing team appears to be bigger, faster. Their playing style is strategically ruthless while also being stealthy enough to avoid penalties.

Your usual way of doing things is no match for the ferocity of this threat: key players are sustaining injuries that could put them out of commission for the rest of the season or longer. By the second half, the score is 10-40, your team’s confidence is flagging, and the coach is standing impotently on the sidelines with his face in his palm.

To survive or even win in the second half, your coach will have to adopt a more agile game plan, and your team will have to strive for cooperation across the board. What worked in the past is irrelevant – now is the time to upgrade your offensive strategy.

1.2. Adapt to Survive, Optimize to Win.

Before the massive economic impact of COVID-19, Accounts Receivable (AR) teams at supplier organizations were already facing disruption. The advancing wave of Digital Transformation meant AR departments saw a substantial increase in the volume of digital transactions with customers. Post-pandemic, the growing dependence on digital transactions and digital technologies has only accelerated.

With AR departments, pressures related to digital disruption, and the pandemic aside, Collections Management faces additional challenges. They not only have to follow up on past-due receivables, but they also have the extra pressure of being a key touchpoint for the customer experience. Considered one of the most critical interfaces a company has with its buyers (customers), the collections team is responsible for maintaining a positive customer relationship while ensuring that invoices get paid within agreed-upon terms.

Collections Management teams can further struggle due to the complexity of internal business processes. For example, if an organization fosters an environment where subpar information sharing and data silos are common, collectors would lack a 360-degree view of their customers. This could render their dunning strategy ineffective – and worse – lead to bad customer response.

To support recovery from a historic downturn in the global economy, organizations and AR teams will have to change how they approach receivables and its impact on working capital and cash-on-hand. Using tools like Artificial Intelligence (AI) and Machine Learning (ML) to optimize the collection of receivables and lower DSO will be an even bigger area of focus across supplier organizations.

1.3. Cash-on-Hand Means More Time on the Clock.

Recognizing that cash-on-hand is a strong deciding factor between which businesses are dying or surviving in the new economy, corporate executives and finance leaders are giving no indication that they’re relenting in their expectations of the AR department—and more specifically—collections teams. In fact, they’re expecting more of them because collections teams are responsible for helping organizations leverage their most valuable asset on the balance sheet—accounts receivable.

In an extreme economic downturn, cash-on-hand is a business’s safety net. During the global pandemic, organizations with access to liquid cash and securities have been and continue to be in a better position to retain their workforce, meet accounts payable, and continue servicing customers. A Wall Street Journal report states that cash-rich companies can continue to run their businesses for a year or more, even if they cut no cost or don’t make a single sale.

In pre-COVID times, a company could expect the majority of its accounts receivable to be paid on time. Now, with economic and operational disruption everywhere, the rate of past-due payments is increasing, and available working capital is under threat.

1.4. Accounts Payable is Already Using a New Playbook.

In the game of getting paid as quickly as possible, the line of scrimmage rests between Accounts Payable (buyers) and Accounts Receivable (suppliers). The AR department is interested in bringing in

as much cash from customers as possible, while Accounts Payable (AP) is invested in extending payment cycles to keep working capital within their company as long as possible.

Both departments are facing specific pressures due to the economic downturn; however, AP is showing signs of faring a bit better. A recent poll provides a better than expected picture of how well AP has handled 2020, with 63% of poll respondents indicating little to no disruption of operations due to COVID-19.

AP is moving ahead of the curve when it comes to adapting to marketplace pressures that have been driven by Digital Transformation and the recent pandemic. The global economic downturn means they will only invest more heavily in the tools and technologies that are helping them hold on to cash. This includes AI and ML assisted apps that predict optimized times to make payments and automated invoicing software that looks for disputable invoices. This will mean an increase in disputes, more time spent by AR teams in pulling data from customer portals, and longer payment cycles.

Collections teams must be willing and prepared to deal with these changes with the goal of making it as easy as possible for customers to make payment.

Red Flags: Major Evolutions Taking Place Across Collections Management.

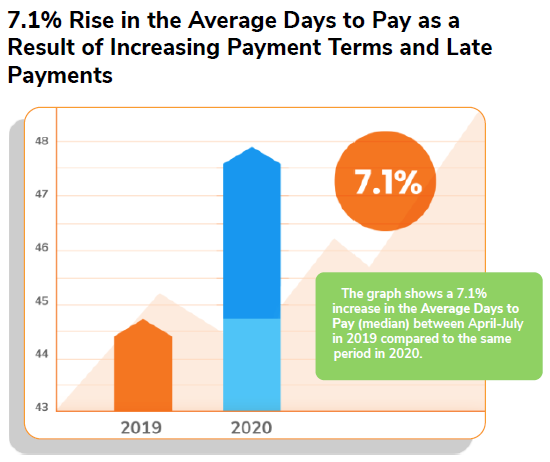

- 7.1% Rise in the Average Days to Pay as a Result of Increasing Payment Terms and Late Payments

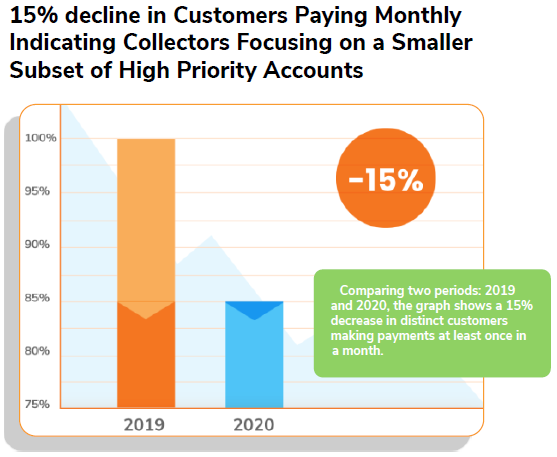

- 15% decline in Customers Paying Monthly Indicating Collectors Focusing on a Smaller Subset of High Priority Accounts

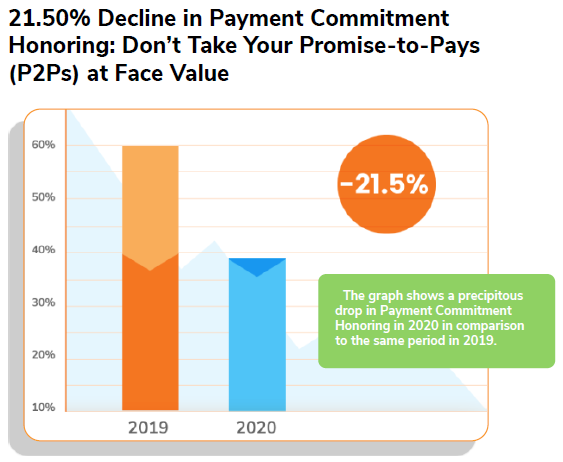

- 21.50% Decline in Payment Commitment Honoring: Don’t Take Your Promise-to-Pays (P2Ps) at Face Value

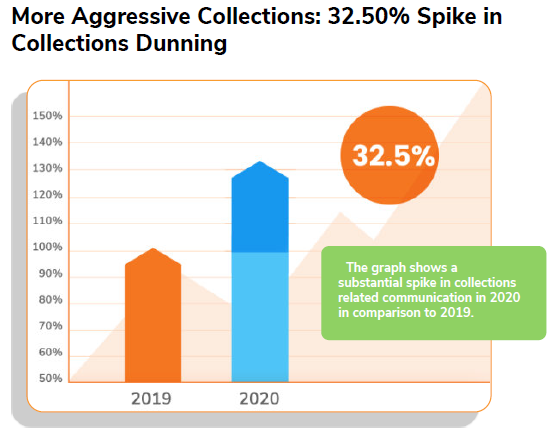

- More Aggressive Collections: 32.50% Spike in Collections Dunning

Collections management focuses on two primary concerns:

1. Will a company’s customer pay at all?

2. When will they pay?

When responding to a global downturn in the economy, collections have a clear and direct impact on an organization’s finance objectives and relationships with customers. Given the extreme financial pressures being imposed on customers, many of whom are facing challenging decisions when determining which bills can be paid, a collection strategy today is not just about collecting money faster but also about prioritizing relationship management across the customer portfolio.

The research team at HighRadius parsed through AR collections data patterns from 200+ industry-leading companies in our client portfolio. Our observations are presented below to illustrate the state of collections in 2020.

2.1. Four Collections Trends That We Noticed in 2020.

Comparing a period in 2019 (April – July) to a similar period in 2020:

- Average Days to Pay has increased by 7%

- Number of unique customers paying every month has decreased by 15%

- Payment Commitment Honoring has fallen by 21.50%

- External Communication with Customers, Carriers, and Brokers has risen by 35%

Why We Looked at This…

To develop an objective understanding of what’s changed in the collections landscape, the first data point our team focused on was Average Days to Pay. Average Days to Pay is the average time it takes to close an invoice.

Average Days to Pay = the total number of days to pay divided by the number of closed invoices for a particular customer.

While an increase in payment cycle time was anticipated, our team noted that HighRadius customers exhibited a lower increase in payment cycle time in comparison to external industry benchmarks. We expected this number to be much higher but were pleasantly surprised to see it only at 7.1%.

Why We Looked at This…

Since we saw a rise in Average Days to Pay, we looked at the number of customers who are making regular payments.

Customers making payments = the number of customers paying every month, specifically, from among customers who are supposed to pay in a month and have completed at least one payment a month

The above graph shows the number of unique customers paying (median) between the period of April-July in 2019 and the same period during 2020. The data indicates a clear drop of 15% in the number of customers making regular payments across industries.

In our experience working with over 200+ industry-leading companies, we’ve observed a common trend where companies rely on an 80-20 approach to collections activity. This means organizations are expending 80% effort collecting on the 20% most crucial accounts in their portfolio. This results in

companies leaving a hefty amount of accounts receivable uncollected.

As a result of the pandemic, collections teams have switched focus towards their most critical accounts (based on the customer’s credit limit, payment history, accounts receivable balance, reference checks, etc.) thus contributing to the drop in the number of customers paying.

Though this might have been acceptable in the short term, collection teams must prepare themselves to scale their operations and increase their collections customer portfolio coverage to 100% to survive in the new economy.

Why We Looked at This…

One of the most important metrics that helped us understand the contentious relationship that exists between AR departments and their AP counterparts was the number of payment commitments honored.

Payment Commitment Honoring is expressed as the percentage of payment amount that was actually collected, to that was initially committed (promise-topay) to the collector.

The above chart highlights the number of payment commitments honored between the period of April-July in 2019 and the same period during 2020. It illustrates a precipitous drop of 21.50% in the median value.

Many companies use payment commitments as input for their cash forecasting models. If these commitments are not honored, it has a substantial impact on their ability to forecast and manage working capital accurately.

Potential Causes for Payment Commitments Not Being Honored:

- Collectors were under increased pressure to deliver and were capturing payment commitments even when they were not fully confident about those commitments being met by the buyers.

- On the Accounts Payable side, a lot of buyers were unsure about their cash flow and were making payment commitments to maintain business continuity and definitely did not want their lines of credit to get impacted.

- Whether a buyer had the money to make a payment, or how high of a priority an AR supplier was to a buyer. If a supplier sells something non-essential, then a buyer can more easily opt to keep an invoice unpaid while continuing to pay more essential suppliers.

This is a clear call-to-action for a system that enables collectors to analyze the integrity of these payment commitments and truly understand the ability to pay of each customer – this is far more important than an actual payment commitment, which might not have any value.

Why We Looked at This…

Finally, we wanted to understand how collections teams are reacting to the trends detailed above.

Collections-related communication = volume of correspondence, disputes, payment commitments, and dunning activity for each customer.

This chart highlights the volume of interactions and communications (number of phone calls, emails, and correspondences, etc.) with customers, carriers, and brokers between April-July between 2019 and 2020. It illustrates a sizable spike of 32.50% in communications volume.

In response to market volatility, collections teams are getting more aggressive with their efforts to collect payments ASAP. The economic uncertainty has pushed collections teams to more aggressively focus on the 0-30 day aging buckets as compared to the 60+ day bucket, which used to be a typical priority.

This may work in the short-term; however, it’s not sustainable over the long-term for two reasons:

1. It is difficult to scale this activity (correspondence, disputes, payment commitments, communications, etc) across the entire customer portfolio without a collections management system.

2. A continuous aggressive collections strategy ruins the customer experience.

Key Changes to Expect in the World of Collections in 2021

Digital technology is rapidly being adopted by world-class organizations. Collections teams need to be proactive about using technology to remove friction from the accounts receivable process.

The following is a summary of what leading industry experts foresee in the new economy and the changing Collections Management landscape.

AR leaders are starting to embrace the reality that a new strategy is required to ensure they win in 2021. This will involve reducing the cash conversion cycle by collecting payments faster and more cost effectively while also focusing on strengthening customer relationships.

To accomplish this, collections teams must ensure that cash from a sale is received within its due date according to payment terms to maintain a healthy DSO (Days Sales Outstanding) and to meet a company’s obligations of safeguarding working capital.

3.1. A Proactive Approach to Collections is Required to Win the Game.

Historically, collections teams have depended on a reactive dunning model. This meant waiting for customers to become pastdue before signaling collectors to reach out to them. In the new economy, waiting for an invoice to go past-due before acting on it is akin to casually sipping water on the sidelines and only jumping into action after you see a runner back from the other team heading full- tilt for the 20-yard line.

While a reactive dunning model may have been adequate in the old economy, current realities have rendered it high-risk if not totally obsolete. With more customers falling into delinquency, greater effort and cost is expended to capture overdue payments when the AR department doesn’t take timely preemptive action.

If an organization lacks advanced digital technology and an effective workforce to follow up with overdue customers, they end up defaulting to the 80/20 pattern of expending 80% of their effort to collect on 20% of the highest value accounts. With cash-in-hand being so important, this is obviously not the most practical method to follow.

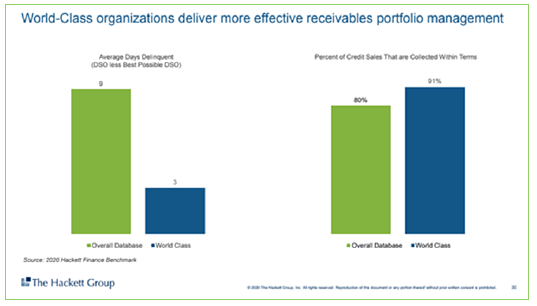

World-class organizations have proactive collections teams that are embracing the advantages provided by Big Data, Machine Learning, and Artificial Intelligence. Utilizing these resources allows them to receive real-time risk signals from public financials, credit agencies, and customer payment patterns and to take preventative action to stave off a delinquency event.

Switching to a modern proactive dunning model means taking full advantage of the power of digital technology. In the game of getting paid quickly and on time, using such technology is like receiving valuable silent hand signals from the head coach before your opponent makes a move. Instead of focusing on customers who are already behind on payments, proactive collections is all about having your collections team focus on customers who have a high probability of becoming delinquent and thus can work on changing the outcome.

3.2. Peeking Into the Accounts Payable Playbook: Buyer AP Teams Will Keep Pushing the Line of Scrimmage on Payment Terms.

The global pandemic has taken a significant toll on business spend negatively affecting 60% of global accounts payable by volume. In response, payment terms for large accounts have been pushed from 30 days to 60 days and even 90 days.

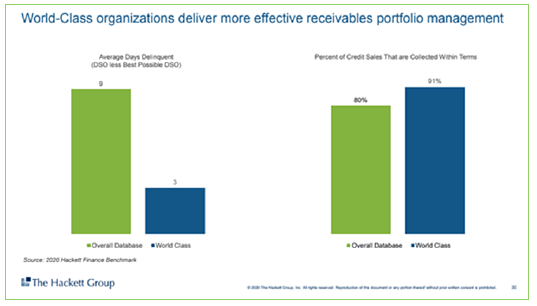

The first response of the Accounts Payables team of any company in this situation has been to stretch the payment cycle and maximize working capital. Below is an example from the food and consumer goods industry showing that DPO (Days Payable Outstanding) in Q1 2020 increased significantly from the previous year.

3.3. Invoice Processing Automation: Get Ready to Deal With More Customer Web Portals, Disputes & Deductions, and Longer Payment Terms.

Your buyer’s AP department is looking to reduce the time spent on emails, telephone calls, and in-person transactions with their vendors/suppliers. As a result, there is an influx of automation solutions entering the market that not only help buyers utilize their time more effectively but also increase their cash position by optimizing payment time.

What does this mean for you?

- Customers of all shapes and sizes will migrate toward AP Portals, which will require you to upload payment information & invoices, fetch remittances, and spend more time tracking payment status.

- AP teams have become meticulous about reviewing invoice line items – and when in even small doubt quick to create a dispute to stall payments. As a result, AR departments must brace for an increasing volume of disputes and deductions.

- Buyers are tightening their cash management with AI-assisted payment decision-making tools. These systems will study early payment discounts, stretch Days Payable Outstanding (DPO) and make a sum total optimization of which invoices to pay on a particular day. Hence, you may need to reevaluate early payment discount strategies.

3.4. Team Effort in the New Economy Means Frictionless Collaboration Between You and Your Customer.

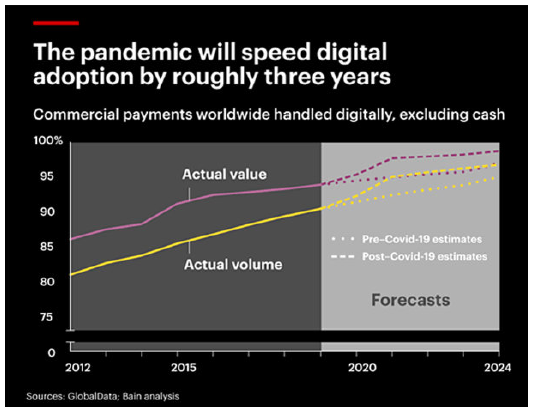

Digital payments are no longer optional, part of the “new normal.” The move to digital payments is an obvious win-win, and the pandemic has only accelerated adoption.

Converting physical payment collection methods to digital provides a three-fold benefit: it’s an obvious gesture of goodwill shown for the safety of your customers, in an increasingly “touchless” world, it provides a more convenient method for customers to pay, and it allows organizations to collect payment faster.

While paperless payments have been adopted the world over, the U.S. has held on to paper check processing in many industries. According to Bain Research, “The pandemic will speed up digital adoption by roughly three years.” This means that organizations and industries holding on to antiquated methods will now be forced to “get on board” to remain competitive.

B2B Buyers Will Expect a B2C-Like Payment Experience.

Studies have shown that a poorly designed user interface can have a huge negative impact on customer engagement. 38% of people will stop interacting with a website if the layout is unattractive. 88% will not return to a site after having a poor experience. During this sensitive time when customers are deciding which bills to prioritize, it’s incumbent upon organizations to embrace Human-Centered Design principles as they develop and upgrade their payment portals.

Unfortunately, a lot of AR teams have been investing in customer portals for billing and invoicing which are clunky, lack critical features, or may only be useful for a subset of customers. In the old economy, buyer preferences for making payments differed across industries and buyer segments, and there was more leeway to accommodate outliers.

In the new economy, regardless of sector, there is an overall push toward embracing digital mobile payments that are fast, easy, and convenient. To gain a competitive edge and increase working capital, a world-class organization should focus on applying the best practices of digital transformation to this critical customer relationship tool.

3.5. Collections is now a C-Suite Priority.

Globally, collections teams are going to remain a top priority for CFOs. Through 2020, the collections department has proven to be resilient in serving as the frontline for finance leadership’s mission to safeguarding working capital. It is now time for collections leaders to fully invest in building high-performance collections teams by embracing digital transformation tools and trends that will be pivotal in achieving and sustaining growth in 2021.

What does this mean for you?

- You will need to provide real-time visibility on the performance of receivables. Real-time progress checks of each collector’s performance (number of customers, the total amount collected, customers reached) and the impact on business value metrics (such as Percentage Current, Net Recovery Rate, etc).

- You will need to share performance reports at a high-frequency. C-suite will need to know early in the game if the needle is moving in the right direction to make strategic decisions.

You will need to build a high-performance culture in the team. Apply predictive analytics processing. Drill down into metrics and keep making improvements at micro (monitoring leading indicators and trending KPIs) as well as macro levels (Business Value metrics and bottom-line impact) as a future-proof strategy. - You will need to gain greater visibility into customer performance. Utilize big data to build a 360-degree view of all of your customers and a deeper understanding of their performance metrics, financial health, and status. Retrieve necessary customer data including invoice data, payment commitments, and payment history on a single screen for each customer with the capability to dig deeper and drill down into individual accounts for further details such as credit information, disputes, notes, and call logs.

Building a More Resilient Playbook

Software is a primary tool in your Playbook. To secure more working capital, organizations will have to make certain to implement the right software that’s able to meet key AR demands.

In this white paper, we took a macro overview of the new economy and what’s driving the evolution of the Collections Management process. We outlined red flag trends that world-class Collections Management teams should have on their radar and what your industry peers recommend. With our reconnaissance complete, it’s now time to lay out the strategy for your 2021 Collections Management Playbook.

We are in a unique situation where CFO’s and finance teams are looking for AR software to preserve cash and safeguard working capital. At the same time, some are still skeptical about the actual impact a digital technology upgrade will have on their business.

To guarantee ROI from the digital transformation of your collections management process, you need to ensure that you can deliver on the following demands:

4.1. Proactive Collections with Artificial Intelligence.

In collections management systems, AI is a prerequisite for preemptive dunning. It can assist teams in multiple capacities such as: identifying at-risk customers before they default, generating prioritized worklists, and predicting the date on which a customer is most likely to pay*.

It can also identify the appropriate actions on customers at any given point in time and then trigger them; actions such as automated dunning of customers by sending out automated emails, scheduling notices of default by mail, and by making automated phone calls for “touchless” collections.

In reactive dunning models, collectors can expend up to 30% of their work time deciding which delinquent buyers to contact and how to contact them. In reactive AR departments, collectors rely on their intuition, skill, and experience to build worklists (prioritized lists of accounts to contact, how to contact them, and when.)

Instead of basing the analysis on the best available real-time data, collectors rely on backward-looking static indicators such as Average Days Delinquent (ADD) to prioritize customers to develop their collections strategies.

Collections teams traditionally look at static indicators, such as Average Days Delinquent (ADD) to estimate payment date for a customer and, consequently, to implement dynamic strategies for dunning, however, reliance on this metric has failed to produce optimal results.

Static data and human intuition are grossly inefficient when matched against the tactics employed by digitally transformed AR departments. Considering that a single collector can be assigned hundreds of thousands of accounts (depending on the size of a company), it’s practically impossible to expect a high level of efficiency from the process without the assistance of digital technology.

Automatically Generate a Prioritized List of Customers Every Day Based on AI-Predicted Payment Dates and Improvise Your Dunning Strategies With AI-Recommended Next Steps

In comparison, an AI/ML assisted system is able to proactively mimic human problem-solving capabilities on a larger scale and at lightning speed based on real-time dynamic data so that the collectors can maximize their productivity and achieve cash collection goals effectively.

As an example, the HighRadius Rivana AI Engine is capable of building a Random Forest Regression Model (a Machine Learning Model) by studying over 40+ invoice and customer level factors and can predict invoice payment dates with an accuracy of greater than 90%.

The ability to provide insights, and recommend proactive collection strategies is perhaps the most valuable attribute of an AI/ML platform. By analyzing customer purchasing and payment patterns from disparate data sources, an AI supported system can present predictive outcomes that allow preemptive actions to be taken. Collectors can do away with tedious tasks that previously consumed a great portion of their productivity and instead defer to the AIsupported system for prioritized worklists. This helps start the recovery process earlier and have it conclude faster – thereby reducing the overall collections cycle time.

With the adoption of AI, businesses have access to more powerful customer segmentation, faster resolution of low-value, low-risk accounts, and better decision-making on high-value, at-risk accounts.

Collections AI Success Story: ShurTech Brands

ShurTech, the leading manufacturer of scrim-backed pressure-sensitive tape sold under the “Duck” brand, has manufacturing and distribution in 12 countries. As can be imagined, managing AR on such a scale is no small feat. ShurTech’s collections management process was prime for a digital technology upgrade.

Challenges with their collections:

- Broken customer experience as a result of manual prioritization of their worklist

- Lack of visibility in tracking, planning, and execution of customer correspondence that was done manually via emails, fax, and phone calls

- No centralized repository of notes – their SAP system allowed for only item-level notes

- Unreliable ad-hoc reminders from Outlook and spreadsheets

Using HighRadius Collections Cloud, ShurTech leveraged artificial intelligence to devise a proactive collections strategy for their Accounts Receivable. As a result, the team saw a 46% reduction in time taken to collect on all past-due accounts and a 50% reduction in overall past-due AR. Read the full case study here.

4.2. Touchless Connectivity with Buyer AP Portals.

A growing number of AP departments are hosting their invoice and payments processes through web-based portals – this means that more AR teams will be required to work effectively with these interfaces. There are two primary areas that AR must focus on when working with AP payment portals:

- Effectively posting invoices to payment portals. With the increasing prevalence of AP payment portals, AR must be willing to explore ways to push invoices directly into these platforms effectively. The faster that invoices can be posted with all the required information, the higher probability of invoices being processed in a timely manner.

- Keeping the data related to customers, worklists, and payment status updated and accurate. AR must also maintain the ability to track the payment status of payments-due once invoices are sent and ensure that invoices that aren’t getting paid do not fall through the cracks without finding out why. Moreover, collectors must monitor which invoices are getting paid to ensure that they don’t end up calling customers who have already paid!

4.3. Integrated VoIP Calling to Increase Collector Efficiency.

Integrated VoIP calling with an integrated dialer enables collectors to contact any customer across the globe as well as to send emails, log notes, and promises-to-pay (payment commitments) within a single system.

We have noticed a huge demand in integrated VoIP calling as teams switched to working remotely. VoIP functionalities have proven to be invaluable for collections teams and boosting CEI (Collection Effectiveness Index). However, we strongly believe that this need will continue even as some team members start returning to work on-premises.

Two more noteworthy benefits of VoIP technology include:

- Having one less device to be managed. Plugin your headset and collectors are good to go versus having to stick a phone between their ear and shoulder, struggling to take notes.

- Second, call tracking and quality control for managers to audit. For a manager, call tracking is a high-value analytic that allows senior staff to determine how well remote collections teams are meeting key performance indicators. These include monitoring the number of calls made, payments committed (promise-to-pays created), follow-ups and payment reminders, etc. – which affect the overall performance, such as Collector Productivity (CEI), Percentage Current, Days Sales Outstanding (DSO), Average Days Delinquent (ADD) to build high-performing collections teams.

4.4. Collectors Will Start Playing an Active Role in Dispute Management.

The global economic downturn, as well as the adoption of AIassisted software, has resulted in an increase in billing and invoicing disputes from AP departments.

In your new playbook, collectors occupy a primary role in dispute management as they are literally the first line of contact for your customers. In this position, they are also likely to be the first to know that a customer is going to make a short-payment.

Considering this, collectors now need to play two roles:

- First, they can create a pre-deduction. Unique to HighRadius’ Collections Cloud, pre-deductions are placeholders for an eventual deduction based on the backup documents and information provided by the customer. All of the aggregated documents (Claim copies, Proof of Deliveries (PODs), reason codes, etc) can be easily attached to the pre-deduction as pdf files and sent over to the deductions team for review. It enables AR analysts to get information about deductions or disputes, even before payment is received. This fast-tracks research & resolution and allows information to be shared about the status of deductions or disputes raised by the customer.

- Second, they can potentially resolve any customer queries that might eventually result in the customer not having to short-pay at all. Hence, collectors and collection management systems need to have the ability to relay information to and fro between the deductions and claims modules.

4.5. Custom Payment Plans, Easy Payment, and Installment Options.

World-class organizations recognize the value of their existing customers and will always explore ways to innovate and improve operations and services so that they can keep them.

There has been a significant rise in the number of payment plans being created since the onset of the global pandemic. Considering it can cost five times more to acquire a new customer as opposed to keeping an existing buyer, it makes sense to work with a customer to determine their willingness and ability to pay.

There has been a significant rise in the number of payment plans being created since the onset of the global pandemic. If a customer is suffering due to the recent economic downturn, offering a systematic payment plan allows an impacted business to pay its dues on an installment basis to stay within credit utilization thresholds and allow some breathing room for economic recovery.

Still further, offering flexible payment terms can make you more attractive as a supplier providing a major boost to your cash-on-hand. In a recent survey, 40% of respondents said they would be more willing to complete a transaction if offered a payment plan. Businesses that provide flexible payments have seen revenues increase by as much as 50% (compared to an equivalent business in the same industry offering payment plans).

If your organization embarks on offering flexible payments, an effective collections management system is a requirement. Without it, collections teams will not be able to adequately track custom payment plans for multiple customers across their portfolio.

4.6. Enable Customers to Pay Where They Are.

One of the hallmarks of Digital Transformation is human-centered design (HCD), a principle that positions human ease-of-use as the primary focus of any digital development project to enhance adoption. Interfaces, apps, and platforms that follow best-in-class practices will eliminate friction, simplify operations, and endeavor to provide users with a positive experience.

Most invoicing and payment initiatives have little to offer beyond a payment portal, which means many missed opportunities.

Move beyond a portal – Your customers have divergent needs!

They want invoices not just on the portal but also delivered through email, EDI, print and mail, uploaded to AP portals like Ariba, Tungsten, or even pushed to their accounting software like Quickbooks.

They also want flexibility with payment options – multi-currency support, FX, local payment methods, as well as the option to pay on both web and mobile.

Are you able to provide your customers with an Amazon-like payment experience?

All payment portals are not created equally, and all companies do not follow best-practices for development. This means that payment experiences can vary tremendously from company to company. Considering that an AP department may need to log into multiple portals monthly to execute payments, poorly designed portals may inject friction into the payment process that makes capturing payment more difficult.

One way to simplify payment processing is to include secure guest payment links in dunning emails. This eliminates the extra step of having a customer navigate to a payment portal and login to submit payments. Instead, they simply click the secure link and leverage various digital payment options— pay via bank account, credit, debit cards, other standard digital payments, mobile apps, or even e-wallets—and proceed to pay. The payment is completed, all within 3 clicks, without even having to log in or remember another password!

The simplicity of paying via a dunning email link positions your billing process in the customer’s mind as one of the easier payments to make and allows collections teams to capture payments more quickly.

Payment via secure email links is included as a feature of HighRadius’ Collections platform and provides the following benefits:

- Secure payment gateway with PCI DSS Compliance

- Multiple payment formats supported, including Bank Account, ACH, credit cards, and other e-payment options

- Customers can download payment receipts instantly

- Suppliers can view all payments made within the application in a ‘Payments History Tab’

- The remittance details are automatically sent to the cash application team for straight-through cash posting

4.7. Instant Replay: Track Team Performance in Real-Time to Improve and Win the Long-Game.

High-performance Culture and Visibility: A high-performance culture is a set of behaviors that leads an organization to achieve superior results based on constant feedback and engagement within the organization between team leaders, team members, and customers.

First, managers need a top-down view of their organization to understand which areas, units, teams, or customer segments require improvement. Second, they need a bottom-up view to understand how each collector on a team is doing by looking at their leading indicators and not just the collectors lagging indicators.

A high-performance culture primarily depends on the alignment of organizational strategies and priorities. Some of the common high-performing culture traits of a world-class AR team include:

Real-time visibility into collections activities and metrics:

“Is my quarterback really making the right tackles? Is my defense strong enough?”

Real-time daily progress checks of each collector’s performance (no. of customers, the total amount collected, customers reached), meeting daily performance goals are an indicator of meeting business value metrics (such as Percentage Current, Net Recovery Rate, etc.)

Goal Setting to stay on top of collections:

“Keeping the odds in my favor by creating the right game plan”

Defining specific targets (collection effectiveness, to credit risk to blocked order SLAs) and real time monitoring of how teams and individuals are performing in comparison to plan.

Continuous Performance Benchmarking:

“Setting the real records for players to break to win big in the long-term game.”

Benchmarking KPIs with the industry gold standard as well as benchmarking with individual collectors to identify which collectors are performing better than others, deduce their best practices, and help implement them for the entire team to beat targets.

The primary focus of an ideal collections management platform should be building a long-term stable business by delivering innovation and ensuring that all the involved stakeholders achieve high performance.

Such an environment ensures that AR transformation succeeds at all levels and delivers true business value. For AR, an ideal solution should measure metrics such as:

- It starts with tech-adoption and product usage metrics: Track how well your users engage with the new technology to leverage the available features and functionality to its fullest potential, fast-track their work, and make better decisions

- Good technology drives better analyst performance: Provides transparent, real-time reflection using performance metrics from their effectiveness in capturing payment commitments to their ability to recover invalid deductions.

- Better analyst performance results in improved customer performance: Provides a deep-level look at the performance of any single customer, or customer segments, enables taking strategic action or course corrections.

- Business value and KPIs: Real-time visibility into Business Value Metrics and trending KPI information to help managers assess how teams and technology are creating bottom-line business impact by reducing DSO, increasing available working capital, and reducing borrowing costs.

Business value and KPIs

If 2020 was a blitz by the opposing forces of COVID-19 and digital transformation, this playbook is designed to give you the “secret sauce” for dominating in 2021 and beyond. The recommended strategies laid out in this paper will help your organization build a strong offensive line and a clearly defined comeback route to winning in the second half.

We’ve discussed the requirements and benefits of implementing a high performance collections management system. HighRadius provides just such a platform to hundreds of successful collections teams around the world. Kickoff your AR department’s digital transformation with a guided free demo of the AI-powered HighRadius Collections Cloud today.